Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

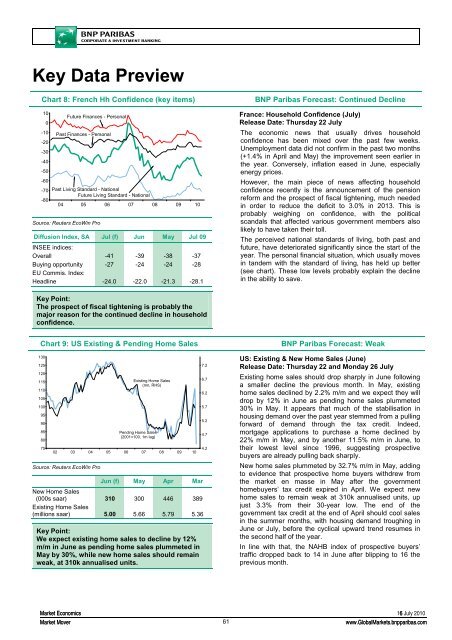

Chart 8: French Hh Confidence (key items)<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

Future Finances - Personal<br />

Past Finances - Personal<br />

-70 Past Living Standard - National<br />

Future Living Standard - National<br />

-80<br />

04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Diffusion Index, SA Jul (f) Jun May Jul 09<br />

INSEE indices:<br />

Overall -41 -39 -38 -37<br />

Buying opportunity -27 -24 -24 -28<br />

EU Commis. Index:<br />

Headline -24.0 -22.0 -21.3 -28.1<br />

<strong>BNP</strong> Paribas Forecast: Continued Decline<br />

France: Household Confidence (July)<br />

Release Date: Thursday 22 July<br />

The economic news that usually drives household<br />

confidence has been mixed over the past few weeks.<br />

Unemployment data did not confirm in the past two months<br />

(+1.4% in April and May) the improvement seen earlier in<br />

the year. Conversely, inflation eased in June, especially<br />

energy prices.<br />

However, the main piece of news affecting household<br />

confidence recently is the announcement of the pension<br />

reform and the prospect of fiscal tightening, much needed<br />

in order to reduce the deficit to 3.0% in 2013. This is<br />

probably weighing on confidence, with the political<br />

scandals that affected various government members also<br />

likely to have taken their toll.<br />

The perceived national standards of living, both past and<br />

future, have deteriorated significantly since the start of the<br />

year. The personal financial situation, which usually moves<br />

in tandem with the standard of living, has held up better<br />

(see chart). These low levels probably explain the decline<br />

in the ability to save.<br />

Key Point:<br />

The prospect of fiscal tightening is probably the<br />

major reason for the continued decline in household<br />

confidence.<br />

Chart 9: US Existing & Pending Home Sales<br />

130<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

Existing Home Sales<br />

(mn, RHS)<br />

Pending Home Sales<br />

(2001=100, 1m lag)<br />

02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Jun (f) May Apr Mar<br />

New Home Sales<br />

(000s saar) 310 300 446 389<br />

Existing Home Sales<br />

(millions saar) 5.00 5.66 5.79 5.36<br />

Key Point:<br />

We expect existing home sales to decline by 12%<br />

m/m in June as pending home sales plummeted in<br />

May by 30%, while new home sales should remain<br />

weak, at 310k annualised units.<br />

7.2<br />

6.7<br />

6.2<br />

5.7<br />

5.2<br />

4.7<br />

4.2<br />

<strong>BNP</strong> Paribas Forecast: Weak<br />

US: Existing & New Home Sales (June)<br />

Release Date: Thursday 22 and Monday 26 July<br />

Existing home sales should drop sharply in June following<br />

a smaller decline the previous month. In May, existing<br />

home sales declined by 2.2% m/m and we expect they will<br />

drop by 12% in June as pending home sales plummeted<br />

30% in May. It appears that much of the stabilisation in<br />

housing demand over the past year stemmed from a pulling<br />

forward of demand through the tax credit. Indeed,<br />

mortgage applications to purchase a home declined by<br />

22% m/m in May, and by another 11.5% m/m in June, to<br />

their lowest level since 1996, suggesting prospective<br />

buyers are already pulling back sharply.<br />

New home sales plummeted by 32.7% m/m in May, adding<br />

to evidence that prospective home buyers withdrew from<br />

the market en masse in May after the government<br />

homebuyers’ tax credit expired in April. We expect new<br />

home sales to remain weak at 310k annualised units, up<br />

just 3.3% from their 30-year low. The end of the<br />

government tax credit at the end of April should cool sales<br />

in the summer months, with housing demand troughing in<br />

June or July, before the cyclical upward trend resumes in<br />

the second half of the year.<br />

In line with that, the NAHB index of prospective buyers’<br />

traffic dropped back to 14 in June after blipping to 16 the<br />

previous month.<br />

<strong>Market</strong> <strong>Economics</strong> 166 July 2010<br />

<strong>Market</strong> Mover<br />

61<br />

www.Global<strong>Market</strong>s.bnpparibas.com