Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Market</strong> Economics | Interest Rate Strategy | Forex Strategy 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

<strong>Market</strong> Outlook 2-3<br />

Fundamentals 4-15<br />

• US: Roadmap to Fed Tightening 4-6<br />

• Sovereign Debt: Time for Europe to 7<br />

Act<br />

• French Regional Elections 8-9<br />

• UK: Inflation Report – Surprisingly 10-11<br />

Dovish<br />

• Sweden: Earlier Rate Hikes on 12-13<br />

Agenda<br />

• Japan: Slowing Consumption<br />

14-15<br />

Recovery<br />

Interest Rate Strategy 16-37<br />

• US: Fed Provides More Details on Exit 16-17<br />

Plan<br />

• US: Impact of Buyouts on Rates and 18-19<br />

MBS<br />

• EUR: Limited Scope for a Rapid<br />

20<br />

Recovery<br />

• EUR: Demand for ECB’s Liquidity Still 21<br />

High<br />

• EUR: Monitoring Dutch Pension Funds 22<br />

• EUR: Peripheral ASW Curves Re- 23<br />

Steepening<br />

• EUR/GBP 2s10s Carry Box Revisited 24<br />

• JGBs: Wait for Price Dips in Q2 25<br />

• Global Inflation Watch 26-29<br />

• Inflation: BEs Less Sensitive to Credit 30-31<br />

Fears?<br />

• Europe iTraxx Credit Indices 32-34<br />

• Technical Analysis 35-36<br />

• Trade Reviews 37<br />

FX Strategy 38-44<br />

• Strategy: EUR Problem, Global Risks 38-41<br />

• Technical Strategy: SEK Steams 42-43<br />

Ahead<br />

• Trading Positions 44<br />

Forecasts & Calendars 45-62<br />

• 1 Week Economic Calendar 45-46<br />

• Key Data Preview 47-56<br />

• 4 Week Calendar 57<br />

• Treasury & SAS Issuance 58-59<br />

• Central Bank Watch 60<br />

• Economic Forecasts 61<br />

• FX Forecasts 62<br />

Contacts 63<br />

www.Global<strong>Market</strong>s.bnpparibas.com<br />

• The focus will remain on Greece/EMU in the coming<br />

days.<br />

• The statement from the EU Head of States confirmed a<br />

political will to support Greece while reiterating the need<br />

for it to implement the necessary fiscal discipline.<br />

• The statement represents progress. The EU has moved<br />

from an implicit to explicit commitment to protect Greece.<br />

The strict conditions attached to it could lend Greece the<br />

credibility it sorely needs.<br />

• However, details are still lacking. We may get some<br />

details on a commitment to act if needed after the Finance<br />

Ministers’ meetings early next week.<br />

• EMU core markets may give up some of their recent<br />

gains while peripheral spreads should continue to<br />

normalise, although the move is likely to be a bumpy one.<br />

• A near-term setback in core EGBs could be reinforced<br />

by the negative tone on Treasuries. We expect a<br />

steepening bias on both curves over the week ahead.<br />

• The JGB market is likely to remain within the narrow<br />

range in place since the start of this year.<br />

• As previously highlighted, one consequence of the<br />

current EMU crisis is a weaker euro.<br />

• We believe any rebound following the announcement of<br />

more detailed measures during the coming days would be<br />

short-lived.<br />

• We expect the GBP to remain under selling pressure<br />

while we are positive on the AUD and SEK.<br />

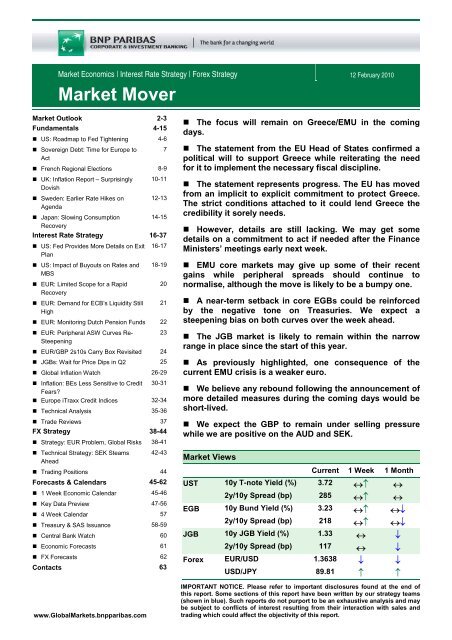

<strong>Market</strong> Views<br />

Current 1 Week 1 Month<br />

UST 10y T-note Yield (%) 3.72 ↔↑ ↔<br />

2y/10y Spread (bp) 285 ↔↑ ↔<br />

EGB 10y Bund Yield (%) 3.23 ↔↑ ↔↓<br />

2y/10y Spread (bp) 218 ↔↑ ↔↓<br />

JGB 10y JGB Yield (%) 1.33 ↔ ↓<br />

2y/10y Spread (bp) 117 ↔ ↓<br />

Forex EUR/USD 1.3638 ↓ ↓<br />

USD/JPY 89.81 ↑ ↑<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams<br />

(shown in blue). Such reports do not purport to be an exhaustive analysis and may<br />

be subject to conflicts of interest resulting from their interaction with sales and<br />

trading which could affect the objectivity of this report.

<strong>Market</strong> Outlook<br />

The market has already<br />

reacted positively to the<br />

EU statement on Greece -<br />

the conditions of any<br />

financial support will be<br />

key<br />

The Greek crisis has turned into a critical test of EMU, forcing EU officials to<br />

demonstrate greater coordination and solidarity. There is no alternative for<br />

Greece but to implement those fiscal measures already announced and<br />

probably more – pension reform will be discussed in the spring. But after<br />

pressuring Greece for several weeks to impose the necessary fiscal<br />

discipline, the outcome of the EU leaders’ summit on Thursday was a very<br />

clear message backing Greece.<br />

The statement represents progress. The EU has moved from an implicit to<br />

explicit commitment to protect Greece. Strict conditions attached could lend<br />

Greece the credibility it sorely needs. However, details are still lacking. We<br />

may get some details on a commitment to act if needed after the Finance<br />

Ministers’ meetings early next week.<br />

Details on potential financial assistance for Greece under strict conditions<br />

would further enhance market confidence – the 10y GGB/Bund spread has<br />

already compressed by roughly 90bp this week to close to 270bp, after<br />

peaking at 400bp at the end of January. Ultimately, the current debate is<br />

about EMU governments (Greece at this stage) giving up part of their<br />

independence in terms of fiscal policy; this has been the missing link within<br />

EMU since day one. The EMU framework may emerge strengthened from<br />

the current crisis although none of the governments will willingly cede fiscal<br />

autonomy.<br />

While the road is likely to remain bumpy, EMU political will is now strong<br />

enough to conclude that the highs on Greek spreads are behind us<br />

480<br />

430<br />

380<br />

10y GGB/Bund (ASW)<br />

GRE CDS 5y<br />

480<br />

430<br />

380<br />

240<br />

190<br />

10y PGB/Bund<br />

10y GGB/Bund (RHS)<br />

10y SPGB/Bund<br />

400<br />

300<br />

330<br />

280<br />

230<br />

Nov 16th: BoG triggers a<br />

sell-off in Greek Bonds<br />

with its warning on<br />

Greek banks<br />

330<br />

280<br />

230<br />

140<br />

90<br />

200<br />

180<br />

130<br />

180<br />

130<br />

40<br />

100<br />

80<br />

Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10<br />

80<br />

-10<br />

Nov-08 Feb-09 May-09 Aug-09 Nov-09<br />

0<br />

Source: Reuters EcoWin Pro<br />

Core EGBs to give up<br />

some of their recent<br />

gains…<br />

…a move which could be<br />

reinforced by a negative<br />

tone on Treasuries<br />

The commitment of European political and monetary authorities to address<br />

the situation in a credible and coordinated way is a pre-condition for a<br />

durable compression of intra-EMU spreads. Support for peripherals will<br />

reverse part of the recent move towards safety although any setback on core<br />

