Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

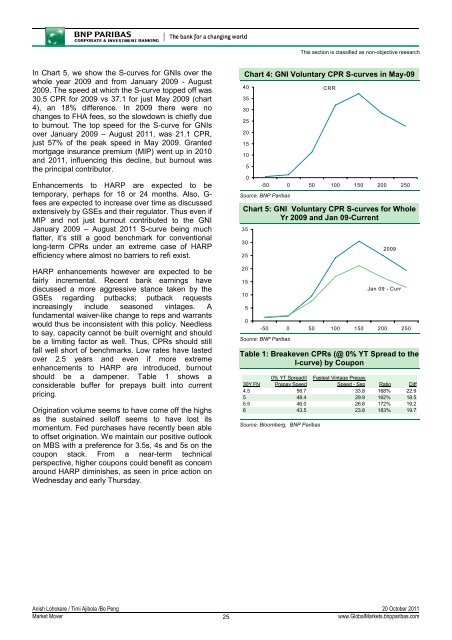

This section is classified as non-objective researchIn Chart 5, we show the S-curves for GNIs over thewhole year 2009 and from January 2009 - August2009. The speed at which the S-curve topped off was30.5 CPR for 2009 vs 37.1 for just May 2009 (chart4), an 18% difference. In 2009 there were nochanges to FHA fees, so the slowdown is chiefly dueto burnout. The top speed for the S-curve for GNIsover January 2009 – August 2011, was 21.1 CPR,just 57% of the peak speed in May 2009. Grantedmortgage insurance premium (MIP) went up in 2010and 2011, influencing this decline, but burnout wasthe principal contributor.Enhancements to HARP are expected to betemporary, perhaps for 18 or 24 months. Also, G-fees are expected to increase over time as discussedextensively by GSEs and their regulator. Thus even ifMIP and not just burnout contributed to the GNIJanuary 2009 – August 2011 S-curve being muchflatter, it’s still a good benchmark for conventionallong-term CPRs under an extreme case of HARPefficiency where almost no barriers to refi exist.HARP enhancements however are expected to befairly incremental. Recent bank earnings havediscussed a more aggressive stance taken by theGSEs regarding putbacks; putback requestsincreasingly include seasoned vintages. Afundamental waiver-like change to reps and warrantswould thus be inconsistent with this policy. Needlessto say, capacity cannot be built overnight and shouldbe a limiting factor as well. Thus, CPRs should stillfall well short of benchmarks. Low rates have lastedover 2.5 years and even if more extremeenhancements to HARP are introduced, burnoutshould be a dampener. Table 1 shows aconsiderable buffer for prepays built into currentpricing.Origination volume seems to have come off the highsas the sustained selloff seems to have lost itsmomentum. Fed purchases have recently been ableto offset origination. We maintain our positive outlookon MBS with a preference for 3.5s, 4s and 5s on thecoupon stack. From a near-term technicalperspective, higher coupons could benefit as concernaround HARP diminishes, as seen in price action onWednesday and early Thursday.Chart 4: GNI Voluntary CPR S-curves in May-094035302520151050CRR-50 0 50 100 150 200 250Source: <strong>BNP</strong> ParibasChart 5: GNI Voluntary CPR S-curves for WholeYr 2009 and Jan 09-Current353025201510502009Jan 09 - Curr-50 0 50 100 150 200 250Source: <strong>BNP</strong> ParibasTable 1: Breakeven CPRs (@ 0% YT Spread to theI-curve) by Coupon30Y FN0% YT Spread/IPrepay SpeedFastest Vintage PrepaySpeed - Sep Ratio Diff4.5 56.7 33.8 168% 22.95 48.4 29.9 162% 18.55.5 46.0 26.8 172% 19.26 43.5 23.8 183% 19.7Source: Bloomberg, <strong>BNP</strong> ParibasAnish Lohokare / Timi Ajibola /Bo Peng 20 October 2011<strong>Market</strong> Mover25www.Global<strong>Market</strong>s.bnpparibas.com