Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

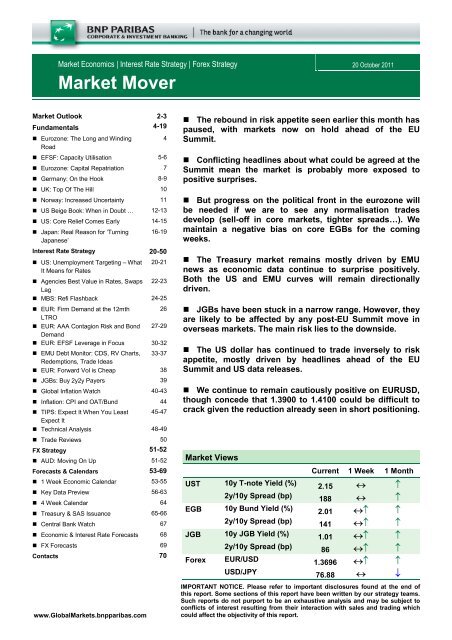

<strong>Market</strong> Economics | Interest Rate Strategy | Forex Strategy 20 October 2011<strong>Market</strong> Mover<strong>Market</strong> <strong>Outlook</strong> 2-3Fundamentals 4-19• Eurozone: The Long and Winding4Road• EFSF: Capacity Utilisation 5-6• Eurozone: Capital Repatriation 7• Germany: On the Hook 8-9• UK: Top Of The Hill 10• Norway: Increased Uncertainty 11• US Beige Book: When in Doubt … 12-13• US: Core Relief Comes Early 14-15• Japan: Real Reason for ‘Turning 16-19Japanese’Interest Rate Strategy 20-50• US: Unemployment Targeting – What 20-21It Means for Rates• Agencies Best Value in Rates, Swaps 22-23Lag• MBS: Refi Flashback 24-25• EUR: Firm Demand at the 12mth 26LTRO• EUR: AAA Contagion Risk and Bond 27-29Demand• EUR: EFSF Leverage in Focus 30-32• EMU Debt Monitor: CDS, RV Charts, 33-37Redemptions, Trade Ideas• EUR: Forward Vol is Cheap 38• JGBs: Buy 2y2y Payers 39• Global Inflation Watch 40-43• Inflation: CPI and OAT/Bund 44• TIPS: Expect It When You Least 45-47Expect It• Technical Analysis 48-49• Trade Reviews 50FX Strategy 51-52• AUD: Moving On Up 51-52Forecasts & Calendars• 1 Week Economic Calendar53-6953-55• Key Data Preview 56-63• 4 Week Calendar 64• Treasury & SAS Issuance 65-66• Central Bank Watch 67• Economic & Interest Rate Forecasts 68• FX Forecasts 69Contacts70www.Global<strong>Market</strong>s.bnpparibas.com• The rebound in risk appetite seen earlier this month haspaused, with markets now on hold ahead of the EUSummit.• Conflicting headlines about what could be agreed at theSummit mean the market is probably more exposed topositive surprises.• But progress on the political front in the eurozone willbe needed if we are to see any normalisation tradesdevelop (sell-off in core markets, tighter spreads…). Wemaintain a negative bias on core EGBs for the comingweeks.• The Treasury market remains mostly driven by EMUnews as economic data continue to surprise positively.Both the US and EMU curves will remain directionallydriven.• JGBs have been stuck in a narrow range. However, theyare likely to be affected by any post-EU Summit move inoverseas markets. The main risk lies to the downside.• The US dollar has continued to trade inversely to riskappetite, mostly driven by headlines ahead of the EUSummit and US data releases.• We continue to remain cautiously positive on EURUSD,though concede that 1.3900 to 1.4100 could be difficult tocrack given the reduction already seen in short positioning.<strong>Market</strong> ViewsUST 10y T-note Yield (%)2y/10y Spread (bp)EGB 10y Bund Yield (%)2y/10y Spread (bp)JGB 10y JGB Yield (%)2y/10y Spread (bp)Forex EUR/USDUSD/JPYCurrent 1 Week 1 Month2.15 ↔ ↑188 ↔ ↑2.01 ↔↑ ↑141 ↔↑ ↑1.01 ↔↑ ↑86 ↔↑ ↑1.3696 ↔↑ ↑76.88 ↔ ↓IMPORTANT NOTICE. Please refer to important disclosures found at the end ofthis report. Some sections of this report have been written by our strategy teams.Such reports do not purport to be an exhaustive analysis and may be subject toconflicts of interest resulting from their interaction with sales and trading whichcould affect the objectivity of this report.

<strong>Market</strong> <strong>Outlook</strong><strong>Market</strong>s remain on holdahead of the EU SummitThe rally in risky assets seen during the first half of October has paused dueto a barrage of contradictory headlines about exactly what has been and willbe agreed ahead of the European Summit this weekend. Talk of a possibledelay to the European Summit is indicative of the difficulties in securing acomprehensive agreement.According to German government officials, talks on leveraging the EFSFwere making 'good progress'. But the French finance minister was quotedsubsequently saying that France favours the involvement of the ECB in theprocess. Germany, and apparently the ECB, judging by the comments at thepress conference earlier this month, are opposed this involvement.A delay would not be a good signal short term. However, if it increased thelikelihood of a comprehensive deal being struck ahead of the G20 meeting inearly November, that could ultimately be a positive development. On thepositive side, progress is being made on other elements of the discussion,including the bank capital issue.EMU Major Upcoming Events21 October Extraordinary Eurogroup meeting21 October EUR 1.6bn T-Bill redemption in Greece22 October EUR 1.1bn coupon payment in Greece23 October EU Summit3 November ECB policy decision3-4 November G20 Summit7-8 November Eurogroup/EcoFin meeting in Luxembourg11 November EUR 2.0bn T-Bill redemption in Greece18 November EUR 1.3bn T-Bill redemption in Greece20 November General elections in Spain29-30 November Eurogroup/EcoFin meeting in Luxembourg8 December ECB policy decision9 December EU SummitWe expect somenormalisation afterupcoming summitsSource: <strong>BNP</strong> ParibasData-wise, the upcoming bundle of surveys will continue to show morefallout on the eurozone economy from the stress in markets and the highlevel of uncertainty. The composite PMI is already consistent with a fall inoutput, and prior weakness in the forward-looking components (new ordersetc) suggests it will continue to slide. In addition, the Eurocoin indicator islikely to go below zero for the first time since 2009. UK sentiment surveysare also likely to show more evidence of contagion.Given recent price action and conflicting signals, the market now looks moreexposed to positive surprises at the upcoming meetings. We maintain anegative bias on core EGBs for the coming weeks although, once again,political developments will set the tone. The benchmark curve will remaindirectionally driven, with further flattening/steepening pressuresaccompanied by bullish/bearish tones by the end of the week.Intra-EMU spreads have been rising again. French government bondspreads in particular are under sharp widening pressure following a reportfrom Moody’s indicating it will monitor and assess France’s stable outlookover the next three months by considering how much progress has beenmade in the plan to curb the deficit and any adverse developments. Contraryto previous episodes of sovereign stress, speculation is now being directedtoward economies where the fundamental fiscal picture is relatively positive.These recent developments highlight the need for decisive action fromgovernments at the upcoming EU and G20 summits.Cyril Beuzit 20 October 2011<strong>Market</strong> Mover2www.Global<strong>Market</strong>s.bnpparibas.com

Germany: On the Hook• German data releases signal risks to growthare increasing.• The labour market seems strong butaggregate figures hide some crucial shifts in itsstructure, which could weaken domesticdemand.• This week, the Ministry of Economicspublished its new forecasts of 2.9% GDP growthin 2011 and 1.0% in 2012. It does not expect arecession.• Neither do we currently forecast a recession,expecting GDP growth of 2.7% in 2011 and 1.0%in 2012. However, we recognise that risks of aweak start to 2012 are rising.Source: Reuters EcoWin ProChart 1: Trade Balance (EUR bn)Chart 2: Industrial Production vs. Orders (Levels)In general, German data releases over the pastmonth have sent conflicting signals about theeconomy’s growth outlook. Although only one quarterof a q/q fall in GDP is currently expected by <strong>BNP</strong>Paribas, arguments that the domestic economy willremain resilient in the face of the slowdown in globalactivity look vulnerable.Official forecasts: no recessionThis week, the German Ministry of Economicsofficially presented its new growth forecasts. Itforecasts that in 2011 GDP will grow by 2.9%,representing only a slight downward revision to itsprevious forecast of 0.1 of a percentage point. Aslowdown in activity in Q4 is expected, but not a fall.2012 growth is forecast at only 1.0%, down from1.8% forecast previously. Domestic demand will, inthis scenario, replace the external sector as the maindriver of growth.In our October Global <strong>Outlook</strong>, we expected “normal”growth in Q3 to be followed by a fall in activity in Q4and a return to trend growth thereafter. For the fullyear, this results in 2.7% growth for 2011, comingfrom the strong carryover from Q1. We then expect aweakening in growth to 1.0% in 2012.Both Ministry of Economics and our forecasts see areturn to trend growth as early as Q1 2012, butrecent data suggest that the economy could prove tobe less resilient than anticipated and may start 2012below expectations.Expectations declineSurveys of current economic conditions show aSource: Reuters EcoWin Prodeterioration in sentiment, but levels indicate thatconditions remain well above long-term averages.Expectations for activity over the next six months,however, declined earlier and more sharply in boththe ZEW and the Ifo. In October, the ZEWexpectations index fell further than expected to thelowest level since the post-Lehman crisis. However,due to the composition of the survey, the index ismore vulnerable to financial than to real economydata and hence tends to overshoot. The Ifoexpectation index is following the ZEW’s downwardtrend. Comparable falls in the Ifo in the past weretypically followed by a recession, but theserecessions were neither steep nor longer than twoquarters.The PMIs lie between confidence and hard data asthey rely on a qualitative statement based oncompany accounts. Currently, it is the labour marketthat is keeping the PMI, now at 50.5, in expansionterritory. Sub-indices, such as new orders, declinedKen Wattret 20 October 2011<strong>Market</strong> Mover8www.Global<strong>Market</strong>s.bnpparibas.com

