- Page 1 and 2:

TEAMFLY

- Page 6:

Data Mining Techniques For Marketin

- Page 10:

To Stephanie, Sasha, and Nathaniel.

- Page 16:

xx Acknowledgments And, of course,

- Page 20:

TEAMFLY Team-Fly ®

- Page 24:

xxiv Introduction Even if the techn

- Page 30:

Contents Acknowledgments About the

- Page 34:

Contents vii Learning Things That A

- Page 38:

Contents ix Different Kinds of Chur

- Page 42:

Contents xi Chapter 8 How Does a Ne

- Page 46:

Contents xiii Case Study: Who Is Us

- Page 50:

Contents xv Chapter 14 Data Mining

- Page 54:

Contents xvii Availability of Train

- Page 58:

CHAPTER 1 Why and What Is Data Mini

- Page 62:

Why and What Is Data Mining? 3 In t

- Page 66:

Why and What Is Data Mining? 5 many

- Page 70:

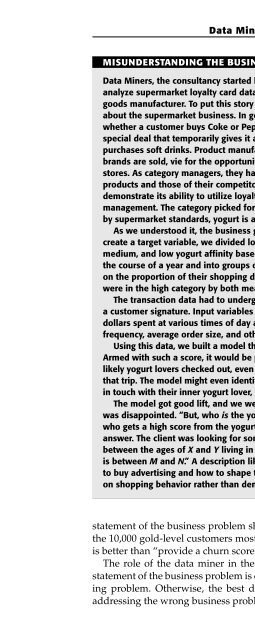

Why and What Is Data Mining? 7 DATA

- Page 74:

Why and What Is Data Mining? 9 Clas

- Page 78:

Why and What Is Data Mining? 11 cho

- Page 82:

Why and What Is Data Mining? 13 man

- Page 86:

Why and What Is Data Mining? 15 Com

- Page 90:

Why and What Is Data Mining? 17 sit

- Page 94:

Why and What Is Data Mining? 19 And

- Page 100:

22 Chapter 2 Data is at the heart o

- Page 104:

24 Chapter 2 Marketing literature f

- Page 108:

26 Chapter 2 What Is the Virtuous C

- Page 112:

28 Chapter 2 that lurking inside th

- Page 116:

30 Chapter 2 possible to identify t

- Page 120:

32 Chapter 2 All of these measureme

- Page 124: 34 Chapter 2 Data mining results ch

- Page 128: 36 Chapter 2 Quota Savings Randomiz

- Page 132: 38 Chapter 2 Some of these fields r

- Page 136: 40 Chapter 2 How Data Mining Was Ap

- Page 140: 42 Chapter 2 smaller group of likel

- Page 144: 44 Chapter 3 years, the authors hav

- Page 148: 46 Chapter 3 Ford is the only one w

- Page 152: 48 Chapter 3 Figure 3.2 shows anoth

- Page 156: 50 Chapter 3 The data mining method

- Page 160: 52 Chapter 3 In the most general se

- Page 164: 54 Chapter 3 of maleness. It seems

- Page 168: 56 Chapter 3 Step One: Translate th

- Page 172: 58 Chapter 3 ■■ ■■ ■■ C

- Page 178: Data Mining Methodology and Best Pr

- Page 182: Data Mining Methodology and Best Pr

- Page 186: Data Mining Methodology and Best Pr

- Page 190: Data Mining Methodology and Best Pr

- Page 194: Data Mining Methodology and Best Pr

- Page 198: Data Mining Methodology and Best Pr

- Page 202: Data Mining Methodology and Best Pr

- Page 206: Data Mining Methodology and Best Pr

- Page 210: Data Mining Methodology and Best Pr

- Page 214: Data Mining Methodology and Best Pr

- Page 218: Data Mining Methodology and Best Pr

- Page 222: Data Mining Methodology and Best Pr

- Page 226:

Data Mining Methodology and Best Pr

- Page 230:

CHAPTER 4 Data Mining Applications

- Page 234:

Data Mining Applications 89 Data mi

- Page 238:

Data Mining Applications 91 are “

- Page 242:

Data Mining Applications 93 TIP Whe

- Page 246:

Data Mining Applications 95 DATA BY

- Page 250:

