Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

More clarity was given on the sequencing of<br />

monetary policy tightening<br />

The testimony provided a baseline scenario of the<br />

steps that would be taken to tighten monetary policy.<br />

He described the large-scale purchases on<br />

Treasuries, Agencies and MBS as a component of<br />

monetary policy put in place when the Fed reached<br />

the zero bound on interest rates and the economy<br />

was still under “severe stress”. These purchases<br />

were financed through the creation of a tremendous<br />

amount of excess reserves that led to loss of control<br />

over the effective Fed funds rate (Chart 1) even as<br />

they “helped improve conditions in private credit<br />

markets and put downward pressure on longer-term<br />

private borrowing rates and spreads.” However, the<br />

extreme liquidity in money markets has apparently<br />

led the Fed to decide two things: first, it will need to<br />

mop up some of the excess reserves before actually<br />

raising rates, and second, “during the transition to a<br />

more normal policy configuration”, the Fed is<br />

considering shifting its target policy rate to the rate<br />

paid on reserves rather than a target Fed funds rate.<br />

The reason that the policy to pay interest on bank<br />

reserves did not effectively put a floor under Fed<br />

funds is that the mortgage agencies are suppliers of<br />

funds to the overnight lending market and yet cannot<br />

place deposits at the Fed; therefore, the Fed funds<br />

has traded below the rate paid on reserves since the<br />

policy to pay interest on reserves was implemented<br />

in October 2008. A Congressional act would be<br />

required to allow the mortgage agencies to deposit<br />

money at the Fed, and it is not clear why the Fed<br />

does not pursue this as a way to gain more control<br />

over short-term rates. In any case, the Fed has<br />

concluded that “the Federal funds rate could for a<br />

time become a less reliable indicator than usual of<br />

conditions in short-term money markets” and is<br />

considering shifting to a target rate over which it<br />

would have absolute control. Presumably, this would<br />

come along with an expected range for Fed funds<br />

and Chairman Bernanke also suggested it could<br />

involve targets for reserve quantities.<br />

The tools for draining excess reserves, as previously<br />

announced, include mainly reverse repos and a term<br />

deposit facility at the Fed. He said “The capability to<br />

carry out [reverse repos] with primary dealers, using<br />

our holdings of Treasury and agency debt securities,<br />

has already been tested and is currently available.<br />

To further increase its capacity to drain reserves<br />

through reverse repos, the Federal Reserve is also in<br />

the process of expanding the set of counterparties<br />

with which it can transact and developing the<br />

infrastructure necessary to use its MBS holdings as<br />

collateral in these transactions.” Presumably, the<br />

counterparties beyond primary dealers could include<br />

money markets and possibly even the mortgage<br />

agencies. The Fed has had some concerns about<br />

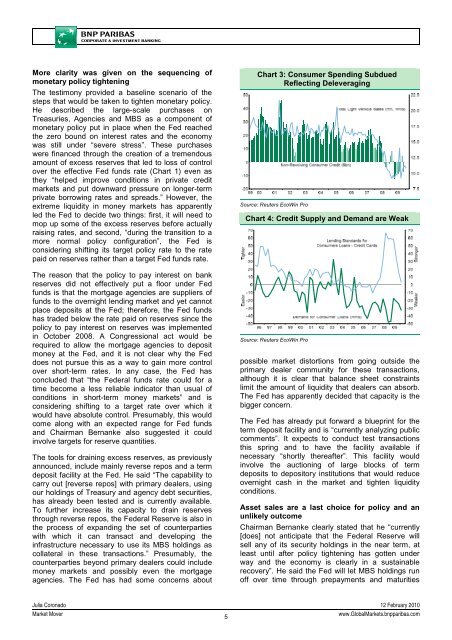

Chart 3: Consumer Spending Subdued<br />

Reflecting Deleveraging<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Credit Supply and Demand are Weak<br />

Source: Reuters EcoWin Pro<br />

possible market distortions from going outside the<br />

primary dealer community for these transactions,<br />

although it is clear that balance sheet constraints<br />

limit the amount of liquidity that dealers can absorb.<br />

The Fed has apparently decided that capacity is the<br />

bigger concern.<br />

The Fed has already put forward a blueprint for the<br />

term deposit facility and is “currently analyzing public<br />

comments”. It expects to conduct test transactions<br />

this spring and to have the facility available if<br />

necessary “shortly thereafter”. This facility would<br />

involve the auctioning of large blocks of term<br />

deposits to depository institutions that would reduce<br />

overnight cash in the market and tighten liquidity<br />

conditions.<br />

Asset sales are a last choice for policy and an<br />

unlikely outcome<br />

Chairman Bernanke clearly stated that he “currently<br />

[does] not anticipate that the Federal Reserve will<br />

sell any of its security holdings in the near term, at<br />

least until after policy tightening has gotten under<br />

way and the economy is clearly in a sustainable<br />

recovery”. He said the Fed will let MBS holdings run<br />

off over time through prepayments and maturities<br />

Julia Coronado 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

5<br />

www.Global<strong>Market</strong>s.bnpparibas.com