Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

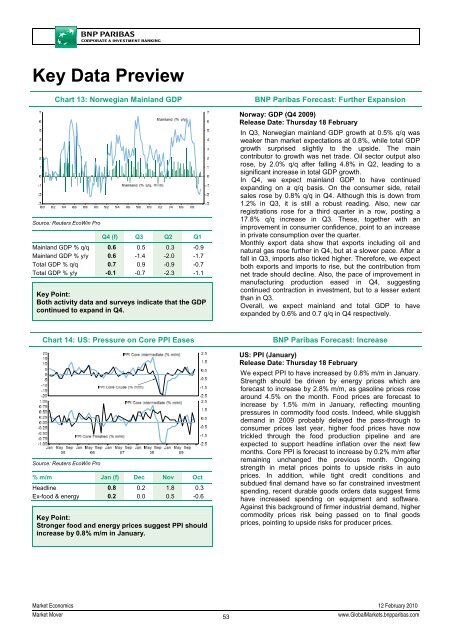

Chart 13: Norwegian Mainland GDP<br />

Source: Reuters EcoWin Pro<br />

Q4 (f) Q3 Q2 Q1<br />

Mainland GDP % q/q 0.6 0.5 0.3 -0.9<br />

Mainland GDP % y/y 0.6 -1.4 -2.0 -1.7<br />

Total GDP % q/q 0.7 0.9 -0.9 -0.7<br />

Total GDP % y/y -0.1 -0.7 -2.3 -1.1<br />

Key Point:<br />

Both activity data and surveys indicate that the GDP<br />

continued to expand in Q4.<br />

<strong>BNP</strong> Paribas Forecast: Further Expansion<br />

Norway: GDP (Q4 2009)<br />

Release Date: Thursday 18 February<br />

In Q3, Norwegian mainland GDP growth at 0.5% q/q was<br />

weaker than market expectations at 0.8%, while total GDP<br />

growth surprised slightly to the upside. The main<br />

contributor to growth was net trade. Oil sector output also<br />

rose, by 2.0% q/q after falling 4.8% in Q2, leading to a<br />

significant increase in total GDP growth.<br />

In Q4, we expect mainland GDP to have continued<br />

expanding on a q/q basis. On the consumer side, retail<br />

sales rose by 0.8% q/q in Q4. Although this is down from<br />

1.2% in Q3, it is still a robust reading. Also, new car<br />

registrations rose for a third quarter in a row, posting a<br />

17.8% q/q increase in Q3. These, together with an<br />

improvement in consumer confidence, point to an increase<br />

in private consumption over the quarter.<br />

Monthly export data show that exports including oil and<br />

natural gas rose further in Q4, but at a slower pace. After a<br />

fall in Q3, imports also ticked higher. Therefore, we expect<br />

both exports and imports to rise, but the contribution from<br />

net trade should decline. Also, the pace of improvement in<br />

manufacturing production eased in Q4, suggesting<br />

continued contraction in investment, but to a lesser extent<br />

than in Q3.<br />

Overall, we expect mainland and total GDP to have<br />

expanded by 0.6% and 0.7 q/q in Q4 respectively.<br />

Chart 14: US: Pressure on Core PPI Eases<br />

Source: Reuters EcoWin Pro<br />

% m/m Jan (f) Dec Nov Oct<br />

Headline 0.8 0.2 1.8 0.3<br />

Ex-food & energy 0.2 0.0 0.5 -0.6<br />

Key Point:<br />

Stronger food and energy prices suggest PPI should<br />

increase by 0.8% m/m in January.<br />

<strong>BNP</strong> Paribas Forecast: Increase<br />

US: PPI (January)<br />

Release Date: Thursday 18 February<br />

We expect PPI to have increased by 0.8% m/m in January.<br />

Strength should be driven by energy prices which are<br />

forecast to increase by 2.8% m/m, as gasoline prices rose<br />

around 4.5% on the month. Food prices are forecast to<br />

increase by 1.5% m/m in January, reflecting mounting<br />

pressures in commodity food costs. Indeed, while sluggish<br />

demand in 2009 probably delayed the pass-through to<br />

consumer prices last year, higher food prices have now<br />

trickled through the food production pipeline and are<br />

expected to support headline inflation over the next few<br />

months. Core PPI is forecast to increase by 0.2% m/m after<br />

remaining unchanged the previous month. Ongoing<br />

strength in metal prices points to upside risks in auto<br />

prices. In addition, while tight credit conditions and<br />

subdued final demand have so far constrained investment<br />

spending, recent durable goods orders data suggest firms<br />

have increased spending on equipment and software.<br />

Against this background of firmer industrial demand, higher<br />

commodity prices risk being passed on to final goods<br />

prices, pointing to upside risks for producer prices.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

53<br />

www.Global<strong>Market</strong>s.bnpparibas.com