Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Global Inflation Watch<br />

Large jumps in headline inflation over<br />

In the US, UK and eurozone, headline inflation has<br />

risen sharply over the past six months. As the sharp<br />

falls in food and energy inflation at the end of 2008<br />

have dropped out of the y/y comparison, it has<br />

mechanically pushed headline inflation up from its<br />

lows last summer. In the US and UK, headline CPI<br />

and RPI inflation have risen by around 5pp in just six<br />

months, reaching 2.7% and 3.5% y/y respectively in<br />

December. Eurozone CPI inflation gained around<br />

2pp over the same period to reach 0.9% y/y at the<br />

end of last year.<br />

The bulk of the base effects, however, are now past,<br />

and, on our forecasts, headline inflation is fast<br />

approaching its peaks for the year in all three<br />

countries.<br />

This should be evident in this week’s US CPI release,<br />

where a 0.3% m/m print that we are expecting for the<br />

month would lift the y/y rate by just 0.1pp to 2.8%. In<br />

the breakdown, we expect energy prices to have<br />

risen by 2.4% m/m, and food CPI by 0.2% m/m.<br />

Core inflation, meanwhile, should rise by 0.2% m/m.<br />

Underlying price pressures remain contained, but<br />

metal prices have been trending higher in recent<br />

months, and having surfaced in import and producer<br />

price inflation, have scope to have an impact on the<br />

CPI too. Auto prices would probably be the first CPI<br />

component to be affected by this upside risk.<br />

Otherwise, sluggish shelter prices and plummeting<br />

unit labour costs suggest underlying price pressures<br />

will remain contained.<br />

In the UK, the CPI should post a final month of<br />

accelerating inflation during January. The big story<br />

this month is the return of the rate of VAT to 17½%.<br />

Given the extent of the upward surprise last month,<br />

there is a suggestion that some firms have already<br />

passed on the VAT hike early. However, we also<br />

believe that conservative management of Christmas<br />

inventories has meant that the degree of discounting<br />

was probably less generous than last year.<br />

If there is full pass-through of the VAT hike, this could<br />

add a full percentage point to y/y inflation. However,<br />

several retailers have reported that they will not pass<br />

on the VAT hike, while others have said it will be<br />

deferred. Hence we expect a near ¾%pp addition in<br />

January.<br />

RPI inflation is likely to rise slightly more sharply, not<br />

least given accelerating house price inflation and<br />

base effects related to the mortgage interest<br />

component.<br />

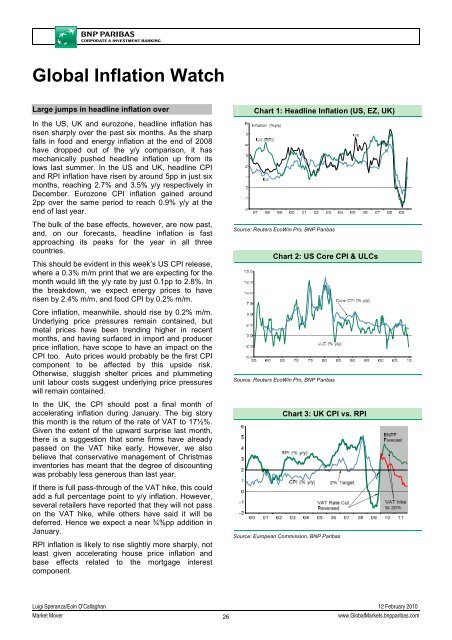

Chart 1: Headline Inflation (US, EZ, UK)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 2: US Core CPI & ULCs<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 3: UK CPI vs. RPI<br />

Source: European Commission, <strong>BNP</strong> Paribas<br />

Luigi Speranza/Eoin O’Callaghan 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

26<br />

www.Global<strong>Market</strong>s.bnpparibas.com