Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Market</strong> <strong>Economics</strong> | <strong>Interest</strong> <strong>Rate</strong> <strong>Strategy</strong> | Forex <strong>Strategy</strong> 16 July 2010<br />

<strong>Market</strong> Mover<br />

<strong>Market</strong> Outlook 2-3<br />

Fundamentals 4-20<br />

• Where Have You Gone, Joe<br />

4-6<br />

DiMaggio?<br />

• US Housing: A Cold Summer 7-9<br />

• UK: Mind the Gap 10-11<br />

• Denmark: The Tide is Turning 12-13<br />

• China: House Price Controls to 14-15<br />

Continue<br />

• Japan: Post-Election Outlook for Tax 16-17<br />

Reform<br />

• Japan: PM Kan’s Dubious <strong>Economics</strong> 18-20<br />

<strong>Interest</strong> <strong>Rate</strong> <strong>Strategy</strong> 21-50<br />

• US: 10y Range Trade with a Receiver 21<br />

Fly<br />

• US: TSY Switches for Yield/Duration 22-23<br />

Pickup<br />

• US: Corporate Issuance and Swap 24-25<br />

Spreads<br />

• MBS: Higher Coupons Could Speed 26-27<br />

Up Later<br />

• EUR: Eonias to Push Up Further 28<br />

• EUR: Deflation Macro Hedge Via 29<br />

Options<br />

• EUR: Yet Another Volatility Deflation 30<br />

Trade<br />

• EUR: SAS Diversification to Enhance 31<br />

Yields<br />

• JGBs: Fiscal Austerity – Not an Easy 32<br />

Task<br />

• Global Inflation Watch 33-36<br />

• Inflation: Sell 30y in the UK & US 37-38<br />

• GBP: Evolving LDI Demand with Shift 39-42<br />

to CPI?<br />

• Europe iTraxx Credit Indices 43-46<br />

• Technical Analysis 47-48<br />

• Trade Reviews 49<br />

FX <strong>Strategy</strong> 50-55<br />

• <strong>Strategy</strong>: Returning to EURAUD 50-52<br />

Bearish Strategies<br />

• Technical <strong>Strategy</strong>: 53-54<br />

• Trading Positions 55<br />

Forecasts & Calendars 56-70<br />

• 1 Week Economic Calendar 56-57<br />

• Key Data Preview 58-63<br />

• 4 Week Calendar 64<br />

• Treasury & SAS Issuance 65-66<br />

• Central Bank Watch 67<br />

• Economic & <strong>Interest</strong> <strong>Rate</strong> Forecasts 68<br />

• FX Forecasts 69<br />

Contacts 70<br />

www.Global<strong>Market</strong>s.bnpparibas.com<br />

• A strong start to the corporate earnings season has<br />

brought support to risk appetite.<br />

• However, the setback in safe-haven flows has remained<br />

limited, with ongoing concerns about sovereign debt and<br />

the recent softening of economic data supporting govvies.<br />

• We remain constructive on the main government bond<br />

markets over the coming weeks, expecting flatter curves.<br />

• The minutes of June's FOMC meeting suggest that the<br />

door to a further round of unconventional stimulus has<br />

opened further.<br />

• The results of the EU-wide stress tests will be<br />

announced on 23 July. The CEBS statement last week<br />

failed to clarify a number of issues, including in particular<br />

the assumptions on sovereign debt developments.<br />

• The lack of concrete information available at this stage,<br />

on a number of fronts, suggests that national governments<br />

have struggled to reach agreement over the specific<br />

details. This is not a good sign.<br />

• Supply/demand conditions remain favourable for the<br />

JGB market.<br />

• We expect the pro-cyclical and commodity currencies<br />

to remain supported in the medium term.<br />

• Some further near-term gains are expected for the EUR<br />

and GBP in the current environment as position unwinding<br />

persists.<br />

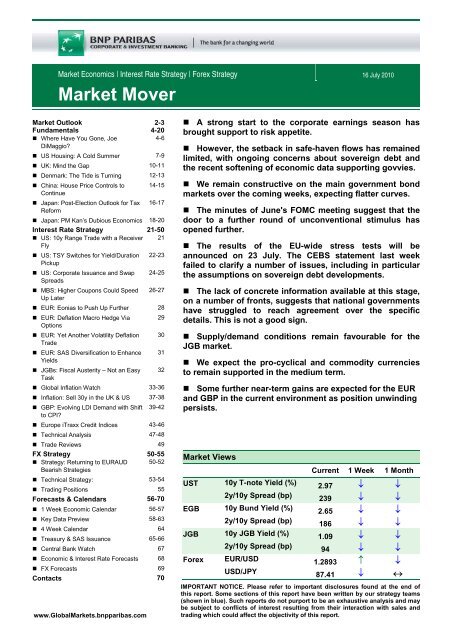

<strong>Market</strong> Views<br />

UST 10y T-note Yield (%)<br />

2y/10y Spread (bp)<br />

EGB 10y Bund Yield (%)<br />

2y/10y Spread (bp)<br />

JGB 10y JGB Yield (%)<br />

2y/10y Spread (bp)<br />

Forex<br />

EUR/USD<br />

USD/JPY<br />

Current 1 Week 1 Month<br />

2.97 ↓ ↓<br />

239 ↓ ↓<br />

2.65 ↓ ↓<br />

186 ↓ ↓<br />

1.09 ↓ ↓<br />

94 ↓ ↓<br />

1.2893 ↑ ↓<br />

87.41 ↓ ↔<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams<br />

(shown in blue). Such reports do not purport to be an exhaustive analysis and may<br />

be subject to conflicts of interest resulting from their interaction with sales and<br />

trading which could affect the objectivity of this report.

<strong>Market</strong> Outlook<br />

Fragile rebound in risk<br />

appetite after a positive<br />

start to the earnings<br />

season<br />

Government bond markets gave up some of their recent gains over the past<br />

week following a positive start to the earnings season. In Europe, the<br />

assumptions behind the stress test appear increasingly credible and the<br />

remaining question concerns the recapitalisation funds that may need to be<br />

made available. In addition, the European Financial Stability Facility should<br />

be operational by the end of August, according to the CEO of the SPV.<br />

Finally, Greece passed the test of the primary market with relative ease: the<br />

auction of 26-week bills was well received.<br />

However, the recent setback in safety trades has remained limited, notably<br />

as the fundamental context remains bond-supportive. Most of the recent<br />

economic data have indeed continued to paint a picture of a recovery that is<br />

losing momentum. The latest FOMC minutes indicate an adjustment to lower<br />

long-term forecasts for growth and core inflation, and higher for<br />

unemployment. These concerns about the growth outlook are generating an<br />

immediate policy response. The Fed is suggesting that excess liquidity will<br />

remain in place for longer than the market had been expecting while several<br />

FOMC members are putting forward the view that additional measures<br />

should be considered if the outlook deteriorates further. This has led to the<br />

market pushing its rate hike expectations out further along the curve, also<br />

providing support for the Treasury market.<br />

The strong start to the earnings season supports risk appetite but<br />

govvies remain resilient<br />

4.0<br />

10 yr N ote Y ield<br />

3.9<br />

3.8<br />

3.7<br />

3.6<br />

3.5<br />

3.4<br />

3.3<br />

3.2<br />

S&P (RHS)<br />

3.1<br />

3.0<br />

2.9<br />

Jan Feb Mar Apr May Jun Jul<br />

10<br />

Source: Reuters EcoWin Pro<br />

1225<br />

1200<br />

1175<br />

1150<br />

1125<br />

1100<br />

1075<br />

1050<br />

1025<br />

1000<br />

Supportive environment<br />

for Tsy though the upside<br />

potential looks limited on<br />

short-dated maturities<br />

We remain constructive on Treasuries over the coming weeks, with the<br />

prospect of another downward surprise to core CPI looming. The FOMC<br />

minutes should now set the stage for a dovish monetary policy report from<br />

Bernanke to Congress next week. With long-term forecasts being revised to<br />

show a bleaker picture than forecast a few months ago, the talk has shifted<br />

