Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

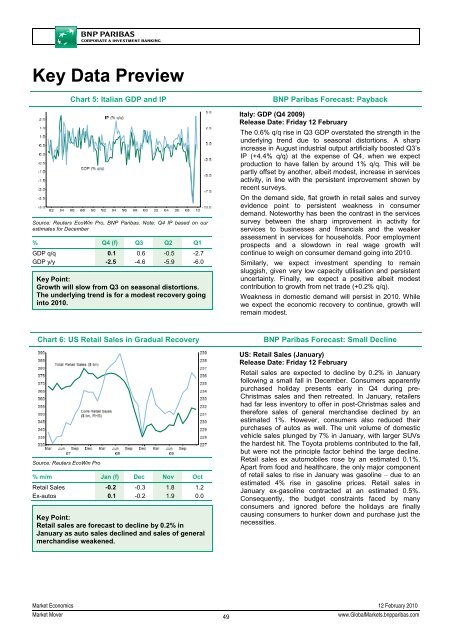

Chart 5: Italian GDP and IP<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas. Note: Q4 IP based on our<br />

estimates for December<br />

% Q4 (f) Q3 Q2 Q1<br />

GDP q/q 0.1 0.6 -0.5 -2.7<br />

GDP y/y -2.5 -4.6 -5.9 -6.0<br />

Key Point:<br />

Growth will slow from Q3 on seasonal distortions.<br />

The underlying trend is for a modest recovery going<br />

into 2010.<br />

<strong>BNP</strong> Paribas Forecast: Payback<br />

Italy: GDP (Q4 2009)<br />

Release Date: Friday 12 February<br />

The 0.6% q/q rise in Q3 GDP overstated the strength in the<br />

underlying trend due to seasonal distortions. A sharp<br />

increase in August industrial output artificially boosted Q3’s<br />

IP (+4.4% q/q) at the expense of Q4, when we expect<br />

production to have fallen by around 1% q/q. This will be<br />

partly offset by another, albeit modest, increase in services<br />

activity, in line with the persistent improvement shown by<br />

recent surveys.<br />

On the demand side, flat growth in retail sales and survey<br />

evidence point to persistent weakness in consumer<br />

demand. Noteworthy has been the contrast in the services<br />

survey between the sharp improvement in activity for<br />

services to businesses and financials and the weaker<br />

assessment in services for households. Poor employment<br />

prospects and a slowdown in real wage growth will<br />

continue to weigh on consumer demand going into 2010.<br />

Similarly, we expect investment spending to remain<br />

sluggish, given very low capacity utilisation and persistent<br />

uncertainty. Finally, we expect a positive albeit modest<br />

contribution to growth from net trade (+0.2% q/q).<br />

Weakness in domestic demand will persist in 2010. While<br />

we expect the economic recovery to continue, growth will<br />

remain modest.<br />

Chart 6: US Retail Sales in Gradual Recovery<br />

Source: Reuters EcoWin Pro<br />

% m/m Jan (f) Dec Nov Oct<br />

Retail Sales -0.2 -0.3 1.8 1.2<br />

Ex-autos 0.1 -0.2 1.9 0.0<br />

Key Point:<br />

Retail sales are forecast to decline by 0.2% in<br />

January as auto sales declined and sales of general<br />

merchandise weakened.<br />

<strong>BNP</strong> Paribas Forecast: Small Decline<br />

US: Retail Sales (January)<br />

Release Date: Friday 12 February<br />

Retail sales are expected to decline by 0.2% in January<br />

following a small fall in December. Consumers apparently<br />

purchased holiday presents early in Q4 during pre-<br />

Christmas sales and then retreated. In January, retailers<br />

had far less inventory to offer in post-Christmas sales and<br />

therefore sales of general merchandise declined by an<br />

estimated 1%. However, consumers also reduced their<br />

purchases of autos as well. The unit volume of domestic<br />

vehicle sales plunged by 7% in January, with larger SUVs<br />

the hardest hit. The Toyota problems contributed to the fall,<br />

but were not the principle factor behind the large decline.<br />

Retail sales ex automobiles rose by an estimated 0.1%.<br />

Apart from food and healthcare, the only major component<br />

of retail sales to rise in January was gasoline – due to an<br />

estimated 4% rise in gasoline prices. Retail sales in<br />

January ex-gasoline contracted at an estimated 0.5%.<br />

Consequently, the budget constraints faced by many<br />

consumers and ignored before the holidays are finally<br />

causing consumers to hunker down and purchase just the<br />

necessities.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

49<br />

www.Global<strong>Market</strong>s.bnpparibas.com