EGBs is likely to be limited as govvies remain supported by other factors<br />

such as concerns about growth, the risk of tighter monetary policy in China<br />

and more regulation ahead. In other words, the overall mix for risk appetite is<br />

not favourable overall – as illustrated by the performance of the main equity<br />

indices since the start of the year.<br />

A limited sell-off of core EGBs would lead the curve to re-steepen slightly,<br />

allowing the 2-5-10y fly to rebound. This, our favourite scenario near term, is<br />

based on the ability of the European authorities to deliver a credible<br />

message to the markets.<br />

In the US, Bernanke said the FOMC’s policy outlook (“extended period”,<br />

subdued inflation etc.) has not changed since the last meeting and then<br />

Cyril Beuzit 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

2<br />

www.Global<strong>Market</strong>s.bnpparibas.com

gave a few specific details on the Fed’s exit strategy. This was interpreted as<br />

stepping up the rhetoric on eventual tightening. The discount rate is likely to<br />

be raised at some point, although the discount window is barely used and<br />

had already failed the test of being a “cap on Libor” earlier in the crisis. The<br />

issue of paying interest on reserves is more relevant and could be bearish<br />

for Fed funds, which in turn will filter through to OIS, repo and Libor.<br />

All in all, Bernanke’s testimony could serve as the catalyst for even higher<br />

yields as the market’s attention shifts away from sovereign debt fears and<br />

back to the FOMC and major economic data. Recall that it only took a few<br />

positive data surprises for yields to jump. This asymmetric bias towards<br />

higher yields prompted us to be bearish at the start of the week; we remain<br />

in that camp.<br />

The technical picture looks fragile for Treasuries: when looking at a<br />

2007/2010 daily chart, we see that the market has drawn a wide bottom<br />

head-and-shoulders pattern with a neckline at 3.83% on the 10y T-note; this<br />

level was tested in early January.<br />

JGBs likely to stay rangebound<br />

Whatever the exit to the<br />

current EMU crisis, the<br />

medium-term outlook<br />

looks negative for the euro<br />

The JGB market has fluctuated within a narrow range since the start of 2010<br />

despite the global decline in stock prices. Intraday volatility has also fallen<br />

sharply, with the market showing very little reaction to factors that would<br />

ordinarily be considered buying or selling triggers. Next Tuesday's (16 Feb)<br />

5yr offering is likely to be readily digested, given that banks remain awash<br />

with surplus funds. We see no obvious ramifications for the yen bond market<br />

from upcoming decisions regarding the EMU crisis; JGB yields are unlikely<br />

to rise by more than the tiniest amount while the Nikkei 225 remains mired<br />

near the 10,000 mark.<br />

In the FX market, the euro remains at the top of the agenda. While a<br />

European rescue package for peripheral bond markets could allow the EUR<br />

to benefit from a short covering rally, the long-term prospects remain outright<br />

bearish for the single currency. Deflationary adjustment pressures will be<br />

unleashed for almost a fifth of the eurozone economy, suggesting inflation is<br />

likely to undershoot the ECB’s internal staff projections. Rate and yield<br />

differentials should continue working against the euro in the medium term.<br />

At the same time, when the EUR loses yield and rate attractiveness, central<br />

bank reserve managers are less inclined to shift USD reserves into euros.<br />

Last year, currency reserves rose by an impressive USD 768 bln, mainly<br />

driven by Asia. China has printed money and, by its quasi-fixed USDCNY<br />

6.82 exchange rate, has added to the supply of USDs. However, Asian<br />

monetary authorities generally and China’s in particular have started<br />

tightening monetary policy, imposing measures to curb hot money inflows<br />

even as net export growth is declining. As a result, currency reserve growth<br />

will ease, automatically reducing the supply of USDs added to the market<br />

and thus suggesting a lower EURUSD.<br />

Short GBP, long AUD &<br />

SEK<br />

A big currency investment theme is selling currencies where the credit<br />

multiplier is not working – as opposed to currencies benefiting from credit<br />

expansion. In the UK, the adjusted M4 has continued to decline, supporting<br />

our view that a high level of leverage is deflationary, especially if banks bear<br />

a substantial share of the leverage. The BoE’s revision of its two year<br />

inflation projection down to 1.2% will not bode well for the GBP as the<br />

sterling money market curve will have to flatten out. The performance of the<br />

GBP and 3x9 sterling FRA are tightly correlated. Hence, we expect sterling<br />

to remain under selling pressure.<br />

Australia and Sweden are two countries where there is a positive credit<br />

multiplier. The outperformance of the AUD and SEK has received additional<br />

support from the low sovereign debt levels reported in the countries.<br />

Cyril Beuzit 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

3<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US: Roadmap to Fed Tightening<br />

• Chairman Bernanke carefully distinguished<br />

between policies aimed at providing emergency<br />

liquidity and more traditional monetary policy in<br />

his testimony on Wednesday.<br />

Chart 1: Effective Fed Funds Has Been Volatile<br />

• Emergency liquidity programmes have been<br />

almost completely phased out, with a hike in the<br />

discount rate and the end of the TAF and TALF<br />

programs the likely next steps.<br />

• The most likely sequence of monetary policy<br />

tightening will involve a draining of excess<br />

reserves well before the first rate hike, and the<br />

target policy rate shifting to the rate paid on<br />

reserves. Asset sales are a last step in an<br />

extremely frothy macroeconomic scenario.<br />

• There is little in the testimony to change<br />

expected timing of policy tightening, which will<br />

still be determined by the evolution of the<br />

economic recovery.<br />

Emergency liquidity policies are near an end as<br />

financial market conditions normalise<br />

On a day when Washington DC found itself<br />

snowbound, making it impossible for Chairman<br />

Bernanke to appear before the House Financial<br />

<strong>Services</strong> Committee as scheduled, the Federal<br />

Reserve nonetheless released his testimony. The<br />

testimony provided more details and specifics than<br />

we had seen previously about the likely sequence of<br />

actions the Fed will take as it transitions away from<br />

an extremely accommodative policy stance. That<br />

said, the speech did not change our expectations of<br />

the timing of eventual rate hikes and markets were<br />

little changed on balance after the release of the<br />

testimony.<br />

Chairman Bernanke clearly distinguished between<br />

emergency liquidity policies the Fed put in place “in<br />

its role as liquidity provider of last resort” and those<br />

that allowed the Fed to effectively push through the<br />

zero bound on interest rates in an effort to stimulate<br />

economic activity. Emergency liquidity policies<br />

included a number of programmes that provided<br />

short-term funding to distressed markets. In his<br />

testimony, Chairman Bernanke indicated that, “as<br />

was intended, use of many of the Federal Reserve's<br />

lending facilities has declined sharply as financial<br />

conditions have improved”. He signalled that the next<br />

step in ending this emergency lending role was a<br />

“modest increase in the spread between the discount<br />

rate and the target Federal funds rate” that will be<br />

considered “before long” as well as a reduction in the<br />

maximum maturity of discount window borrowing to<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Banks And Credit Still Contracting<br />