away from when the Fed could tighten. Instead, Fed speakers are now<br />

discussing the implications of disinflation, and possible further asset<br />

purchases or other forms of stimulus.<br />

One risk to our positive call on Treasuries is that the stock market continues<br />

its recovery as expectations for corporate earnings are generally upbeat. We<br />

are certainly wary of this and favour having short exposure in the front end<br />

as cheap protection against our main view. At 0.60%, the 2y note is again at<br />

the low end of its yield range so risk/reward favours a short, although with<br />

the cost of negative carry.<br />

Cyril Beuzit 16 July 2010<br />

<strong>Market</strong> Mover<br />

2<br />

www.Global<strong>Market</strong>s.bnpparibas.com

2-10s receivers attractive<br />

in the 150bp area<br />

JGBs remain solid<br />

In Europe, we also remain more comfortable in the short run being<br />

positioned for a flatter curve – rather than going for outright longs on longdated<br />

maturities. The front end of the curve still looks at risk, with further<br />

unwinding of carry trades ahead. Remaining uncertainties about the stress<br />

test should continue to support EGBs and this week’s auctions were<br />

relatively easily digested, helping intra-EMU spreads to consolidate further<br />

despite the downgrade of Portugal by Moody’s from Aa2 to A1. Irish spreads<br />

were under pressure following the news that Ireland may announce a deficit<br />

for 2010 of almost 17% of GDP as EUR 8.3bn capital given to AIB could be<br />

requalified and included, adding 5.25pp to a projected 11.5% deficit.<br />

In Japan, last weekend's election defeat for the DPJ-led ruling coalition<br />

meant a loss of its majority in the upper house. With many party insiders<br />

attributing the poor showing to Prime Minister Naoto Kan's bungled handling<br />

of the consumption tax debate, there are fears that the government's fiscal<br />

rebuilding efforts might now need to be put on hold for the time being.<br />

Yoshimi Watanabe – leader of Your Party, which won ten of the seats<br />

contested in Sunday's election – wants the government and the Bank of<br />

Japan to target an inflation rate of +2%, which suggests to us that political<br />

pressures may force the central bank to take additional easing measures in<br />

the relatively near future.<br />

Massive untapped demand among domestic investors continues to support<br />

JGBs, with dip-buying helping to limit the market's overall reaction to the<br />

recent rally in stock prices. Short-covering in the super-long sector has<br />

driven a significant flattening of the yield curve, but we expect to see an<br />

easing or partial reversal of this flattening bias ahead of next Thursday's<br />

20yr auction.<br />

Pro-cyclical and<br />

commodity currencies to<br />

remain supported medium<br />

term<br />

In FX markets, while fears of a renewed slowdown may cause some nearterm<br />

volatility, we expect global investor sentiment to be supported by the<br />

apparent readiness of monetary authorities to take prompt action,<br />

suggesting that the pro-cyclical and commodity currencies will remain<br />

supported over the medium term. Indeed, the Fed highlighting downside<br />

risks and the softer data from China are currently overshadowing the strong<br />

corporate earnings data, putting equity markets under pressure and<br />

triggering a broad position unwinding in currency markets – with the USD<br />

selling off. USD weakness is likely to be most emphasised against the yen,<br />

given the continued sensitivity of USD/JPY to US data and developments in<br />

the US yield curve.<br />

However, we believe that the current moves will provide another opportunity<br />

to establish medium-term bullish strategies in the commodity currencies.<br />

Indeed, members of the FOMC have expressed their willingness to take<br />

action if the outlook deteriorates further, while China has reaffirmed its<br />

commitment to sustaining growth. Hence, although some further volatility is<br />

expected in the near term, we would look to buy the AUD in particular as<br />

long as overall Chinese growth is maintained and global liquidity remains<br />

ample.<br />

Further near-term upside<br />

on EUR and GBP<br />

Some further near-term gains are expected for the EUR and GBP in the<br />

current environment as position unwinding persists. However, once again<br />

this will provide an opportunity to establish medium-term strategic positions,<br />

with the EUR and GBP expected to become vulnerable to significant moves<br />

lower again as the full extent of the negative impact from fiscal tightening will<br />

likely become apparent in the weeks ahead. We look to take advantage of a<br />

EUR/AUD rebound over the coming week to establish a medium-term<br />

bearish position.<br />

Cyril Beuzit 16 July 2010<br />

<strong>Market</strong> Mover<br />

3<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Where Have You Gone, Joe DiMaggio?<br />

• The debate on more stimulus in the US has<br />

heated up with a stutter in economic growth and<br />

falling core inflation.<br />

Chart 1: Fiscal Concerns Have Driven Policy<br />

Tightening<br />

• The prospect of additional unconventional<br />

measures has risen. Given our forecasts –<br />

especially for core inflation – QE2 looks likely,<br />

though the form it would take is uncertain.<br />

• In contrast, the ECB is set on the exit from<br />

unconventional measures. Different tracks for<br />

the two central banks could have a big impact<br />

on markets and currencies.<br />

The tone of the global recovery has shifted<br />

notably in recent months and debates are<br />

underway as to whether more policy stimulus is<br />

needed to keep the recovery on track<br />

The tone of the global recovery has shifted notably in<br />

recent months. The European fiscal crisis spurred a<br />

rout in risky assets and a round of fiscal tightening<br />

measures that will limit growth in the next several<br />

years. More recently, a softening in economic data in<br />

the US and China has raised further questions about<br />

the staying power of the rebound, and debates are<br />

underway as to whether more policy stimulus is<br />

needed to keep the recovery on track.<br />

There was considerable disagreement on the need<br />

for more stimulus at the G20 meetings in June, with<br />

European policymakers arguing for fiscal restraint to<br />

shore up credibility and the US arguing for further<br />

deficit-financed stimulus to spur activity. However,<br />

even in the US, the political will for more fiscal<br />

stimulus appears to have evaporated, with aid to<br />

cash-strapped states and unemployment benefits<br />

having recently been nixed by Congress.<br />

This leaves monetary policy, although here the<br />

options are again limited. Short-term rates are<br />

already hovering just above zero, leaving the<br />

duration of zero rates and central bank balance<br />

sheets as the only remaining tools. While Euro area<br />

monetary policymakers have been dragged kicking<br />

and screaming into measures supporting sovereign<br />

funding markets, the Fed proactively shifted its<br />

language in June in a way that pushed back market<br />

expectations for policy tightening. Ultimately, we<br />

think monetary policymakers will be pushed into<br />

delivering more stimulus to prevent a debt<br />

deflationary dynamic from derailing the recovery.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: The US Recovery is Weakest in Post-<br />