elow 50 in August, indicating a further weakening inactivity is likely. And, whenever the German PMI fallsbelow the 50-point benchmark, it remains there fornine months on average, accompanied by twoquarters of falls in GDP on average.August data were weakThe latest hard data are available for August – themonth when soft (survey) indicators took theirhardest hit. Better than expected data came from theexternal sector, where exports increased again by3.5% m/m while imports were unchanged, driving thetrade balance upwards again. However, thecumulative trade balance until August of EUR 98.9bnwas EUR 7bn below its average in the same periodof 2004-2010. And this decline is due to intraeurozonetrade, which accounted for 60% ofGermany’s surplus over 2004-2010. The tradebalance with eurozone members in the year toAugust was down EUR 8bn compared to previousyears. A slowdown in activity in the global economyis likely to cut net trade’s valuable contribution toGDP growth further.Industrial production weakened less than expected inAugust: growth slowed to 7.9% y/y compared to10.4% in July (sa). However, this weakening is likelyto persist as new orders declined for the secondmonth in a row in August, slowing growth to 3.6% y/yfrom 8.9%. The moderation in the growth in exportorders has been sharper in recent months than fordomestic orders, once more underlining the highexposure of the economy to global growth. Inaddition, industrial production seems to be high inrelation to the level of orders, increasing the risk andscope for a downward adjustment (Chart 2).Labour market is the brightest spot – but becautiousThe German labour market outperformedexpectations again in September, with the number ofunemployed down by a further 27,000, lowering theunemployment rate to 6.9%. Lower unemploymenthas not been registered in the series’ records sincereunification.Typically, such a strong labour market should boostconsumer confidence and eventually also domesticdemand growth. But so far, this spillover has notmaterialised. Consumer confidence has remainedalmost stable, but consumption itself decreased inQ2 and more recently, retail sales (although not themost reliable indicator for total consumption) fell at itsfastest rate in four years.Labour hoarding in 2008/2009 was facilitated bymassive subsidy programmes for short-time labour.Chart 3: Labour <strong>Market</strong>, Share of Part-timeSource: Reuters EcoWin ProNearly 1.5 million employed fell into this category atits peak in mid-2009, but these figures have comeback down to 66,000 in July 2011 (latest available).Firms currently seem to be struggling to fill positionswith qualified staff, as indicated by a lengthening inthe time required to fill a vacant post from 55 to 65days a year. This increases the cost related to hiring,and in a context of a potential shortage in highlyqualified labour, hoarding could be less expensive forcompanies than firing.But labour market conditions are not as bright asthey seem: employment shifted from full- to part-timeemployment on all qualification levels over the pasttwo decades, according to the findings of a recentstudy conducted at the DIW institute. Indeed,although unemployment decreased, the total numberof hours has only returned to pre-crisis levels. As aresult, total hours worked returned to its long-termaverage and pre-2008 levels only in Q1 2011,although employment has risen by nearly 1 millionsince then. This structural shift in the labour marketaffects the potential for domestic demand, ashousehold revenues do not necessarily increase,especially when part-time employment is only thesecond best solution because full-time employmentoffers are rare.Growth outlook built on slippery groundAll of the above makes us think that the economy ismuch more vulnerable than generally perceived.Should the problems in the external environmentaffecting Germany not be sorted out rapidly, wesuspect the labour market may not be sufficientlystrong to support domestic demand growth, in whichcase, the period of expected decline in GDP couldeasily expand into 2012. Currently, we see anincreased risk of this happening, but a rapid politicalsolution could easily invert the risk balance again.Ken Wattret 20 October 2011<strong>Market</strong> Mover9www.Global<strong>Market</strong>s.bnpparibas.com

UK: Top Of The Hill• The September reading of UK consumerprice inflation showed it surging to 5.2%, upfrom 4.5% in August.• But we and the MPC expect it to fall sharplynext year.• Indeed, the risks are on the downside andthe MPC will need to consider more QE byFebruary.The September reading of UK consumer priceinflation showed it surging to 5.2% y/y, up from 4.5%in August. That represents the highest annual rate ofCPI inflation since September 2008.Of the 0.7pp rise in inflation, 0.45pp was accountedfor by higher utility bills. That was in line with our ownexpectations. But on top of this effect, transportprices also contributed to a higher reading. Betweenthis August and September transport prices declinedby 2.1%, compared with 3.4% a year ago. That wasdue to a smaller fall in air fares this September thanlast year, as well as in sea fares. Overall, transportadded 0.2pp to the annual CPI inflation rate. Thesmaller jump in the RPI annual rate, from 5.2% to5.6%, partly reflects lower weights for air and seafares in the index.We expect inflation to remain above 5% in October,though declining to 5.1%. RPI inflation should movedown to 5.5% next month. Despite the high currentrate, the Bank of England’s Monetary PolicyCommittee remains quite convinced that inflation willdrop sharply next year and we would broadly agreewith that.There are a number of reasons why we can beconfident of a sharp fall back. For one, the rate ofVAT rose by 2.5pp in January 2011 and this will dropout of the twelve-month inflation calculation over thefirst quarter of 2012 (assuming some gradual passthroughof the rise). That alone should see at least1pp off the annual inflation rate. But on top of thisimpact, many of the upside commodity induced risesin inflation look to have peaked. For example, globalfood prices appear to have flattened off, while UKwholesale energy prices have done likewise.In the bigger picture, since 2008 UK consumer priceshave increased by around 7.5% more than in theeurozone and the US. As the Bank of England isfond of pointing out, virtually all of that difference canbe accounted for by the impact of the fall in the valueof sterling and the subsequent rise in import prices.13012512011511010510095908580Chart 1: UK, US and Eurozone CPI Since 2008Jan 2008 Jul 2008 Jan 2009 Jul 2009 Jan 2010 Jul 2010 Jan 2011 Jul 2011Source BloombergUK CPIUS CPIEurozone CPIUK Import pricesSince 2008 import prices excluding energy haverisen by around 25%. Once allowance is also madefor the rise in VAT, that can account for thedifference in CPI performance.In the medium term, as these effects wash out thedata, UK consumer price inflation should begin tobetter reflect underlining domestically generatedinflation. And here evidence suggests inflationarypressure is very restrained, with annualised unitlabour growth in the second quarter of 1.1%.This week’s MPC minutes to the October meetingunderlined the Committee’s belief that inflation willfall sharply next year. Indeed, the growing downsiderisks facing UK demand growth were described ashaving increased “significantly” since the AugustInflation Report. That reflects the Committee’sconcern about the weakening in the UK’s mainexport markets, as well as the impact that financialmarket tensions may have on credit conditions. Infact, the MPC now think it is more likely that inflationwill undershoot the 2% target in the medium term,and the available indicators suggested that growth inQ4 would be “close to zero”. The Committee,therefore, found the case for an extension of QE“compelling”.We believe the risks are to the downside of theCommittee’s view that GDP will be flat in Q4, withrecent surveys suggesting a contraction is morelikely. Moreover the shock to household incomesfrom higher utility bills will also knock spendingvolumes in due course. It therefore remains likelythat the macroeconomic backdrop to theCommittee’s meetings early in the new year will notbe auspicious, and we look for it to agree anotherextension to quantitative easing by February.David Tinsley 20 October 2011<strong>Market</strong> Mover10www.Global<strong>Market</strong>s.bnpparibas.com