Source: Reuters EcoWin Pro<br />

28 days from 90 days. Prior to the crisis, the spread<br />

between the discount rate and Fed funds was 100bp<br />

and loans that were generally overnight were<br />

lengthened to 90 days. Furthermore, he indicated<br />

that he anticipates that funding through the Term<br />

Auction Facility (TAF) and the Term Asset-Backed<br />

Securities Loan Facility (TALF) “will also be phased<br />

out soon”. He stressed that “These changes, like the<br />

closure of a number of lending facilities earlier this<br />

month, should be viewed as further normalization of<br />

the Federal Reserve's lending facilities, in light of the<br />

improving conditions in financial markets; they are<br />

not expected to lead to tighter financial conditions for<br />

households and businesses and should not be<br />

interpreted as signalling any change in the outlook<br />

for monetary policy, which remains about as it was at<br />

the time of the January meeting of the FOMC.”<br />

Julia Coronado 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

4<br />

www.Global<strong>Market</strong>s.bnpparibas.com

More clarity was given on the sequencing of<br />

monetary policy tightening<br />

The testimony provided a baseline scenario of the<br />

steps that would be taken to tighten monetary policy.<br />

He described the large-scale purchases on<br />

Treasuries, Agencies and MBS as a component of<br />

monetary policy put in place when the Fed reached<br />

the zero bound on interest rates and the economy<br />

was still under “severe stress”. These purchases<br />

were financed through the creation of a tremendous<br />

amount of excess reserves that led to loss of control<br />

over the effective Fed funds rate (Chart 1) even as<br />

they “helped improve conditions in private credit<br />

markets and put downward pressure on longer-term<br />

private borrowing rates and spreads.” However, the<br />

extreme liquidity in money markets has apparently<br />

led the Fed to decide two things: first, it will need to<br />

mop up some of the excess reserves before actually<br />

raising rates, and second, “during the transition to a<br />

more normal policy configuration”, the Fed is<br />

considering shifting its target policy rate to the rate<br />

paid on reserves rather than a target Fed funds rate.<br />

The reason that the policy to pay interest on bank<br />

reserves did not effectively put a floor under Fed<br />

funds is that the mortgage agencies are suppliers of<br />

funds to the overnight lending market and yet cannot<br />

place deposits at the Fed; therefore, the Fed funds<br />

has traded below the rate paid on reserves since the<br />

policy to pay interest on reserves was implemented<br />

in October 2008. A Congressional act would be<br />

required to allow the mortgage agencies to deposit<br />

money at the Fed, and it is not clear why the Fed<br />

does not pursue this as a way to gain more control<br />

over short-term rates. In any case, the Fed has<br />

concluded that “the Federal funds rate could for a<br />

time become a less reliable indicator than usual of<br />

conditions in short-term money markets” and is<br />

considering shifting to a target rate over which it<br />

would have absolute control. Presumably, this would<br />

come along with an expected range for Fed funds<br />

and Chairman Bernanke also suggested it could<br />

involve targets for reserve quantities.<br />

The tools for draining excess reserves, as previously<br />

announced, include mainly reverse repos and a term<br />

deposit facility at the Fed. He said “The capability to<br />

carry out [reverse repos] with primary dealers, using<br />

our holdings of Treasury and agency debt securities,<br />

has already been tested and is currently available.<br />

To further increase its capacity to drain reserves<br />

through reverse repos, the Federal Reserve is also in<br />

the process of expanding the set of counterparties<br />

with which it can transact and developing the<br />

infrastructure necessary to use its MBS holdings as<br />

collateral in these transactions.” Presumably, the<br />

counterparties beyond primary dealers could include<br />

money markets and possibly even the mortgage<br />

agencies. The Fed has had some concerns about<br />

Chart 3: Consumer Spending Subdued<br />

Reflecting Deleveraging<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Credit Supply and Demand are Weak<br />

Source: Reuters EcoWin Pro<br />

possible market distortions from going outside the<br />

primary dealer community for these transactions,<br />

although it is clear that balance sheet constraints<br />

limit the amount of liquidity that dealers can absorb.<br />

The Fed has apparently decided that capacity is the<br />

bigger concern.<br />

The Fed has already put forward a blueprint for the<br />

term deposit facility and is “currently analyzing public<br />

comments”. It expects to conduct test transactions<br />

this spring and to have the facility available if<br />

necessary “shortly thereafter”. This facility would<br />

involve the auctioning of large blocks of term<br />

deposits to depository institutions that would reduce<br />

overnight cash in the market and tighten liquidity<br />

conditions.<br />

Asset sales are a last choice for policy and an<br />

unlikely outcome<br />

Chairman Bernanke clearly stated that he “currently<br />

[does] not anticipate that the Federal Reserve will<br />

sell any of its security holdings in the near term, at<br />

least until after policy tightening has gotten under<br />

way and the economy is clearly in a sustainable<br />

recovery”. He said the Fed will let MBS holdings run<br />

off over time through prepayments and maturities<br />

Julia Coronado 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

5<br />

www.Global<strong>Market</strong>s.bnpparibas.com

and that “in the long run, the Federal Reserve<br />

anticipates that its balance sheet will shrink toward<br />

more historically normal levels and that most or all of<br />

its security holdings will be Treasury securities”. The<br />

Fed would consider selling securities only in a robust<br />

macroeconomic scenario, and “any such sales would<br />

be at a gradual pace, would be clearly communicated<br />

to market participants, and would entail appropriate<br />

consideration of economic conditions”. The clear<br />

signal is that the Fed is comfortable living with an<br />

expanded balance sheet for some time.<br />

The testimony provides more detail about<br />

sequencing and execution but does not change<br />

our view of the likely timing of policy tightening<br />

While some market participants view this clarity from<br />

the Fed as a signal that such operations are on the<br />

near-term horizon, we would stress that Chairman<br />

Bernanke reiterated that the current stance of policy<br />

has not changed and will be determined by economic<br />

and financial market developments.<br />

Indeed, it is difficult to see the Fed moving to raise<br />

rates when bank lending is still contracting (Chart 2).<br />

Small and mid-size banks continue to fail; the FDIC<br />

took over 148 institutions in 2009 and has already<br />

taken on 16 in 2010. This suggests an ongoing<br />

consolidation process from the financial crisis that is<br />

limiting credit supply.<br />

However, there is also a significant demand element;<br />

the broad economy is still deleveraging and this has<br />

been manifested in a subdued recovery in final sales<br />

to date (Chart 3 and 4). It would seem that some<br />

recovery in private credit creation would likely come<br />

before the Fed decided that the economy was<br />

building up too much steam and needed to be<br />

restrained. Rather, we view this as an indication of<br />

the extraordinary complexity and uncertainty in<br />

orchestrating policy tightening in these unusual<br />

circumstances and a desire by the Fed to develop<br />

and communicate a robust toolkit well in advance.<br />

Julia Coronado 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Sovereign Debt: Time for Europe to Act<br />

