On the Surface

On the Surface

On the Surface

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

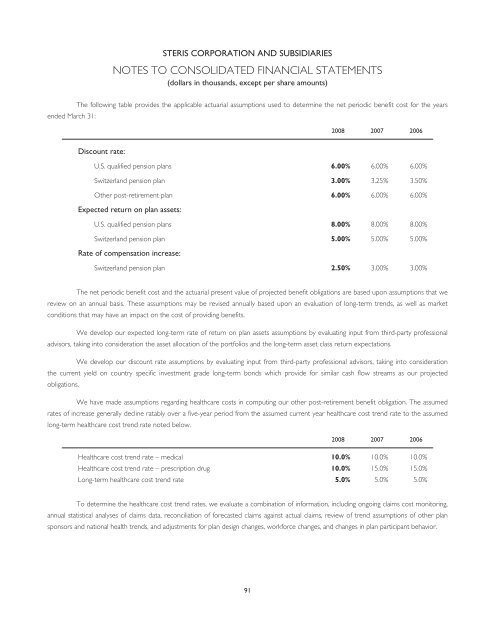

STERIS CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(dollars in thousands, except per share amounts)<br />

ended March 31:<br />

The following table provides <strong>the</strong> applicable actuarial assumptions used to determine <strong>the</strong> net periodic benefit cost for <strong>the</strong> years<br />

2008 2007 2006<br />

Discount rate:<br />

U.S. qualified pension plans 6.00% 6.00% 6.00%<br />

Switzerland pension plan 3.00% 3.25% 3.50%<br />

O<strong>the</strong>r post-retirement plan 6.00% 6.00% 6.00%<br />

Expected return on plan assets:<br />

U.S. qualified pension plans 8.00% 8.00% 8.00%<br />

Switzerland pension plan 5.00% 5.00% 5.00%<br />

Rate of compensation increase:<br />

Switzerland pension plan 2.50% 3.00% 3.00%<br />

The net periodic benefit cost and <strong>the</strong> actuarial present value of projected benefit obligations are based upon assumptions that we<br />

review on an annual basis. These assumptions may be revised annually based upon an evaluation of long-term trends, as well as market<br />

conditions that may have an impact on <strong>the</strong> cost of providing benefits.<br />

We develop our expected long-term rate of return on plan assets assumptions by evaluating input from third-party professional<br />

advisors, taking into consideration <strong>the</strong> asset allocation of <strong>the</strong> portfolios and <strong>the</strong> long-term asset class return expectations.<br />

We develop our discount rate assumptions by evaluating input from third-party professional advisors, taking into consideration<br />

<strong>the</strong> current yield on country specific investment grade long-term bonds which provide for similar cash flow streams as our projected<br />

obligations.<br />

We have made assumptions regarding healthcare costs in computing our o<strong>the</strong>r post-retirement benefit obligation. The assumed<br />

rates of increase generally decline ratably over a five-year period from <strong>the</strong> assumed current year healthcare cost trend rate to <strong>the</strong> assumed<br />

long-term healthcare cost trend rate noted below.<br />

2008 2007 2006<br />

Healthcare cost trend rate – medical 10.0% 10.0% 10.0%<br />

Healthcare cost trend rate – prescription drug 10.0% 15.0% 15.0%<br />

Long-term healthcare cost trend rate 5.0% 5.0% 5.0%<br />

To determine <strong>the</strong> healthcare cost trend rates, we evaluate a combination of information, including ongoing claims cost monitoring,<br />

annual statistical analyses of claims data, reconciliation of forecasted claims against actual claims, review of trend assumptions of o<strong>the</strong>r plan<br />

sponsors and national health trends, and adjustments for plan design changes, workforce changes, and changes in plan participant behavior.<br />

91