Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

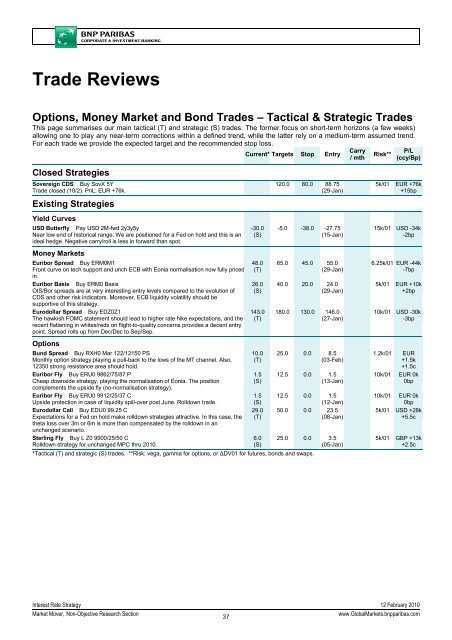

Trade Reviews<br />

Options, Money <strong>Market</strong> and Bond Trades – Tactical & Strategic Trades<br />

This page summarises our main tactical (T) and strategic (S) trades. The former focus on short-term horizons (a few weeks)<br />

allowing one to play any near-term corrections within a defined trend, while the latter rely on a medium-term assumed trend.<br />

For each trade we provide the expected target and the recommended stop loss.<br />

Current* Targets Stop Entry<br />

Closed Strategies<br />

Sovereign CDS Buy SovX 5Y<br />

Trade closed (10/2). PnL: EUR +76k.<br />

Existing Strategies<br />

Yield Curves<br />

USD Butterfly Pay USD 2M-fwd 2y3y5y<br />

Near low end of historical range. We are positioned for a Fed on hold and this is an<br />

ideal hedge. Negative carry/roll is less in forward than spot.<br />

Money <strong>Market</strong>s<br />

Euribor Spread Buy ERM0M1<br />

Front curve on tech support and unch ECB with Eonia normalisation now fully priced<br />

in.<br />

Euribor Basis Buy ERM0 Basis<br />

OIS/Bor spreads are at very interesting entry levels compared to the evolution of<br />

CDS and other risk indicators. Moreover, ECB liquidity volatility should be<br />

supportive of this strategy.<br />

Eurodollar Spread Buy EDZ0Z1<br />

The hawkish FOMC statement should lead to higher rate hike expectations, and the<br />

recent flattening in whites/reds on flight-to-quality concerns provides a decent entry<br />

point. Spread rolls up from Dec/Dec to Sep/Sep.<br />

-30.0<br />

(S)<br />

48.0<br />

(T)<br />

26.0<br />

(S)<br />

143.0<br />

(T)<br />

120.0 80.0 88.75<br />

(29-Jan)<br />

-5.0 -38.0 -27.75<br />

(15-Jan)<br />

65.0 45.0 55.0<br />

(29-Jan)<br />

40.0 20.0 24.0<br />

(29-Jan)<br />

180.0 130.0 146.0<br />

(27-Jan)<br />

Options<br />

Bund Spread Buy RXH0 Mar 122/12150 PS<br />

10.0 25.0 0.0 8.5<br />

Monthly option strategy playing a pull-back to the lows of the MT channel. Also,<br />

12350 strong resistance area should hold.<br />

(T)<br />

(03-Feb)<br />

Euribor Fly Buy ERU0 9862/75/87 P<br />

1.5 12.5 0.0 1.5<br />

Cheap downside strategy, playing the normalisation of Eonia. The position<br />

(S)<br />

(13-Jan)<br />

complements the upside fly (no-normalisation strategy).<br />

Euribor Fly Buy ERU0 9912/25/37 C<br />

1.5 12.5 0.0 1.5<br />

Upside protection in case of liquidity spill-over post June. Rolldown trade.<br />

(S)<br />

(12-Jan)<br />

Eurodollar Call Buy EDU0 99.25 C<br />

29.0 50.0 0.0 23.5<br />

Expectations for a Fed on hold make rolldown strategies attractive. In this case, the (T)<br />

(08-Jan)<br />

theta loss over 3m or 6m is more than compensated by the rolldown in an<br />

unchanged scenario.<br />

Sterling Fly Buy L Z0 9900/25/50 C<br />

6.0 25.0 0.0 3.5<br />

Rolldown strategy for unchanged MPC thru 2010.<br />

(S)<br />

(05-Jan)<br />

*Tactical (T) and strategic (S) trades. **Risk: vega, gamma for options, or ΔDV01 for futures, bonds and swaps.<br />

Carry<br />

/ mth<br />

Risk**<br />

P/L<br />

(ccy/Bp)<br />

5k/01 EUR +76k<br />

+15bp<br />

15k/01 USD -34k<br />

-2bp<br />

6.25k/01 EUR -44k<br />

-7bp<br />

5k/01 EUR +10k<br />

+2bp<br />

10k/01 USD -30k<br />

-3bp<br />

1.2k/01 EUR<br />

+1.5k<br />

+1.5c<br />

10k/01 EUR 0k<br />

0bp<br />

10k/01 EUR 0k<br />

0bp<br />

5k/01 USD +28k<br />

+5.5c<br />

5k/01 GBP +13k<br />

+2.5c<br />

Interest Rate Strategy 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

37<br />

www.Global<strong>Market</strong>s.bnpparibas.com