Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

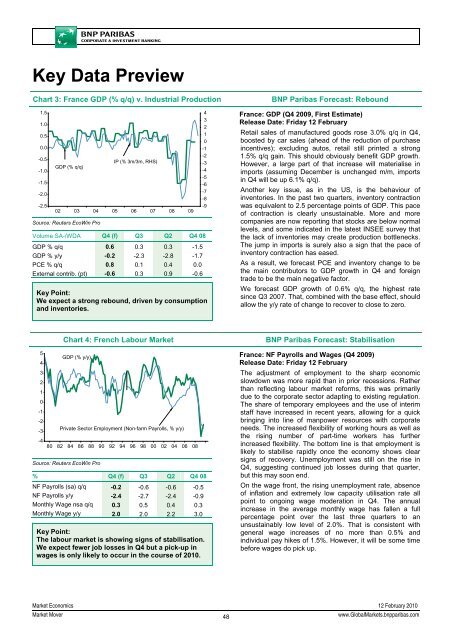

Chart 3: France GDP (% q/q) v. Industrial Production<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

GDP (% q/q)<br />

IP (% 3m/3m, RHS)<br />

02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro<br />

Volume SA-/WDA Q4 (f) Q3 Q2 Q4 08<br />

GDP % q/q 0.6 0.3 0.3 -1.5<br />

GDP % y/y -0.2 -2.3 -2.8 -1.7<br />

PCE % q/q 0.8 0.1 0.4 0.0<br />

External contrib. (pt) -0.6 0.3 0.9 -0.6<br />

Key Point:<br />

We expect a strong rebound, driven by consumption<br />

and inventories.<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

-5<br />

-6<br />

-7<br />

-8<br />

-9<br />

<strong>BNP</strong> Paribas Forecast: Rebound<br />

France: GDP (Q4 2009, First Estimate)<br />

Release Date: Friday 12 February<br />

Retail sales of manufactured goods rose 3.0% q/q in Q4,<br />

boosted by car sales (ahead of the reduction of purchase<br />

incentives); excluding autos, retail still printed a strong<br />

1.5% q/q gain. This should obviously benefit GDP growth.<br />

However, a large part of that increase will materialise in<br />

imports (assuming December is unchanged m/m, imports<br />

in Q4 will be up 6.1% q/q).<br />

Another key issue, as in the US, is the behaviour of<br />

inventories. In the past two quarters, inventory contraction<br />

was equivalent to 2.5 percentage points of GDP. This pace<br />

of contraction is clearly unsustainable. More and more<br />

companies are now reporting that stocks are below normal<br />

levels, and some indicated in the latest INSEE survey that<br />

the lack of inventories may create production bottlenecks.<br />

The jump in imports is surely also a sign that the pace of<br />

inventory contraction has eased.<br />

As a result, we forecast PCE and inventory change to be<br />

the main contributors to GDP growth in Q4 and foreign<br />

trade to be the main negative factor.<br />

We forecast GDP growth of 0.6% q/q, the highest rate<br />

since Q3 2007. That, combined with the base effect, should<br />

allow the y/y rate of change to recover to close to zero.<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Chart 4: French Labour <strong>Market</strong><br />

GDP (% y/y)<br />

Private Sector Employment (Non-farm Payrolls, % y/y)<br />

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08<br />

Source: Reuters EcoWin Pro<br />

% Q4 (f) Q3 Q2 Q4 08<br />

NF Payrolls (sa) q/q -0.2 -0.6 -0.6 -0.5<br />

NF Payrolls y/y -2.4 -2.7 -2.4 -0.9<br />

Monthly Wage nsa q/q 0.3 0.5 0.4 0.3<br />

Monthly Wage y/y 2.0 2.0 2.2 3.0<br />

Key Point:<br />

The labour market is showing signs of stabilisation.<br />

We expect fewer job losses in Q4 but a pick-up in<br />

wages is only likely to occur in the course of 2010.<br />

<strong>BNP</strong> Paribas Forecast: Stabilisation<br />

France: NF Payrolls and Wages (Q4 2009)<br />

Release Date: Friday 12 February<br />

The adjustment of employment to the sharp economic<br />

slowdown was more rapid than in prior recessions. Rather<br />

than reflecting labour market reforms, this was primarily<br />

due to the corporate sector adapting to existing regulation.<br />

The share of temporary employees and the use of interim<br />

staff have increased in recent years, allowing for a quick<br />

bringing into line of manpower resources with corporate<br />

needs. The increased flexibility of working hours as well as<br />

the rising number of part-time workers has further<br />

increased flexibility. The bottom line is that employment is<br />

likely to stabilise rapidly once the economy shows clear<br />

signs of recovery. Unemployment was still on the rise in<br />

Q4, suggesting continued job losses during that quarter,<br />

but this may soon end.<br />

On the wage front, the rising unemployment rate, absence<br />

of inflation and extremely low capacity utilisation rate all<br />

point to ongoing wage moderation in Q4. The annual<br />

increase in the average monthly wage has fallen a full<br />

percentage point over the last three quarters to an<br />

unsustainably low level of 2.0%. That is consistent with<br />

general wage increases of no more than 0.5% and<br />

individual pay hikes of 1.5%. However, it will be some time<br />

before wages do pick up.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

48<br />

www.Global<strong>Market</strong>s.bnpparibas.com