War Period<br />

Source: Reuters EcoWin Pro<br />

There seem to be constraints on how much more<br />

fiscal stimulus can be delivered in the US, and<br />

even the more robust European economies with<br />

the ability to engage in further stimulus have<br />

opted for fiscal austerity<br />

The best outcome on the fiscal side would be further<br />

temporary stimulus measures – say, aid to states to<br />

help ease the downward adjustment in spending and<br />

more tax credits for house purchases, coupled with<br />

measures that address the longer-term fiscal outlook.<br />

These should include things that address the<br />

structural deficit from social security and Medicare<br />

such as implementing a near-term ramping up of the<br />

retirement and Medicare eligibility ages. This doesn’t<br />

appear a realistic option, however, given the political<br />

appetite for tackling the US ageing issues. Extending<br />

the Bush tax cuts, at least partially, is a possibility<br />

although this does not provide much stimulus.<br />

Rather, it forestalls tightening so it doesn’t really<br />

Julia Coronado and Paul Mortimer-Lee 16 July 2010<br />

<strong>Market</strong> Mover<br />

4<br />

www.Global<strong>Market</strong>s.bnpparibas.com

arrest the slow growth dynamic we seem to be falling<br />

into. The recent failure of a USD 140bn stimulus bill<br />

that included aid to states and unemployment benefit<br />

extensions to pass the Senate highlights the lack of<br />

political will for further deficit spending. This is not a<br />

philosophical or theoretical issue, but a clear<br />

message from voters to Congress in an election<br />

year. It appears US voters don’t necessarily object<br />

strongly to the Japan-like scenario of slower growth.<br />

This could shift if economic conditions deteriorate<br />

much further but there seem to be constraints on<br />

how much more fiscal stimulus can be delivered in<br />

the US.<br />

The situation is different in Europe. Countries in the<br />

periphery have to tighten fiscal policy hard in order to<br />

try to restore credibility and overcome a potential<br />

inability to sell debt. Ideally, in these circumstances,<br />

we would have liked to have seen the countries with<br />

better fiscal conditions refrain from tightening, or<br />

even supplying a bit of temporary stimulus in order to<br />

support overall aggregate demand. In fact, the<br />

reverse is happening with Germany intent on<br />

tightening policy to set an example. Our view is that<br />

Germany’s expansion owes far too much to exports<br />

and far too little to aggregate demand. A bit of fiscal<br />

push – or a lack of brake – when the momentum in<br />

the traded goods sector was strong could have<br />

helped the recovery spread more broadly to the nontraded<br />

sector. However, that was not to be. Overall,<br />

the fiscal tightening, together with the effects of the<br />

fiscal crisis (lower confidence, likely less willingness<br />

to supply credit by banks) led us to halve our growth<br />

forecast for the eurozone in 2011 to 0.6%.<br />

The choices for monetary policy are also very<br />

difficult<br />

The choices for monetary policy are also very<br />

difficult. In general, it is easier to be aggressive and<br />

creative when you are addressing liquidity crises or<br />

the potential for a second Great Depression and<br />

much harder when the scenario is a Japan-like<br />

outcome of slow growth and no inflation. There are a<br />

few easy first steps. The Fed already took the first<br />

step toward lengthening the horizon for zero rates in<br />

June by citing financial tightening and acknowledging<br />

the downward trend in inflation. It could further<br />

strengthen its language around the inflation and<br />

employment conditions that would lead to both<br />

further easing as well as tightening. Beyond rhetoric,<br />

the Fed could easily announce that it will re-invest<br />

the MBS rolling off, a decision that would forestall a<br />

decline in its balance sheet of USD 100bn-150bn per<br />

year that would otherwise begin in H2. This would be<br />

a signal that it is willing to maintain the current easy<br />

stance of policy and wouldn’t require a new facility or<br />

the re-initiation of an expired facility. Doing so would<br />

imply it would absorb 40-60% of net new mortgage<br />

supply at current rates. It could also lower the<br />

Chart 3: Core Prices are Decelerating<br />

Source: Reuters EcoWin Pro<br />

interest it is paying on reserves from 25bp to zero,<br />

although this could lead to dysfunction in overnight<br />

funding markets (hence leaving it at 25bp and<br />

keeping a target for fed funds as a range between<br />

zero and 25bp even at the height of the crisis).<br />

Further expansion in central bank balance sheets<br />

would be predicated on a worsening in economic<br />

and financial conditions from here<br />

Phase two of quantitative easing, which is to say a<br />

further expansion in the Fed’s balance sheet, would<br />

be predicated on a worsening in conditions from here<br />

that could include deterioration in the labour market,<br />

further pronounced deceleration in inflation that<br />

appears to be leading to deflationary expectations<br />

(one could argue we are getting close with<br />

Treasuries where they are), indications that housing<br />

is slipping back into dangerous territory, or more<br />

pronounced financial market distress.<br />

Housing is still a source of systemic risk as a further<br />

significant leg-down in prices could produce a wave<br />

of strategic defaults and bank losses. This could<br />

prompt the Fed to invoke 13.3 (acting in “unusual<br />

and exigent circumstances”) and add another<br />

tranche of MBS purchases. While buying Treasuries<br />

is the purest form of quantitative easing – and the<br />

ease of exit is certainly something that recommends<br />

it – these purchases would likely raise political and<br />

market concerns that the Fed is monetising the debt.<br />

The Treasury purchase programme was widely<br />

viewed as ineffective by the Fed and certainly<br />

Treasuries are the asset class least in need of<br />

support. QE II would thus more likely be based on a<br />

serious worsening in conditions that would facilitate<br />

the invocation of 13.3 and further credit easing.<br />

There is a scenario in between that does not have<br />

an easy policy prescription – the muddle-through<br />

scenario we are currently in<br />

Beyond committing to zero rates and a stable<br />

balance sheet, it seems difficult to announce a bold<br />

Julia Coronado and Paul Mortimer-Lee 16 July 2010<br />

<strong>Market</strong> Mover<br />

5<br />

www.Global<strong>Market</strong>s.bnpparibas.com

new expansion of the Fed balance sheet without a<br />

notable deterioration in the outlook. And it is not<br />

obvious that more mortgage purchases would be<br />

effective in stimulating aggregate demand, which is<br />

to say it is not clear the balance sheet can be<br />

effective in fine-tuning the outlook. In a speech in<br />

May 2003, then Fed Chairman Alan Greenspan gave<br />

three policy prescriptions to cure the Japanese<br />

deflation and stagnation. He said the Bank of Japan<br />

should commit to a price level rather than an inflation<br />

rate, thus signalling it would allow a period of<br />

reflation, or inflation temporarily above its target. He<br />

also suggested the Bank of Japan should purchase<br />

securities without consideration of the potential<br />

balance sheet losses realised down the road. Finally,<br />

he suggested that the federal government and the<br />

central bank engage in a one-time tax cut financed<br />

by the central bank’s printing of money. This seems<br />

to be an action expressly prohibited by the Federal<br />

Reserve Act and one that would be unwelcome in the<br />

current political environment.<br />

Eurozone on a different path<br />

The Fed has stopped adding to its balance sheet for<br />

the last several months, keeping the stock of<br />

purchased assets at high levels, and is now mulling<br />

whether to engage in further unconventional<br />

measures. The ECB’s policy in unconventional space<br />

has seen more variation.<br />

Aside from a tiny amount of covered-bond<br />

purchases, the ECB’s policy in unconventional space<br />

was until May not the outright purchase of assets but<br />

rather supplying liquidity in the money market. That<br />

has had two dimensions – supplying fixed rate<br />

money at an amount to be decided by the banks, not<br />

the ECB (fixed rate, full allotment), and supplying that<br />

money for longer periods than usual (i.e. through 3-,<br />

6- and 12-month Long Term Refinancing Operations<br />

or LTROs). Exit from this policy had already started<br />

with adjustments to duration – there have been no<br />

further 12-month LTROs since December last year.<br />

Despite the clear signs of financial stress in Greece –<br />

widening CDS and government bonds spreads,<br />

increased reliance by Greek banks on Bank of<br />

Greece funding – the ECB continued with its exit<br />

strategy, scrapping the 6-month LTRO after April and<br />

announcing that the 3-month LTRO would be a<br />

variable rate tender from April.<br />

The eurozone sovereign debt crisis put a stop to the<br />

exit in early May, with the ECB (i) reintroducing<br />

another 6-month fixed rate full allotment LTRO; (ii)<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Chart 4: ECB Government Bond Purchases<br />

(EURbn)<br />

Source: ECB<br />

ECB Purchases under the<br />

Securities <strong>Market</strong>s Programme (EURbn)<br />

1 2 3 4 5 6 7 8 9<br />

Weeks from the start of the Programme<br />

committing to further 3-month fixed rate full allotment<br />

LTROs until September; and (iii) buying limited<br />

amounts of peripheral government debt.<br />

The lack of enthusiasm for the latter course is<br />

illustrated by the public dissent expressed by Mr<br />

Weber at the instigation of the sovereign debt<br />

purchases and also by the scaling back we have<br />

seen in the quantity of those purchases over recent<br />

weeks (see Chart 4). This trend down in purchases<br />

shows that the ECB is continuing with the exit policy<br />

as is also clear from the fall in excess reserves and<br />

increase in money market rates following the<br />

expiration of the first 12-month repo on 1 July.<br />

Overall then, the Fed is contemplating a further<br />

round of QE in order to stabilise the economy and<br />

avoid a shift down in inflation expectations while the<br />

ECB seems to be continuing, albeit with a blip, its<br />

policy of trying to exit unconventional policies. It is<br />

quite possible that, in coming months, we see the<br />

ECB continuing to exit while the Fed institutes some<br />

form of QE2. The impact of this on the markets will<br />

depend on the speed of the ECB exit, the macro<br />

backdrop and exactly what measures the Fed<br />

chooses to pursue and on what scale. In underlying<br />

philosophy, there is a big gap between the Fed – do<br />

everything possible to avoid bad outcomes – and the<br />

ECB – do as little as possible and hope for the best.<br />

There is also a difference in terms of response to<br />

developments in the real economy, with the ECB<br />

being much less activist and eschewing ‘fine-tuning’.<br />

Thus it is quite possible that we see very different<br />

policy moves in coming months on the two sides of<br />

the Atlantic, which would have important implications<br />

for bonds, spreads and currencies.<br />

Julia Coronado and Paul Mortimer-Lee 16 July 2010<br />

<strong>Market</strong> Mover<br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US Housing: A Cold Summer<br />

