Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: Fed Provides More Details on Exit Plan<br />

• Bernanke outlined several steps and<br />

programmes that will help facilitate the Fed’s<br />

exit strategy in his speech on Wednesday.<br />

• The Fed is to conduct reverse repos with<br />

not only dealers, but also money market funds<br />

and other counterparties. We would argue that<br />

GSEs are a possibility as well.<br />

3<br />

2<br />

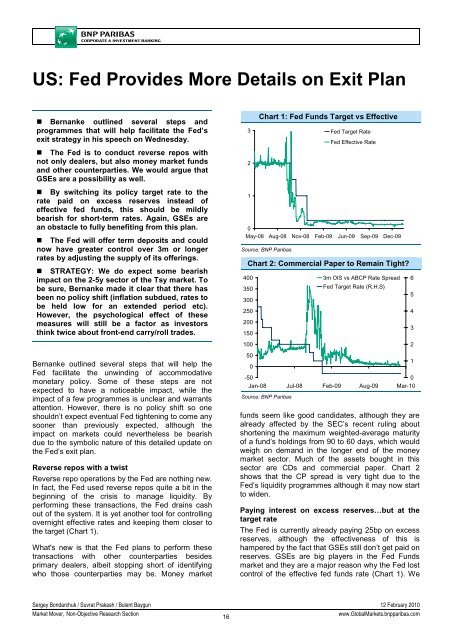

Chart 1: Fed Funds Target vs Effective<br />

Fed Target Rate<br />

Fed Effective Rate<br />

• By switching its policy target rate to the<br />

rate paid on excess reserves instead of<br />

effective fed funds, this should be mildly<br />

bearish for short-term rates. Again, GSEs are<br />

an obstacle to fully benefiting from this plan.<br />

• The Fed will offer term deposits and could<br />

now have greater control over 3m or longer<br />

rates by adjusting the supply of its offerings.<br />

• STRATEGY: We do expect some bearish<br />

impact on the 2-5y sector of the Tsy market. To<br />

be sure, Bernanke made it clear that there has<br />

been no policy shift (inflation subdued, rates to<br />

be held low for an extended period etc).<br />

However, the psychological effect of these<br />

measures will still be a factor as investors<br />

think twice about front-end carry/roll trades.<br />

1<br />

0<br />

May-08 Aug-08 Nov-08 Feb-09 Jun-09 Sep-09 Dec-09<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Commercial Paper to Remain Tight?<br />

400<br />

3m OIS vs ABCP Rate Spread 6<br />

350<br />

Fed Target Rate (R.H.S)<br />

5<br />

300<br />

250<br />

4<br />

200<br />

3<br />

150<br />

100<br />

2<br />

Bernanke outlined several steps that will help the<br />

Fed facilitate the unwinding of accommodative<br />

monetary policy. Some of these steps are not<br />

expected to have a noticeable impact, while the<br />

impact of a few programmes is unclear and warrants<br />

attention. However, there is no policy shift so one<br />

shouldn’t expect eventual Fed tightening to come any<br />

sooner than previously expected, although the<br />

impact on markets could nevertheless be bearish<br />

due to the symbolic nature of this detailed update on<br />

the Fed’s exit plan.<br />

Reverse repos with a twist<br />

Reverse repo operations by the Fed are nothing new.<br />

In fact, the Fed used reverse repos quite a bit in the<br />

beginning of the crisis to manage liquidity. By<br />

performing these transactions, the Fed drains cash<br />

out of the system. It is yet another tool for controlling<br />

overnight effective rates and keeping them closer to<br />

the target (Chart 1).<br />

What's new is that the Fed plans to perform these<br />

transactions with other counterparties besides<br />

primary dealers, albeit stopping short of identifying<br />

who those counterparties may be. Money market<br />

50<br />

0<br />

-50<br />

0<br />

Jan-08 Jul-08 Feb-09 Aug-09 Mar-10<br />

Source: <strong>BNP</strong> Paribas<br />

funds seem like good candidates, although they are<br />

already affected by the SEC’s recent ruling about<br />

shortening the maximum weighted-average maturity<br />

of a fund’s holdings from 90 to 60 days, which would<br />

weigh on demand in the longer end of the money<br />

market sector. Much of the assets bought in this<br />

sector are CDs and commercial paper. Chart 2<br />

shows that the CP spread is very tight due to the<br />

Fed’s liquidity programmes although it may now start<br />

to widen.<br />

Paying interest on excess reserves…but at the<br />

target rate<br />

The Fed is currently already paying 25bp on excess<br />

reserves, although the effectiveness of this is<br />

hampered by the fact that GSEs still don’t get paid on<br />

reserves. GSEs are big players in the Fed Funds<br />

market and they are a major reason why the Fed lost<br />

control of the effective fed funds rate (Chart 1). We<br />

1<br />

Sergey Bondarchuk / Suvrat Prakash / Bulent Baygun 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com