The sovereign debt crisis in the eurozone is about a<br />

lot more than Greece, Spain, Portugal and Ireland or<br />

any other country. It is about the collective political<br />

will of eurozone countries to set in stone the firm<br />

fiscal foundations that are necessary to underpin<br />

EMU. Remember that EMU stand for Economic and<br />

Monetary Union and not just Monetary Union. In<br />

short, the credibility of the project is at a testing point.<br />

At the end of this period, EMU will emerge stronger<br />

or significantly weaker.<br />

If one or more countries have sufficiently poor fiscal<br />

deficit and debt dynamics, then they risk undermining<br />

EMU in several ways. Speculation about credit risks<br />

for a sovereign can have knock-on effects on its<br />

partners in the union. There may be upward<br />

pressures on rates and dislocation in money<br />

markets. Risk premia and uncertainty may rise,<br />

undermining growth, or the currency and other asset<br />

markets may become volatile. Monetary policy may<br />

end up compromised or overburdened. For example,<br />

potentially the ECB could end up in the invidious<br />

position of having to choose between tightening<br />

monetary conditions to reflect economic<br />

developments when that would intensify a debt crisis<br />

or setting rates too low to avoid a debt crisis.<br />

As with any club, if one member imposes negative<br />

externalities on the other members of EMU, then the<br />

other members can reasonably expect to have an<br />

important say on the future behaviour of that<br />

member.<br />

The mechanism that is supposed to achieve this in<br />

the eurozone is of course the Stability and Growth<br />

Pact (SGP). Now, it is not delivering much stability<br />

and precious little growth. Unfortunately, despite the<br />

Commission having endorsed the Greek stability<br />

programme, the market has not put a lot of credibility<br />

in the plan.<br />

Greece could eventually manufacture its own<br />

credibility by delivering on its promises. But the<br />

market is unlikely to give them that amount of time. If<br />

a country cannot establish quickly its own credibility<br />

in the eyes of the market, what may be needed is an<br />

effective reduction of that state’s sovereignty over its<br />

own economic and to some extent social policies. It<br />

can borrow the credibility of its stronger peers.<br />

This is the rational behind the decision on Thursday<br />

to offer potential financial support if needed, and to<br />

bring in ECB and IMF expertise in the design and<br />

monitoring of Greece’s adjustment programme. The<br />

Commission will liase with the ECB to “closely<br />

monitor the implementation of the [stability<br />

programme’s] recommendations” and will draw on<br />

the expertise of the IMF to “propose additional<br />

measures”. These measures are designed to buy<br />

breathing space for Greece to implement its plans<br />

and for those plans to start paying dividends, while in<br />

the short term alleviating potential funding problems<br />

and market disruption.<br />

If this sounds like an IMF-style programme to you,<br />

then you are right. Note that we say an “IMF-style”<br />

programme. Crucially, the EU are limiting its use of<br />

the IMF to its expertise - a Fund programme might<br />

help to fix the current crisis, but as we said above,<br />

there is a longer-term game playing out here, which<br />

is for the fiscal soul of EMU. If the Fund were to bring<br />

a full programme to the eurozone, it will be an<br />

admission of failure by the Commission and the<br />

Council. It would be a public acknowledgement that<br />

the Europeans cannot put their own house in order. It<br />

would undermine the credibility of the institutions<br />

supporting EMU and will set a terrible precedent for<br />

the future.<br />

The monitoring of Greece’s adjustment programme<br />

in conjunction with the ECB and use of IMF expertise<br />

to propose additional measures is a crucial feature of<br />

the EU’s statement. If the EU had offered support to<br />

Greece without monitoring or conditions then some<br />

of the same problems would arise – EU institutions<br />

and the fiscal underpinning for the euro would be<br />

seen to be weak and deficient. We’ve learned a lot<br />

about moral hazard over recent months and years<br />

and the involvement of IMF expertise suggests the<br />

Council and Commission understand the risks. If its<br />

support were seen to be a pure “bailout”, then it<br />

would have created a terrible moral hazard,<br />

encouraging poor fiscal performance in the future by<br />

current and future members of the EMU.<br />

We could argue that infringing on the sovereignty of<br />

a member state is not enshrined in any treaty.<br />

Maybe, but it seems to us that the EU’s support for<br />

an adjustment programme under strict conditionality<br />

is precisely what was required. If this path is adhered<br />

to, then EMU can emerge from this episode<br />

strengthened and steeled. It will have come of age.<br />

Anything less will leave it much weaker than before.<br />

Paul Mortimer-Lee 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

7<br />

www.Global<strong>Market</strong>s.bnpparibas.com

French Regional Elections<br />

• The direct impact of regional elections is<br />

limited, as is the economic power of local<br />

authorities.<br />

• However, these elections will most likely be<br />

followed by a modest cabinet reshuffle. Further,<br />

the vote will set the political tone for the<br />

pension reform due later this year and for the<br />

implementation of fiscal tightening in 2011.<br />

The French regional elections are due on 14 and 21<br />

March (see Box 1). At first sight, the stakes are not<br />

huge. One would expect that, right after the worst<br />

recession of the last 50 years (with GDP falling 2.2%<br />

in 2009), the ruling government is likely to experience<br />

what is called on the French side of the channel a<br />

"Waterloo". These two ideas may be too simplistic.<br />

Political reading<br />

The regions have limited economic power, although it<br />

has been increasing in recent years. Their budgets<br />

are controlled and their leeway to vote a budget with<br />

a deficit is limited. Moreover, the government aims to<br />

reduce the scope for regions to increase spending,<br />

and the mandate of the councils will be reduced from<br />

six to four years ahead of an overhaul of how local<br />

authorities are organised. The real economic<br />

influence of the regional elections is indirect, via<br />

future government policy and possibly the upper<br />

house.<br />

In the last regional elections, the left-wing parties<br />

won the council presidency in 20 of the 22<br />

metropolitan regions 1 . Martine Aubry, the leader of<br />

the Socialist Party (PS) has said she is targeting the<br />

grand slam. Obviously, that is highly ambitious.<br />

Conversely, it will be much easier for the right-wing<br />

coalition to win more than the only two regions<br />

(Alsace and Corsica) that they currently run.<br />

In particular, part of the 2004 disaster for the<br />

government was due to the strength of the extremeright<br />

party 2 , the National Front (FN), which has<br />

1 There are four overseas regions, where local branches of<br />

the national parties are taking part together with local<br />

parties. As a consequence, the results are not fully<br />

comparable and people always focus on the 22 mainland<br />

regions.<br />

2 The National Front was then surfing on its relative 2002<br />

success when it managed to oust the Socialist candidate<br />

from the second round of the presidential elections.<br />

Conversely, PS supporters voted massively in 2004 to<br />

avoid a repeat of the 2002 disaster.<br />

Deadline to present lists<br />

Box 1: Election Calendar<br />

Event Date <strong>Market</strong><br />

relevance<br />

15 February<br />

Outcome of the first round 14 March<br />

8pm* **<br />

Outcome of the second round 21 March<br />

8pm* *<br />

Possible Cabinet reshuffle 24 – 31<br />

March ***<br />

Elections of presidents of late March<br />

regional councils<br />

early April -<br />

Source: <strong>BNP</strong> Paribas<br />

* The first estimate (normally quite reliable) of the vote outcome is<br />

announced by the press at 8pm local time; the final results are usually<br />

known during the night.<br />

Box 2: Electoral Process<br />

The regional elections are held on a two-round basis.<br />

Parties or coalitions present one list per region (the<br />

number of seats averages 85 but depends on the size of<br />

the region).<br />

After the first round, if one list has an absolute majority, it<br />

gets 25% of the seats* with the remaining seats distributed<br />

among the other lists that obtained at least 5% of the<br />

votes. If no list has an absolute majority, there is a second<br />

round.<br />

The lists that obtained less than 5% of votes are out; the<br />

lists that gained over 10% may either remain or merge<br />

with others, and these with 5-10% can only merge with<br />

lists that have obtained more than 10%. The rule is<br />

different for overseas territories and Corsica.<br />

After the second round, the list that has obtained most<br />

votes gets 25% of the seats*. The other seats are<br />

distributed according to the vote outcome.<br />

At the next council meeting, the president of each region is<br />

elected by the council members (by absolute majority, in a<br />

secret ballot).<br />

Source: <strong>BNP</strong> Paribas<br />

* the attribution of 25% of the seats to a list that arrived first guarantees an<br />

absolute majority in the council to this list as long as it gathers more than<br />

