On the Surface

On the Surface

On the Surface

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

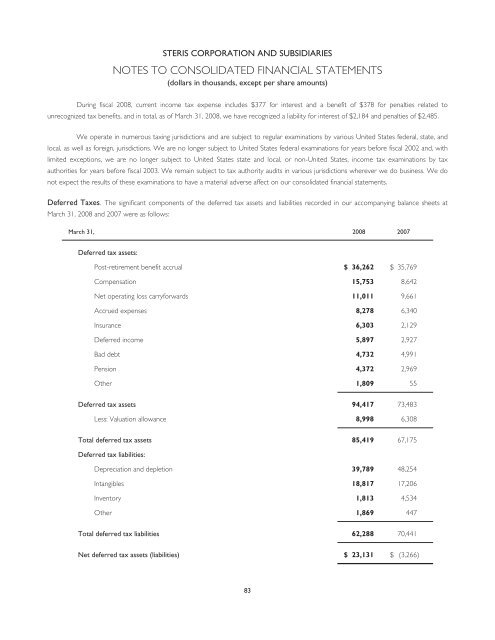

STERIS CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(dollars in thousands, except per share amounts)<br />

During fiscal 2008, current income tax expense includes $377 for interest and a benefit of $378 for penalties related to<br />

unrecognized tax benefits, and in total, as of March 31, 2008, we have recognized a liability for interest of $2,184 and penalties of $2,485.<br />

We operate in numerous taxing jurisdictions and are subject to regular examinations by various United States federal, state, and<br />

local, as well as foreign, jurisdictions. We are no longer subject to United States federal examinations for years before fiscal 2002 and, with<br />

limited exceptions, we are no longer subject to United States state and local, or non-United States, income tax examinations by tax<br />

authorities for years before fiscal 2003. We remain subject to tax authority audits in various jurisdictions wherever we do business. We do<br />

not expect <strong>the</strong> results of <strong>the</strong>se examinations to have a material adverse affect on our consolidated financial statements.<br />

Deferred Taxes. The significant components of <strong>the</strong> deferred tax assets and liabilities recorded in our accompanying balance sheets at<br />

March 31, 2008 and 2007 were as follows:<br />

March 31, 2008 2007<br />

Deferred tax assets:<br />

Post-retirement benefit accrual $ 36,262 $ 35,769<br />

Compensation 15,753 8,642<br />

Net operating loss carryforwards 11,011 9,661<br />

Accrued expenses 8,278 6,340<br />

Insurance 6,303 2,129<br />

Deferred income 5,897 2,927<br />

Bad debt 4,732 4,991<br />

Pension 4,372 2,969<br />

O<strong>the</strong>r 1,809 55<br />

Deferred tax assets 94,417 73,483<br />

Less: Valuation allowance 8,998 6,308<br />

Total deferred tax assets 85,419 67,175<br />

Deferred tax liabilities:<br />

Depreciation and depletion 39,789 48,254<br />

Intangibles 18,817 17,206<br />

Inventory 1,813 4,534<br />

O<strong>the</strong>r 1,869 447<br />

Total deferred tax liabilities 62,288 70,441<br />

Net deferred tax assets (liabilities) $ 23,131 $ (3,266)<br />

83