Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Update on curves<br />

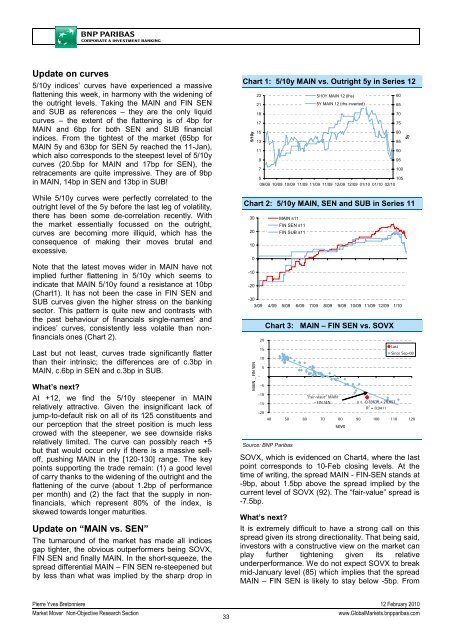

5/10y indices’ curves have experienced a massive<br />

flattening this week, in harmony with the widening of<br />

the outright levels. Taking the MAIN and FIN SEN<br />

and SUB as references – they are the only liquid<br />

curves – the extent of the flattening is of 4bp for<br />

MAIN and 6bp for both SEN and SUB financial<br />

indices. From the tightest of the market (65bp for<br />

MAIN 5y and 63bp for SEN 5y reached the 11-Jan),<br />

which also corresponds to the steepest level of 5/10y<br />

curves (20.5bp for MAIN and 17bp for SEN), the<br />

retracements are quite impressive. They are of 9bp<br />

in MAIN, 14bp in SEN and 13bp in SUB!<br />

While 5/10y curves were perfectly correlated to the<br />

outright level of the 5y before the last leg of volatility,<br />

there has been some de-correlation recently. With<br />

the market essentially focussed on the outright,<br />

curves are becoming more illiquid, which has the<br />

consequence of making their moves brutal and<br />

excessive.<br />

Note that the latest moves wider in MAIN have not<br />

implied further flattening in 5/10y which seems to<br />

indicate that MAIN 5/10y found a resistance at 10bp<br />

(Chart1). It has not been the case in FIN SEN and<br />

SUB curves given the higher stress on the banking<br />

sector. This pattern is quite new and contrasts with<br />

the past behaviour of financials single-names’ and<br />

indices’ curves, consistently less volatile than nonfinancials<br />

ones (Chart 2).<br />

Last but not least, curves trade significantly flatter<br />

than their intrinsic; the differences are of c.3bp in<br />

MAIN, c.6bp in SEN and c.3bp in SUB.<br />

What’s next?<br />

At +12, we find the 5/10y steepener in MAIN<br />

relatively attractive. Given the insignificant lack of<br />

jump-to-default risk on all of its 125 constituents and<br />

our perception that the street position is much less<br />

crowed with the steepener, we see downside risks<br />

relatively limited. The curve can possibly reach +5<br />

but that would occur only if there is a massive selloff,<br />

pushing MAIN in the [120-130] range. The key<br />

points supporting the trade remain: (1) a good level<br />

of carry thanks to the widening of the outright and the<br />

flattening of the curve (about 1.2bp of performance<br />

per month) and (2) the fact that the supply in nonfinancials,<br />

which represent 80% of the index, is<br />

skewed towards longer maturities.<br />

Update on “MAIN vs. SEN”<br />

The turnaround of the market has made all indices<br />

gap tighter, the obvious outperformers being SOVX,<br />

FIN SEN and finally MAIN. In the short-squeeze, the<br />

spread differential MAIN – FIN SEN re-steepened but<br />

by less than what was implied by the sharp drop in<br />

Chart 1: 5/10y MAIN vs. Outright 5y in Series 12<br />

5/10y<br />

23<br />

21<br />

19<br />

17<br />

15<br />

13<br />

11<br />

9<br />

7<br />

5/10Y MAIN 12 (lhs)<br />

5Y MAIN 12 (rhs inverted)<br />

60<br />

65<br />

70<br />

75<br />

80<br />

85<br />

90<br />

95<br />

100<br />

5<br />

105<br />

09/09 10/09 10/09 11/09 11/09 11/09 12/09 12/09 01/10 01/10 02/10<br />

Chart 2: 5/10y MAIN, SEN and SUB in Series 11<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

3/09 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 1/10<br />

MAIN _ FIN SEN<br />

-<br />

20<br />

15<br />

10<br />

5<br />

-5<br />

-10<br />

-15<br />

-20<br />

MAIN s11<br />

FIN SEN s11<br />

FIN SUB s11<br />

Chart 3: MAIN – FIN SEN vs. SOVX<br />

y = -0.3963x + 28.857<br />

R 2 = 0.9411<br />

40 50 60 70 80 90 100 110 120<br />

Source: <strong>BNP</strong> Paribas<br />

"Fair-vlaue" MAIN<br />

- FIN SEN<br />

SOVX<br />

SOVX, which is evidenced on Chart4, where the last<br />

point corresponds to 10-Feb closing levels. At the<br />

time of writing, the spread MAIN - FIN-SEN stands at<br />

-9bp, about 1.5bp above the spread implied by the<br />

current level of SOVX (92). The “fair-value” spread is<br />

-7.5bp.<br />

What’s next?<br />

It is extremely difficult to have a strong call on this<br />

spread given its strong directionality. That being said,<br />

investors with a constructive view on the market can<br />

play further tightening given its relative<br />

underperformance. We do not expect SOVX to break<br />

mid-January level (85) which implies that the spread<br />

MAIN – FIN SEN is likely to stay below -5bp. From<br />

Last<br />

5y<br />

Since Sep-09<br />

Pierre Yves Bretonniere 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong> Non-Objective Research Section<br />

33<br />

www.Global<strong>Market</strong>s.bnpparibas.com