Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

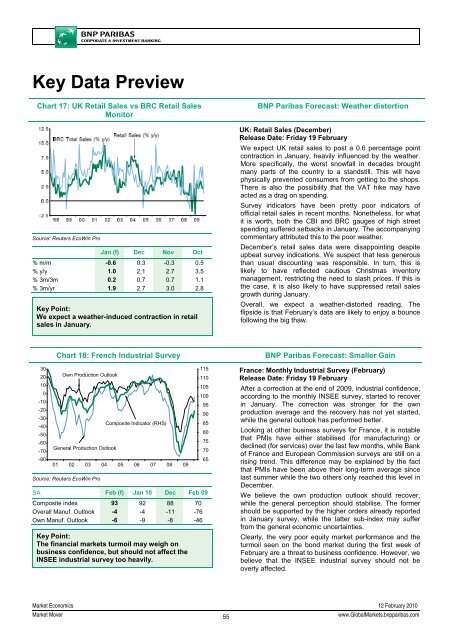

Chart 17: UK Retail Sales vs BRC Retail Sales<br />

Monitor<br />

Source: Reuters EcoWin Pro<br />

Jan (f) Dec Nov Oct<br />

% m/m -0.6 0.3 -0.3 0.5<br />

% y/y 1.0 2.1 2.7 3.5<br />

% 3m/3m 0.2 0.7 0.7 1.1<br />

% 3m/yr 1.9 2.7 3.0 2.8<br />

Key Point:<br />

We expect a weather-induced contraction in retail<br />

sales in January.<br />

<strong>BNP</strong> Paribas Forecast: Weather distortion<br />

UK: Retail Sales (December)<br />

Release Date: Friday 19 February<br />

We expect UK retail sales to post a 0.6 percentage point<br />

contraction in January, heavily influenced by the weather.<br />

More specifically, the worst snowfall in decades brought<br />

many parts of the country to a standstill. This will have<br />

physically prevented consumers from getting to the shops.<br />

There is also the possibility that the VAT hike may have<br />

acted as a drag on spending.<br />

Survey indicators have been pretty poor indicators of<br />

official retail sales in recent months. Nonetheless, for what<br />

it is worth, both the CBI and BRC gauges of high street<br />

spending suffered setbacks in January. The accompanying<br />

commentary attributed this to the poor weather.<br />

December’s retail sales data were disappointing despite<br />

upbeat survey indications. We suspect that less generous<br />

than usual discounting was responsible. In turn, this is<br />

likely to have reflected cautious Christmas inventory<br />

management, restricting the need to slash prices. If this is<br />

the case, it is also likely to have suppressed retail sales<br />

growth during January.<br />

Overall, we expect a weather-distorted reading. The<br />

flipside is that February’s data are likely to enjoy a bounce<br />

following the big thaw.<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

-70<br />

-80<br />

Chart 18: French Industrial Survey<br />

Own Production Outlook<br />

General Production Outlook<br />

Composite Indicator (RHS)<br />

01 02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

70<br />

65<br />

SA Feb (f) Jan 10 Dec Feb 09<br />

Composite index 93 92 88 70<br />

Overall Manuf. Outlook -4 -4 -11 -76<br />

Own Manuf. Outlook -6 -9 -8 -46<br />

Key Point:<br />

The financial markets turmoil may weigh on<br />

business confidence, but should not affect the<br />

INSEE industrial survey too heavily.<br />

<strong>BNP</strong> Paribas Forecast: Smaller Gain<br />

France: Monthly Industrial Survey (February)<br />

Release Date: Friday 19 February<br />

After a correction at the end of 2009, industrial confidence,<br />

according to the monthly INSEE survey, started to recover<br />

in January. The correction was stronger for the own<br />

production average and the recovery has not yet started,<br />

while the general outlook has performed better.<br />

Looking at other business surveys for France, it is notable<br />

that PMIs have either stabilised (for manufacturing) or<br />

declined (for services) over the last few months, while Bank<br />

of France and European Commission surveys are still on a<br />

rising trend. This difference may be explained by the fact<br />

that PMIs have been above their long-term average since<br />

last summer while the two others only reached this level in<br />

December.<br />

We believe the own production outlook should recover,<br />

while the general perception should stabilise. The former<br />

should be supported by the higher orders already reported<br />

in January survey, while the latter sub-index may suffer<br />

from the general economic uncertainties.<br />

Clearly, the very poor equity market performance and the<br />

turmoil seen on the bond market during the first week of<br />

February are a threat to business confidence. However, we<br />

believe that the INSEE industrial survey should not be<br />

overly affected.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

55<br />

www.Global<strong>Market</strong>s.bnpparibas.com