Norway: Increased Uncertainty• The Norges Bank left the policy rateunchanged at 2.25%, in line with marketexpectations.• Downward revisions to inflation forecastsand increased uncertainty regarding theeconomic outlook led to a lowering of the policyrate profile.• The Bank now intends to deliver the nextrate hike in Q3 2012. We believe it will comeearlier in Q1 2012.Rates on holdIn line with our and market expectations, the NorgesBank kept its policy rate unchanged at 2.25% at itsOctober meeting. The accompanying policystatement was dovish. The biggest change was thatthe Bank now intends to deliver the next rate hike “ina year’s time”. Although “growth in the Norwegianeconomy remains robust”, the Bank noted that“turbulence and weaker prospects abroad are alsoaffecting the outlook for the Norwegian economy”.So, if tensions in the financial markets intensify andthe outlook for growth and inflation weakens further,the Bank left the door open for policy rate cuts.Norges Bank’s latest forecastsLooking at the forecasts in the new Monetary PolicyReport, the Norges Bank now expects mainland GDPto grow by 2.75% in 2011, down from its previousprojection of 3.00%. Meanwhile, the 2012 and 2013mainland GDP growth forecasts were left unchanged(Table 1).CPI forecasts were revised down for the period 2011-2013. For CPI-ATE, the Bank kept its 2011 forecastof 1.00% unchanged, but revised 2012 and 2013forecasts 0.25pp lower to 1.75% and 2.25%. This isin line with our forecast that a stronger domesticcurrency and moderation in external price pressuresshould lead to some downward revisions to CPI andCPI-ATE forecasts. But, as we highlighted before,this did not change the Bank’s profile that CPI-ATEinflation is to reach a trough this year and annualCPI-ATE inflation is to print higher next year,compared with this year.Policy outlookIn terms of policy going forward, these downwardrevisions to inflation forecasts and an “unusually highlevel of uncertainty surrounding developmentsahead” led to a downward revision to the Bank’spolicy rate profile. The new quarterly policy rateprojections suggest the Bank intends to deliver thenext rate hike in Q3 2012, in August at the earliest.Table 1: Norges Bank’s Forecasts (% y/y)*CPICPI-ATEGDPMainlandGDP2011 2012 2013 20141½(1¾)1(1)1½(1¾)2¾(3)1½(1¾)1¾(2)3(2¾)3¾(3¾)2(2½)2¼(2½)2½(2¼)3¼(3¼)2¼(2½)2¼(2½)2¼(2)3(2¾)Key Policy 2.25 2.41 3.23 4.01Rate (avg.for Q4) (2.65) (3.87) (4.68) (4.79)Source: The Norges Bank, Monetary Policy Report, 3/11, OctoberNote: *Forecasts in Monetary Policy Report, 2/11, June in parenthesisClearly the Bank is giving weight to uncertaintyregarding the developments ahead, in particular inEurope. The adverse external developmentsstemming from the eurozone are having spillovereffects on the Norwegian export sector and leadingto higher money market spreads.We agree with the Bank’s assessment that the policyrate should be left unchanged for some time to come,given broad expectations that the major advancedcountry central banks are to keep their policy rateslow for a while. From the Bank’s assessment, it isclear that a stronger krone is a source of concern forthe Bank. In particular, it noted that “an appreciablyfaster rise in the interest rate at home than abroadwould increase the risk of a krone appreciation,resulting in inflation that is too low”.But we believe the next rate hike is to come earlier inQ1 2012, in March. As we highlighted before,although there are some signs that economic growthis to moderate over the period ahead, mainly due tothe impact of external developments on Norway,domestic economic conditions are to remainrelatively robust. Consumer spending is stillsupported by high house prices, robust growth incredit to households, high real personal disposableincomes and a tight labour market. Furthermore, oiland housing investment are to provide a boost to theeconomy overall. In particular on housing, therelatively low level of interest rates and high demandcontinues to push housing starts higher.The risk to this forecast is that the Bank will keep thepolicy rate unchanged for longer than we assume, ifthe negative spillover effects of externaldevelopments on Norway are larger than we expect,inflation surprises the Bank to the downside and thekrone appreciates significantly.Gizem Kara 20 October 2011<strong>Market</strong> Mover11www.Global<strong>Market</strong>s.bnpparibas.com

we believe that contractions in private payrolls willfollow (Chart 2). The latest Beige Book showedcompanies reported more doubt about the strengthof the recovery, noting “restraint in hiring and capitalspending plans”. When in doubt - you don’t expand.Nonetheless, in line with better economic data inSeptember, our in-house Beige Book WeaknessIndicator, which tallies all instances of the wordscontaining the root “weak” and, thus, provides uswith a quantitative measure for this qualitative report,improved to 63 counts from 86 in the previous report.However, the reading remains at recessionary levelsand suggests a double-dip recession is probably stillin the cards (Chart 3).Foreigners support domestic regional economiesIn the details, the latest Beige Book suggested thatconsumer spending was up slightly in most Districts,with auto sales and tourism leading the way. Themajority of Districts reported increases in auto salesas several Districts noted a greater availability of newvehicles as the supply disruptions that had plaguedauto dealerships in the aftermath of the Japanesedisaster subsided. Thus, as the supply chaindisruption unwound, we saw a recent jump in autosales.The pick up in tourism activity throughout this yearhas shown a somewhat more persistent nature.Indeed, a weaker dollar continues to attract moretourists each year. The Beige Book noted that“tourism was generally higher in those Districtsreporting on the sector”. For example, contacts inNew York noted that, “despite the negative impact ofHurricane Irene, Broadway and hotel revenuescontinued to rise”. Regional data are reported with asignificant lag, however, the data available throughthe summer months of this year indicated a higherlevel of New York JFK airport traffic in 2011compared to the previous years (Chart 4), and asignificant pick up in tourism-related industries’payrolls (Chart 5). As such, external demand forcheaper dollar-denominated goods helps supportdomestic retail sales but might not necessarily reflectthe underlying strength of domestic consumerspending. In that respect, the Beige Book noted that“a large flow of Canadian shoppers has contributedsignificantly to strong overall sales” in the New Yorkregion.Going into a holiday season…Business spending increased somewhat from theprevious report. However, a number of Districtsreported that a weaker and more uncertain economicoutlook had increased caution and was weighing onfuture spending plans. Several districts indicated that“many retailers were reluctant to build inventoriesChart 4: New York JFK Airport TrafficSource: Haver AnalyticsChart 5: Amusement, Gambling, and RecreationIndustries – New York StateSource: Reuters EcoWin ProSource: Reuters EcoWin ProChart 6: Container TrafficTeus: 20-foot equivalent units or 20-foot-long cargo containerahead of the holiday season, pointing to recentdeclines in consumer confidence”. The recent dataon container traffic suggest the shipping volumes inAugust and September were the worst since therecession in 2009 (Chart 6). While the incomingspending data have pointed to resiliency, sentimentremains fragile and threatens to lead to a selffulfillingcontraction in activity. Political developmentsout of Europe will be key to which way the tide turns.Yelena Shulyatyeva 20 October 2011<strong>Market</strong> Mover13www.Global<strong>Market</strong>s.bnpparibas.com

weakness in clothing sales in July and August as wellas weaker import price growth in September.Vehicle prices also exerted downward pressure oncore goods price inflation in September. New vehicleprices have been broadly flat for the past threemonths as the market has been returning to normalafter the disruption of the Japanese earthquake inMarch. Meanwhile, used car prices fell 0.6% m/m inSeptember, after surging 6.5% in the six months toAugust. Together, the fall in apparel and vehicleprices contributed to a 0.25% m/m decline in coregoods prices, which was the largest fall sinceDecember 2008. Core services price inflation wasalso weak in September, rising just 0.05% m/m aseducation and health-care inflation both softened inthe month.One month is not a trendThe moderation of core inflation in September is apositive development. Most forecasters, includingourselves, had been anticipating a weakening in coreinflation through the second half of 2011 as theimpulse from the earlier rise in commodity prices andother supply shocks waned (Chart 3). But untilSeptember, this expectation had been confoundedby the data. However, it is important to rememberthat September is just one month; we will have towait and see if the moderation in core inflationcontinues into the final months of 2011. To that end,the 0.2% m/m increase in the Cleveland Fed’sweighted median and trimmed mean measures ofunderlying inflation in September was less positivenews.Headline, core inflation to moderate in 2012Despite the downside surprise to core prices inSeptember, we have made only marginaladjustments to our core inflation forecasts fromOctober onwards. This is largely because we hadalready projected monthly core outturns to average alittle over 0.1% over the next 12 months due both tothe pass through of lower commodity prices and anincrease in labour market slack. RollingWednesday’s data into our forecast, we now expecty/y core inflation to peak at 2.1% in December 2011and, then, fall to 1.5% by the end of 2012.On the other hand, we have made more substantialadjustments to our headline CPI forecast in light ofthe continued divergence between WTI and retailgasoline prices. Historically, we have seen a verytight