Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

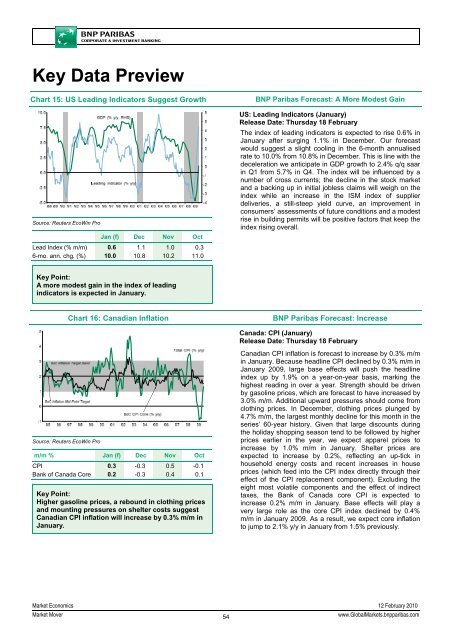

Chart 15: US Leading Indicators Suggest Growth<br />

Source: Reuters EcoWin Pro<br />

Jan (f) Dec Nov Oct<br />

Lead Index (% m/m) 0.6 1.1 1.0 0.3<br />

6-mo. ann. chg. (%) 10.0 10.8 10.2 11.0<br />

<strong>BNP</strong> Paribas Forecast: A More Modest Gain<br />

US: Leading Indicators (January)<br />

Release Date: Thursday 18 February<br />

The index of leading indicators is expected to rise 0.6% in<br />

January after surging 1.1% in December. Our forecast<br />

would suggest a slight cooling in the 6-month annualised<br />

rate to 10.0% from 10.8% in December. This is line with the<br />

deceleration we anticipate in GDP growth to 2.4% q/q saar<br />

in Q1 from 5.7% in Q4. The index will be influenced by a<br />

number of cross currents; the decline in the stock market<br />

and a backing up in initial jobless claims will weigh on the<br />

index while an increase in the ISM index of supplier<br />

deliveries, a still-steep yield curve, an improvement in<br />

consumers’ assessments of future conditions and a modest<br />

rise in building permits will be positive factors that keep the<br />

index rising overall.<br />

Key Point:<br />

A more modest gain in the index of leading<br />

indicators is expected in January.<br />

Chart 16: Canadian Inflation<br />

<strong>BNP</strong> Paribas Forecast: Increase<br />

Canada: CPI (January)<br />

Release Date: Thursday 18 February<br />

Source: Reuters EcoWin Pro<br />

m/m % Jan (f) Dec Nov Oct<br />

CPI 0.3 -0.3 0.5 -0.1<br />

Bank of Canada Core 0.2 -0.3 0.4 0.1<br />

Key Point:<br />

Higher gasoline prices, a rebound in clothing prices<br />

and mounting pressures on shelter costs suggest<br />

Canadian CPI inflation will increase by 0.3% m/m in<br />

January.<br />

Canadian CPI inflation is forecast to increase by 0.3% m/m<br />

in January. Because headline CPI declined by 0.3% m/m in<br />

January 2009, large base effects will push the headline<br />

index up by 1.9% on a year-on-year basis, marking the<br />

highest reading in over a year. Strength should be driven<br />

by gasoline prices, which are forecast to have increased by<br />

3.0% m/m. Additional upward pressures should come from<br />

clothing prices. In December, clothing prices plunged by<br />

4.7% m/m, the largest monthly decline for this month in the<br />

series’ 60-year history. Given that large discounts during<br />

the holiday shopping season tend to be followed by higher<br />

prices earlier in the year, we expect apparel prices to<br />

increase by 1.0% m/m in January. Shelter prices are<br />

expected to increase by 0.2%, reflecting an up-tick in<br />

household energy costs and recent increases in house<br />

prices (which feed into the CPI index directly through their<br />

effect of the CPI replacement component). Excluding the<br />

eight most volatile components and the effect of indirect<br />

taxes, the Bank of Canada core CPI is expected to<br />

increase 0.2% m/m in January. Base effects will play a<br />

very large role as the core CPI index declined by 0.4%<br />

m/m in January 2009. As a result, we expect core inflation<br />

to jump to 2.1% y/y in January from 1.5% previously.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

54<br />

www.Global<strong>Market</strong>s.bnpparibas.com