Data Mining Applications 97 mining

- Page 254:

Data Mining Applications 99 ROC CUR

- Page 258:

Data Mining Applications 101 BENEFI

- Page 262:

Data Mining Applications 103 How th

- Page 266:

Data Mining Applications 105 $400,0

- Page 270:

Data Mining Applications 107 before

- Page 274:

Data Mining Applications 109 Start

- Page 278:

Data Mining Applications 111 can be

- Page 282:

Data Mining Applications 113 The bi

- Page 286:

Data Mining Applications 115 Costs

- Page 290:

Data Mining Applications 117 and so

- Page 294:

Data Mining Applications 119 From a

- Page 298:

Data Mining Applications 121 to ass

- Page 302:

CHAPTER 5 The Lure of Statistics: D

- Page 306:

The Lure of Statistics: Data Mining

- Page 310:

Cumulative Proportion The Lure of S

- Page 314:

The Lure of Statistics: Data Mining

- Page 318:

The Lure of Statistics: Data Mining

- Page 322:

The Lure of Statistics: Data Mining

- Page 326:

The Lure of Statistics: Data Mining

- Page 330:

The Lure of Statistics: Data Mining

- Page 334:

The Lure of Statistics: Data Mining

- Page 338:

The Lure of Statistics: Data Mining

- Page 342:

The Lure of Statistics: Data Mining

- Page 346:

The Lure of Statistics: Data Mining

- Page 350:

The Lure of Statistics: Data Mining

- Page 354:

The Lure of Statistics: Data Mining

- Page 358:

The Lure of Statistics: Data Mining

- Page 362:

The Lure of Statistics: Data Mining

- Page 366:

The Lure of Statistics: Data Mining

- Page 370:

The Lure of Statistics: Data Mining

- Page 374:

The Lure of Statistics: Data Mining

- Page 378:

The Lure of Statistics: Data Mining

- Page 382:

The Lure of Statistics: Data Mining

- Page 388:

166 Chapter 6 rule (such as income

- Page 392:

168 Chapter 6 1 1 lifetime orders <

- Page 396:

170 Chapter 6 For many applications

- Page 400:

172 Chapter 6 Finding the Splits At

- Page 404:

174 Chapter 6 Splitting on a Catego

- Page 408:

176 Chapter 6 claims were paid auto

- Page 412:

178 Chapter 6 Purity measures for e

- Page 416:

180 Chapter 6 To calculate the tota

- Page 420:

182 Chapter 6 COMPARING TWO SPLITS

- Page 424:

184 Chapter 6 does for continuous v

- Page 428:

186 Chapter 6 COMPARING MISCLASSIFI

- Page 432:

188 Chapter 6 COMPARING MISCLASSIFI

- Page 436:

190 Chapter 6 Error Rate Prune here

- Page 440:

192 Chapter 6 Miner using its defau

- Page 444:

194 Chapter 6 Watch the game? No Ye

- Page 448:

196 Chapter 6 Table 6.1 All Possibl

- Page 452:

198 Chapter 6 space, the correspond

- Page 456:

200 Chapter 6 Last Movie in Group L

- Page 460:

202 Chapter 6 TEAMFLY Figure 6.15 A

- Page 464:

204 Chapter 6 Figure 6.16 Miner. A

- Page 468:

206 Chapter 6 Simulating the Future

- Page 472:

208 Chapter 6 USING DECISION TREES

- Page 478:

CHAPTER 7 Artificial Neural Network

- Page 482:

Artificial Neural Networks 213 This

- Page 486:

Artificial Neural Networks 215 The

- Page 490:

Artificial Neural Networks 217 Tabl

- Page 494:

Artificial Neural Networks 219 Neur

- Page 498:

Artificial Neural Networks 221 inpu

- Page 502:

Artificial Neural Networks 223 outp

- Page 506:

Artificial Neural Networks 225 SIGM

- Page 510:

Artificial Neural Networks 227 The

- Page 514:

Artificial Neural Networks 229 to c

- Page 518:

Artificial Neural Networks 231 The

- Page 522:

Artificial Neural Networks 233 This

- Page 526:

Artificial Neural Networks 235 TIP

- Page 530:

