On the Surface

On the Surface

On the Surface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

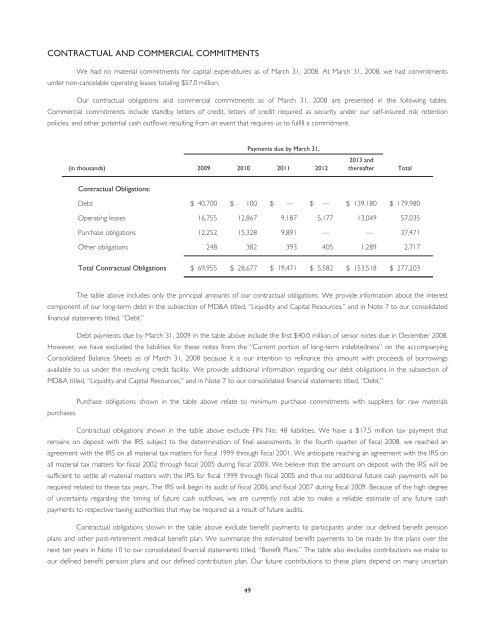

CONTRACTUAL AND COMMERCIAL COMMITMENTS<br />

We had no material commitments for capital expenditures as of March 31, 2008. At March 31, 2008, we had commitments<br />

under non-cancelable operating leases totaling $57.0 million.<br />

Our contractual obligations and commercial commitments as of March 31, 2008 are presented in <strong>the</strong> following tables.<br />

Commercial commitments include standby letters of credit, letters of credit required as security under our self-insured risk retention<br />

policies, and o<strong>the</strong>r potential cash outflows resulting from an event that requires us to fulfill a commitment.<br />

Payments due by March 31,<br />

(in thousands) 2009 2010 2011 2012<br />

2013 and<br />

<strong>the</strong>reafter<br />

Total<br />

Contractual Obligations:<br />

Debt $ 40,700 $ 100 $ — $ — $ 139,180 $ 179,980<br />

Operating leases 16,755 12,867 9,187 5,177 13,049 57,035<br />

Purchase obligations 12,252 15,328 9,891 — — 37,471<br />

O<strong>the</strong>r obligations 248 382 393 405 1,289 2,717<br />

Total Contractual Obligations $ 69,955 $ 28,677 $ 19,471 $ 5,582 $ 153,518 $ 277,203<br />

The table above includes only <strong>the</strong> principal amounts of our contractual obligations. We provide information about <strong>the</strong> interest<br />

component of our long-term debt in <strong>the</strong> subsection of MD&A titled, “Liquidity and Capital Resources,” and in Note 7 to our consolidated<br />

financial statements titled, “Debt.”<br />

Debt payments due by March 31, 2009 in <strong>the</strong> table above include <strong>the</strong> first $40.0 million of senior notes due in December 2008.<br />

However, we have excluded <strong>the</strong> liabilities for <strong>the</strong>se notes from <strong>the</strong> “Current portion of long-term indebtedness” on <strong>the</strong> accompanying<br />

Consolidated Balance Sheets as of March 31, 2008 because it is our intention to refinance this amount with proceeds of borrowings<br />

available to us under <strong>the</strong> revolving credit facility. We provide additional information regarding our debt obligations in <strong>the</strong> subsection of<br />

MD&A titled, “Liquidity and Capital Resources,” and in Note 7 to our consolidated financial statements titled, “Debt.”<br />

Purchase obligations shown in <strong>the</strong> table above relate to minimum purchase commitments with suppliers for raw materials<br />

purchases.<br />

Contractual obligations shown in <strong>the</strong> table above exclude FIN No. 48 liabilities. We have a $17.5 million tax payment that<br />

remains on deposit with <strong>the</strong> IRS subject to <strong>the</strong> determination of final assessments. In <strong>the</strong> fourth quarter of fiscal 2008, we reached an<br />

agreement with <strong>the</strong> IRS on all material tax matters for fiscal 1999 through fiscal 2001. We anticipate reaching an agreement with <strong>the</strong> IRS on<br />

all material tax matters for fiscal 2002 through fiscal 2005 during fiscal 2009. We believe that <strong>the</strong> amount on deposit with <strong>the</strong> IRS will be<br />

sufficient to settle all material matters with <strong>the</strong> IRS for fiscal 1999 through fiscal 2005 and thus no additional future cash payments will be<br />

required related to <strong>the</strong>se tax years. The IRS will begin its audit of fiscal 2006 and fiscal 2007 during fiscal 2009. Because of <strong>the</strong> high degree<br />

of uncertainty regarding <strong>the</strong> timing of future cash outflows, we are currently not able to make a reliable estimate of any future cash<br />

payments to respective taxing authorities that may be required as a result of future audits.<br />

Contractual obligations shown in <strong>the</strong> table above exclude benefit payments to participants under our defined benefit pension<br />

plans and o<strong>the</strong>r post-retirement medical benefit plan. We summarize <strong>the</strong> estimated benefit payments to be made by <strong>the</strong> plans over <strong>the</strong><br />

next ten years in Note 10 to our consolidated financial statements titled, “Benefit Plans.” The table also excludes contributions we make to<br />

our defined benefit pension plans and our defined contribution plan. Our future contributions to <strong>the</strong>se plans depend on many uncertain<br />

49