on third of total votes.<br />

subsequently lost a large part of its support.<br />

Consequently, the FN is less likely this year than in<br />

2004 to take part in the second round (when they ran<br />

in 18 regions, see Box 2). We may see more run-offs<br />

than in 2004, which should favour the centre-right<br />

coalition.<br />

-<br />

Dominique Barbet 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

8<br />

www.Global<strong>Market</strong>s.bnpparibas.com

The PS is more likely to face in the second round<br />

either a dissident list (e.g. in Languedoc, where the<br />

outgoing region's president has been banned from<br />

the party for making racist comments) or more<br />

radical left-wing lists (there are numerous extremeleft<br />

parties which have made partial coalitions,<br />

though they are struggling to come up with unified<br />

lists).<br />

Compared with 2004, the centre-right coalition has<br />

gained an ally (CPNT) and the PS has lost one as<br />

the communists have joined forces with some of the<br />

other extreme-left parties.<br />

As a result, the different left-wing and green lists may<br />

get more votes in the first round than in 2004<br />

(Chart 1); this would send a serious warning signal to<br />

the government. According to the most recent<br />

opinion polls, conducted at the national level, the<br />

centre-right coalition may get some 30% of the vote,<br />

vs. 27% for PS-led lists and 10% for the greens 3 .<br />

Nevertheless, the centre-right coalition is still likely to<br />

gain more regional presidencies in 2010 than in<br />

2004.<br />

The true economic stakes<br />

What matters most for financial markets is the<br />

distribution of votes in the first round, and whether or<br />

not this can be depicted as a "no confidence vote" in<br />

the government. The number of regions possibly won<br />

or lost by the centre-right coalition or the PS-green<br />

one (see Box 1) is less crucial.<br />

After the elections, a cabinet reshuffle can be<br />

expected. The President will argue he has heard the<br />

message from the popular vote and will shake up the<br />

cabinet to demonstrate this. He will use the<br />

opportunity to replace a few ministers who have been<br />

less successful (such as the minister of health).<br />

François Fillon is likely to stay as Prime Minister; he<br />

is currently more popular than the President and in a<br />

good position to lead on the pension reform, which is<br />

due to be discussed right after the regional elections.<br />

The identity of the new minister of social affairs (if a<br />

new appointment is made), in charge of this<br />

structural reform, and moreover the first speech he or<br />

she delivers will provide some indication as to how<br />

ambitious the reform could be. The markets are also<br />

keen to know whether the ministers in charge of the<br />

economy (Christine Lagarde) and budget (Eric<br />

Woerth) will retain their present positions. If they do,<br />

the credibility of the fiscal tightening policy would<br />

probably increase.<br />

70<br />

60<br />

50<br />

40<br />

Chart 1: Sarkozy’s Popularity Rating<br />

30<br />

Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09<br />

Source:<br />

No confidence<br />

Confidence<br />

Table 1: Outcome of the 2004 Regional<br />

Elections<br />

Coalitions Parties Votes Seats Presid.<br />

Extreme Left 4.95%<br />

Left wing 40.16% 20<br />

Mainstream Coalition 39.11% 1126<br />

Others 1.04% 36<br />

Right Wing 34.47% 2<br />

Mainstream Coalition 33.73% 522<br />

Others 0.74% 4<br />

Extreme Right 16.14%<br />

FN 14.70% 156<br />

Others 1.44%<br />

Miscellaneous 4.29% 4<br />

Fishers/Hunters 1.64%<br />

Other Ecologists 1.59%<br />

Others (incl. regionalists)* 1.07% 36<br />

Source: <strong>BNP</strong> Paribas<br />

Looking further down the road, the newly elected<br />

regional council members will take part in the upper<br />

house elections 4 . Presently the centre-right coalition<br />

only has a slim 52.5% majority in the upper house,<br />

and it could lose this next year.<br />

Our view<br />

We expect the participation rate to be lower in 2010<br />

than in 2004. According to opinion polls, the votes for<br />

the left-wing parties should significantly exceed those<br />

for the centre-right coalition, but probably not as<br />

much as in 2004. Consequently we expect that,<br />

though the PS will retain, by far, the largest number<br />

of regions, it may lose one or two vs. 2004. This<br />

would allow the government to push ahead with the<br />

planned reforms, in particular that of the pension<br />

system, and fiscal tightening, which is due to start in<br />

2011.<br />

3 The extreme right may get 9%, the Modem (which did not<br />

exist in 2004) 6% and the extreme left 11%, but in most<br />

regions these will be split between two or more lists.<br />

4 Half the upper house members will be elected in<br />

September 2011 by about 75k already-elected people,<br />

including the regional council members.<br />

Dominique Barbet 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

9<br />

www.Global<strong>Market</strong>s.bnpparibas.com

UK: Inflation Report – Surprisingly Dovish<br />

• The February Inflation Report was far more<br />

dovish than expected.<br />

Chart 1: BoE Inflation Projection (<strong>Market</strong> Rate<br />

Expectations)<br />

• Based on market interest rate expectations,<br />

the Bank’s CPI inflation projection is<br />

substantially below target two years ahead and<br />

still below target after three years.<br />

• The Inflation Report reinforced our<br />

conviction that the first Bank Rate hike is a very<br />

long way off.<br />

Surprisingly dovish<br />

The February Inflation Report was far more dovish<br />

than expected. Most forecasters, including ourselves,<br />

judged that – given the incremental news since the<br />

November Inflation Report – an upward revision to<br />

the inflation projection at the two year ahead horizon<br />

looked likely. What actually happened was the<br />

inflation projection was revised down, sharply.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: BoE Inflation Projection (Unchanged<br />

