Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Denmark: The Tide is Turning<br />

• Given excess liquidity in the eurozone,<br />

higher money market rates in Denmark led to an<br />

appreciation of the krone earlier in 2010.<br />

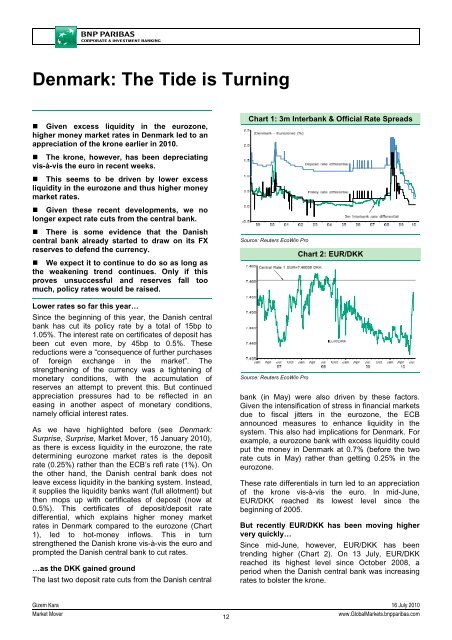

Chart 1: 3m Interbank & Official <strong>Rate</strong> Spreads<br />

• The krone, however, has been depreciating<br />

vis-à-vis the euro in recent weeks.<br />

• This seems to be driven by lower excess<br />

liquidity in the eurozone and thus higher money<br />

market rates.<br />

• Given these recent developments, we no<br />

longer expect rate cuts from the central bank.<br />

• There is some evidence that the Danish<br />

central bank already started to draw on its FX<br />

reserves to defend the currency.<br />

• We expect it to continue to do so as long as<br />

the weakening trend continues. Only if this<br />

proves unsuccessful and reserves fall too<br />

much, policy rates would be raised.<br />

Lower rates so far this year…<br />

Since the beginning of this year, the Danish central<br />

bank has cut its policy rate by a total of 15bp to<br />

1.05%. The interest rate on certificates of deposit has<br />

been cut even more, by 45bp to 0.5%. These<br />

reductions were a “consequence of further purchases<br />

of foreign exchange in the market”. The<br />

strengthening of the currency was a tightening of<br />

monetary conditions, with the accumulation of<br />

reserves an attempt to prevent this. But continued<br />

appreciation pressures had to be reflected in an<br />

easing in another aspect of monetary conditions,<br />

namely official interest rates.<br />

As we have highlighted before (see Denmark:<br />

Surprise, Surprise, <strong>Market</strong> Mover, 15 January 2010),<br />

as there is excess liquidity in the eurozone, the rate<br />

determining eurozone market rates is the deposit<br />

rate (0.25%) rather than the ECB’s refi rate (1%). On<br />

the other hand, the Danish central bank does not<br />

leave excess liquidity in the banking system. Instead,<br />

it supplies the liquidity banks want (full allotment) but<br />

then mops up with certificates of deposit (now at<br />

0.5%). This certificates of deposit/deposit rate<br />

differential, which explains higher money market<br />

rates in Denmark compared to the eurozone (Chart<br />

1), led to hot-money inflows. This in turn<br />

strengthened the Danish krone vis-à-vis the euro and<br />

prompted the Danish central bank to cut rates.<br />

…as the DKK gained ground<br />

The last two deposit rate cuts from the Danish central<br />

Source: Reuters EcoWin Pro<br />

Source: Reuters EcoWin Pro<br />

Chart 2: EUR/DKK<br />

bank (in May) were also driven by these factors.<br />

Given the intensification of stress in financial markets<br />

due to fiscal jitters in the eurozone, the ECB<br />

announced measures to enhance liquidity in the<br />

system. This also had implications for Denmark. For<br />

example, a eurozone bank with excess liquidity could<br />

put the money in Denmark at 0.7% (before the two<br />

rate cuts in May) rather than getting 0.25% in the<br />

eurozone.<br />

These rate differentials in turn led to an appreciation<br />

of the krone vis-à-vis the euro. In mid-June,<br />

EUR/DKK reached its lowest level since the<br />

beginning of 2005.<br />

But recently EUR/DKK has been moving higher<br />

very quickly…<br />

Since mid-June, however, EUR/DKK has been<br />

trending higher (Chart 2). On 13 July, EUR/DKK<br />

reached its highest level since October 2008, a<br />

period when the Danish central bank was increasing<br />

rates to bolster the krone.<br />

Gizem Kara 16 July 2010<br />

<strong>Market</strong> Mover<br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com