• After the expiry of the first-time<br />

homebuyers’ tax credit at the end of April,<br />

housing starts in May plunged by 10.0% m/m,<br />

existing home sales declined by 2.2%, pending<br />

home sales fell 30.0%, and new home sales<br />

plummeted by 32.7%.<br />

• It is clear that much of the stabilisation in<br />

housing demand over the past year was a<br />

pulling forward of demand through low rates<br />

and the tax credit, leaving the outlook for<br />

housing highly uncertain.<br />

• Weekly data on mortgage applications to<br />

purchase indicate buyers’ interest declined<br />

further in June and early July after falling<br />

considerably in May – suggesting housing<br />

demand will remain depressed throughout the<br />

summer.<br />

2000<br />

1750<br />

1500<br />

1250<br />

1000<br />

750<br />

500<br />

Chart 1: Housing Starts to Remain Weak<br />

250<br />

May Aug Nov Feb May Aug Nov Feb May Aug Nov Feb May Aug Nov Feb May<br />

06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Building Permits (lagged 1 month, k)<br />

Housing Starts (k)<br />

Chart 2: Pending Home Sales Plunge in May<br />

• As we move into the second half of the year,<br />

residential investment is likely to weigh again<br />

on economic growth.<br />

• In Q2, part of this weakness should have<br />

been offset by strength in brokers’<br />

commissions, as total housing sales were better<br />

supported in April.<br />

• We have revised our forecast for residential<br />

investment down to 11.5% q/q AR for Q2 and to<br />

a decline of 5.0% in Q3.<br />

The recent data point to a notable softening in<br />

economic growth. Residential construction is<br />

one sector showing weakness<br />

Economic data softened notably in June, suggesting<br />

the recovery has lost some momentum. Housing<br />

demand has fallen more sharply than expected after<br />

the expiry of the homebuyers’ tax credit; the outlook<br />

for H2 is uncertain but likely to be a neutral at best<br />

for growth. Housing starts plunged by 66k (10% m/m)<br />

to 593k annualised units in May, erasing 80% of the<br />

gains recorded so far this year. Worryingly,<br />

weakness was concentrated in the single-family<br />

sector of the market, where builders broke ground on<br />

17.2% fewer projects in May compared to the<br />

previous month.<br />

Building permits fell for the second consecutive<br />

month in May, declining by 5.9% m/m after a 10.9%<br />

contraction in April, suggesting the pace of new<br />

construction is likely to remain depressed over the<br />

summer. Given that permits lead housing starts by<br />

Source: Reuters EcoWin Pro<br />

Chart 3: No Demand for New Homes<br />

Source: Reuters EcoWin Pro<br />

one to two months, the May decline in permits points<br />

to more weakness in new construction over the near<br />

term (Chart 1). Indeed, we expect housing starts to<br />

decline by another 13k to 580k in the June report<br />

next week. The weakness dovetails with a recent 5-<br />

point decline in the National Association of Builders<br />

Yelena Shulyatyeva 16 July 2010<br />

<strong>Market</strong> Mover<br />

7<br />

www.Global<strong>Market</strong>s.bnpparibas.com

confidence index, as builders reported that prospects<br />

for single family sales deteriorated in June.<br />

Existing home sales should drop sharply in June<br />

following a smaller decline the previous month. In<br />

May, existing home sales declined by 2.2% m/m and<br />

we expect they will drop by 12% in June as pending<br />

home sales plummeted 30% in May (Chart 2). New<br />

home sales plunged 32.7% m/m in May, supplying<br />

further evidence that prospective homebuyers pulled<br />

out of the market en masse after the government<br />

homebuyers’ tax credit expired in April. We expect<br />

new home sales to remain weak in June at 310k<br />

annualised units, rebounding by just 3.3% from the<br />

30-year low (Chart 3). Housing is slipping back into<br />

dangerous territory and a further extension of the tax<br />

credit could be beneficial. However, the recent failure<br />

of a stimulus bill that included aid to states and<br />

unemployment benefit extensions to pass the Senate<br />

highlights the lack of political will for further deficit<br />

spending.<br />

The bill signed into law on 2 July only extends<br />

the deadline for closing transactions<br />

The Homebuyer Assistance and Improvement Act of<br />

2010, signed by President Obama on 2 July,<br />

recognises that an estimated 180,000 prospective<br />

new homeowners were not able to meet the 30 June<br />

closing deadline for the tax credit that expired in April<br />

due to red tape involving mortgage lenders and<br />

guarantors. The new legislation extends the closing<br />

deadline from 30 June to 30 September for eligible<br />

homebuyers. The law thus provides any homebuyer<br />

who entered into a contract on a home by 30 April<br />

but was unable to go to closing within the required 60<br />

days, an additional 90 days to close and qualify for<br />

the credit. The legislation is great news for those<br />

homebuyers who were unable to close before 30<br />

June. However, it does not extend the deadline for<br />

homebuyers to sign a contract for a home. Therefore,<br />

while the new law will likely smooth the projected<br />

path of declines in existing home sales, it will not<br />

help revive the demand for housing.<br />

Mortgage applications have plunged recently,<br />

suggesting housing demand will remain subdued<br />

Mortgage applications to purchase a home declined<br />

by 22% m/m in May and another 11.5% in June, to<br />

their lowest level since 1996 – suggesting<br />

prospective buyers are already pulling back sharply<br />

and helping underpin our belief that housing demand<br />

will remain sluggish in the summer months (Chart 4).<br />

We have revised our forecast for residential<br />

investment down to 11.5% q/q AR for Q2 and to<br />

negative 5.0% in Q3<br />

We previously estimated more of a boost from the<br />

tax credit programme and the pullback to be more<br />

Chart 4: Mortgage Applications Plunged in May<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Broker Commissions to Support<br />