Bank Rate)<br />

More specifically, the inflation projection based on<br />

market rate expectations was around 1.2% y/y at the<br />

two year ahead horizon. That compares to around<br />

1.8% at that horizon last time around and there were<br />

grounds for an upward revision.<br />

Similarly, the inflation projection based on<br />

unchanged Bank Rate was also revised down. Last<br />

time, the projection was 2¼-2½% y/y and rising<br />

sharply at that point. Now, that projection is around<br />

1.8% y/y. To be clear, the committee stresses time<br />

and again that the projection is about more than just<br />

the central ‘modal’ projection. What has changed<br />

here is the upside risks to the projection are<br />

somewhat greater than the downside risks to the<br />

projection. One might infer from this that the Bank<br />

expects a subdued inflation profile, but is<br />

acknowledging in the risk distribution the tendency<br />

for these data to surprise on the upside.<br />

Similarly, the profile is more than just a two year<br />

ahead projection. Apart from the near 1-2 quarters,<br />

the central inflation projection is persistently below<br />

target thereafter.<br />

Fiscal fudge<br />

The key message is that both inflation projections<br />

have undergone a huge downward revision. The<br />

rationale for that appears to have been influenced by<br />

the fiscal tightening included in the Pre-Budget<br />

Report. Specifically, the new report noted that:<br />

Source: Reuters EcoWin Pro<br />

“A significant fiscal consolidation is in prospect. The<br />

precise nature and pace of that correction are<br />

uncertain. The Committee’s projections are<br />

conditioned on the plans set out in the December<br />

2009 Pre-Budget Report. That consolidation is likely<br />

to put downward pressure on spending and inflation<br />

over the forecast period.”<br />

That compared to the following in the November<br />

Inflation Report:<br />

“The Committee’s projections are conditioned on the<br />

fiscal plans set out in the 2009 Budget. Those plans<br />

implied a marked rise in the ratio of public sector<br />

debt to GDP. Stabilising that ratio will require some<br />

combination of a reduction in government spending<br />

and a rise in taxation as a share of GDP”.<br />

Hence, there has been an evolution in the Bank’s<br />

thinking with regard to how fiscal policy will affect the<br />

Alan Clarke 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com

outlook for GDP and inflation. So have forecasters<br />

been asleep at the wheel and should we have seen<br />

this revision to the Bank’s forecasts coming? Given<br />

what the MPC said in the January minutes, one can<br />

feel excused for being a little surprised by the extent<br />

of the revisions in the February Inflation Report:<br />

Chart 3: <strong>BNP</strong> Paribas vs BoE Inflation<br />

Projection (%, y/y)<br />

“A fuller analysis of the Government’s Pre-Budget<br />

Report than had been possible when the Committee<br />

had met in December implied that the published<br />

plans did not contain significant news for the outlook<br />

relative to the assumptions underlying the November<br />

Inflation Report”.<br />

We would say that a near 0.5 percentage point<br />

slashing of the two year ahead inflation projection is<br />

pretty significant news! Reading between the lines,<br />

the Bank got such a kicking at the November Inflation<br />

Report press conference for having such an upbeat<br />

growth projection and taking no account of the<br />

inevitable fiscal tightening that it wanted to avoid a<br />

repeat. We completely agree with the thrust of the<br />

revisions. After all, our own CPI inflation projection is<br />

even lower than the Bank’s during 2011.<br />

Rate hikes are a long way off<br />

The interpretation is crystal-clear. The fact that the<br />

inflation projection based on market rate<br />

expectations is well below target two years ahead<br />

shows the market is well ahead of itself in pricing in<br />

rate hikes. That projection is still below the 2%<br />

inflation target even after three years. Furthermore,<br />

with even more fiscal tightening likely to be<br />

announced in the aftermath of the election, that<br />

projection could be revised down yet further.<br />

The latest Inflation Report supports our long-held<br />

forecast that Bank Rate is likely to remain on hold for<br />

a very long time. We are at the very aggressive end<br />

of the consensus range. While most expect a rate<br />

hike before the end of this year, we expect no rate<br />

Source: Reuters EcoWin Pro<br />

hikes for the whole of 2010, and probably the whole<br />

of next year. The new Inflation Report has reinforced<br />

our conviction. King stated that it is far too soon to<br />

conclude that no further bond buying is needed.<br />

Clearly the door is open to more QE, though the<br />

likely improving data flow will make that a much<br />

harder call.<br />

The next key event on the UK monetary policy<br />

horizon is next week’s MPC minutes. In November,<br />

the inflation projections provoked one member to<br />

dissent in favour of more QE than the GBP 25bn<br />

expansion that was delivered. Since then, the<br />

inflation projection has been shifted lower. Hence if<br />

one member saw the case for more QE back in<br />

November, these projections would clearly support<br />

the case for dissenting now. Hence we expect a split<br />

vote. Clearly the majority on the committee opted for<br />

a pause in QE. King noted that it was not the Bank’s<br />

job to fine-tune by using QE.<br />

Alan Clarke 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

11<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Sweden: Earlier Rate Hikes on Agenda<br />

• The Riksbank kept the repo rate at the<br />

historical low of 0.25% at its February meeting,<br />

as generally expected.<br />

• The further improvement in economic<br />

conditions was acknowledged, and overall the<br />

statement was hawkish compared to<br />

December’s.<br />

• The Riksbank thus brought forward its<br />

projection for the first rate hike, from autumn to<br />

summer or early autumn.<br />

• We agree with this assessment and expect<br />

the first rate hike to be delivered in July.<br />

However, if stress in financial markets<br />

intensifies and uncertainty increases, there is a<br />

risk that the Riksbank will wait until September.<br />

CPI<br />

CPIF<br />

GDP<br />

Repo rate<br />

(%)<br />

Table 1: Riksbank’s Forecasts (% y/y)<br />

2009 2010 2011 2012<br />

-0.3<br />

(-0.3)<br />

1.9<br />

(1.9)<br />

-4.5<br />

(-4.5)<br />

0.7<br />

(0.7)<br />

1.6<br />

(0.8)<br />

1.9<br />

(1.2)<br />

2.5<br />

(2.7)<br />

0.4<br />

(0.3)<br />

2.9<br />

(3.0)<br />

1.4<br />

(1.5)<br />

3.4<br />

(3.4)<br />

1.8<br />

(1.6)<br />

3.1<br />

(3.6)<br />

1.8<br />

(1.9)<br />

3.1*<br />

(3.5)<br />

3.3<br />

(3.6)<br />

Source: The Riksbank. December 2009 forecasts in brackets<br />

Note: * The downward revision is because, in the previous forecast for<br />

2012, the Riksbank used an incorrect calculation factor to take into<br />

account the difference in the number of working days in 2011 and 2012.<br />

Chart 1: Policy Rate (%)<br />

Further improvement in economic conditions<br />

The Riksbank left the policy rate unchanged at<br />

0.25% at its February meeting, in line with market<br />

expectations. The opening paragraph of the policy<br />

statement noted that “the assessment now is that the<br />

upturn in economy activity rests on more solid<br />

ground”. Therefore the Executive Board stated this<br />

time round that it has reasons for increasing the repo<br />

rate somewhat sooner than was assessed in<br />

December, when the Riksbank reiterated its<br />

projection that the repo rate should be kept at its low<br />

until the autumn. The Executive Board now expects<br />

that “it will begin to raise the repo rate in the summer<br />

or early autumn”. The statement also mentioned that<br />

“it will be possible to make the increases in the<br />

slightly longer term more gradually and the forecast<br />

for the repo rate in the longer term has therefore<br />

been adjusted downwards somewhat”.<br />

Hawkish tone<br />

The Riksbank mentioned the steady improvement in<br />

financial markets and slight increase in global growth<br />

since its last meeting in December. Compared with<br />

the previous statement, there was a change in<br />

language regarding the recovery. The Riksbank<br />

again stated the recovery in household consumption,<br />

but noted that “the development of the manufacturing<br />

industry is still lagging behind”. This is a more<br />

positive statement compared with the previous one,<br />

where industrial production was described as ”still<br />

weak”. Clearly, given the increase in surveys such as<br />

the manufacturing PMI, which at its current level is<br />

the highest among the main advanced economies,<br />

the Riksbank acknowledges that leading indicators<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Exports & Manufacturing PMI New<br />

Export Orders<br />

Source: Reuters EcoWin Pro<br />

suggest an improvement in production in the coming<br />

period. The Riksbank also seemed to be more<br />

confident on the global economic outlook. The<br />

assessment was that ”demand for Swedish products<br />

will increase and exports will rise”.<br />

Gizem Kara 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com

On inflation, Riksbank’s language was hawkish<br />

compared with the December statement. The<br />

increase in inflation in recent months was noted.<br />

Also, the expectation of weak wage increases was<br />

perceived to “help reduce inflationary pressures in<br />

the period ahead”. This is a marked change from the<br />

emphasis on the “downside risks to inflation” in the<br />

December statement.<br />

Revisions to Riksbank’s forecasts<br />

In terms of revisions to growth and inflation<br />

projections, the GDP growth forecast for this year<br />

has been revised down from 2.7% to 2.5%. Inflation<br />

forecasts for 2010, on the other hand, were revised<br />

upwards in light of the surprises on inflation. CPI was<br />

revised up from 0.8% to 1.6%, hence why the<br />

Riksbank now expects to deliver its first rate hike<br />

earlier, and CPIF from 1.2% to 1.9%. 2011 forecasts<br />

were revised down only by 0.1pp for both CPI and<br />

CPIF (to 2.9% and 1.4% respectively).<br />

Chart 3: GDP and Unemployment<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Riksbank’s Policy Projections in<br />

December 2009 & February 2010<br />

Dissenter to the decision<br />

This time around, there was only one dissenter to the<br />

decision. Deputy Governor Lars E.O. Svensson once<br />

more entered a reservation against the decision and<br />

advocated cutting the repo rate to 0%. Deputy<br />

Governors Lars Nyberg and Barbro Wickman-Parak<br />

clearly did not dissent to today’s decision as the<br />

outcome was in line with their long-held view that ”it<br />

would be necessary to raise the interest rate sooner<br />

than indicated by the proposed interest rate path, but<br />

that the path would then not need to be so steep<br />

during the remaining forecast period”.<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Repo Rate (%, quarterly averages)<br />

Dec-09<br />

Feb-10<br />

Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412<br />

Our policy expectations<br />

Last week we highlighted that the further<br />

improvement in domestic economic conditions does<br />

provide a reason (see <strong>Market</strong> <strong>Mover</strong>, 5 February<br />

2010) for the Riksbank to bring forward its projection<br />

for the first rate hike from the autumn to the summer,<br />

i.e. from September to July. We also noted that there<br />

is already disagreement among the deputy governors<br />

regarding growth prospects, with deputy governors<br />

Nyberg and Wickman-Parak having a more positive<br />

view on the growth outlook, which would necessitate<br />

earlier rate hikes than forecast by the Riksbank.<br />

But, given the tensions in financial markets and<br />

increased uncertainty due to concerns over the fiscal<br />

situation in high-debt countries, we expected the<br />

Riksbank to adopt a cautious approach this time<br />

around and keep its repo rate path unchanged for the<br />

time being.<br />

Source: The Riksbank<br />

The Riksbank, however, seems to be more certain of<br />

the growth outlook, given the further improvement in<br />

economic conditions since the December meeting.<br />

Therefore, we believe the first rate hike will come in<br />

July, as economic conditions should continue to<br />

improve and the increase in unemployment is likely<br />

to be less than generally expected by the Riksbank<br />

previously.<br />

However, if stress in financial markets intensifies on<br />

the back of concerns over the sustainability of fiscal<br />

balances in some countries and uncertainty<br />

increases, there is a risk that the Riksbank will wait<br />

until September to start its hiking cycle.<br />

Gizem Kara 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Japan: Slowing Consumption Recovery<br />