Artificial Neural Networks 237 can

- Page 534:

Artificial Neural Networks 239 The

- Page 538:

Artificial Neural Networks 241 Othe

- Page 542:

Artificial Neural Networks 243 The

- Page 546:

Artificial Neural Networks 245 or d

- Page 550:

Artificial Neural Networks 247 Tabl

- Page 554:

Artificial Neural Networks 249 Self

- Page 558:

Artificial Neural Networks 251 The

- Page 562:

Artificial Neural Networks 253 ther

- Page 566:

Artificial Neural Networks 255 can

- Page 572:

258 Chapter 8 obvious geometric int

- Page 576:

260 Chapter 8 The first stage of MB

- Page 580:

262 Chapter 8 One possible combinat

- Page 584:

264 Chapter 8 1 0.9 0.8 0.7 0.6 0.5

- Page 588:

266 Chapter 8 What Are the Codes? T

- Page 592:

268 Chapter 8 USING RELEVANCE FEEDB

- Page 596:

270 Chapter 8 Choosing the Number o

- Page 600:

272 Chapter 8 3. Commutativity. Dir

- Page 604:

274 Chapter 8 MEASURING THE EFFECTI

- Page 608:

276 Chapter 8 Gender is an example

- Page 612:

278 Chapter 8 Furthermore, there is

- Page 616:

280 Chapter 8 In Table 8.12, the fi

- Page 620:

282 Chapter 8 Table 8.16 Confidence

- Page 624:

284 Chapter 8 Comparing Profiles On

- Page 628:

286 Chapter 8 produces better resul

- Page 632:

288 Chapter 9 In this shopping bask

- Page 636:

290 Chapter 9 The order is the fund

- Page 640:

292 Chapter 9 Order Characteristics

- Page 644:

294 Chapter 9 450 400 Mail Drop 350

- Page 648:

296 Chapter 9 Association Rules One

- Page 652:

298 Chapter 9 explanation: Is the d

- Page 656:

300 Chapter 9 This simple co-occurr

- Page 660:

302 Chapter 9 Detergent 1 0 0 1 1 S

- Page 664:

304 Chapter 9 Table 9.3 Transaction

- Page 668:

306 Chapter 9 The number of combina

- Page 672:

308 Chapter 9 Data Quality The data

- Page 676:

310 Chapter 9 Table 9.6 Confidence

- Page 680:

312 Chapter 9 For instance, in the

- Page 684:

314 Chapter 9 A pizza restaurant ha

- Page 688:

316 Chapter 9 TIP Adding virtual tr

- Page 692:

318 Chapter 9 Sequential Analysis U

- Page 696:

320 Chapter 9 Market basket analysi

- Page 700:

322 Chapter 10 often yields very in

- Page 704:

324 Chapter 10 Oops! These edges in

- Page 708:

326 Chapter 10 A C D Pregel River N

- Page 712:

328 Chapter 10 leaves the car in th

- Page 716:

330 Chapter 10 Directed Graphs The

- Page 720:

332 Chapter 10 The Kleinberg Algori

- Page 724:

334 Chapter 10 Identifying the Cand

- Page 728:

336 Chapter 10 Hubs and Authorities

- Page 732:

338 Chapter 10 353 3658 00:00:41

- Page 736:

169 44 61 340 Chapter 10 The proces

- Page 740:

342 Chapter 10 USING SQL TO COLOR A

- Page 744:

5 MOU 344 Chapter 10 customer behav

- Page 748:

346 Chapter 10 Second, link analysi

- Page 754:

CHAPTER 11 Automatic Cluster Detect

- Page 758:

Automatic Cluster Detection 351 the

- Page 762:

Automatic Cluster Detection 353 The

- Page 766:

Automatic Cluster Detection 355 the

- Page 770:

Automatic Cluster Detection 357 X 2

- Page 774:

Automatic Cluster Detection 359 thi

- Page 778:

Automatic Cluster Detection 361 DIS

- Page 782:

Automatic Cluster Detection 363 Man

- Page 786:

Automatic Cluster Detection 365 Use

- Page 790:

Automatic Cluster Detection 367 The

- Page 794:

Automatic Cluster Detection 369 sub

- Page 798:

Automatic Cluster Detection 371 Dis

- Page 802:

Automatic Cluster Detection 373 is

- Page 806:

Automatic Cluster Detection 375 sig

- Page 810:

Automatic Cluster Detection 377 Cre

- Page 814:

Automatic Cluster Detection 379 Pop

- Page 818:

Automatic Cluster Detection 381 Les

- Page 822:

CHAPTER 12 Knowing When to Worry: H

- Page 826:

Hazard Functions and Survival Analy

- Page 830:

Hazard Functions and Survival Analy

- Page 834:

Hazard Functions and Survival Analy

- Page 838:

Hazard Functions and Survival Analy

- Page 842:

Hazard Functions and Survival Analy

- Page 846:

Hazard Functions and Survival Analy

- Page 850:

Hazard Functions and Survival Analy

- Page 854:

Hazard Functions and Survival Analy

- Page 858:

1 Hazard Functions and Survival Ana

- Page 862:

Hazard Functions and Survival Analy

- Page 866:

Hazard Functions and Survival Analy

- Page 870:

Hazard Functions and Survival Analy

- Page 874:

Hazard Functions and Survival Analy

- Page 878:

Hazard Functions and Survival Analy

- Page 882:

Hazard Functions and Survival Analy

- Page 886:

Hazard Functions and Survival Analy

- Page 890:

Hazard Functions and Survival Analy

- Page 894:

Hazard Functions and Survival Analy

- Page 900:

422 Chapter 13 problems involving c

- Page 904:

424 Chapter 13 template for the hum

- Page 908:

426 Chapter 13 generation n generat

- Page 912:

428 Chapter 13 SIMPLE OVERVIEW OF G

- Page 916:

430 Chapter 13 Table 13.3 The Popul

- Page 920:

432 Chapter 13 Table 13.5 The Popul

- Page 924:

434 Chapter 13 So far, this problem

- Page 928:

436 Chapter 13 schema match the cor

- Page 932:

438 Chapter 13 The Schema Theorem e

- Page 936:

440 Chapter 13 The first problem fa

- Page 940:

442 Chapter 13 trained to fill in a

- Page 944:

444 Chapter 13 Figure 13.7 The Gena

- Page 948:

446 Chapter 13 Lessons Learned Gene

- Page 952:

448 Chapter 14 has largely replaced

- Page 956:

450 Chapter 14 NO CUSTOMER RELATION

- Page 960:

452 Chapter 14 ■■ ■■ Automa

- Page 964:

454 Chapter 14 Such agent relations

- Page 968:

456 Chapter 14 Larger businesses, o

- Page 972:

458 Chapter 14 Subscription Relatio

- Page 976:

Respond from Some Channel Not Pay 4

- Page 980:

462 Chapter 14 Who Are the Prospect

- Page 984:

464 Chapter 14 What Is the Role of

- Page 988:

466 Chapter 14 New sales come in th

- Page 992:

468 Chapter 14 AN ENGINE FOR CHURN

- Page 996:

470 Chapter 14 Winback Once custome

- Page 1000:

TEAMFLY Team-Fly ®

- Page 1004:

474 Chapter 15 believe that, over t

- Page 1008:

476 Chapter 15 The level of abstrac

- Page 1012:

478 Chapter 15 effort. One of the g

- Page 1016:

480 Chapter 15 WHAT IS A RELATIONAL

- Page 1020:

482 Chapter 15 WHAT IS A RELATIONAL

- Page 1024:

484 Chapter 15 warehouse must be re

- Page 1028:

486 Chapter 15 One or more of these

- Page 1032:

488 Chapter 15 Central Repository T

- Page 1036:

490 Chapter 15 BACKGROUND ON PARALL

- Page 1040:

492 Chapter 15 important type of da

- Page 1044:

494 Chapter 15 The data warehouse i

- Page 1048:

496 Chapter 15 In the middle are of

- Page 1052:

498 Chapter 15 Shop Date Product sh

- Page 1056:

500 Chapter 15 The third type of cu

- Page 1060:

502 Chapter 15 ranges of customer v

- Page 1064:

504 Chapter 15 Conformed Dimensions

- Page 1068:

506 Chapter 15 In diagrams, the dim

- Page 1072:

508 Chapter 15 One of the problems

- Page 1076:

510 Chapter 15 graph. Neural networ

- Page 1080:

512 Chapter 15 A typical data wareh

- Page 1084:

514 Chapter 16 A Customer-Centric O

- Page 1088:

516 Chapter 16 data is not readily

- Page 1092:

518 Chapter 16 Operational Data (bi

- Page 1096:

520 Chapter 16 Collecting the Right

- Page 1100:

522 Chapter 16 devising new product

- Page 1104:

524 Chapter 16 direct mail decrease

- Page 1108:

526 Chapter 16 A new data mining gr

- Page 1112:

528 Chapter 16 Scoring is not compl

- Page 1116:

530 Chapter 16 three major modules,

- Page 1120:

532 Chapter 16 What is appealing ab

- Page 1124:

534 Chapter 16 account future growt

- Page 1128:

536 Chapter 16 Comprehensible Outpu

- Page 1132:

538 Chapter 16 step is to create a

- Page 1136:

540 Chapter 17 budget for buying ha

- Page 1140:

542 Chapter 17 It is perhaps unfort

- Page 1144:

544 Chapter 17 The distribution of

- Page 1148:

546 Chapter 17 Before ignoring a co

- Page 1152:

548 Chapter 17 Figure 17.4 Angoss K

- Page 1156:

550 Chapter 17 ■■ True numeric

- Page 1160:

552 Chapter 17 Dates and Times Date

- Page 1164:

554 Chapter 17 Neural networks and

- Page 1168:

556 Chapter 17 One of the most impo

- Page 1172:

558 Chapter 17 Constructing the Cus

- Page 1176:

560 Chapter 17 Identifying the Cust

- Page 1180:

562 Chapter 17 business customers o

- Page 1184:

564 Chapter 17 Making Progress Alth

- Page 1188:

566 Chapter 17 Changes over Time Pe

- Page 1192:

568 Chapter 17 DM TM WEB Credit Car

- Page 1196:

570 Chapter 17 When the lookup tabl

- Page 1200:

572 Chapter 17 Pivoting Regular Tim

- Page 1204:

574 Chapter 17 Summarizing Transact

- Page 1208:

576 Chapter 17 One method of calcul

- Page 1212:

578 Chapter 17 TIP When many differ

- Page 1216:

580 Chapter 17 Revolvers, Transacto

- Page 1220:

582 Chapter 17 Table 17.5 Six Credi

- Page 1224:

584 Chapter 17 Table 17.6 Potential

- Page 1228:

586 Chapter 17 $2,000 $1,500 $1,000

- Page 1232:

588 Chapter 17 120 Payment as Multi

- Page 1236:

590 Chapter 17 The Dark Side of Dat

- Page 1240:

592 Chapter 17 Dirty Data Dirty dat

- Page 1244:

594 Chapter 17 and so on. However,

- Page 1248:

596 Chapter 17 varies from tool to

- Page 1252:

598 Chapter 18 Getting Started The

- Page 1256:

600 Chapter 18 These are areas wher

- Page 1260:

602 Chapter 18 proof-of-concept pro

- Page 1264:

604 Chapter 18 Although the details

- Page 1268:

606 Chapter 18 less likely to churn

- Page 1272:

608 Chapter 18 from one record to a

- Page 1276:

610 Chapter 18 are appropriate for

- Page 1280:

612 Chapter 18 serial number and ph

- Page 1284:

614 Chapter 18 plan allows. Since t

- Page 1288:

616 Index analysis differential res

- Page 1292:

618 Index auxiliary information, 56

- Page 1296:

620 Index champion-challenger appro

- Page 1300:

622 Index creative process, data mi

- Page 1304:

624 Index data (continued) missing

- Page 1308:

626 Index discrete outcomes, classi

- Page 1312:

628 Index genetic algorithms case s

- Page 1316:

630 Index intuition, data explorati

- Page 1320:

632 Index memory-based reasoning (M

- Page 1324:

634 Index new customer information

- Page 1328:

636 Index proof-of-concept projects

- Page 1332:

638 Index response, survey response

- Page 1336:

640 Index SQL data, time series ana

- Page 1340:

642 Index testing (continued) KS (K