relationship between the West TexasIntermediate (WTI) crude oil and gasoline prices.However, since March, they have followed differentChart 3: Lower oil prices = lower core inflation160140120100806040200BrentCore Goods Inflation (3m/3m ar) (RHS)Jan 00 Jan 03 Jan 06 Jan 09Source: Reuters EcoWin ProChart 4: Gasoline prices are now tracking Brent1101009080706050Retail GasolineJan 10 Apr 10 Jul 10 Oct 10 Jan 11 Apr 11 Jul 11Source: Reuters EcoWin ProBrentpaths, and instead, gas prices have had a tightercorrelation with Brent crude oil prices (which havefallen much more moderately than WTI).Differences in supply fundamentals explain the largeincrease in Brent/WTI spreads in recent months, aswell as the breakdown of the relationship betweenWTI prices and retail gas prices. Higher quality WTIhas been pouring into Cushing, Oklahoma from theNorth, but high transport costs and supplybottlenecks have prevented this increased supplyfrom quickly reaching the coastline. The result hasbeen a stockpiling of WTI inventories and lower WTIprices.Meanwhile, supply disruptions have resulted in atight Brent oil market, pushing prices up relative toWTI. The upshot of these two forces is that a greatmany US refineries have had to rely on moreexpensive Brent oil to produce gasoline for the USmarket. In our forecasts, we assume that thesesupply imbalances unwind only slowly and that retailgas prices continue to follow Brent prices moreclosely. This implies a more gradual reduction inheadline CPI inflation from 3.9% y/y in September to3.2% in December 2011 and 1.6% at the end of2012.WTI864209080706050-2-4-6110100Jeremy Lawson and Bricklin Dwyer 20 October 2011<strong>Market</strong> Mover15www.Global<strong>Market</strong>s.bnpparibas.com

Japan: Real Reason for ‘Turning Japanese’• Putting off needed structural reforms for lackof political (and popular) will to tolerate shorttermpain for the sake of long-term gain is arecipe for continued crises.• As in Europe today, after its bubble burstJapan relied for a long time on (1) forbearancepolicies to grow out of its balance-sheet woesand (2) aggressive fiscal spending to maintainthe spending structure and to shore up slumpinggrowth, but the result has been prolonged subpargrowth and biggest public debt of anydeveloped nation.• Japanese policymakers had thoughtproblems could be solved by economic growth,but trend growth cannot recover as long asbalance-sheet troubles are left unresolved. Thisrequires strict asset assessments, adequateloan-loss reserves and public fund bailouts.4.54.03.53.02.52.01.51.00.50.0Chart 1: Japan’s Per Capita Trend Growth Rate(= natural rate of interest, %)Potential grow th rate per w orker(five-year moving average)-0.585 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11Source: Cabinet office, MIC, <strong>BNP</strong> ParibasChart 2: Eurozone’s Per Capita Trend Growth Rate(= natural rate of interest, %)3.0• It seems that the sovereign debt crisis inEurope today is being aggravated becausepolicymakers are doing the same thing Japandid earlier.2.52.01.5Potential grow th rate per labor force(five-year moving average)• While Japan was the frontrunner in problemslike balance-sheet woes, banking crises, longtermeconomic stagnation, public debt anddeflation, the eurozone has surpassed Japan insovereign debt issues destabilising the financialsystem. But if Japan continues to put off fiscalreforms, it could end up like the ailing nations ofsouthern Europe today, but without a Germanyto bail it out.1.00.50.0-0.598 99 00 01 02 03 04 05 06 07 08 09 10 11Source: Eurostat, <strong>BNP</strong> ParibasThere are numerous reasons why the sovereign debtwoes in the eurozone have been aggravated. Onereason is the adoption of forbearance policies, whichJapan also did after the bursting of its real estatebubble of the 1980s. Rather than quickly moving toresolve the balance-sheet troubles afflictingEuropean banks, something that requires stricterasset assessments, adequate loan-loss reserves,and then plugging any capital shortfalls with publicmoney (if funds cannot be procured from the market),policymakers in the eurozone have opted forforbearance policies in the hope that revivedeconomic activity will enable their economies to growout of these problems. Unfortunately, as Japandiscovered, the failure to resolve balance-sheettroubles actually weighs on economic activity. Thetrend growth rate (i.e., potential growth rate) declinesbecause both real and human capital accumulation,is thwarted by impaired financial intermediation andfalling growth expectations.But as in Japan in the 1990s, various pressures workagainst the imposition of strict asset assessments.For one thing, banks themselves are wary becauseof the inevitable damage to earnings. Second,instead of cracking down on banks to ensure thatassets are stringently evaluated, authorities tend toallow lax assessments out of concern that banksmight cut back on credit to the detriment of themacroeconomy. Third, since strict assetassessments usually necessitate the injection oftaxpayer money to shore up undercapitalised banks,the authorities prefer to avoid doing this becausesuch bailouts are not only unpopular but they alsoRyutaro Kono 20 October 2011<strong>Market</strong> Mover16www.Global<strong>Market</strong>s.bnpparibas.com

exacerbate fiscal deficits. Thus, as long as theauthorities can act at their own discretion, they tendto gravitate toward forbearance policy.Forbearance policy and fiscal stimulus: twosides of same coinAnother reason for Europe’s worsening sovereigndebt woes is the aggressive fiscal stimulus to propup growth rates, which is really just the flip side offorbearance policy. First, budget deficits are run upto maintain spending structures that areunsustainable because they are predicated on taxrevenue levels of the bubble’s heyday (this isparticularly true in Greece, Portugal and Italy). Then,to shore up floundering growth when a boom ends,policymakers irrationally undertake additional fiscalspending. The result is the massive fiscal deficits thatcurrently afflict some eurozone states.0-2-4-6-8-10-12Chart 3: Fiscal Conditions in Eurozone(2011 forecasts)Public debt (% of GDP)0 20 40 60 80 100 120 140 160 180 200 220Budget deficit (% of GDP)SpainGermanyFranceUKUSEuro areaPortugalIrelandItalySource: European Commission, OECD, <strong>BNP</strong> ParibasGreeceChart 4: Current Account in OECD Nations(% of GDP, 2010)JapanEconomic growth during a bubble is inherentlyunsustainableEconomic expansion during a bubble is inherentlyunsustainable, so some degree of reduced growthmust be tolerated while the bubble’s excesses areundone. Although Japan’s lesson of the 1990sshows that, no matter how aggressivemonetary/fiscal policy might be, trend growth will notrevive as long as balance-sheets are not cleaned up.The authorities in many European nations still spentmassive amounts of tax money to prop up growthafter the “once-in-a-century crisis.”20151050-5-10-15NorwayLuxembourgSwitzerlandGermanyIcelandSwedenNetherlandsDenmarkJapanFinlandSource: OECD, <strong>BNP</strong> ParibasAustriaKoreaIrelandHungaryBelgiumMexicoUnited KingdomCzech RepublicSlovak RepublicFranceCanadaPolandItalyUnited StatesAustraliaTurkeyNew ZealandSpainPortugalGreeceSovereign debt woes trigger financial systemturmoilProblems in the eurozone are, as we have pointedout, basically the same as those experienced byJapan in the 1990s, and by the US today. Followingthe collapse of its credit bubble, America also optedfor a forbearance approach to its balance-sheettroubles, but the discretionary macro stabilisationfailed to prop up US growth and only saddled thenation with a higher level of public debt. Theeurozone, however, is facing an even moretroublesome issue: problems in the financial systemare aggravating the sovereign debt woes, which, inturn, are giving rise to further financial system turmoil.In Greece, for example, it is blatantly clear that futuretaxes cannot pay down the nation’s overwhelmingpublic debt. Consequently, prices on Greekgovernment bonds have collapsed, making itessentially impossible to finance budget deficits. Thegovernments of Ireland and Portugal also are havingdifficulty in resolving fiscal problems on their own,though the conditions are not as severe as in Greece.As for Spain and Italy, default is very unlikely but thefinancial markets are still concerned because the risksurrounding the repayment of their public debt is notas low as it used to be.Abnormal condition of being unable to raisecapital to bail out ailing banksThe upshot of all this is that cleaning up the bankingsector in the southern eurozone states, with strictasset assessments and the injection of public moneyto shore up undercapitalised banks, is made difficultby the crisis of confidence in the debt that thesegovernments issue. Consequently, what actuallyneeds shoring up is the government debt itself, whichnormally ought to be the safest domestic asset. Andbecause the leading banks in Europe are so heavilyexposed to this problem sovereign debt, theirsoundness is also being questioned. As pointed outin the Weekly Economic Report of 9 August 2011(What might happen if Japan defaults? Financialinnovations stemming from the Glorious Revolution),the smooth undertaking of financial transactions, thelifeblood of an economy, is impaired when thefinancial system is shaken by a plunge in value ofgovernment bonds, the foundation of a country’scredibility. Thus, despite being developed economies,the states of southern Europe are in the abnormalsituation of being unable to raise capital to bail outtheir ailing banks.Ryutaro Kono 20 October 2011<strong>Market</strong> Mover17www.Global<strong>Market</strong>s.bnpparibas.com