• Thanks largely to the effects of fiscal<br />

stimulus, household spending has been<br />

recovering since Q2 2009. However, there are<br />

signs that the tempo slowed significantly in Q4.<br />

• This is because the driver of the<br />

consumption recovery, stimulus-fuelled outlays<br />

for durable goods, is starting to lose steam, as<br />

evidenced by the plateauing of passenger car<br />

sales.<br />

• Owing to the severe state of household<br />

incomes, spending on areas unaffected by<br />

stimulus has remained weak, making it likely<br />

that the consumption recovery will falter in<br />

coming quarters.<br />

• Because the worst is over for<br />

employment/income conditions, an outright<br />

collapse in consumption is unlikely even after<br />

the support from fiscal stimulus ends.<br />

Chart 1: Sales of New Motor Vehicles including<br />

Mini Vehicles (annualised, sa, 10k)<br />

650<br />

600<br />

550<br />

500<br />

450<br />

400<br />

350<br />

02 03 04 05 06 07 08 09 10<br />

Source: Japan Automobile Dealers Association, <strong>BNP</strong> Paribas<br />

Chart 2: Department Store Sales (sa, JPY bn)<br />

690<br />

670<br />

650<br />

630<br />

610<br />

Consumption has been recovering since Q2 2009,<br />

thanks largely to the effects of fiscal stimulus. But<br />

areas not directly benefiting from that stimulus have<br />

remained lacklustre. With signs emerging that<br />

stimulus is losing its impact, we analyse the outlook<br />

for consumer spending.<br />

Recovery tempo slowed in Q4<br />

On a GDP basis, real consumer spending crested in<br />

Q1 2008 and over the following year plunged 3.8%<br />

before touching bottom in Q1 2009. Spending<br />

revived in Q2 2009 with a solid 1.2% q/q gain and<br />

advanced a further 0.9% in Q3. While monthly<br />

statistics suggest positive growth continued into Q4,<br />

we estimate that the tempo slowed to just 0.2% q/q.<br />

Effects of fiscal stimulus are waning<br />

The driver of Q4 consumption is again durable goods<br />

spending, the area benefiting most directly from the<br />

government’s various stimulative policies. But even<br />

here the tempo is waning. For example, car sales,<br />

the beneficiary of subsidies/tax breaks for the<br />

purchase of eco-friendly models, grew 3.0% q/q in<br />

Q4 according to our seasonally adjusted estimates,<br />

but that is well off the robust 17.4% q/q pace evident<br />

in Q3. (While commercial sales figures released by<br />

the METI show little difference between sales growth<br />

in Q3 and Q4 – 6.0% q/q and 6.8% q/q, respectively –<br />

the METI uses different seasonal adjustment and the<br />

reading for December is a sharp drop of 4.2% m/m,<br />

also suggesting slowing momentum.)<br />

590<br />

570<br />

550<br />

530<br />

510<br />

04 05 06 07 08 09<br />

Source: Japan Department Stores Association, <strong>BNP</strong> Paribas<br />

In terms of new cars sales (our seasonally adjusted<br />

estimates), the total bottomed out in March 2009 and<br />

by the summer had shifted substantially higher.<br />

Since October, however, this total has generally<br />

moved sideways. In January 2010, new cars sales<br />

were up a brisk 36.8% y/y but just 0.7% m/m. While<br />

this plateauing can partially be attributed to supply<br />

constraints for the hot-selling hybrid models, there<br />

are no such impediments for other models and their<br />

formerly robust sales have still stalled.<br />

Meanwhile, as for the stimulus benefiting household<br />

appliances, the eco-point system (whereby<br />

purchases of eco-friendly appliances earn points that<br />

can be redeemed for gift certificates and other items),<br />

sales of flat-panel TVs remain as solid as ever, due<br />

in part to the switchover to terrestrial digital<br />

broadcasting from July 2011. However, the METI’s<br />

Indices of Tertiary Industry Activity show a marked<br />

weakness for the retailers of household appliances,<br />

with real sales falling in both November and<br />

December.<br />

Ryutaro Kono/ Hiroshi Shiraishi 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

14<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Spending on other areas never did improve<br />

Turning to areas of consumption unaffected by the<br />

stimulus, the tone remains weak. The situation is<br />

especially dire for department stores, which primarily<br />

market big-ticket items that today’s frugal consumers<br />

shun. According to our seasonally adjusted estimates,<br />

department store sales plummeted 4.8% q/q in Q4,<br />

far worse than Q3’s 0.3% drop. While sales on a<br />

monthly basis revived in December on the back of<br />

earlier-than-usual sales campaigns, the level remains<br />

below that of September owing to the steep sales<br />

declines posted in October and November.<br />

Preliminary figures for individual department stores in<br />

January show y/y declines ranging from 0.5% to<br />

roughly 7%. While that might be an improvement<br />

from December, month-on-month sales are generally<br />

flat.<br />

According to METI’s commercial sales statistics,<br />

business also remains sluggish for the retailers of<br />

food and beverages, with nominal sales in Q4 falling<br />

2.0% q/q. While falling prices act to deflate nominal<br />

sales, this sector’s real sales in Q4 were still down<br />

0.6% q/q. Although supermarkets and convenience<br />

stores are desperately trying to shore up sales of<br />

food/beverages by slashing prices and introducing<br />

cheaper private-brand goods, such strategies have<br />

not sparked demand.<br />

Meanwhile, the index of service consumption (a subindex<br />

of the Indices of All Industries) remains weak,<br />

with the reading for October being 0.2% m/m<br />

followed by -0.3% m/m in November, which, when<br />

averaged out, yields a flat trajectory from Q3. As for<br />

service spending moving forward, the December’s<br />

Consumer Confidence Survey’s section on<br />

expenditure plans for services in the coming quarter<br />

shows weakness in all six survey categories (sports,<br />

concerts, amusement parks, household services,<br />

restaurants, self-enlightenment).<br />

Consumption recovery will momentarily falter<br />

The fundamental reason for consumption being weak<br />

is the severe state of households’ income conditions<br />

(inadequate social welfare systems also play a big<br />

part in explaining the structural weakness of<br />

consumption). Most households realise that the drop<br />

in income from 2008 is permanent, and not just the<br />

result of a cyclical shock; households have lowered<br />

their spending levels to reflect this. That winter<br />

bonuses again fell sharply this year only reinforces<br />

the conviction that income has permanently shifted<br />

lower.<br />

Although many companies have returned to<br />

profitability on the back of booming exports, they will<br />

likely maintain a restrictive stance towards payroll<br />

costs as the return rate on capital remains low.<br />

Accordingly, any appreciable improvement in<br />

103<br />

102<br />

101<br />

100<br />

99<br />

98<br />

97<br />

96<br />

95<br />

94<br />

Chart 3: Indices of All Industries Activity,<br />

<strong>Services</strong> Consumption (CY2005=100)<br />

03 04 05 06 07 08 09<br />

Source: METI, <strong>BNP</strong> Paribas<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

Chart 4: Total Cash Earnings (% y/y)<br />

04 05 06 07 08 09<br />

Source: MHLW, <strong>BNP</strong> Paribas<br />

Special Cash Earnings<br />

Non-scheduled<br />

Total Cash Earnings<br />

Scheduled<br />

employment/income conditions is unlikely anytime<br />

soon or, as we have stated in previous reports, it will<br />

be a while before a positive feedback loop between<br />

income and expenditure starts to function. Given this<br />

situation, the recovery in consumption will likely falter<br />

in coming quarters as the effects of fiscal stimulus<br />

fade.<br />

That said, all is not completely grim with respect to<br />

household income conditions, as overtime earnings<br />

are rising alongside revived factory activity and the<br />

downturn in scheduled earnings is also easing<br />

thanks to increased working hours (something that<br />

previously had been sharply cut).<br />

With respect to employment, the picture is also<br />

stabilising, with the forward indicator of the job-offer<br />

ratio posting improvement for four straight months.<br />

Thus, the worst seems to be over for<br />

employment/income conditions. While those<br />

conditions might not significantly improve anytime<br />

soon, consumption is unlikely to collapse after the<br />

fiscal stimulus ends.<br />

Ryutaro Kono/ Hiroshi Shiraishi 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

