Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR/GBP 2s10s Carry Box Revisited<br />

• Rolldown strategies continue to be pursued<br />

in a still-low yield environment. We review the<br />

EUR/GBP 2s10s swap carry box trade, which<br />

proved to be popular last year.<br />

• STRATEGY: Given the weaker correlation<br />

structure, we would monitor the forward term<br />

structure in order to lock in a higher profit of<br />

carry than currently available. Enter the trade for<br />

total carry ex-ante of around 50bp.<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

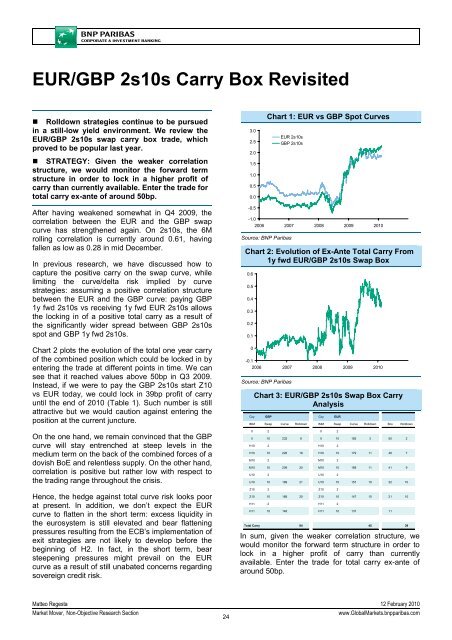

Chart 1: EUR vs GBP Spot Curves<br />

EUR 2s10s<br />

GBP 2s10s<br />

After having weakened somewhat in Q4 2009, the<br />

correlation between the EUR and the GBP swap<br />

curve has strengthened again. On 2s10s, the 6M<br />

rolling correlation is currently around 0.61, having<br />

fallen as low as 0.28 in mid December.<br />

In previous research, we have discussed how to<br />

capture the positive carry on the swap curve, while<br />

limiting the curve/delta risk implied by curve<br />

strategies: assuming a positive correlation structure<br />

between the EUR and the GBP curve: paying GBP<br />

1y fwd 2s10s vs receiving 1y fwd EUR 2s10s allows<br />

the locking in of a positive total carry as a result of<br />

the significantly wider spread between GBP 2s10s<br />

spot and GBP 1y fwd 2s10s.<br />

Chart 2 plots the evolution of the total one year carry<br />

of the combined position which could be locked in by<br />

entering the trade at different points in time. We can<br />

see that it reached values above 50bp in Q3 2009.<br />

Instead, if we were to pay the GBP 2s10s start Z10<br />

vs EUR today, we could lock in 39bp profit of carry<br />

until the end of 2010 (Table 1). Such number is still<br />

attractive but we would caution against entering the<br />

position at the current juncture.<br />

On the one hand, we remain convinced that the GBP<br />

curve will stay entrenched at steep levels in the<br />

medium term on the back of the combined forces of a<br />

dovish BoE and relentless supply. On the other hand,<br />

correlation is positive but rather low with respect to<br />

the trading range throughout the crisis.<br />

Hence, the hedge against total curve risk looks poor<br />

at present. In addition, we don’t expect the EUR<br />

curve to flatten in the short term: excess liquidity in<br />

the eurosystem is still elevated and bear flattening<br />

pressures resulting from the ECB’s implementation of<br />

exit strategies are not likely to develop before the<br />

beginning of H2. In fact, in the short term, bear<br />

steepening pressures might prevail on the EUR<br />

curve as a result of still unabated concerns regarding<br />

sovereign credit risk.<br />

-0.5<br />

-1.0<br />

2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Evolution of Ex-Ante Total Carry From<br />

1y fwd EUR/GBP 2s10s Swap Box<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

-0.1<br />

2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 3: EUR/GBP 2s10s Swap Box Carry<br />

Analysis<br />

Ccy GBP Ccy EUR<br />

IMM Swap Curve Rolldown IMM Swap Curve Rolldown Box Rolldown<br />

0 2 0 2<br />

0 10 232 6 0 10 182 3 50 2<br />

H10 2 H10 2<br />

H10 10 226 18 H10 10 179 11 48 7<br />

M10 2 M10 2<br />

M10 10 209 20 M10 10 168 11 41 9<br />

U10 2 U10 2<br />

U10 10 189 21 U10 10 157 10 32 10<br />

Z10 2 Z10 2<br />

Z10 10 168 20 Z10 10 147 10 21 10<br />

H11 2 H11 2<br />

H11 10 148 H11 10 137 11<br />

Total Carry 84 45 39<br />

In sum, given the weaker correlation structure, we<br />

would monitor the forward term structure in order to<br />

lock in a higher profit of carry than currently<br />

available. Enter the trade for total carry ex-ante of<br />

around 50bp.<br />

Matteo Regesta 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

24<br />

www.Global<strong>Market</strong>s.bnpparibas.com