Residential Investment in Q2<br />

Source: Reuters EcoWin Pro<br />

muted. We had projected residential investment to<br />

grow 17.0% q/q AR in Q2 and 5% in Q3. However,<br />

recent developments suggest less growth in Q2 and<br />

point to a contraction in Q3. In Q2, part of this<br />

weakness should have been offset by strength in<br />

brokers’ commissions, as total housing sales jumped<br />

by 8.5% m/m in April. The latest FOMC minutes<br />

made a note that “on net, the upswing in the volume<br />

of real estate transactions in recent months was<br />

likely to boost the brokers’ commissions component<br />

of residential investment in the second quarter”.<br />

Indeed, while new home sales plummeted by 32.7%<br />

m/m in May, demand for newly built homes currently<br />

accounts for a mere 5% of the market, while sales of<br />

previously owned homes dominate demand. In this<br />

respect, while existing home sales declined by 2.2%<br />

m/m to 5.66mn annualised units in May, the<br />

weakness was not enough to offset a healthy 8.0%<br />

gain in April. Brokers’ commissions on the sale of<br />

residential structures currently represent 18.6% of<br />

residential investment, and were supportive of overall<br />

growth (Chart 5). However, a 30% m/m plunge in the<br />

pending home sales index, which leads existing<br />

home sales by one to two months, points to less of a<br />

contribution from brokers’ commissions in Q2 than<br />

we previously estimated. Against this background,<br />

Yelena Shulyatyeva 16 July 2010<br />

<strong>Market</strong> Mover<br />

8<br />

www.Global<strong>Market</strong>s.bnpparibas.com

we expect residential investment to grow by 11.5%<br />

q/q AR and contract by 5.0% in Q3.<br />

Subdued outlook<br />

The Freddie Mac 30-year fixed mortgage rate hit a<br />

new low of 4.57% last week (Chart 6). Fresh lows in<br />

mortgage rates should provide some support to<br />

housing demand. However, the bigger effect should<br />

be on mortgage applications to refinance. We look<br />

for only a modest improvement in housing demand<br />

through the remainder of the year. Consequently,<br />

there is likely to be downward pressure on housing<br />

prices. As the FOMC minutes noted: “House prices<br />

declined somewhat in recent months, reversing some<br />

of the modest increases that occurred in the spring<br />

and summer of 2009”. Home prices will likely remain<br />

sluggish throughout this year.<br />

Chart 6: Mortgage <strong>Rate</strong>s at Historical Bottom<br />

Source: Reuters EcoWin Pro<br />

Yelena Shulyatyeva 16 July 2010<br />

<strong>Market</strong> Mover<br />

9<br />

www.Global<strong>Market</strong>s.bnpparibas.com

UK Inflation: Mind the Gap<br />

• Recent changes in the inflation measure<br />

used to index benefits and pensions have<br />

attracted attention to the difference between CPI<br />

and RPI inflation.<br />

Chart 1: Contributions to CPI-RPI Difference<br />

• We examine here exactly what drives the<br />

difference between CPI and RPI inflation and<br />

how the gap is likely to evolve.<br />

• We expect the gap to narrow temporarily<br />

over the coming year, before widening sharply<br />

during 2012 when Bank <strong>Rate</strong> begins to rise.<br />

The switch in the gauge of inflation that is used to<br />

benchmark private sector pension schemes has<br />

generated considerable attention in the differences<br />

between CPI and RPI inflation. The move, intended<br />

to boost consistency, follows the announcement in<br />

the Emergency Budget that public sector pensions<br />

and benefits will now rise in line with CPI inflation<br />

rather than RPI inflation. Given this, we have<br />

provided a guide to what the differences in the two<br />

indices are and secondly, how we expect the gap<br />

between the two to evolve.<br />

Difference between CPI and RPI<br />

The CPI and RPI are compiled using the same<br />

underlying price data. However, there are a number<br />

of differences:<br />

• The CPI excludes a number of RPI series, in<br />

particular, council tax, mortgage interest<br />

payments, housing depreciation and<br />

buildings insurance;<br />

• The CPI includes a number of series that are<br />

not included in the RPI. In particular,<br />

university accommodation fees, foreign<br />

students’ university fees and stockbrokers’<br />

charges;<br />

• The weights applied to some components of<br />

the CPI are a little different from the weights<br />

applied to the equivalent component of the<br />

RPI; and<br />

• The CPI uses the geometric mean to<br />

combine the individual prices while the RPI<br />

uses the arithmetic mean.<br />

Note that RPIX is the RPI excluding mortgage<br />

interest payments.<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Recent developments in the CPI-RPI differential<br />

The experience of the last 18 months provides a very<br />

good illustration of what typically determines the<br />

differential between CPI and RPI inflation.<br />

By far the biggest difference between CPI and RPI<br />

inflation is the inclusion of housing related<br />

components in the RPI but not the CPI (Chart 1). In<br />

turn, mortgage interest payments (MIPs) and house<br />

price inflation tend to be the biggest contributors.<br />

By way of example, the gap between CPI and RPI<br />

inflation exploded to over 3 percentage points during<br />

2009. RPI inflation plunged to a low-point of<br />

-1.6% y/y while CPI inflation only slowed to 1.1%.<br />

RPI inflation slumped owing to a combination of<br />

falling house prices and interest rate cuts. More<br />

specifically, the BoE slashed Bank <strong>Rate</strong> from 5.75%<br />

to 0.5%. This caused the MIPs component to plunge<br />

by 45% y/y. Given a weight of around 5% in the RPI<br />

index, that subtracted over 2pp from RPI inflation.<br />

Similarly, the house price inflation component of the<br />

RPI slumped to a low point of -13% y/y. With a<br />

weight of 5% in the index, that subtracted over 0.5pp<br />

from headline RPI inflation.<br />

Over the last year the differential has reversed i.e.<br />

RPI inflation has gone from around 3pp below CPI<br />

inflation, to 2pp above CPI inflation. The bulk of that<br />

change has reflected an unwinding of the influences<br />

that provoked last year’s undershoot. More<br />

specifically, since mortgage rates are no longer<br />

falling, the near 45% y/y decline in the MIPs<br />

component has recovered to +5%. That 50pp move<br />

in itself has added almost 2.5pp to RPI inflation since<br />

the trough. Likewise, house price inflation has<br />

Alan Clarke 16 July 2010<br />

<strong>Market</strong> Mover<br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com

ebounded from -13% y/y to +8%. That has added<br />

another percentage point to headline RPI inflation.<br />

These developments have neutralised the<br />

contribution from housing and explain why RPI<br />

inflation is no longer below CPI inflation, but not why<br />

RPI inflation is now above CPI inflation. There are<br />

two main reasons for the near 2pp overshoot of RPI<br />

inflation relative to CPI inflation.<br />

The first is the formula effect i.e. the different<br />

averaging technique used in calculating the index.<br />

This is pretty stable through time at around 0.5pp,<br />

though currently accounts for 0.8pp of the differential.<br />

The other key contributor to the current gap is<br />

differences in weights between the two series. A<br />

good example of this is alcohol and tobacco. In the<br />

CPI this component has a weight of 4%, while it is<br />

more than double that (9.1%) in the RPI. Alcohol and<br />

tobacco inflation has been accelerating much more<br />

quickly than average over the last year, which, given<br />

the higher weight in the RPI helps to explain why RPI<br />

inflation has risen by more than CPI inflation.<br />

Which way now?<br />

We expect the gap between RPI and CPI inflation to<br />

narrow over the next 12 months to almost zero<br />

before widening again during 2012. More specifically,<br />

we expect a slowdown in the components such as<br />

alcohol that have accounted for much of the current<br />

gap between RPI and CPI inflation. Similarly, slowing<br />

house price inflation should bear down on RPI<br />

inflation, also contributing to the narrowing gap with<br />

CPI inflation.<br />

Thereafter we expect interest rate hikes during 2012<br />

to drive a wedge between the two series. Given the<br />

extremely low level of mortgage rates, a small<br />

interest rate hike is likely to have a big effect on RPI<br />

inflation.<br />

By way of example, the current level of the average<br />

mortgage rate according to the BoE is around 3½%.<br />

If the BoE were to hike Bank <strong>Rate</strong> to 2% by end-<br />

2012 (i.e. in line with market expectations), given the<br />

typical 70% passthrough to mortgage rates, that<br />

would represent a 30% increase in the MIPs<br />

component. In turn, that would add around 1.5pp to<br />

RPI inflation.<br />

from the MIPs component and hence the gap<br />

between RPI and CPI inflation. Unless Bank <strong>Rate</strong><br />

continues to rise for ever, that contribution from rising<br />

mortgage rates should at some point begin to fade –<br />

2014 in our view. Although we would envisage the<br />

gap narrowing at that point the formula effect should<br />

ensure that the gap between CPI and RPI inflation<br />

stabilises at around 0.5-0.75pp.<br />

Changes to the index<br />

One potential additional influence on this gap is the<br />

inclusion of some measure of house price inflation in<br />

the CPI. When this does happen, it should help to<br />

narrow the gap between RPI and CPI inflation.<br />

However, this change has been a long time coming<br />

and we gather is unlikely before 2012.<br />

Conclusion<br />

Over the longer run, the gap between RPI and CPI<br />

inflation is likely to narrow relative to current levels to<br />

reside closer to 0.5pp y/y. However, over the shorter<br />

term, the gap is likely to remain variable not least<br />

when the BoE eventually begins to raise Bank <strong>Rate</strong>.<br />

While this presents a potential headache for private<br />

sector pension funds in adjusting to the new rules,<br />

the adoption of the CPI for indexing public sector<br />

pensions was a master stroke by the Chancellor. It is<br />

likely to save the government around GBP 6bn per<br />

year by 2014-15.<br />

Clearly, there has been some discontent expressed<br />

by those who will be receiving less from their state<br />

pensions. However, few (if any) have acknowledged<br />

that this year’s increase was well above RPI inflation.<br />

September is the reference month for public sector<br />

pensions and benefits. Last September, RPI inflation<br />

was around -1½% y/y. However, because of the<br />

2.5% floor applied to public sector pensions this<br />

year’s increase was 4pp above RPI inflation. The<br />

bottom line is that public sector pension payments<br />

may well miss out on the boost to RPI inflation (of up<br />

to 4pp) once Bank <strong>Rate</strong> begins to rise. However, we<br />

suspect a spell of amnesia will block out memories of<br />

the RPI increase awarded in April 2010.<br />

Alan Clarke 16 July 2010<br />

<strong>Market</strong> Mover<br />

11<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Denmark: The Tide is Turning<br />