15<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US: Fed Provides More Details on Exit Plan<br />

• Bernanke outlined several steps and<br />

programmes that will help facilitate the Fed’s<br />

exit strategy in his speech on Wednesday.<br />

• The Fed is to conduct reverse repos with<br />

not only dealers, but also money market funds<br />

and other counterparties. We would argue that<br />

GSEs are a possibility as well.<br />

3<br />

2<br />

Chart 1: Fed Funds Target vs Effective<br />

Fed Target Rate<br />

Fed Effective Rate<br />

• By switching its policy target rate to the<br />

rate paid on excess reserves instead of<br />

effective fed funds, this should be mildly<br />

bearish for short-term rates. Again, GSEs are<br />

an obstacle to fully benefiting from this plan.<br />

• The Fed will offer term deposits and could<br />

now have greater control over 3m or longer<br />

rates by adjusting the supply of its offerings.<br />

• STRATEGY: We do expect some bearish<br />

impact on the 2-5y sector of the Tsy market. To<br />

be sure, Bernanke made it clear that there has<br />

been no policy shift (inflation subdued, rates to<br />

be held low for an extended period etc).<br />

However, the psychological effect of these<br />

measures will still be a factor as investors<br />

think twice about front-end carry/roll trades.<br />

1<br />

0<br />

May-08 Aug-08 Nov-08 Feb-09 Jun-09 Sep-09 Dec-09<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Commercial Paper to Remain Tight?<br />

400<br />

3m OIS vs ABCP Rate Spread 6<br />

350<br />

Fed Target Rate (R.H.S)<br />

5<br />

300<br />

250<br />

4<br />

200<br />

3<br />

150<br />

100<br />

2<br />

Bernanke outlined several steps that will help the<br />

Fed facilitate the unwinding of accommodative<br />

monetary policy. Some of these steps are not<br />

expected to have a noticeable impact, while the<br />

impact of a few programmes is unclear and warrants<br />

attention. However, there is no policy shift so one<br />

shouldn’t expect eventual Fed tightening to come any<br />

sooner than previously expected, although the<br />

impact on markets could nevertheless be bearish<br />

due to the symbolic nature of this detailed update on<br />

the Fed’s exit plan.<br />

Reverse repos with a twist<br />

Reverse repo operations by the Fed are nothing new.<br />

In fact, the Fed used reverse repos quite a bit in the<br />

beginning of the crisis to manage liquidity. By<br />

performing these transactions, the Fed drains cash<br />

out of the system. It is yet another tool for controlling<br />

overnight effective rates and keeping them closer to<br />

the target (Chart 1).<br />

What's new is that the Fed plans to perform these<br />

transactions with other counterparties besides<br />

primary dealers, albeit stopping short of identifying<br />

who those counterparties may be. Money market<br />

50<br />

0<br />

-50<br />

0<br />

Jan-08 Jul-08 Feb-09 Aug-09 Mar-10<br />

Source: <strong>BNP</strong> Paribas<br />

funds seem like good candidates, although they are<br />

already affected by the SEC’s recent ruling about<br />

shortening the maximum weighted-average maturity<br />

of a fund’s holdings from 90 to 60 days, which would<br />

weigh on demand in the longer end of the money<br />

market sector. Much of the assets bought in this<br />

sector are CDs and commercial paper. Chart 2<br />

shows that the CP spread is very tight due to the<br />

Fed’s liquidity programmes although it may now start<br />

to widen.<br />

Paying interest on excess reserves…but at the<br />

target rate<br />

The Fed is currently already paying 25bp on excess<br />

reserves, although the effectiveness of this is<br />

hampered by the fact that GSEs still don’t get paid on<br />

reserves. GSEs are big players in the Fed Funds<br />

market and they are a major reason why the Fed lost<br />

control of the effective fed funds rate (Chart 1). We<br />

1<br />

Sergey Bondarchuk / Suvrat Prakash / Bulent Baygun 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com

would argue that resolving this issue would help the<br />

Fed regain better control of overnight rates. In fact,<br />

the Fed might also be already considering reverse<br />

repos with GSEs, as it has not yet specified which<br />

counterparties are under consideration.<br />

Bernanke outlined a key change in the Fed’s<br />

approach which could help it gain stronger control of<br />

short-term rates. The Fed will shift its policy target to<br />

the rate paid on reserves instead of the fed effective<br />

rate during the early stages of tightening. Effective<br />

fed funds has occasionally been driven much lower<br />

than expected as the banking system dumps<br />

reserves in that market on days of excessive liquidity.<br />

This makes it difficult for the Fed to control effective<br />

rates during the early stages of rate increases. By<br />

protecting against unexpected plunges in the Fed<br />

effective rate, this should force an upward<br />

adjustment to OIS, GC and even Libor, although<br />

perhaps only slightly since most of the time there is<br />

not a dramatic drop in effective rates.<br />

Offering term deposits<br />

This isn't the first time a potential Term Deposit<br />

Facility has been mentioned by the Fed. The<br />

implication of introducing such a facility, especially<br />

ahead of rate hikes, is that it could give the Fed<br />

effective control of rates longer than 1m or even 3m.<br />

As another tool for draining liquidity, the Fed "plans<br />

to offer to depository institutions term deposits, which<br />

are roughly analogous to certificates of deposit that<br />

the institutions offer to their customers".<br />

By offering deposit out to (say) 3m, the Fed could<br />

arguably directly control the 3m rate, besides the<br />

traditional overnight fed funds rate. Although an<br />

argument can be made that investors will set the<br />

rate, the Fed could nevertheless influence it by<br />

adjusting the supply of its offerings. Therefore, if the<br />

Fed starts to use this facility before official rate hikes,<br />

it could at the very least increase volatility and quiet<br />

possibly push up short rates. Testing of the TDF is<br />

scheduled to start in the spring on a small scale,<br />

implying that the use of this facility will scale up as<br />

the economy improves.<br />

Therefore, considering that the Fed has hinted that<br />

liquidity draining exercises will ramp up before official<br />

rate hikes, we could see the potential impact on rates<br />

as early as mid-to-late spring. As such,<br />

carry/rolldown plays should be considered with this in<br />

mind.<br />

On discount window, TAF and TALF wind-down<br />

The Fed’s current outstanding discount window<br />

borrowing is down to USD 89bn from a crisis peak of<br />

USD 438bn. Therefore, the discount window is barely<br />

used despite the Fed’s intense promotion of the<br />

facility at the start of the crisis. The idea was that<br />

banks would be willing to borrow from the Fed in<br />

case Libor rates were higher, thus making the<br />

discount window a “cap in Libor”. This failed the test<br />

and so other liquidity programmes were needed.<br />

Thus, a raise in the discount rate is unlikely to<br />

increase Libor (or other short-term rates) although<br />

some investors will surely still regard this as a<br />

hawkish message.<br />

Likewise, we expect no noticeable impact from the<br />

wind-down of other facilities, such as TAF on 8<br />

March and TALF on 31 March (30 June for CMBS<br />

collateral) as utilisation of these programmes has<br />

dwindled recently.<br />

Asset sales<br />

Lastly, security sales shouldn’t be a concern in the<br />

short/medium term, as the Fed doesn’t anticipate<br />

selling security holdings “at least until after policy<br />

tightening has gotten under way and the economy is<br />

clearly in a sustainable recovery”.<br />

Bernanke has used very careful and measured<br />