MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FMCI Update<br />

• Financial and monetary conditions<br />

tightened in most of the major advanced<br />

economies during July.<br />

• The slower pace of increase in equities (in<br />

% y/y terms) was one of the main drivers of the<br />

tightening of conditions over the month.<br />

• Among the major advanced economies, the<br />

US FMCI points to the loosest financial and<br />

monetary conditions and the Swedish FMCI, the<br />

tightest.<br />

• Meanwhile, in Asia, conditions loosened<br />

significantly in China. In <strong>India</strong>, conditions<br />

loosened slightly and in South Korea they<br />

remained broadly stable.<br />

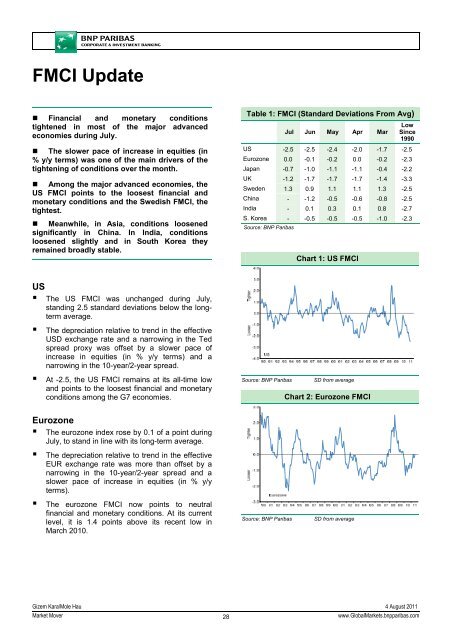

Table 1: FMCI (Standard Deviations From Avg)<br />

Low<br />

Jul Jun May Apr Mar Since<br />

1990<br />

US -2.5 -2.5 -2.4 -2.0 -1.7 -2.5<br />

Eurozone 0.0 -0.1 -0.2 0.0 -0.2 -2.3<br />

Japan -0.7 -1.0 -1.1 -1.1 -0.4 -2.2<br />

UK -1.2 -1.7 -1.7 -1.7 -1.4 -3.3<br />

Sweden 1.3 0.9 1.1 1.1 1.3 -2.5<br />

China - -1.2 -0.5 -0.6 -0.8 -2.5<br />

<strong>India</strong> - 0.1 0.3 0.1 0.8 -2.7<br />

S. Korea - -0.5 -0.5 -0.5 -1.0 -2.3<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 1: US FMCI<br />

US<br />

• The US FMCI was unchanged during July,<br />

standing 2.5 standard deviations below the longterm<br />

average.<br />

• The depreciation relative to trend in the effective<br />

USD exchange rate and a narrowing in the Ted<br />

spread proxy was offset by a slower pace of<br />

increase in equities (in % y/y terms) and a<br />

narrowing in the 10-year/2-year spread.<br />

• At -2.5, the US FMCI remains at its all-time low<br />

and points to the loosest financial and monetary<br />

conditions among the G7 economies.<br />

Source: <strong>BNP</strong> Paribas<br />

SD from average<br />

Chart 2: Eurozone FMCI<br />

Eurozone<br />

• The eurozone index rose by 0.1 of a point during<br />

July, to stand in line with its long-term average.<br />

• The depreciation relative to trend in the effective<br />

EUR exchange rate was more than offset by a<br />

narrowing in the 10-year/2-year spread and a<br />

slower pace of increase in equities (in % y/y<br />

terms).<br />

• The eurozone FMCI now points to neutral<br />

financial and monetary conditions. At its current<br />

level, it is 1.4 points above its recent low in<br />

March 2010.<br />

Source: <strong>BNP</strong> Paribas<br />

SD from average<br />

Gizem Kara/Mole Hau 4 August 2011<br />

Market Mover<br />

28<br />

www.GlobalMarkets.bnpparibas.com