Annual Report for 2011-2012 - Vizag Steel

Annual Report for 2011-2012 - Vizag Steel

Annual Report for 2011-2012 - Vizag Steel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RASHTRIYA ISPAT NIGAM LIMITED<br />

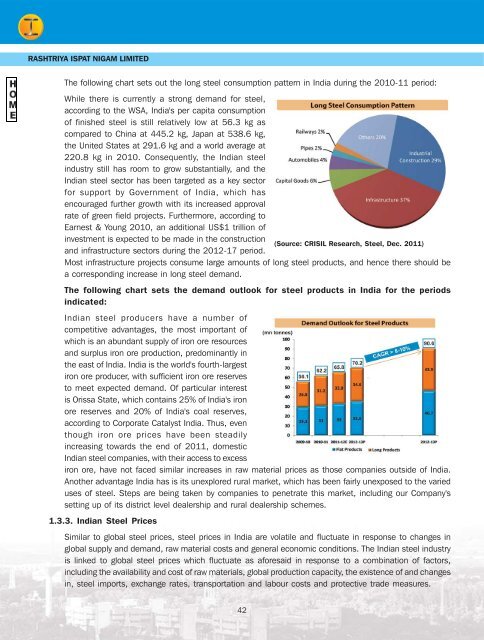

The following chart sets out the long steel consumption pattern in India during the 2010-11 period:<br />

While there is currently a strong demand <strong>for</strong> steel,<br />

according to the WSA, India's per capita consumption<br />

of finished steel is still relatively low at 56.3 kg as<br />

compared to China at 445.2 kg, Japan at 538.6 kg,<br />

the United States at 291.6 kg and a world average at<br />

220.8 kg in 2010. Consequently, the Indian steel<br />

industry still has room to grow substantially, and the<br />

Indian steel sector has been targeted as a key sector<br />

<strong>for</strong> support by Government of India, which has<br />

encouraged further growth with its increased approval<br />

rate of green field projects. Furthermore, according to<br />

Earnest & Young 2010, an additional US$1 trillion of<br />

investment is expected to be made in the construction<br />

(Source: CRISIL Research, <strong>Steel</strong>, Dec. <strong>2011</strong>)<br />

and infrastructure sectors during the <strong>2012</strong>-17 period.<br />

Most infrastructure projects consume large amounts of long steel products, and hence there should be<br />

a corresponding increase in long steel demand.<br />

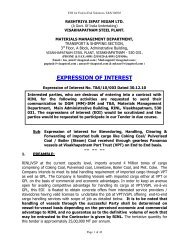

The following chart sets the demand outlook <strong>for</strong> steel products in India <strong>for</strong> the periods<br />

indicated:<br />

Indian steel producers have a number of<br />

competitive advantages, the most important of<br />

which is an abundant supply of iron ore resources<br />

and surplus iron ore production, predominantly in<br />

the east of India. India is the world's fourth-largest<br />

iron ore producer, with sufficient iron ore reserves<br />

to meet expected demand. Of particular interest<br />

is Orissa State, which contains 25% of India's iron<br />

ore reserves and 20% of India's coal reserves,<br />

according to Corporate Catalyst India. Thus, even<br />

though iron ore prices have been steadily<br />

increasing towards the end of <strong>2011</strong>, domestic<br />

Indian steel companies, with their access to excess<br />

iron ore, have not faced similar increases in raw material prices as those companies outside of India.<br />

Another advantage India has is its unexplored rural market, which has been fairly unexposed to the varied<br />

uses of steel. Steps are being taken by companies to penetrate this market, including our Company's<br />

setting up of its district level dealership and rural dealership schemes.<br />

1.3.3. Indian <strong>Steel</strong> Prices<br />

Similar to global steel prices, steel prices in India are volatile and fluctuate in response to changes in<br />

global supply and demand, raw material costs and general economic conditions. The Indian steel industry<br />

is linked to global steel prices which fluctuate as a<strong>for</strong>esaid in response to a combination of factors,<br />

including the availability and cost of raw materials, global production capacity, the existence of and changes<br />

in, steel imports, exchange rates, transportation and labour costs and protective trade measures.<br />

42