ABG Shipyard (ABGSHI) - ICICI Direct

ABG Shipyard (ABGSHI) - ICICI Direct

ABG Shipyard (ABGSHI) - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

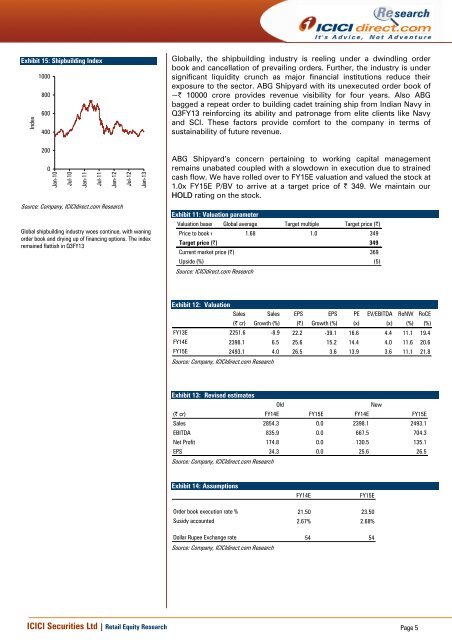

Exhibit 15: Shipbuilding Index<br />

1000<br />

800<br />

Index<br />

600<br />

400<br />

Globally, the shipbuilding industry is reeling under a dwindling order<br />

book and cancellation of prevailing orders. Further, the industry is under<br />

significant liquidity crunch as major financial institutions reduce their<br />

exposure to the sector. <strong>ABG</strong> <strong>Shipyard</strong> with its unexecuted order book of<br />

~| 10000 crore provides revenue visibility for four years. Also <strong>ABG</strong><br />

bagged a repeat order to building cadet training ship from Indian Navy in<br />

Q3FY13 reinforcing its ability and patronage from elite clients like Navy<br />

and SCI. These factors provide comfort to the company in terms of<br />

sustainability of future revenue.<br />

200<br />

0<br />

Jan-10<br />

Jul-10<br />

Jan-11<br />

Jul-11<br />

Jan-12<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Jul-12<br />

Jan-13<br />

Global shipbuilding industry woes continue, with waning<br />

order book and drying up of financing options. The index<br />

remained flattish in Q3FY13<br />

<strong>ABG</strong> <strong>Shipyard</strong>’s concern pertaining to working capital management<br />

remains unabated coupled with a slowdown in execution due to strained<br />

cash flow. We have rolled over to FY15E valuation and valued the stock at<br />

1.0x FY15E P/BV to arrive at a target price of | 349. We maintain our<br />

HOLD rating on the stock.<br />

Exhibit 11: Valuation parameter<br />

Valuation based Global average Target multiple Target price (|)<br />

Price to book v 1.68 1.0 349<br />

Target price (|) 349<br />

Current market price (|) 369<br />

Upside (%) (5)<br />

Source: <strong>ICICI</strong>direct.com Research<br />

Exhibit 12: Valuation<br />

Sales Sales EPS EPS PE EV/EBITDA RoNW RoCE<br />

(| cr) Growth (%) (|) Growth (%) (x) (x) (%) (%)<br />

FY13E 2251.6 -8.9 22.2 -39.1 16.6 4.4 11.1 19.4<br />

FY14E 2398.1 6.5 25.6 15.2 14.4 4.0 11.6 20.6<br />

FY15E 2493.1 4.0 26.5 3.6 13.9 3.6 11.1 21.8<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 13: Revised estimates<br />

Old<br />

New<br />

(| cr) FY14E FY15E FY14E FY15E<br />

Sales 2854.3 0.0 2398.1 2493.1<br />

EBITDA 835.9 0.0 667.5 704.3<br />

Net Profit 174.8 0.0 130.5 135.1<br />

EPS 34.3 0.0 25.6 26.5<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 14: Assumptions<br />

FY14E<br />

FY15E<br />

Order book execution rate % 21.50 23.50<br />

Susidy accounted 2.67% 2.68%<br />

Dollar Rupee Exchange rate 54 54<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 5