• Given excess liquidity in the eurozone,<br />

higher money market rates in Denmark led to an<br />

appreciation of the krone earlier in 2010.<br />

Chart 1: 3m Interbank & Official <strong>Rate</strong> Spreads<br />

• The krone, however, has been depreciating<br />

vis-à-vis the euro in recent weeks.<br />

• This seems to be driven by lower excess<br />

liquidity in the eurozone and thus higher money<br />

market rates.<br />

• Given these recent developments, we no<br />

longer expect rate cuts from the central bank.<br />

• There is some evidence that the Danish<br />

central bank already started to draw on its FX<br />

reserves to defend the currency.<br />

• We expect it to continue to do so as long as<br />

the weakening trend continues. Only if this<br />

proves unsuccessful and reserves fall too<br />

much, policy rates would be raised.<br />

Lower rates so far this year…<br />

Since the beginning of this year, the Danish central<br />

bank has cut its policy rate by a total of 15bp to<br />

1.05%. The interest rate on certificates of deposit has<br />

been cut even more, by 45bp to 0.5%. These<br />

reductions were a “consequence of further purchases<br />

of foreign exchange in the market”. The<br />

strengthening of the currency was a tightening of<br />

monetary conditions, with the accumulation of<br />

reserves an attempt to prevent this. But continued<br />

appreciation pressures had to be reflected in an<br />

easing in another aspect of monetary conditions,<br />

namely official interest rates.<br />

As we have highlighted before (see Denmark:<br />

Surprise, Surprise, <strong>Market</strong> Mover, 15 January 2010),<br />

as there is excess liquidity in the eurozone, the rate<br />

determining eurozone market rates is the deposit<br />

rate (0.25%) rather than the ECB’s refi rate (1%). On<br />

the other hand, the Danish central bank does not<br />

leave excess liquidity in the banking system. Instead,<br />

it supplies the liquidity banks want (full allotment) but<br />

then mops up with certificates of deposit (now at<br />

0.5%). This certificates of deposit/deposit rate<br />

differential, which explains higher money market<br />

rates in Denmark compared to the eurozone (Chart<br />

1), led to hot-money inflows. This in turn<br />

strengthened the Danish krone vis-à-vis the euro and<br />

prompted the Danish central bank to cut rates.<br />

…as the DKK gained ground<br />

The last two deposit rate cuts from the Danish central<br />

Source: Reuters EcoWin Pro<br />

Source: Reuters EcoWin Pro<br />

Chart 2: EUR/DKK<br />

bank (in May) were also driven by these factors.<br />

Given the intensification of stress in financial markets<br />

due to fiscal jitters in the eurozone, the ECB<br />

announced measures to enhance liquidity in the<br />

system. This also had implications for Denmark. For<br />

example, a eurozone bank with excess liquidity could<br />

put the money in Denmark at 0.7% (before the two<br />

rate cuts in May) rather than getting 0.25% in the<br />

eurozone.<br />

These rate differentials in turn led to an appreciation<br />

of the krone vis-à-vis the euro. In mid-June,<br />

EUR/DKK reached its lowest level since the<br />

beginning of 2005.<br />

But recently EUR/DKK has been moving higher<br />

very quickly…<br />

Since mid-June, however, EUR/DKK has been<br />

trending higher (Chart 2). On 13 July, EUR/DKK<br />

reached its highest level since October 2008, a<br />

period when the Danish central bank was increasing<br />

rates to bolster the krone.<br />

Gizem Kara 16 July 2010<br />

<strong>Market</strong> Mover<br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com

At first glance, this latest development is puzzling. A<br />

current account surplus and changes in capital flows<br />

mean Denmark is still running a basic balance<br />

surplus, pointing to a stronger currency. Also, there is<br />

still a 25bp gap between the interest rate on<br />

certificates of deposit in Denmark and the ECB<br />

deposit rate – hence arbitrage opportunities continue.<br />

Chart 3: Use of Deposit Facility at the ECB &<br />

EUR/DKK<br />

So what is driving the recent depreciation of the DKK<br />

vis-a-vis the EUR?<br />

…driven by developments in the eurozone policy<br />

There seems to be a relationship between the use of<br />

the deposit facility at the ECB and developments in<br />

EUR/DKK over the past couple of months (Chart 3).<br />

The depreciation of the DKK could be partially driven<br />

by lower excess reserves in the eurozone, which<br />

could suggest lower flows into the DKK.<br />

Since the end of June, short-term money market<br />

rates in the euro area have also been drifting higher.<br />

The 1-week and 3-month Euribor rates have risen<br />

10-15bp over the past three weeks and are now back<br />

at their levels of June and August last year,<br />

respectively. The recent changes to refinancing<br />

operations at the ECB, including the expiry of the first<br />

1-year long-term refinancing operation, have reduced<br />

the excess liquidity in the system. This is pushing<br />

money market rates higher. Also, at the press<br />

conference after the rate decision last week, the ECB<br />

hinted at backing away from its unconventional<br />

measures. We believe the ECB should commit to<br />

take whatever action is necessary, given the<br />

problems in the eurozone sovereign debt markets<br />

and banks. But the ECB seems to be pushing on with<br />

the exit strategy, leading to expectations of higher<br />

rates (although the ECB has asserted that the<br />

increase in short-term rates should not be interpreted<br />

as a policy signal).<br />

In the meantime, Danish money market rates have<br />

been hovering around their all-time lows. With EUR<br />

rates now pushing up, money market spreads are<br />

trending lower. For example, given lower excess<br />

liquidity now in the eurozone, the Danish overnight<br />

rate spread vis-à-vis the eurozone has even turned<br />

negative (Chart 4). This is leading to outflows from<br />

the DKK into the EUR.<br />

The implications for Danish monetary policy<br />

We had expected the Danish central bank to cut its<br />

policy and deposit rates further as rate differentials<br />

with the eurozone were leading to an appreciation of<br />

the krone. But the recent depreciation of the DKK visà-vis<br />

the EUR suggests rate cuts are now unlikely,<br />

leading us to change our view.<br />

There is already some evidence that the central bank<br />

Source: Reuters EcoWin Pro<br />

Chart 4: O/N <strong>Rate</strong> Spread (%) & EUR/DKK (% y/y)<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Foreign Exchange Reserves<br />

Source: Reuters EcoWin Pro<br />

started to draw on its FX reserves to defend the<br />

currency (EURDKK ticked down on 14 July and<br />

pushing lower at the time of writing).<br />

Our assumption is that the ECB will further extend its<br />

liquidity provision, although likely divisions on the<br />

Governing Council could delay the implementation of<br />

such policies. Given this, the Danish central bank is<br />

likely to continue to draw on its FX reserves in the<br />

short term to support the currency. Only if such<br />

action fails, and reserves fall too much, the bank will<br />

need to hike rates.<br />

Gizem Kara 16 July 2010<br />

<strong>Market</strong> Mover<br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com

