On the Surface

On the Surface

On the Surface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STERIS CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(dollars in thousands, except per share amounts)<br />

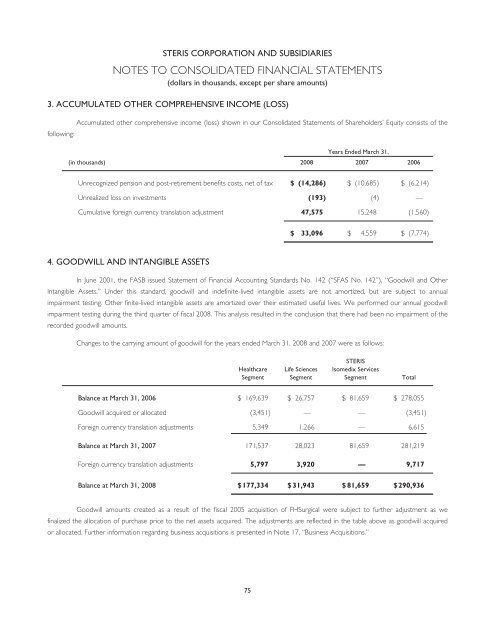

3. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)<br />

following:<br />

Accumulated o<strong>the</strong>r comprehensive income (loss) shown in our Consolidated Statements of Shareholders’ Equity consists of <strong>the</strong><br />

Years Ended March 31,<br />

(in thousands) 2008 2007 2006<br />

Unrecognized pension and post-retirement benefits costs, net of tax $ (14,286) $ (10,685) $ (6,214)<br />

Unrealized loss on investments (193) (4) —<br />

Cumulative foreign currency translation adjustment 47,575 15,248 (1,560)<br />

$ 33,096 $ 4,559 $ (7,774)<br />

4. GOODWILL AND INTANGIBLE ASSETS<br />

In June 2001, <strong>the</strong> FASB issued Statement of Financial Accounting Standards No. 142 (“SFAS No. 142”), “Goodwill and O<strong>the</strong>r<br />

Intangible Assets.” Under this standard, goodwill and indefinite-lived intangible assets are not amortized, but are subject to annual<br />

impairment testing. O<strong>the</strong>r finite-lived intangible assets are amortized over <strong>the</strong>ir estimated useful lives. We performed our annual goodwill<br />

impairment testing during <strong>the</strong> third quarter of fiscal 2008. This analysis resulted in <strong>the</strong> conclusion that <strong>the</strong>re had been no impairment of <strong>the</strong><br />

recorded goodwill amounts.<br />

Changes to <strong>the</strong> carrying amount of goodwill for <strong>the</strong> years ended March 31, 2008 and 2007 were as follows:<br />

Healthcare<br />

Segment<br />

Life Sciences<br />

Segment<br />

STERIS<br />

Isomedix Services<br />

Segment<br />

Total<br />

Balance at March 31, 2006 $ 169,639 $ 26,757 $ 81,659 $ 278,055<br />

Goodwill acquired or allocated (3,451) — — (3,451)<br />

Foreign currency translation adjustments 5,349 1,266 — 6,615<br />

Balance at March 31, 2007 171,537 28,023 81,659 281,219<br />

Foreign currency translation adjustments 5,797 3,920 — 9,717<br />

Balance at March 31, 2008 $177,334 $ 31,943 $ 81,659 $290,936<br />

Goodwill amounts created as a result of <strong>the</strong> fiscal 2005 acquisition of FHSurgical were subject to fur<strong>the</strong>r adjustment as we<br />

finalized <strong>the</strong> allocation of purchase price to <strong>the</strong> net assets acquired. The adjustments are reflected in <strong>the</strong> table above as goodwill acquired<br />

or allocated. Fur<strong>the</strong>r information regarding business acquisitions is presented in Note 17, “Business Acquisitions.”<br />

75