Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global risks<br />

While the stress in the eurozone has intensified over<br />

the past week and the euro has come under<br />

significant pressure, it is interesting to note that the<br />

euro has not been the weakest currency. In fact<br />

since the beginning of the year, although the euro is<br />

lower against the USD, it has remained supported on<br />

many of the crosses. The underperformers are the<br />

commodity currencies and sterling. In fact the<br />

commodity currencies could well be the main<br />

casualties of the year, along with sterling.<br />

Sterling stands out – as vulnerable<br />

In many cases sterling and the commodity currencies<br />

are exposed to the very risks that are currently<br />

causing the most concern within Europe. Indeed, the<br />

UK net debt to GDP ratio is expected to increase<br />

rapidly over the next few years, reaching 67% in<br />

2010 and 74% in 2011 on our forecasts. This is likely<br />

to be worse than in Spain, where government debt is<br />

expected to reach 66.3% of GDP in 2010 and 74.0%<br />

in 2011.<br />

While sterling stands out as the most vulnerable of<br />

the major currencies given its poor and deteriorating<br />

fiscal position, which is likely to see the UK’s AAA<br />

rating called into question post the election if action is<br />

not taken, the commodity currencies are also<br />

exposed to the additional risk of global liquidity<br />

withdrawal. Indeed, signs that the action already<br />

taken by China is beginning to bite is starting to have<br />

a direct negative impact on the AUD far earlier than<br />

originally anticipated. The RBA has also signalled a<br />

slowing of the pace of tightening, citing the<br />

anticipated tightening of policy in China. As a result,<br />

we have also lowered our AUDUSD forecast.<br />

Most bearish<br />

In the case of sterling we have the most bearish<br />

GBPUSD forecast in the market for end-2010<br />

(GBPUSD 1.31) and the data from the UK provide<br />

little reason to change this bearish assessment. The<br />

UK has shown the weakest and most fragile of<br />

recoveries, especially compared to its developed<br />

economy peers. Taking a full quarter longer to<br />

emerge from recession than most other major<br />

economies, with a weak 0.1% q/q print in Q4, there<br />

are also signs that the brighter spots within the UK<br />

economy are already running out of steam. The<br />

latest survey evidence from the UK consumer sector<br />

(BRC) is showing some worrying signs, but the<br />

biggest concern has to be the collapse in the new<br />

buyer enquires in the housing market as revealed by<br />

the RICS house price survey. This is widely regarded<br />

as one of the better leading indicators of the UK<br />

housing market and the current pace of deterioration<br />

does not bode well for the housing market.<br />

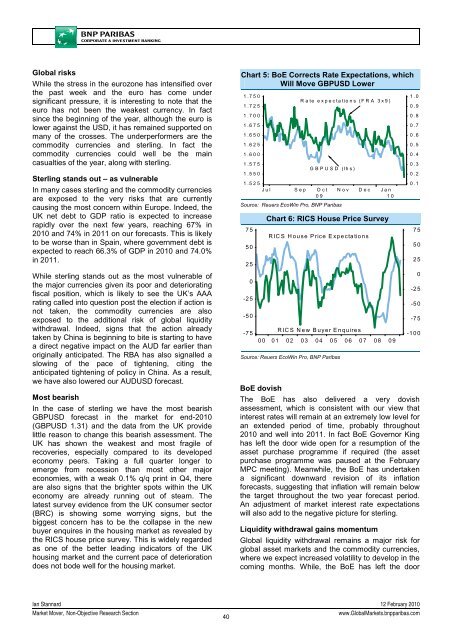

Chart 5: BoE Corrects Rate Expectations, which<br />

Will Move GBPUSD Lower<br />

1.750<br />

1.725<br />

1.700<br />

1.675<br />

1.650<br />

1.625<br />

1.600<br />

1.575<br />

1.550<br />

1.525<br />

Jul<br />

Rate expectations (FRA 3x9)<br />

GBPUSD (lhs)<br />

Source: Reuers EcoWin Pro, <strong>BNP</strong> Paribas<br />

75<br />

50<br />

25<br />

0<br />

-25<br />

-50<br />

-75<br />

Sep Oct Nov Dec Jan<br />

09<br />

10<br />

Chart 6: RICS House Price Survey<br />

RICS House Price Expectations<br />

RICS New Buyer Enquires<br />

00 01 02 03 04 05 06 07 08 09<br />

Source: Reuers EcoWin Pro, <strong>BNP</strong> Paribas<br />

BoE dovish<br />

The BoE has also delivered a very dovish<br />

assessment, which is consistent with our view that<br />

interest rates will remain at an extremely low level for<br />

an extended period of time, probably throughout<br />

2010 and well into 2011. In fact BoE Governor King<br />

has left the door wide open for a resumption of the<br />

asset purchase programme if required (the asset<br />

purchase programme was paused at the February<br />

MPC meeting). Meanwhile, the BoE has undertaken<br />

a significant downward revision of its inflation<br />

forecasts, suggesting that inflation will remain below<br />

the target throughout the two year forecast period.<br />

An adjustment of market interest rate expectations<br />

will also add to the negative picture for sterling.<br />

Liquidity withdrawal gains momentum<br />

Global liquidity withdrawal remains a major risk for<br />

global asset markets and the commodity currencies,<br />

where we expect increased volatility to develop in the<br />

coming months. While, the BoE has left the door<br />

1.0<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

75<br />

50<br />

25<br />

0<br />

-25<br />

-50<br />

-75<br />

-100<br />

Ian Stannard 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

40<br />

www.Global<strong>Market</strong>s.bnpparibas.com