Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: Roadmap to Fed Tightening<br />

• Chairman Bernanke carefully distinguished<br />

between policies aimed at providing emergency<br />

liquidity and more traditional monetary policy in<br />

his testimony on Wednesday.<br />

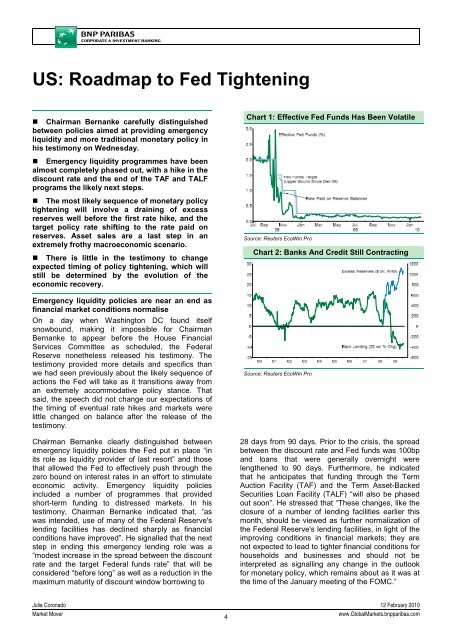

Chart 1: Effective Fed Funds Has Been Volatile<br />

• Emergency liquidity programmes have been<br />

almost completely phased out, with a hike in the<br />

discount rate and the end of the TAF and TALF<br />

programs the likely next steps.<br />

• The most likely sequence of monetary policy<br />

tightening will involve a draining of excess<br />

reserves well before the first rate hike, and the<br />

target policy rate shifting to the rate paid on<br />

reserves. Asset sales are a last step in an<br />

extremely frothy macroeconomic scenario.<br />

• There is little in the testimony to change<br />

expected timing of policy tightening, which will<br />

still be determined by the evolution of the<br />

economic recovery.<br />

Emergency liquidity policies are near an end as<br />

financial market conditions normalise<br />

On a day when Washington DC found itself<br />

snowbound, making it impossible for Chairman<br />

Bernanke to appear before the House Financial<br />

<strong>Services</strong> Committee as scheduled, the Federal<br />

Reserve nonetheless released his testimony. The<br />

testimony provided more details and specifics than<br />

we had seen previously about the likely sequence of<br />

actions the Fed will take as it transitions away from<br />

an extremely accommodative policy stance. That<br />

said, the speech did not change our expectations of<br />

the timing of eventual rate hikes and markets were<br />

little changed on balance after the release of the<br />

testimony.<br />

Chairman Bernanke clearly distinguished between<br />

emergency liquidity policies the Fed put in place “in<br />

its role as liquidity provider of last resort” and those<br />

that allowed the Fed to effectively push through the<br />

zero bound on interest rates in an effort to stimulate<br />

economic activity. Emergency liquidity policies<br />

included a number of programmes that provided<br />

short-term funding to distressed markets. In his<br />

testimony, Chairman Bernanke indicated that, “as<br />

was intended, use of many of the Federal Reserve's<br />

lending facilities has declined sharply as financial<br />

conditions have improved”. He signalled that the next<br />

step in ending this emergency lending role was a<br />

“modest increase in the spread between the discount<br />

rate and the target Federal funds rate” that will be<br />

considered “before long” as well as a reduction in the<br />

maximum maturity of discount window borrowing to<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Banks And Credit Still Contracting<br />

Source: Reuters EcoWin Pro<br />

28 days from 90 days. Prior to the crisis, the spread<br />

between the discount rate and Fed funds was 100bp<br />

and loans that were generally overnight were<br />

lengthened to 90 days. Furthermore, he indicated<br />

that he anticipates that funding through the Term<br />

Auction Facility (TAF) and the Term Asset-Backed<br />

Securities Loan Facility (TALF) “will also be phased<br />

out soon”. He stressed that “These changes, like the<br />

closure of a number of lending facilities earlier this<br />

month, should be viewed as further normalization of<br />

the Federal Reserve's lending facilities, in light of the<br />

improving conditions in financial markets; they are<br />

not expected to lead to tighter financial conditions for<br />

households and businesses and should not be<br />

interpreted as signalling any change in the outlook<br />

for monetary policy, which remains about as it was at<br />

the time of the January meeting of the FOMC.”<br />

Julia Coronado 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

4<br />

www.Global<strong>Market</strong>s.bnpparibas.com