Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

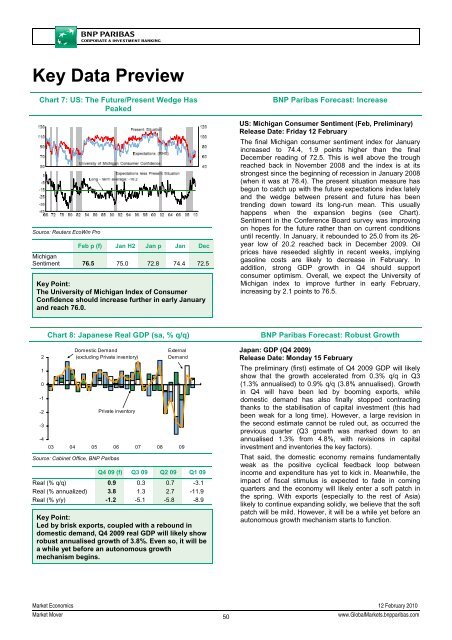

Chart 7: US: The Future/Present Wedge Has<br />

Peaked<br />

Source: Reuters EcoWin Pro<br />

Feb p (f) Jan H2 Jan p Jan Dec<br />

Michigan<br />

Sentiment 76.5 75.0 72.8 74.4 72.5<br />

Key Point:<br />

The University of Michigan Index of Consumer<br />

Confidence should increase further in early January<br />

and reach 76.0.<br />

<strong>BNP</strong> Paribas Forecast: Increase<br />

US: Michigan Consumer Sentiment (Feb, Preliminary)<br />

Release Date: Friday 12 February<br />

The final Michigan consumer sentiment index for January<br />

increased to 74.4, 1.9 points higher than the final<br />

December reading of 72.5. This is well above the trough<br />

reached back in November 2008 and the index is at its<br />

strongest since the beginning of recession in January 2008<br />

(when it was at 78.4). The present situation measure has<br />

begun to catch up with the future expectations index lately<br />

and the wedge between present and future has been<br />

trending down toward its long-run mean. This usually<br />

happens when the expansion begins (see Chart).<br />

Sentiment in the Conference Board survey was improving<br />

on hopes for the future rather than on current conditions<br />

until recently. In January, it rebounded to 25.0 from its 26-<br />

year low of 20.2 reached back in December 2009. Oil<br />

prices have reseeded slightly in recent weeks, implying<br />

gasoline costs are likely to decrease in February. In<br />

addition, strong GDP growth in Q4 should support<br />

consumer optimism. Overall, we expect the University of<br />

Michigan index to improve further in early February,<br />

increasing by 2.1 points to 76.5.<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Chart 8: Japanese Real GDP (sa, % q/q)<br />

Domestic Demand<br />

(excluding Private inventory)<br />

Private inventory<br />

External<br />

Demand<br />

03 04 05 06 07 08 09<br />

Source: Cabinet Office, <strong>BNP</strong> Paribas<br />

Q4 09 (f) Q3 09 Q2 09 Q1 09<br />

Real (% q/q) 0.9 0.3 0.7 -3.1<br />

Real (% annualized) 3.8 1.3 2.7 -11.9<br />

Real (% y/y) -1.2 -5.1 -5.8 -8.9<br />

Key Point:<br />

Led by brisk exports, coupled with a rebound in<br />

domestic demand, Q4 2009 real GDP will likely show<br />

robust annualised growth of 3.8%. Even so, it will be<br />

a while yet before an autonomous growth<br />

mechanism begins.<br />

<strong>BNP</strong> Paribas Forecast: Robust Growth<br />

Japan: GDP (Q4 2009)<br />

Release Date: Monday 15 February<br />

The preliminary (first) estimate of Q4 2009 GDP will likely<br />

show that the growth accelerated from 0.3% q/q in Q3<br />

(1.3% annualised) to 0.9% q/q (3.8% annualised). Growth<br />

in Q4 will have been led by booming exports, while<br />

domestic demand has also finally stopped contracting<br />

thanks to the stabilisation of capital investment (this had<br />

been weak for a long time). However, a large revision in<br />

the second estimate cannot be ruled out, as occurred the<br />

previous quarter (Q3 growth was marked down to an<br />

annualised 1.3% from 4.8%, with revisions in capital<br />

investment and inventories the key factors).<br />

That said, the domestic economy remains fundamentally<br />

weak as the positive cyclical feedback loop between<br />

income and expenditure has yet to kick in. Meanwhile, the<br />

impact of fiscal stimulus is expected to fade in coming<br />

quarters and the economy will likely enter a soft patch in<br />

the spring. With exports (especially to the rest of Asia)<br />

likely to continue expanding solidly, we believe that the soft<br />

patch will be mild. However, it will be a while yet before an<br />

autonomous growth mechanism starts to function.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

50<br />

www.Global<strong>Market</strong>s.bnpparibas.com