Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

115<br />

105<br />

95<br />

85<br />

75<br />

65<br />

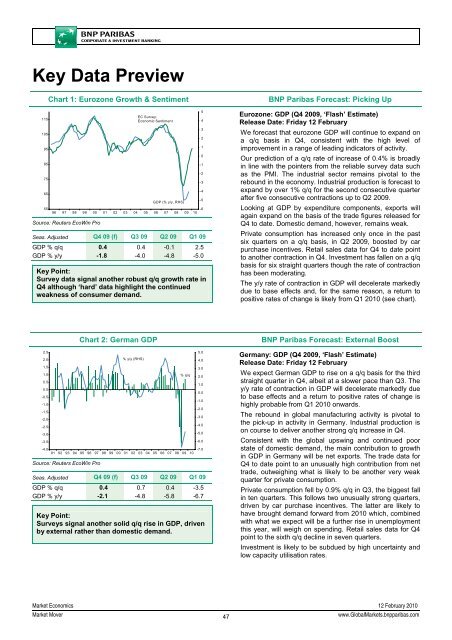

Chart 1: Eurozone Growth & Sentiment<br />

EC Survey:<br />

Economic Sentiment<br />

GDP (% y/y, RHS)<br />

55<br />

-6<br />

96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Seas. Adjusted Q4 09 (f) Q3 09 Q2 09 Q1 09<br />

GDP % q/q 0.4 0.4 -0.1 2.5<br />

GDP % y/y -1.8 -4.0 -4.8 -5.0<br />

Key Point:<br />

Survey data signal another robust q/q growth rate in<br />

Q4 although ‘hard’ data highlight the continued<br />

weakness of consumer demand.<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

-5<br />

<strong>BNP</strong> Paribas Forecast: Picking Up<br />

Eurozone: GDP (Q4 2009, ‘Flash’ Estimate)<br />

Release Date: Friday 12 February<br />

We forecast that eurozone GDP will continue to expand on<br />

a q/q basis in Q4, consistent with the high level of<br />

improvement in a range of leading indicators of activity.<br />

Our prediction of a q/q rate of increase of 0.4% is broadly<br />

in line with the pointers from the reliable survey data such<br />

as the PMI. The industrial sector remains pivotal to the<br />

rebound in the economy. Industrial production is forecast to<br />

expand by over 1% q/q for the second consecutive quarter<br />

after five consecutive contractions up to Q2 2009.<br />

Looking at GDP by expenditure components, exports will<br />

again expand on the basis of the trade figures released for<br />

Q4 to date. Domestic demand, however, remains weak.<br />

Private consumption has increased only once in the past<br />

six quarters on a q/q basis, in Q2 2009, boosted by car<br />

purchase incentives. Retail sales data for Q4 to date point<br />

to another contraction in Q4. <strong>Investment</strong> has fallen on a q/q<br />

basis for six straight quarters though the rate of contraction<br />

has been moderating.<br />

The y/y rate of contraction in GDP will decelerate markedly<br />

due to base effects and, for the same reason, a return to<br />

positive rates of change is likely from Q1 2010 (see chart).<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

-3.0<br />

-3.5<br />

Chart 2: German GDP<br />

-4.0<br />

-7.0<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

% y/y (RHS)<br />

% q/q<br />

Seas. Adjusted Q4 09 (f) Q3 09 Q2 09 Q1 09<br />

GDP % q/q 0.4 0.7 0.4 -3.5<br />

GDP % y/y -2.1 -4.8 -5.8 -6.7<br />

Key Point:<br />

Surveys signal another solid q/q rise in GDP, driven<br />

by external rather than domestic demand.<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

-5.0<br />

-6.0<br />

<strong>BNP</strong> Paribas Forecast: External Boost<br />

Germany: GDP (Q4 2009, ‘Flash’ Estimate)<br />

Release Date: Friday 12 February<br />

We expect German GDP to rise on a q/q basis for the third<br />

straight quarter in Q4, albeit at a slower pace than Q3. The<br />

y/y rate of contraction in GDP will decelerate markedly due<br />

to base effects and a return to positive rates of change is<br />

highly probable from Q1 2010 onwards.<br />

The rebound in global manufacturing activity is pivotal to<br />

the pick-up in activity in Germany. Industrial production is<br />

on course to deliver another strong q/q increase in Q4.<br />

Consistent with the global upswing and continued poor<br />

state of domestic demand, the main contribution to growth<br />

in GDP in Germany will be net exports. The trade data for<br />

Q4 to date point to an unusually high contribution from net<br />

trade, outweighing what is likely to be another very weak<br />

quarter for private consumption.<br />

Private consumption fell by 0.9% q/q in Q3, the biggest fall<br />

in ten quarters. This follows two unusually strong quarters,<br />

driven by car purchase incentives. The latter are likely to<br />

have brought demand forward from 2010 which, combined<br />

with what we expect will be a further rise in unemployment<br />

this year, will weigh on spending. Retail sales data for Q4<br />

point to the sixth q/q decline in seven quarters.<br />

<strong>Investment</strong> is likely to be subdued by high uncertainty and<br />

low capacity utilisation rates.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

47<br />

www.Global<strong>Market</strong>s.bnpparibas.com