China: House Price Controls to Continue<br />

• Since April 17, China has tightened policy in<br />

order to control housing prices, focusing on<br />

suppressing investment and speculative<br />

demand.<br />

50<br />

45<br />

Chart 1: Property Investment Continues<br />

Accelerating (% YTD)<br />

• Housing transactions have fallen<br />

substantially but a significant correction in<br />

house prices has not yet taken place.<br />

• As China’s economic growth momentum<br />

has weakened significantly, the market is<br />

starting to speculate that housing policy will be<br />

relaxed while banks are starting again to extend<br />

mortgage loans for third houses and more.<br />

• Our argument that there will be no relaxation<br />

is underscored by government actions, with<br />

three authorities reiterating that the policies to<br />

rein in house prices are unchanged and that the<br />

objective of controlling prices is intact.<br />

• We expect the correction in house prices to<br />

gain momentum; the housing industry may have<br />

bottomed out by the end of the year.<br />

Commercial banks in Shanghai, Nanjing, Hangzhou,<br />

Shenzhen and Beijing are reported to have quietly<br />

resumed the extension of mortgage loans for third<br />

houses or more but with a deposit of more than 50%<br />

and at a rate of more than 110% of the policy rate.<br />

There has been much speculation that the authorities<br />

will relax house price controls given the general<br />

weakening in economic growth momentum and the<br />

government's increasing concerns of ‘overcooling’.<br />

The authorities said earlier this week that the<br />

measures to control prices are not being rescinded.<br />

The Ministry of Housing and Rural-Urban<br />

Development reiterated that the government will<br />

continue to implement the policies set out by the<br />

state council on 17 April, and remains determined to<br />

suppress investment and speculative demand in<br />

housing. The ministry, however, supports increased<br />

investment in the construction of ordinary and public<br />

housing.<br />

The CBRC, for its part, has clearly stated that there<br />

is no change in mortgage loan policy for second<br />

house and more, with all commercial banks required<br />

to strictly abide by financial rules and regulations.<br />

The State Asset Administration Commission (SAAC)<br />

denied the reports saying it was requiring property<br />

developers in state-owned enterprises (SOEs) to<br />

aggressively acquire more land, restating that the<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

04 05 06 07 08 09 10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

Residential property investment<br />

Property investment<br />

SAAC is demanding 76 central SOEs for which<br />

property development is not their core business to<br />

sell off their property development arms.<br />

House price controls to continue<br />

In fact, the objective of controlling house prices is far<br />

from being achieved. Since 17 April, when the state<br />

council announced its intention to stop housing<br />

prices from rising too far too fast in some cities,<br />

housing transaction have fallen substantially.<br />

However, in tier-1 cities in particular, the correction in<br />

house prices has not yet occurred – at most, it has<br />

just started. This can be seen from the indicators of<br />

property performance below.<br />

Property investment growth continues to accelerate:<br />

it came in at 39.6% y/y in Q2, up from 35.1% in Q1<br />

(H1: 38.1% y/y). Residential housing investment,<br />

which accounts for 69.3% of property investment,<br />

accelerated from 33% y/y in Q1 to 35.1% in Q2 (H1:<br />

34.4% y/y). Property space under construction<br />

increased by 28.7% y/y in H1, but newly started<br />

property space surged by 67.9% y/y. However,<br />

completed property space increased by only 18.2%<br />

y/y, and residential housing space completed rose by<br />

15.5% (Chart 1).<br />

Property transactions have fallen. Property sales<br />

amounted to 394 million sqm in H1 10, up by 15.4%<br />

y/y, but growth slowed from 35.8% y/y in Q1 to 5.4%<br />

in Q2. Residential housing sales rose 12.7% y/y in<br />

H1, but growth plunged from 34.2% in Q1 to 2.2%.<br />

Sale values rose 25.4% y/y in H1 10, but the growth<br />

rate also dropped sharply – from 57.7% y/y in Q1 to<br />

10.1%. Housing sales increased by 20.3%, with<br />

growth slowing to 4.4% in Q2 from 55.2% (Chart 2).<br />

Xingdong Chen 16 July 2010<br />

<strong>Market</strong> Mover<br />

14<br />

www.Global<strong>Market</strong>s.bnpparibas.com

But property prices have barely corrected…<br />

The property price index increased 11.4% y/y in June,<br />

compared to 12.4% in May, 12.8% in April and<br />

11.7% in March. The index actually dropped 0.1%<br />

m/m in June, the first m/m decline recorded for 17<br />

months. The housing price index was up 14.1% y/y in<br />

June, but was flat in m/m terms (Chart 3).<br />

…because property developers are not short of<br />

funding<br />

Property investment capital supply rose 45.6% y/y in<br />

H1. Capital supply is equivalent to 178% of property<br />

investment. Capital borrowed from banks increased<br />

by 34.5% y/y (compared to overall lending growth of<br />

19.2%), property developers’ self-raised funds<br />

surged by 50.9%, and other funds were up by 47.9%.<br />

Property developers are thus not under pressure to<br />

cut house selling prices for cash flow purposes<br />

despite housing inventory rising, even stepping up<br />

the pace of investment and construction (Charts 4<br />

and 5).<br />

Controlling house prices has become a political<br />

game between the central government and property<br />

developers. Local governments are waiting for the<br />

central government to change policy. In our view,<br />

house price controls will not be changed for the time<br />

being. If the government relaxes current policy in any<br />

way, house prices could start to rise again and the<br />

authorities would lose credibility.<br />

In fact, if the government relaxes controls at this<br />

stage, the property industry could in the longer term<br />

suffer even more than it would if policy is left<br />

unchanged. It is a critical time for both the<br />

government and property developers. As long as<br />

house prices fall by 10-15%, social expectation will<br />

be satisfied, the government will relax the controls<br />

and the property industry will be able to return to<br />

normal growth. If the government continues with its<br />

existing policies, the correction in house prices will<br />

gather momentum and the policy objective could be<br />

achieved in Q4 this year.<br />

In terms of policy, we expect the government to strike<br />

a better balance between propping up growth and<br />

economic restructuring at the upcoming summer<br />

meeting; we do not expect a general easing. Rather,<br />

we expect selective easing: a delay or scaling down<br />

of the measures to rectify local government financing<br />

vehicles; the easing of policies designed to tackle<br />

excessive capacity and pollution; and the alleviation<br />

of measures to tighten corporate liquidity.<br />

Chart 2: Property Transactions have Declined<br />

Substantially (% YTD)<br />

90<br />

80<br />

70<br />

60<br />

Property sales value<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Property sales volume<br />

-10<br />

-20<br />

-30<br />

00 01 02 03 04 05 06 07 08 09 10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

Chart 3: House Price Correction has Only Just<br />

Started<br />

114<br />

112<br />

110<br />

108<br />

106<br />

104<br />

102<br />

100<br />

(Dec 08 = 100)<br />

Property price index<br />

98<br />

Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

Chart 4: Housing Inventory is Rising (% YTD)<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

Floor space completed<br />

Property sales volume<br />

-20<br />

00 01 02 03 04 05 06 07 08 09 10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

Chart 5: Newly Started Property Space May<br />

have Peaked (% YTD)<br />

Floor space started<br />

Property sales volume<br />

10<br />

0<br />

-10<br />

-20<br />

00 01 02 03 04 05 06 07 08 09 10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

Xingdong Chen 16 July 2010<br />

<strong>Market</strong> Mover<br />

15<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Japan: Post-Election Outlook for Tax Reform<br />

