Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

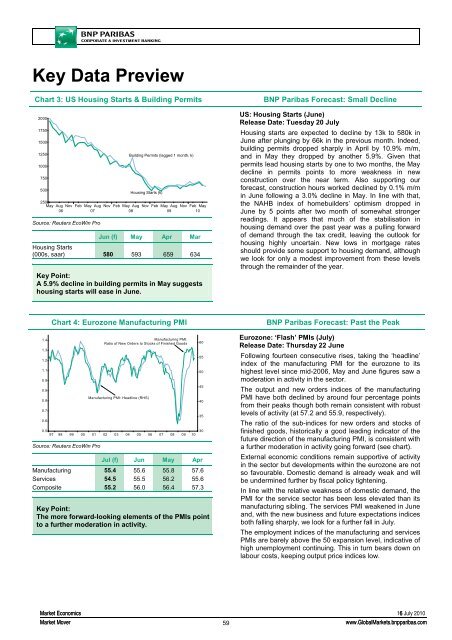

Chart 3: US Housing Starts & Building Permits<br />

2000<br />

1750<br />

1500<br />

1250<br />

1000<br />

750<br />

500<br />

Building Permits (lagged 1 month, k)<br />

Housing Starts (k)<br />

250<br />

May Aug Nov Feb May Aug Nov Feb May Aug Nov Feb May Aug Nov Feb May<br />

06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Jun (f) May Apr Mar<br />

Housing Starts<br />

(000s, saar) 580 593 659 634<br />

Key Point:<br />

A 5.9% decline in building permits in May suggests<br />

housing starts will ease in June.<br />

<strong>BNP</strong> Paribas Forecast: Small Decline<br />

US: Housing Starts (June)<br />

Release Date: Tuesday 20 July<br />

Housing starts are expected to decline by 13k to 580k in<br />

June after plunging by 66k in the previous month. Indeed,<br />

building permits dropped sharply in April by 10.9% m/m,<br />

and in May they dropped by another 5.9%. Given that<br />

permits lead housing starts by one to two months, the May<br />

decline in permits points to more weakness in new<br />

construction over the near term. Also supporting our<br />

forecast, construction hours worked declined by 0.1% m/m<br />

in June following a 3.0% decline in May. In line with that,<br />

the NAHB index of homebuilders’ optimism dropped in<br />

June by 5 points after two month of somewhat stronger<br />

readings. It appears that much of the stabilisation in<br />

housing demand over the past year was a pulling forward<br />

of demand through the tax credit, leaving the outlook for<br />

housing highly uncertain. New lows in mortgage rates<br />

should provide some support to housing demand, although<br />

we look for only a modest improvement from these levels<br />

through the remainder of the year.<br />

1.2<br />

1.1<br />

0.9<br />

0.9<br />

0.8<br />

0.7<br />

0.6<br />

Chart 4: Eurozone Manufacturing PMI<br />

1.4 Manufacturing PMI:<br />

Ratio of New Orders to Stocks of Finished Goods<br />

1.3<br />

Manufacturing PMI: Headline (RHS)<br />

0.5<br />

30<br />

97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Jul (f) Jun May Apr<br />

Manufacturing 55.4 55.6 55.8 57.6<br />

Services 54.5 55.5 56.2 55.6<br />

Composite 55.2 56.0 56.4 57.3<br />

Key Point:<br />

The more forward-looking elements of the PMIs point<br />

to a further moderation in activity.<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

<strong>BNP</strong> Paribas Forecast: Past the Peak<br />

Eurozone: ‘Flash’ PMIs (July)<br />

Release Date: Thursday 22 June<br />

Following fourteen consecutive rises, taking the ‘headline’<br />

index of the manufacturing PMI for the eurozone to its<br />

highest level since mid-2006, May and June figures saw a<br />

moderation in activity in the sector.<br />

The output and new orders indices of the manufacturing<br />

PMI have both declined by around four percentage points<br />

from their peaks though both remain consistent with robust<br />

levels of activity (at 57.2 and 55.9, respectively).<br />

The ratio of the sub-indices for new orders and stocks of<br />

finished goods, historically a good leading indicator of the<br />

future direction of the manufacturing PMI, is consistent with<br />

a further moderation in activity going forward (see chart).<br />

External economic conditions remain supportive of activity<br />

in the sector but developments within the eurozone are not<br />

so favourable. Domestic demand is already weak and will<br />

be undermined further by fiscal policy tightening.<br />

In line with the relative weakness of domestic demand, the<br />

PMI for the service sector has been less elevated than its<br />

manufacturing sibling. The services PMI weakened in June<br />

and, with the new business and future expectations indices<br />

both falling sharply, we look for a further fall in July.<br />

The employment indices of the manufacturing and services<br />

PMIs are barely above the 50 expansion level, indicative of<br />

high unemployment continuing. This in turn bears down on<br />

labour costs, keeping output price indices low.<br />

<strong>Market</strong> <strong>Economics</strong> 166 July 2010<br />

<strong>Market</strong> Mover<br />

59<br />

www.Global<strong>Market</strong>s.bnpparibas.com