Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

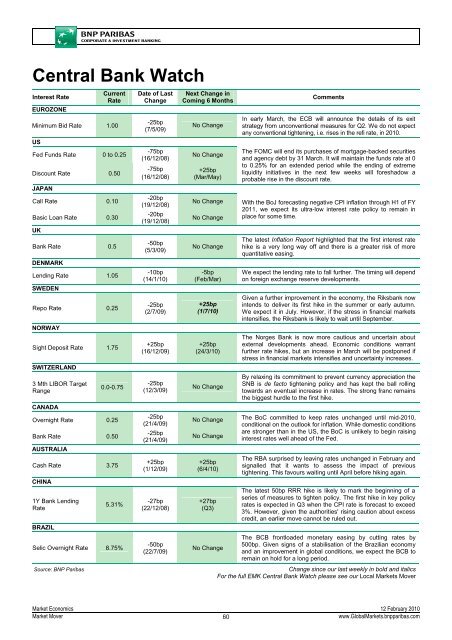

Central Bank Watch<br />

Interest Rate<br />

EUROZONE<br />

Current<br />

Rate<br />

Minimum Bid Rate 1.00<br />

US<br />

Fed Funds Rate 0 to 0.25<br />

Discount Rate 0.50<br />

JAPAN<br />

Call Rate 0.10<br />

Basic Loan Rate 0.30<br />

UK<br />

Bank Rate 0.5<br />

DENMARK<br />

Lending Rate 1.05<br />

SWEDEN<br />

Repo Rate 0.25<br />

NORWAY<br />

Sight Deposit Rate 1.75<br />

SWITZERLAND<br />

3 Mth LIBOR Target<br />

Range<br />

CANADA<br />

0.0-0.75<br />

Overnight Rate 0.25<br />

Bank Rate 0.50<br />

AUSTRALIA<br />

Cash Rate 3.75<br />

CHINA<br />

1Y Bank Lending<br />

Rate<br />

BRAZIL<br />

5.31%<br />

Selic Overnight Rate 8.75%<br />

Source: <strong>BNP</strong> Paribas<br />

Date of Last<br />

Change<br />

-25bp<br />

(7/5/09)<br />

-75bp<br />

(16/12/08)<br />

-75bp<br />

(16/12/08)<br />

-20bp<br />

(19/12/08)<br />

-20bp<br />

(19/12/08)<br />

-50bp<br />

(5/3/09)<br />

-10bp<br />

(14/1/10)<br />

-25bp<br />

(2/7/09)<br />

+25bp<br />

(16/12/09)<br />

-25bp<br />

(12/3/09)<br />

-25bp<br />

(21/4/09)<br />

-25bp<br />

(21/4/09)<br />

+25bp<br />

(1/12/09)<br />

-27bp<br />

(22/12/08)<br />

-50bp<br />

(22/7/09)<br />

Next Change in<br />

Coming 6 Months<br />

No Change<br />

No Change<br />

+25bp<br />

(Mar/May)<br />

No Change<br />

No Change<br />

No Change<br />

-5bp<br />

(Feb/Mar)<br />

+25bp<br />

(1/7/10)<br />

+25bp<br />

(24/3/10)<br />

No Change<br />

No Change<br />

No Change<br />

+25bp<br />

(6/4/10)<br />

+27bp<br />

(Q3)<br />

No Change<br />

Comments<br />

In early March, the ECB will announce the details of its exit<br />

strategy from unconventional measures for Q2. We do not expect<br />

any conventional tightening, i.e. rises in the refi rate, in 2010.<br />

The FOMC will end its purchases of mortgage-backed securities<br />

and agency debt by 31 March. It will maintain the funds rate at 0<br />

to 0.25% for an extended period while the ending of extreme<br />

liquidity initiatives in the next few weeks will foreshadow a<br />

probable rise in the discount rate.<br />

With the BoJ forecasting negative CPI inflation through H1 of FY<br />

2011, we expect its ultra-low interest rate policy to remain in<br />

place for some time.<br />

The latest Inflation Report highlighted that the first interest rate<br />

hike is a very long way off and there is a greater risk of more<br />

quantitative easing.<br />

We expect the lending rate to fall further. The timing will depend<br />

on foreign exchange reserve developments.<br />

Given a further improvement in the economy, the Riksbank now<br />

intends to deliver its first hike in the summer or early autumn.<br />

We expect it in July. However, if the stress in financial markets<br />

intensifies, the Riksbank is likely to wait until September.<br />

The Norges Bank is now more cautious and uncertain about<br />

external developments ahead. Economic conditions warrant<br />

further rate hikes, but an increase in March will be postponed if<br />

stress in financial markets intensifies and uncertainty increases.<br />

By relaxing its commitment to prevent currency appreciation the<br />

SNB is de facto tightening policy and has kept the ball rolling<br />

towards an eventual increase in rates. The strong franc remains<br />

the biggest hurdle to the first hike.<br />

The BoC committed to keep rates unchanged until mid-2010,<br />

conditional on the outlook for inflation. While domestic conditions<br />

are stronger than in the US, the BoC is unlikely to begin raising<br />

interest rates well ahead of the Fed.<br />

The RBA surprised by leaving rates unchanged in February and<br />

signalled that it wants to assess the impact of previous<br />

tightening. This favours waiting until April before hiking again.<br />

The latest 50bp RRR hike is likely to mark the beginning of a<br />

series of measures to tighten policy. The first hike in key policy<br />

rates is expected in Q3 when the CPI rate is forecast to exceed<br />

3%. However, given the authorities' rising caution about excess<br />

credit, an earlier move cannot be ruled out.<br />

The BCB frontloaded monetary easing by cutting rates by<br />

500bp. Given signs of a stabilisation of the Brazilian economy<br />

and an improvement in global conditions, we expect the BCB to<br />

remain on hold for a long period.<br />

Change since our last weekly in bold and italics<br />

For the full EMK Central Bank Watch please see our Local <strong>Market</strong>s <strong>Mover</strong><br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

60<br />

www.Global<strong>Market</strong>s.bnpparibas.com