• The Kan Government’s election defeat was<br />

not due to its talk of a sales tax hike but to<br />

comments that tax hikes would boost growth.<br />

This smacked of ‘big government’ and put off<br />

independent voters.<br />

• Since the pro-reform camp within the DPJ is<br />

sure to be under pressure from the antireformists<br />

to take responsibility for the election<br />

defeat, fiscal reform will likely be stalled in the<br />

near term.<br />

• From a longer-term perspective, fiscal<br />

restructuring will stay on track because the two<br />

largest parties both recognise the need for<br />

reform (including tax rises).<br />

• Until the DPJ’s leadership election in<br />

September (when Kan’s fate as leader will be<br />

determined), we expect the Kan government to<br />

horse-trade with other parties to secure the<br />

cooperation or alliances needed for stable<br />

governance.<br />

Election setback was not due to tax hike talk<br />

Did the Kan government lose Sunday’s Upper House<br />

election (and with it, the ruling bloc’s majority in that<br />

chamber) because of its forward-looking stance on<br />

fiscal restructuring and a consumption tax hike? The<br />

LDP also advocated fiscal reform and a consumption<br />

tax hike, yet it gained seats. Clearly, much of the<br />

electorate now understands that unless fiscal reform<br />

also includes higher taxes, the nation’s public debt<br />

will snowball out of control. One reason voters chose<br />

the LDP over the DPJ is probably that Prime Minister<br />

Kan has been anything but forthcoming on the<br />

reason for the consumption tax hike.<br />

With Kan’s pre-election comments about a tax hike<br />

bolstering economic growth, many voters feared that<br />

the tax hike would not just be used to improve the<br />

state finance and reform social security but it would<br />

also go on new spending programmes under the<br />

guise of ‘growth strategies’. In other words, Kan’s<br />

comments smacked of ‘big government’, and this put<br />

off the majority of independent voters. In any event, if<br />

the prime minister sees a tax hike as a means of<br />

bolstering economic growth via greater state<br />

involvement (spending) in the private sector, he is<br />

grossly mistaken (see accompanying article, Japan:<br />

PM Kan’s Dubious <strong>Economics</strong>).<br />

Chart 1: Composition of Upper House<br />

Ruling <br />

110<br />

People's New<br />

Party and<br />

others (4)<br />

DPJ(106)<br />

Source: <strong>BNP</strong> Paribas<br />

LDP84)<br />

Total242<br />

Opposition<br />

132<br />

Others (18)<br />

New Komeito<br />

(19)<br />

Your Party<br />

(11)<br />

Short-term slowdown in pace of tax reform<br />

What is the outlook for fiscal restructuring following<br />

the government’s election setback? Will tax reform<br />

be sidetracked? One reason Japan’s long-term<br />

interest rate has edged lower this past month is<br />

because the two largest political parties, the ruling<br />

DPJ and the opposition LDP, were both advocating<br />

accelerated fiscal reform in their election campaigns<br />

(of course, the main reason was downward pressure<br />

on the global equilibrium real interest rate from<br />

weakening growth expectations for the US and EU).<br />

Now, with the pro-reform camp within the DPJ likely<br />

to be under pressure from the anti-reformists to take<br />

responsibility for the election defeat, the result will<br />

likely be a compromise in both the tempo and<br />

content of tax reform proposals at least until the<br />

DPJ’s leadership election in September.<br />

Consequently, there could be some increase in the<br />

fiscal risk premium. Even so, we doubt that the longterm<br />

rate will show any pronounced nominal increase<br />

because private sector demand for funds is unlikely<br />

to pick up owing to Japan’s deflation and falling<br />

growth expectations.<br />

Fiscal reform to stay on track over long haul<br />

From a longer-term perspective, however, we do not<br />

think that the latest election results will necessarily<br />

derail fiscal reform. As pointed out above, the DPJ<br />

and LDP both recognise the need for fiscal reform.<br />

Thus, even though the Diet will likely continue to be<br />

divided (the Upper House is controlled by the<br />

opposition, the Lower House by the ruling camp), it is<br />

important that a majority of lawmakers, regardless of<br />

party affiliation, now acknowledge the need for fiscal<br />

consolidation and tax reform. What is more, this shift<br />

in opinion in the Diet was brought about not because<br />

Ryutaro Kono 16 July 2010<br />

<strong>Market</strong> Mover<br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com

political leaders persuaded the public but because<br />

politicians reacted to the public’s own realisation of<br />

the nation’s worsening fiscal predicament. Even if<br />

bickering within the ruling camp somewhat slows the<br />

pace of fiscal restructuring, the divided Diet will,<br />

ironically, ensure that reforms are not derailed<br />

entirely (this is one of the merits of the gradualistic,<br />

consensus-based decision making in a bicameral<br />

system).<br />

Fiscal reform has wide support<br />

Issues such as pension reform and fiscal reform are<br />

national problems, so a supra-partisan approach is<br />

certainly the best way to go. Indeed, the recent fiscal<br />

restructuring programmes of Germany and the UK<br />

were decided by coalition governments. It might<br />

therefore be fortunate that the Kan government’s<br />

recently unveiled fiscal management strategy only<br />

deals with the big picture (objectives, targeted<br />

timeframes). The lack of specifics should make it<br />

easier for parties to collaborate, as they are starting<br />

with a blank slate that can be filled in together –<br />

rather than a detailed programme that must be<br />

haggled over. Each party naturally has its own vision<br />

for Japan and the optimal tax system, but the<br />

country’s dire fiscal situation should make nonpartisan<br />

cooperation on reform possible.<br />

But hurdles exist<br />

That said, there are high hurdles that must be<br />

overcome in order to achieve cooperation with the<br />

opposition. The LDP has indicated that it is prepared<br />

to engage in multiparty talks on the tax reform issue,<br />

on the condition that the DPJ scrap spending<br />

programmes that it promised in its manifesto for last<br />

year’s Lower House election (e.g. child-rearing<br />

allowances). Many reform-minded DPJ lawmakers,<br />

including cabinet ministers, would probably be<br />

amenable to amending the campaign promises in<br />

order to advance discussions on tax reform. However,<br />

the camp (led by Ichiro Ozawa) that is lukewarm on<br />

tax reform is adamant that promises must be kept. If<br />

the reformists move to get their way by force,<br />

acceding to the demands to forgo campaign<br />

promises, there is a chance that the internal divisions<br />

in the DPJ could split the party in two.<br />

Link-ups with like-minded smaller parties?<br />

As for other opposition parties, the policy ideas of<br />

small parties such as New Komeito and Your Party<br />

are similar to those of the DPJ; incorporation into the<br />

ruling coalition is thus not inconceivable. New<br />

Komeito is the most like-minded in that it recognises<br />

the necessity of tax reform (including an increased<br />

consumption tax) in order to prop up the tottering<br />

social welfare systems.<br />

However, an outright link-up with the DPJ looks<br />

unlikely, as New Komeito fought fiercely against the<br />

party in the Upper House election campaign,<br />

slamming the DPJ for its money scandals (Hatoyama,<br />

Ozawa) and ineffective leadership, and arguing that<br />

the DPJ-led coalition should be kicked out of office.<br />

New Komeito, moreover, is still closely linked with<br />

the LDP (they cooperated in the recent election by<br />

not fielding candidates against each other).<br />

Meanwhile, Your Party, a newcomer on the scene<br />

(created in 2009 by LDP defectors) which emerged<br />

as the biggest winner in the Upper House election (it<br />

gained 10 seats), advocates fiscal restructuring via<br />

spending cuts and accelerated growth; it is opposed<br />

to raising taxes. The DPJ would therefore find it<br />

difficult to secure cooperation on tax reform from this<br />

party, although the two might be able to cooperate on<br />

other issues.<br />

Behind-the-scenes horse-trading until after DPJ’s<br />

leadership election<br />

At this juncture, it is hard to gauge what kind of<br />

framework the government will adopt in running the<br />

Diet and formulating policies, including tax reforms.<br />

The DPJ has indicated that it intends to engage in<br />

policy-based cooperation with other parties, but<br />

stronger links with a specific party will be needed for<br />

stable governance. On the surface, not much is likely<br />

to happen until after the DPJ’s leadership election in<br />

September (when Kan’s fate as leader will be<br />

decided), but behind the scenes the Kan government<br />

is likely to horse-trade with other parties to win closer<br />

cooperation, or an alliance.<br />

Ryutaro Kono 16 July 2010<br />

<strong>Market</strong> Mover<br />

17<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Japan: PM Kan’s Dubious <strong>Economics</strong><br />

• Prime Minister Kan has said that tax hikes<br />

and increased government spending can boost<br />

economic growth. We fundamentally disagree<br />

with this assertion.<br />

• Kan might feel that there will be a relatively<br />

high fiscal multiplier if the government<br />

increases spending now, at a time when there<br />