Political question of whether people in Germanyand France want to bail out their neighboursThat said, the budget deficit as a share of GDP forthe eurozone as a whole is not that great. It is lowerthan that of the US and Japan, so the scale ismanageable. Because of this, it could be argued thatthe eurozone’s financial/fiscal troubles boil down tothe political question of whether the citizens inGermany and France will agree to bail out theirsouthern neighbours. In other words, will integrationon the fiscal front proceed or not? A fundamentaldefect of the eurozone is that there has never been amechanism for ensuring that member states maintainfiscal discipline. There are no established rules forhow the entire eurozone should share the fiscal costof a shock that any member cannot handle on itsown, so the authorities first put off taking anyresolute action and then only started adoptingpolicies piecemeal once a crisis began to take shape.While it could be argued that there has been no needfor such a rule, as fiscal support between states wasprohibited in the Lisbon Treaty, such excuses nolonger hold when problems trigger financial turmoilthat engulfs the global economy.Will Japan end up like ailing eurozone states?While Japan was the frontrunner with respect to sucheconomic problems as NPL woes (balance-sheettroubles), banking crises, long-term economicstagnation, surging public debt and deflation, wehave been surpassed by the eurozone with respectto sovereign debt issues destabilising the financialsystem. But if Japan continues to put off fiscalreforms, it will eventually end up like the nations ofsouthern Europe today. Japan could, in fact, be inworse shape because it won’t have a Germany or aFrance to bail it out. (The IMF, of course, could stepin, but that would entail severe conditions like thoseimposed on emerging economies). The US, with itshuge budget deficit and soaring public debt, mayavoid succumbing to such a fate thanks to thegreenback being the global standard. But then again,it may not, as difficulty in financing budget deficitsand the external account could cause the dollarstandard to collapse. At the very least, if thegreenback is no longer the only global standard,easy adjustments via dollar depreciation shouldbecome difficult owing to the loss of seigniorage asthe sole key currency.Needed structural policies are put off out ofconcern over near-term painWhy have the US and Europe failed to heed Japan’slesson and put off needed structural reforms untilcrises emerge in the financial market? The reason isthat politicians, and the people that elect them, tendto be myopic with regard to policymaking, focusingonly on the immediate level of consumption. But, as2520151050Oct-09Nov-09Dec-09Jan-10Chart 5: EU Bond Spreads(%pp, 10-y spread to German bund)GreecePortugalSpainItalyFeb-10Mar-10Apr-10May-10Jun-10Jul-10Source: Bloomberg, <strong>BNP</strong> Paribas30025020015010050Aug-10Sep-10Oct-10Nov-10Dec-10Jan-11Feb-11Mar-11Apr-11May-11Jun-11Jul-11Chart 6: Japan’s Public Debt(central & local, % of GDP, FY)Aug-11Sep-11Oct-11080 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18 20 22Source: MOF, Cabinet office, <strong>BNP</strong> ParibasForecastpointed out in earlier reports, the ultimate aim ofeconomic policy should be to raise the level of percapita real consumption sustainably, bolstering percapita trend growth being an interim objective. Thecrucial point is that the improvement in theconsumption level (trend growth) must continue intothe future and not be just a momentary short-term jolt.For the US and Europe to raise the level ofconsumption sustainably, they must first resolve theirstructural problems (balance-sheet troubles,sovereign debt issues), something that requirespainful burdens over the near term. But becausepeople are loathe to see any reduction in immediateconsumption, needed structural policies are put offuntil problems reach crisis stage.Macro stabilisation does not serve its primaryroleWhile the authorities put off needed structuralpolicies out of concern for near-term pain, theyaggressively resort to discretionary macrostabilisation. Macro stabilisation, however, cannotresolve structural problems like balance-sheettroubles and sovereign debt woes; it can only easeRyutaro Kono 20 October 2011<strong>Market</strong> Mover18www.Global<strong>Market</strong>s.bnpparibas.com

some of the pain arising from structural reforms. Butall too often macro stabilisation becomes a means ofdeferring structural problems, with the result thatpublic debt continues to grow and the financialsystem becomes destabilised by sovereign debtissues. Even monetary policy that lowers the cost ofcapital acts to put off the resolution of structuralproblems. The continuation of super-low interest rateregimes has made it possible for public debt in manynations to swell to current proportions. Given thedamage the real economy could sustain, if long-terminterest rates were to surge because of public debtproblems, central banks have come to pay closeattention to keeping term rates stable. In this respect,G3 monetary policy is already incorporated into debtmanagement.Fiscal policy only redistributes incomePlease note that the economy’s momentaryimprovement (or what seems like improvement) frommacro stabilisation comes at the price of borrowingincome from the future. There is no lastingimprovement in the economy’s level or the level ofconsumption. Fiscal policy basically redistributesincome; it does not create any new added value. Lowinterest rates also do not create added value; theyjust facilitate the front-loading of spending byhouseholds and businesses (zero-rates don’t evenhave this effect if the policy is prolonged).Marginal reforms only make headway whencrises occurWhether it was the balance-sheet troubles of the1990s, the exploding public debt in the 2000s or thecontinued deferral of structural reforms, Japan hasalways been criticised by the global community.Excluding comments that Japan’s discretionarypolicies were not robust enough, most of the criticismhas been on the mark. It is not that we could notidentify policies that would resolve our problems, wesimply lacked the political will to make the toughdecisions that would entail short-term pain (lowerlevel for immediate consumption), even though weknew there would be lasting long-term gains (ahigher permanent consumption level). It is not justthe lack of leadership on this issue by politicians –we, the public, are equally responsible for electingthem. As a result, it is only when crises occur thatstructural policies are marginally adopted. Thecurrent situation in the US and EU fits this pattern,with structural reforms being put off until crises (as inthe eurozone today) make some reforms feasible.Japan was first to face problems that economicgrowth could not cureOver the past ten years or so, we have been askedrepeatedly why reform does not make headway inJapan. Out of desperation, we always say thatdemocracy – government by majority – has gone toextremes in Japan. For a body politic that valuesgroup harmony, it is hard for us to impose increasedburdens on any members of our group (currentgenerations), so we end up foisting our problems onto future generations. But taking democracy toextreme does not seemed limited to Japan. How elsecan we explain the sudden drop in politicalleadership in the US and Europe? Until recently,problems faced by policymakers in the US andEurope could be overcome so long as modestgrowth continued. That was also true for Japan priorto the 1990s. But since the 1990s, Japan hasbecome the first to confront problems that cannot besolved without imposing burdens on the currentgeneration.Financial technology allows big government toborrow ever more moneyAt a time when financial technology has,unfortunately, made it possible for big government toborrow ever more money (deferring problems everlonger), unless we are aware of this shortcoming ingovernment by majority, the constant deferral of ourproblems could lead to a crisis that cannot beovercome.Ryutaro Kono 20 October 2011<strong>Market</strong> Mover19www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchUS: Unemployment Targeting – What ItMeans for Rates• Fed officials started hinting that goingforward the policy outlook may be linked to theunemployment rate (UER), possibly inconjunction with an inflation target, as a prerequisitefor monetary tightening.• Given the anaemic pace of improvement inthe jobs market, if the FOMC did indeedannounce, say, 7% UER as its target, then itcould take anywhere from 2.5 to 5 years to getthere. With the Fed on hold for that long,Treasuries in the front end would rallymassively.