Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

outlook for GDP and inflation. So have forecasters<br />

been asleep at the wheel and should we have seen<br />

this revision to the Bank’s forecasts coming? Given<br />

what the MPC said in the January minutes, one can<br />

feel excused for being a little surprised by the extent<br />

of the revisions in the February Inflation Report:<br />

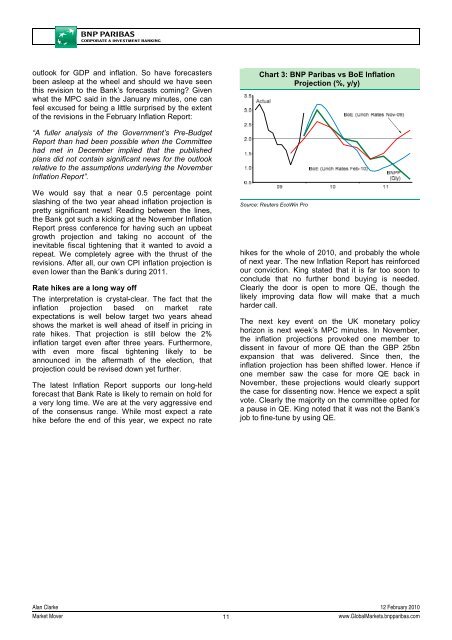

Chart 3: <strong>BNP</strong> Paribas vs BoE Inflation<br />

Projection (%, y/y)<br />

“A fuller analysis of the Government’s Pre-Budget<br />

Report than had been possible when the Committee<br />

had met in December implied that the published<br />

plans did not contain significant news for the outlook<br />

relative to the assumptions underlying the November<br />

Inflation Report”.<br />

We would say that a near 0.5 percentage point<br />

slashing of the two year ahead inflation projection is<br />

pretty significant news! Reading between the lines,<br />

the Bank got such a kicking at the November Inflation<br />

Report press conference for having such an upbeat<br />

growth projection and taking no account of the<br />

inevitable fiscal tightening that it wanted to avoid a<br />

repeat. We completely agree with the thrust of the<br />

revisions. After all, our own CPI inflation projection is<br />

even lower than the Bank’s during 2011.<br />

Rate hikes are a long way off<br />

The interpretation is crystal-clear. The fact that the<br />

inflation projection based on market rate<br />

expectations is well below target two years ahead<br />

shows the market is well ahead of itself in pricing in<br />

rate hikes. That projection is still below the 2%<br />

inflation target even after three years. Furthermore,<br />

with even more fiscal tightening likely to be<br />

announced in the aftermath of the election, that<br />

projection could be revised down yet further.<br />

The latest Inflation Report supports our long-held<br />

forecast that Bank Rate is likely to remain on hold for<br />

a very long time. We are at the very aggressive end<br />

of the consensus range. While most expect a rate<br />

hike before the end of this year, we expect no rate<br />

Source: Reuters EcoWin Pro<br />

hikes for the whole of 2010, and probably the whole<br />

of next year. The new Inflation Report has reinforced<br />

our conviction. King stated that it is far too soon to<br />

conclude that no further bond buying is needed.<br />

Clearly the door is open to more QE, though the<br />

likely improving data flow will make that a much<br />

harder call.<br />

The next key event on the UK monetary policy<br />

horizon is next week’s MPC minutes. In November,<br />

the inflation projections provoked one member to<br />

dissent in favour of more QE than the GBP 25bn<br />

expansion that was delivered. Since then, the<br />

inflation projection has been shifted lower. Hence if<br />

one member saw the case for more QE back in<br />

November, these projections would clearly support<br />

the case for dissenting now. Hence we expect a split<br />

vote. Clearly the majority on the committee opted for<br />

a pause in QE. King noted that it was not the Bank’s<br />

job to fine-tune by using QE.<br />

Alan Clarke 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

11<br />

www.Global<strong>Market</strong>s.bnpparibas.com