Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

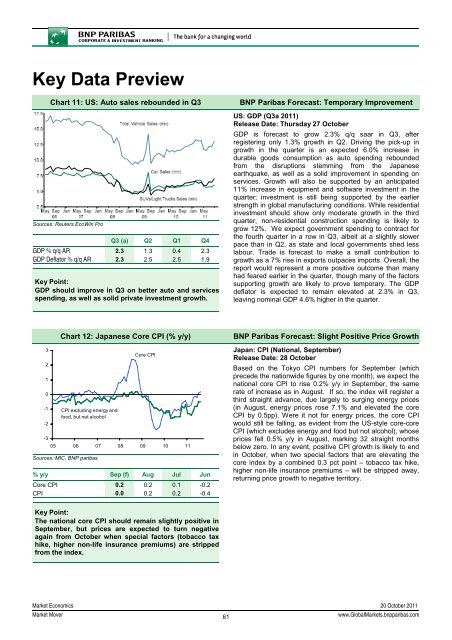

Key Data PreviewChart 11: US: Auto sales rebounded in Q3Sources: Reuters EcoWin ProQ3 (a) Q2 Q1 Q4GDP % q/q AR 2.3 1.3 0.4 2.3GDP Deflator % q/q AR 2.3 2.5 2.5 1.9Key Point:GDP should improve in Q3 on better auto and servicesspending, as well as solid private investment growth.<strong>BNP</strong> Paribas Forecast: Temporary ImprovementUS: GDP (Q3a 2011)Release Date: Thursday 27 OctoberGDP is forecast to grow 2.3% q/q saar in Q3, afterregistering only 1.3% growth in Q2. Driving the pick-up ingrowth in the quarter is an expected 6.0% increase indurable goods consumption as auto spending reboundedfrom the disruptions stemming from the Japaneseearthquake, as well as a solid improvement in spending onservices. Growth will also be supported by an anticipated11% increase in equipment and software investment in thequarter; investment is still being supported by the earlierstrength in global manufacturing conditions. While residentialinvestment should show only moderate growth in the thirdquarter, non-residential construction spending is likely togrow 12%. We expect government spending to contract forthe fourth quarter in a row in Q3, albeit at a slightly slowerpace than in Q2, as state and local governments shed lesslabour. Trade is forecast to make a small contribution togrowth as a 7% rise in exports outpaces imports. Overall, thereport would represent a more positive outcome than manyhad feared earlier in the quarter, though many of the factorssupporting growth are likely to prove temporary. The GDPdeflator is expected to remain elevated at 2.3% in Q3,leaving nominal GDP 4.6% higher in the quarter.3210-1-2-3Chart 12: Japanese Core CPI (% y/y)CPI excluding energy andfood, but not alcoholCore CPI05 06 07 08 09 10 11Sources: MIC, <strong>BNP</strong> paribas% y/y Sep (f) Aug Jul JunCore CPI 0.2 0.2 0.1 -0.2CPI 0.0 0.2 0.2 -0.4<strong>BNP</strong> Paribas Forecast: Slight Positive Price GrowthJapan: CPI (National, September)Release Date: 28 OctoberBased on the Tokyo CPI numbers for September (whichprecede the nationwide figures by one month), we expect thenational core CPI to rise 0.2% y/y in September, the samerate of increase as in August. If so, the index will register athird straight advance, due largely to surging energy prices(in August, energy prices rose 7.1% and elevated the coreCPI by 0.5pp). Were it not for energy prices, the core CPIwould still be falling, as evident from the US-style core-coreCPI (which excludes energy and food but not alcohol), whoseprices fell 0.5% y/y in August, marking 32 straight monthsbelow zero. In any event, positive CPI growth is likely to endin October, when two special factors that are elevating thecore index by a combined 0.3 pct point – tobacco tax hike,higher non-life insurance premiums – will be stripped away,returning price growth to negative territory.Key Point:The national core CPI should remain slightly positive inSeptember, but prices are expected to turn negativeagain from October when special factors (tobacco taxhike, higher non-life insurance premiums) are strippedfrom the index.<strong>Market</strong> Economics 20 October 2011<strong>Market</strong> Mover61www.Global<strong>Market</strong>s.bnpparibas.com