• STRATEGY: If/as UER targeting becomesmore likely, position for the new policy with thefollowing trades: i) outright longs in the frontend up to 5yrs; ii) sell the fly (buy the belly) inTreasury 2s5s10s; iii) put on a 5s30s steepener.What’s all the hoopla about setting targets?The growing chatter from Fed officials about forwardguidance, in the form of unemployment and/orinflation targeting, begs the following questions. If theunemployment rate (UER) does, indeed, have toreach say 7% (the level identified by the Fed'sEvans) as a necessary condition for the Fed totighten monetary policy, what does it mean forTreasury rates? And what does it mean,not when itreaches that level but rather if/when the FOMCannounces its decision to move ahead with this newapproach, possibly as early as at the NovemberFOMC meeting?This may be obvious, but we will state it nonetheless:Treasuries in the front end would rally and do so in abig way. Why? Because at the current anaemic paceof declines we saw since UER reached its peak, itwould take about 3-3.5 years for it to drop to 7%. Ifwe use other periods (see Chart 1), the pace ofimprovement is different, but even in the mostoptimistic scenario similar to the 1992-94 period, itwill likely take close to 2.5 years to get there (seeTable 1). Recall that the Fed pointed out at theirAugust meeting that they envision an environmentthat warrants "exceptionally low levels for the federalfunds rate at least through mid-2013". Now comparethat with the explicit UER target: No matter whichepisode we use from the past for comparison, wecould safely say that it will be well past mid-2013Chart 1: The Employment Story – Always aSlow Turning Ship12108642090 92 94 96 98 00 02 04 06 08 10Table 1: How Many Months Would It Take toBring UER down by 2%?1992-1994 1996-2000 2003-207 2009 to dateNo ofmonths 28 60 49 3812108642Chart 2: UER and Inflation – Not EntirelyDivorced from Each OtherCore Inflation YoY (%, RHS, Inverted)096 98 00 02 04 06 08 10ource: Bloomberg, <strong>BNP</strong> ParibasUnemployment Rate (%)before the UER dips to the 7% area. So, whateverthe market fancied as the horizon for rate hikes in thewake of the August FOMC statement, that's going topale in comparison with the re-pricing that UERtargeting will cause.How much would rates rally?Let us get a bit more specific. Tsy rates in the 2-5yarea should drop precipitously in response, with thecurve flattening in this sector. If you were comfortable0123456Bulent Baygun 20 October 2011<strong>Market</strong> Mover20www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchwith a 2y in the 15-20bp area in anticipation of a Fedon hold for two years, then you would surely becomfortable with a two-year rate below that if youknew that the first rate hike would be pushed backeven further. But the back end of the curve, now,that's another story. It will not follow suit, especially ifany attendant inflation target (say upwards of 2.5%,and worse yet 3% in core) is viewed as too lax.Granted, core inflation will be kept in check as longas there is slack in the economy. In other words, theunemployment rate and inflation are not completelydivorced from each other (see Chart 2), and it isunlikely for core inflation to become rampant absenta material improvement in the jobs market. Be thatas it may, market participants will likely shoot firstand ask questions later. The victim? We wouldcontend that the back end will suffer - if not outright,at least relative to short and intermediate maturities.This suggests positioning for a steepening of thecurve, from 5s to 30s.Now let us dig even deeper (yes, you have thatsinking feeling, we know, we know!). For those of youwho are running short on time and patience, here isthe bottom line: the 3y Treasury rate could drop byabout 25bp, while the 5y could rally by about 50bp.On to the detailsLet's say that, whenever the market views the firstrate hike as being about two years away, the "fair"value for the 2y Tsy rate is around 20bp – as was thecase in August. So, if in one year's time, the UER isstill some two years away from reaching 7%, then the2y Tsy at that time should be trading at 20bp. If that'sthe base case looking one year into the future now,then the 1y forward 2y rate should be 20bp. Tomatch that forward rate, no matter how you look at it,the yield of the 3y Treasury should be sub-20bp.Where is it now? It's trading at 46bp.Now, let’s do the same analysis for the 5y: supposethat the "fair" value of the current 5y Treasury in oneyear's time is around 60bp (somewhere mid-waybetween the lows of the 3y and the 5y rates in 2011).To get to that level in the forwards, roughly speaking,you are looking at a current 5y rate in the 50bp area.That's a whopping 50bp+ drop from the current levelof the 5y, below the September low. Just as anaside, that's not too far from the current level of the5y JGB rate (38bp). Just sayin'.And if your eyes did not glaze over yet, here ismoreSo far, we have been using the recent lows in ratesas a guideline to assess where the forward ratesshould be. Let’s try another approach, just for asanity check. The spread between the prevailing FedFunds target rate and the 3y Treasury rate widenswhen the market expects rate hikes. In the past 20Chart 3: The 3y Yield over Fed Funds Target –Another Useful Yardstick97.564.53-1001.5FF Target Rate (%)3y Tsy/FF Spread (bp, RHS)0-200Jan-90 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Jan-08 Jan-11Source: Bloomberg, <strong>BNP</strong> Paribasyears, when the market suspected imminent ratehikes, the spread traded in the 100 to 200bp range(see Chart 3). So, let’s assume that UER is notprojected to reach 7% for another two years. At thathorizon, the market should be pricing a 100-200bpspread between the Fed Funds target (still virtuallyzero at that time) and the 3y Treasury. In otherwords, the 2y forward 3y Treasury rate should besomewhere between 1 and 2% if the market expectsrate hikes to start in two years’ time. A 2y forward 3yTreasury rate of 1% requires a 5y Treasury rate of65bp, and 2% requires 1.25%. The current 5yTreasury rate of 1.04%, in turn, translates to aforward Fed funds to 3y spread of around 160bp. Inother words, the current level of 1.04% alreadyprovides a very good cushion against marketexpectations of rate hikes in two years’ time, on thedot, and very aggressive hikes at that.What’s the trade?So, you see the front end of the curve has a long wayto go if the FOMC members set their sights on UER.For our money, we would play it in the followingways:• outright longs in the front end up to 5yrs• sell the fly (buy the belly) in Treasury 2s5s10s• put on a 5s30s steepenercurrent spread:165bp300200100And surely, this is just the Fed story. If the marketgets spooked about Europe again, for whateverreason, then it only exacerbates the case forTreasuries to rally, making new lows. However, keepin mind that, in this scenario, the 5s30s dynamic mayplay out differently.0Bulent Baygun 20 October 2011<strong>Market</strong> Mover21www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchUS: Agencies Best Value in Rates, Swaps Lag• There has been a migration of both realmoney and fast money investors into theagency space in recent weeks. Real moneyinvestors who were already active in theproduct have increased their allocations. Thelow yields in Treasuries hurt total return.Agency bullets and callables can easily doubleTreasury yields, particularly in the short end.• Some fast money investors looking to pickup yield and improve performance havereturned to callable agencies. They offer amongthe highest yields for AA+ rated products, thespread risk is minimal - particularly comparedto mortgages in recent weeks, Furthermore,agency haircuts and repo are quite competitivewith Treasuries, meaning investors so inclinedcan take advantage of up to 20x leverage.Steeper Curve, Better Roll DownAlthough projected performance can be evaluated inmultiple ways, the most straightforward method is tocompare carry and roll down. In Table 1, we compareTreasury, swap and agency benchmarks across thecurve and evaluate the carry and roll down.The best roll down (we used a 6m time horizon) isclearly in agencies, which benefit from a steepercurve compared to Treasuries and swaps (shown inChart 1). The best sector on the curve for roll down isin the belly - in the 5- to-7y sector for Treasuries andagencies, where the curve is worth 12.4 to 15.1bp,and in the 5y-sector for swaps where 6m roll downpicks up 14.6bp.Competitive Repo, Better CarryCarry was calculated using 6m term repo for bothTreasuries and agencies. In evaluating the Treasurycurve, we used the special term repo for the on-theruns(ranges from a high of 9bp for the 3yT to a lowof -7bp for the 5yT), and general collateral agencyterm repo for the agency bullets (21 bp). Notsurprisingly, the 6m carry in both Treasuries andagencies is uniformly better than in swaps, where thefinancing is effectively 3m Libor – which is about42bp.Yield (%)2.502.252.001.751.501.251.000.750.500.250.00Source: <strong>BNP</strong> ParibasChart 1: Rates CurvesSwap CurveAgency CurveTreasury Curve0 1 2 3 4 5 6 7 8 9 10Maturity (years)Given the negative repo in the 5yT its carry is bestamong the Treasury group with 13.2bp over 6m. Theflat agency term repo means the carry favours thehighest yielding bonds (since they are mostly on-therunbenchmarks and fairly close to par), making thebest carry in the longest bonds – 14.7bp in the 8yFreddie Mac and 15bp in the 6y Fannie Mae.The final column in the table calculates thecombination of 6m carry + roll down. This shows thatthe agencies offer 21 to 30bp of potential returnversus the 17 to 26bp for Treasuries and 9 to 25bpfor swaps.Be Careful with Projected ReturnsNormally we evaluate agency callables usingprojected returns in Yield Book. For completenessand to provide another basis for comparison, the 6mprojected total return and dollar returns for theTreasuries, agency bullets and swaps are included inthe Table. These projected returns show a slightlydifferent pattern – that Treasuries, not agencies, areexpected to be the best performers. Swaps appear tolag Treasuries rather badly but outperform agenciesin some sectors.Why the difference? This is actually a quirk of YieldBook and emphasises the need to know what theassumptions and methods are when analysingprojected performance data. First, Yield Book doesnot incorporate financing costs (repo), so there is nocalculation of carry. This helps the projectedperformance of the bonds but hurts the performanceof the swaps, which explicitly includes a financingcost. Also, Yield Book does not have an agencycurve, so the bonds have to be priced relative to theswap curve, and the default is to assume that theOAS does not change. Therefore, the actual agencyroll down is underestimated, hurting the relativeperformance.Mary-Beth Fisher 20 October 2011<strong>Market</strong> Mover22www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchTable 1: Cross Rates Comparison of Carry and Roll DownTreasuries Price Yield Duration DV01Assetswap6m TotalROR (%)6m DollarReturn6m RollDownCarry +6m Carry Roll Down2yT 99.72 0.27 1.94 194 -36 0.25 0.25 10.0 6.9 16.93yT 100.12 0.46 2.97 297 -35 0.47 0.47 11.2 7.5 18.75yT 99.83 1.04 4.86 485 -33 1.15 1.15 12.4 13.2 25.67yT 98.52 1.60 6.73 664 -27 1.69 1.67 12.4 12.6 25.010yT 99.75 2.15 9.08 909 -18 1.87 1.87 10.9 12.3 23.2Swaps2yr swap NA 0.64 1.72 172 0 NA 0.17 3.6 4.8 8.53y swap NA 0.82 2.70 270 0 NA 0.47 10.3 6.4 16.75y swap NA 1.38 4.60 460 0 NA 1.14 14.6 10.2 24.87y swap NA 1.88 6.40 640 0 NA 1.44 10.9 11.3 22.210y swap NA 2.35 8.87 887 0 NA 1.52 6.0 10.7 16.7Agency BenchmarksFHLMC 0 3/8 10/30/13 99.79 0.48 2.02 201 -17 0.30 0.30 13.3 9.0 22.3FHLMC 0 3/4 11/25/14 100.00 0.75 3.06 306 -10 0.67 0.67 14.4 10.6 25.1FHLMC 1 3/4 09/10/15 102.74 1.03 3.77 388 -3 0.97 1.00 14.9 12.4 27.3FHLMC 2 08/25/16 103.04 1.35 4.65 480 1 1.27 1.31 15.1 13.6 28.6FHLMC 3 3/4 03/27/19 112.18 1.98 6.67 750 5 1.59 1.79 13.9 14.7 28.5FNMA 0 1/2 08/09/13 100.11 0.44 1.79 179 -19 0.26 0.26 13.0 8.3 21.3FNMA 0 5/8 10/30/14 99.70 0.73 3.00 299 -10 0.64 0.63 14.4 10.4 24.8FNMA 2 3/8 07/28/15 105.12 0.99 3.61 382 -3 0.91 0.96 14.8 12.3 27.1FNMA 1 1/4 09/28/16 99.45 1.37 4.82 479 0 1.31 1.30 15.1 13.3 28.4FNMA 5 02/13/17 117.76 1.51 4.76 565 8 1.32 1.57 15.0 15.0 30.1Source: <strong>BNP</strong> ParibasMary-Beth Fisher 20 October 2011<strong>Market</strong> Mover23www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchMBS: Refi Flashback• Historical Conventional and early 2009 GNS-curves suggest that under normal conditions,the current Conventional S-curve has a lot tocatch up.• But even in an extended period of low ratesunder normal refi conditions, burnout is severe.Fees too are expected to increase over time andshould dampen long term CPRs.• Recent bank earnings discussed that GSEshave taken a more aggressive stance onputbacks. Fundamental changes to reps andwarrants would therefore not be consistent withthat policy. Capacity constraints should limitrefinancing as well.A Walk Through TimeWith enhancements to HARP around the corner, itmakes sense to look at prepays from a historicalperspective. In Chart 1, we show the history of FNprepays since 1994. Setting aside the peaks inrefinancing around late 2002-mid 2003, aggregateCPRs have generally peaked around the 30 CPRlevel. Towards the end of 2002, new lows inmortgage rates led to aggregate CPRs picking up tomid-40s and reached close to 60 CPR during thepeak of the 2003 refi’s.In Chart 2, we show the S-curves relating to some ofthese key periods. Clearly, not just in terms ofaggregate speeds, but also in terms of the S-curve,2003 was an outlier. But the current prepay situationis also a significant outlier, albeit on the oppositeside. If all HARP inefficiencies are eliminated,historical data suggest prepays should mimic the ex-2003 cluster of S-curves in Chart 2 with highercoupons approaching 50-60 CPR.Ginnie Prepays a Benchmark for HARP?Ginnie Mae’s streamlined refinancing could also beused as a benchmark for high HARP efficiency. InChart 3, we show the voluntary CPR history for 2008GNI 6s vs the FHA mortgage rate. The chartindicates that prepays peaked in May 2009 at 46.6CPR. In chart 4, we show the S-curves of voluntaryCPRs for GNIs for May-09. The S-curve tops off at aCPR lower than those seen in the historicalconventional S-curves in Chart 2. This isunderstandable given that higher GN delinquencies,reduce the refiable population to a larger extent.CPR706050403020100Chart 1: FN Fixed Rate Aggregate CPR vsMortgage RateRateJan-94Jan-95Jan-96Jan-97Jan-98Jan-99Jan-00Jan-01Jan-02Jan-03Jan-04Jan-05Jan-06Jan-07Jan-08Jan-09Jan-10Jan-11Source: eMBS, BloombergCPRChart 2: Prepay S-curves During Various RefiWaves80706050403020100-50 -25 0 25 50 75 100 125 150 175 200 225 250Source: <strong>BNP</strong> ParibasDec-98 Nov-01 Oct-02 Jul-03 Apr-04 Sep-11Chart 3: Average FHA Mortgage Rate vs 2008 30yGN I 6% PrepaysCPR50403020102008 GNI 6s04.0Jan-09 Jun-09 Nov-09 Apr-10 Sep-10 Feb-11 Jul-11Source: <strong>BNP</strong> Paribas, BloombergFHA Mortgage RateChart 3 also shows that even though FHA mortgagerates continued to decline steadily over time, prepaysactually declined. Burnout was therefore quite strong.6.56.05.55.04.59.508.507.506.505.504.503.50Mortgage RateMortgage RateAnish Lohokare / Timi Ajibola /Bo Peng 20 October 2011<strong>Market</strong> Mover24www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchIn Chart 5, we show the S-curves for GNIs over thewhole year 2009 and from January 2009 - August2009. The speed at which the S-curve topped off was30.5 CPR for 2009 vs 37.1 for just May 2009 (chart4), an 18% difference. In 2009 there were nochanges to FHA fees, so the slowdown is chiefly dueto burnout. The top speed for the S-curve for GNIsover January 2009 – August 2011, was 21.1 CPR,just 57% of the peak speed in May 2009. Grantedmortgage insurance premium (MIP) went up in 2010and 2011, influencing this decline, but burnout wasthe principal contributor.Enhancements to HARP are expected to betemporary, perhaps for 18 or 24 months. Also, G-fees are expected to increase over time as discussedextensively by GSEs and their regulator. Thus even ifMIP and not just burnout contributed to the GNIJanuary 2009 – August 2011 S-curve being muchflatter, it’s still a good benchmark for conventionallong-term CPRs under an extreme case of HARPefficiency where almost no barriers to refi exist.HARP enhancements however are expected to befairly incremental. Recent bank earnings havediscussed a more aggressive stance taken by theGSEs regarding putbacks; putback requestsincreasingly include seasoned vintages. Afundamental waiver-like change to reps and warrantswould thus be inconsistent with this policy. Needlessto say, capacity cannot be built overnight and shouldbe a limiting factor as well. Thus, CPRs should stillfall well short of benchmarks. Low rates have lastedover 2.5 years and even if more extremeenhancements to HARP are introduced, burnoutshould be a dampener. Table 1 shows aconsiderable buffer for prepays built into currentpricing.Origination volume seems to have come off the highsas the sustained selloff seems to have lost itsmomentum. Fed purchases have recently been ableto offset origination. We maintain our positive outlookon MBS with a preference for 3.5s, 4s and 5s on thecoupon stack. From a near-term technicalperspective, higher coupons could benefit as concernaround HARP diminishes, as seen in price action onWednesday and early Thursday.Chart 4: GNI Voluntary CPR S-curves in May-094035302520151050CRR-50 0 50 100 150 200 250Source: <strong>BNP</strong> ParibasChart 5: GNI Voluntary CPR S-curves for WholeYr 2009 and Jan 09-Current353025201510502009Jan 09 - Curr-50 0 50 100 150 200 250Source: <strong>BNP</strong> ParibasTable 1: Breakeven CPRs (@ 0% YT Spread to theI-curve) by Coupon30Y FN0% YT Spread/IPrepay SpeedFastest Vintage PrepaySpeed - Sep Ratio Diff4.5 56.7 33.8 168% 22.95 48.4 29.9 162% 18.55.5 46.0 26.8 172% 19.26 43.5 23.8 183% 19.7Source: Bloomberg, <strong>BNP</strong> ParibasAnish Lohokare / Timi Ajibola /Bo Peng 20 October 2011<strong>Market</strong> Mover25www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchEUR: Firm Demand at the 12mth LTRO• In addition to its regular 3mth LTRO, theECB will conduct a 12mth LTRO on the sameday next week (26 October). Another ultra-longtender (13mth) will be conducted in December.• There are good reasons to expect demandwill be strong at the operation, although not asmassive as it was in June 2009.• STRATEGY: receive OIS/BOR spreads. Onthe Mar12, target 45bp (versus 56.8 currently).Chart 1: No Possibility for ArbitrageSignificant impact on liquidity’s durationThe average duration of EUR liquidity provided bythe ECB through open market operations (MRO,LTRO and STRO) is currently around 35 days, andhalf of the liquidity has a maturity just below 7 days.The two ultra-long SLTROs the ECB will conductnext week (12mth) and on 21 December (13mth) willraise the average duration of liquidity significantly. Allother things being equal (i.e., the exact roll of MROand STRO), we expect that, after next week’s 12mthtender, the average duration of liquidity provided bythe ECB will rise to longer than 91 days (beyond 3months). Furthermore, after the December 13mthtender, the average duration may extend beyond 200days, or more than six months, with more than half ofthe liquidity having a maturity longer than 300 days.The two upcoming SLTROs will therefore have asignificant impact on liquidity conditions.Firm demand expectedAs far as this month’s operation is concerned, the12mth tender will take place at the same time as theregular 3mth LTRO. EUR 85bn will expire at that timeand a large roll of the 3mth onto the 12mth should beexpected. When the ECB conducted ultra-longtenders in 2009, demand at 3mth regular LTROsremained subdued, in the range EUR 1.1-12.2bn. Ifonly EUR 5bn is rolled onto the new 3mth and therest onto the 12mth, this would imply a EUR 80bnfloor for demand at the SLTRO. In addition, we canreasonably expect demand to be stronger than anexact roll of the EUR 85bn expiry. Indeed, theopportunity offered to banks to acquire 12mthliquidity will attract additional demand.One cannot expect demand to be as strong as it wasat the first 12mth tender the ECB conducted in June2009. Indeed, carry trades are not currently favouredas they were at that time, when the 12mth OIS wasabove the ECB’s refi rate. But note that when theECB conducted the second 1y tender in October2009 the operation attracted more than EUR 75bn inSource: <strong>BNP</strong> ParibasChart 2: Pressure on Liquidity will EaseSource: <strong>BNP</strong> Paribasdemand, despite no possibility for arbitrage, notender expiring, and already more than ampleliquidity conditions. Against this backdrop, demandwell above EUR 100bn at next week’s 12mth LTROwould be no surprise. EUR 100bn of demand wouldlengthen average maturity beyond 90 days and everyadditional EUR 10bn in demand will add around9 days of duration.Tighter OIS/BOR spreadsThe absolute level of liquidity, especially the level ofexcess liquidity in the market, has a significantimpact on OIS rates. The duration of existing liquidityhas a very significant impact on BOR rates and thuson OIS/BOR spreads. An extension of duration afternext week’s tender will drag OIS/BOR spreads down.Strategy: receive OIS/BOR spreads. On the Mar12,target 45bp (versus 56.8 currently).Patrick Jacq 20 October 2011<strong>Market</strong> Mover26www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchEUR: AAA Contagion Risk and Bond Demand• French government bond spreads haverecently come under widening pressure.• Contrary to previous episodes of sovereignstress, a relatively positive fiscal fundamentaloutlook is being questioned by ratherspeculative arguments.• Combined equity and bond market priceaction is a reason for concern.• More globally, the increase in AAAcontagion risk opens important questions ofmedium-term demand stabilisation.• We look at the issue of leveraging the EFSFvia the ECB from a pure monetary policyperspective, concluding that outright full scaleQE is a better option.OAT under pressureOAT have underperformed Bunds by 55bp sinceearly August. Currently, OAT Oct-21 is @54 z-spread(Bund Sep-21+108bp). More recently, OAT have alsostarted to underperform vs BTP (-35bp over the pastmonth in 10Y). What are the drivers? Wildspeculation about France's Aaa/AAA/AAA rating(heard on the street for at least two years; all ratingagencies have so far confirmed highest rating &stable outlook), the performance of Europeanfinancials, the exposure to eurozone periphery (EBAdata), the performance of non-AAA… In a nutshellthe usual array of risk-off variables.France’s recent underperformance does not reflectfundamental or structural weakness, though. Asstressed by our economics team (‘French 2012Deficit: In Control’, <strong>Market</strong> Mover, 29 September2011), “the French government has managed toachieve a smaller deficit than targeted for each yearsince April 2009, and this will again be the case in2011”. Moreover, “we share the government’s implicitexpectation that the primary budget will be balancedby 2013”.In the near term, the supply schedule poses nothreats to OAT. France has already issuedEUR 175.4bn of bonds in 2011, which is 95% of theEUR 184bn target. However, bear in mind that theEUR 184bn target is net of buybacks and thus weneed to factor this into our estimates. France hasconducted EUR 19bn of buybacks up to August2011, where EUR 17.4bn are for bonds maturingafter the end of 2011 and thus have to be added in to250200150100500Germany80%Chart 1: French Bond SupplyFrance87%Source: <strong>BNP</strong> ParibasNetherlands93%Est. 2011 IssuanceFinland82%Austria88%Belgium91%82%Italy% Issuance Completed (RHS)Spain78%Chart 2: Stylised Facts of the Eurocrisis4.03.0BTP/Bund 10YMIB2.01.00.0Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-111.2OAT/Bund 10Y1.00.8CAC0.60.40.20.0Jan-11 Mar-11 May-11 Jul-11 Sep-11 Nov-11Source: <strong>BNP</strong> ParibasChart 3: AAA Contagion Stats120100 OAT/Bund 10Y80 BTP/Bund 10Y (RHS)60402002006 2007 2008 2009 2010 20111.00.5100%90%80%70%60%50%40%120001400016000180002000022000240000.0OAT/Bund correlation-0.5OAT/BTP correlation-1.02006 2007 2008 2009 2010 2011Source: <strong>BNP</strong> Paribas2000250030003500400045005004003002001000Alessandro Tentori / Ioannis Sokos / Camille de Courcel 20 October 2011<strong>Market</strong> Mover27www.Global<strong>Market</strong>s.bnpparibas.com

This section is classified as non-objective researchthis year's funding needs. This means there is aremaining EUR 26bn of issuance until year-end(excluding buybacks for the last four months of theyear for which we have no data yet). With threeauctions remaining (one in October and two inNovember) and one optional auction in December,France can issue an average of EUR 8.7bn perauction and skip the December one. Once weinclude the buybacks to the gross issuance figure weget that France has completed almost 87% of its2011 funding, which is slightly above the 84%eurozone average (Chart 1).For next year the supply picture improves furtherrelative to 2011. We expect gross issuance of Frenchbonds of around EUR 179bn from EUR 184bn in2011. In net issuance terms we expect a fall fromEUR 89bn in 2011 to EUR 80bn in 2012. Frenchbond redemptions are expected to be aroundEUR 99bn in 2012, while the projected deficitestimate is EUR 82bn according to AFT.From a less constructive point of view, the commonstylised fact of this euro crisis is a simultaneousweakness in domestic equity and government bondmarkets, followed by a significant increase involatility, absence of domestic buyers and theeventual ECB decision to purchase bonds (Chart 2).We’ve seen this happening in relatively small as wellas very large markets and economies (e.g. Italy).Pockets of weakness in the architecture of the euroas well as the absence of proactive decisions fromeurozone officials are the main reason for bondmarkets’ underperformance. The dangerous conceptof “Who’s Next?” has crept into investors’ mind.Contagion statsIn terms of total return (iBoxx Sovereign), France isdown 2.8% in October with only Belgium (-4.5%) andIreland (-3.2%) doing worse. Year-to-date, theperformance is around +3%, which puts it at the lowend of the AAA distribution (Germany +6.8%).In terms of price action, we’ve performed acorrelation analysis (Chart 3). Yield correlation toBunds is still around 80%, while spreads remain verycorrelated (e.g. BTP/Bund and OAT/Bund). Onenegative aspect is the increased correlation between10Y BTP yield and OAT (now into positive around20% from as low as -70% before the ECB reactivatedthe SMP). From this analysis, we concludethat contagion risk has recently increased in the AAAsector excluding Germany.Demand stabilisation neededFrom a broader EMU perspective, 10Y Italy is tradingaround 5.90% (Sep-21), i.e. just 20/25bp below thetop despite an estimate 55/60bn purchased by theECB. <strong>Market</strong> confidence in stabilising forces is quitelow at this stage.706050403020ASWChart 4: EFSF vs EUEU Jun-21EFSF Jul-2110Jun-11 Jul-11 Aug-11 Sep-11 Oct-11Source: <strong>BNP</strong> ParibasChart 5: Global Demand for EGB at Risk0.20.1Basis points0.0-0.1-0.2-0.3EMU3 vs EMU ALL index yield-0.4-0.52007 2008 2009 2010 201114%12%10%8%6%4%2%Daily iBoxx price returnvolatility (63 days)FranceGermanyItaly2005 2006 2007 2008 2009 2010 2011Source: <strong>BNP</strong> Paribas400000300000200000100000-100000Chart 6: Excess liquidity and Eonia/Refi0-2000002005 2006 2007 2008 2009 2010 2011Source: <strong>BNP</strong> ParibasEUR mlnExcess cashSpread ECB/Eonia (RHS)ECB/Eonia (21D avg)In that context, price dynamics of EFSF bonds (Jul-21 @62 z-spread and Bund Jul-21 +120bp, seeChart 4) is worrying as the street is questioning notonly investors' appetite for 440bn of EFSF bonds, butalso the impact that further weakness in OAT andBTP will have on the EFSF's AAA rating (the CDOargument has been already officially denied by Mr.Regling himself in a letter to the FT dated 28February 2011 entitled “No grounds to compare theEFSF with a CDO”).-1.0-0.8-0.6-0.4-0.20.00.20.40.6Alessandro Tentori / Ioannis Sokos / Camille de Courcel 20 October 2011<strong>Market</strong> Mover28www.Global<strong>Market</strong>s.bnpparibas.com