Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

averaging introduces sizable upside bias (0.5%)<br />

relative to the ‘geometric’ CPI. Over 10 years, we find<br />

the RPI/CPI spread averages 71bp vs. 54bp over the<br />

past 20 years but is very sensitive to the start<br />

date/period. Assuming CPI is 0.75% below RPI (on<br />

average) and all private sector pension funds switch<br />

to CPI (unlikely) – we see a maximum impact on the<br />

net funding position in the region of £70bn (which<br />

would be similar to the benefit from PPF’s actuarial<br />

changes in Oct-09). With many private pension funds<br />

unlikely to be included in CPI indexation bracket, at<br />

least in the current state of legislation, the use of<br />

AER (instead of SVR) in MIPS and the encapsulation<br />

of housing related prices eventually in CPI suggest<br />

the gap could be lower over time (subject to a likely<br />

lower bound of 0.50% from formula effect). We<br />

expect the realised impact on aggregate PFs’ net<br />

asset/liability to be closer to half this amount (around<br />

£30-40bn). However, optionality in indexation of<br />

pensions (caps and floors) and maximum of (CPI,<br />

RPI and cap) in cases where the Trust Deed<br />

specifies RPI but is subject to the statutory minimum<br />

requirement (CPI), complicates the issue and under<br />

certain assumptions could even increase pension<br />

fund liabilities (according to Redington).<br />

<strong>Market</strong> downplays Risk of Switch to CPI<br />

Understandably, the announcement from Steve<br />

Webb triggered a correction in (long-end)<br />

breakevens. Uncertainty over the impact on private<br />

sector PFs could cause LDI programmes to be<br />

scaled back or placed on hold, weighing further on<br />

breakevens (and liquidity) near-term as sovereign<br />

supply continues. That said, greater net asset/liability<br />

positions (lower deficits/higher surpluses) tend to<br />

encourage LDI hedging and as a consequence are<br />

associated with higher long-end breakeven levels –<br />

Chart 4. In fact, certain LDI related counterparties<br />

have actually increased RPI exposure following the<br />

initial setback against our expectations although<br />

flows are reversing after the UKTi-22 auction.<br />

In Table 2, we estimate LDI demand using the<br />

duration gap (or shortfall) between aggregate PF<br />

assets and liabilities (from PPF data) using typical<br />

actuarial assumptions and liabilities. With respect to<br />

supply, we duration-weight the total market<br />

capitalisation of GBP sovereign and corporate bonds<br />

for both nominal and index-linked markets. Finally,<br />

we combine our demand/supply analysis to gauge<br />

the adequacy of inflation supply to meet pension<br />

funds’ requirements. Relative to the market<br />

capitalisation of outstanding GBP linkers (all RPIlinked),<br />

demand outstrips outstanding market<br />

capitalisation by more than 3 times (compared to<br />

1.15 for nominals). We estimate at least GBP 110bn<br />

(or 57%) of the GBP linker market (by market<br />

capitalisation) is held by DB pension funds (at end-<br />

March 2009) based on Purple Book 2009 – Table 3.<br />

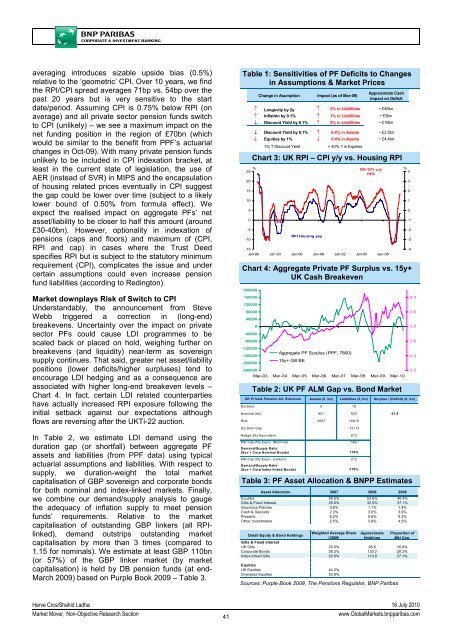

Table 1: Sensitivities of PF Deficits to Changes<br />

in Assumptions & <strong>Market</strong> Prices<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

Change in Asumption<br />

Impact (as of Mar-09)<br />

Approximate Cash<br />

Impact on Deficit<br />

↑ Longevity by 2y ↑ 5% in Liabilities ~ £45bn<br />

↑ Inflation by 0.1% ↑ 1% in Liabilities ~ £9bn<br />

↓ Discount Yield by 0.1% ↑ 2% in Liabilities ~ £18bn<br />

↓ Discount Yield by 0.1% ↑ 0.4% in Assets ~ £3.5bn<br />

↓ Equities by 1% ↓ 0.4% in Assets ~ £4.4bn<br />

1% ? Discount Yield = 40% ? in Equities<br />

Chart 3: UK RPI – CPI y/y vs. Housing RPI<br />

% RPI-CPI yoy<br />

%<br />

25<br />

4<br />

RHS<br />

RPI Housing yoy<br />

-15<br />

Jan-90 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Jan-08<br />

Chart 4: Aggregate Private PF Surplus vs. 15y+<br />

UK Cash Breakeven<br />

200000<br />

160000<br />

120000<br />

80000<br />

40000<br />

0<br />

-40000<br />

-80000<br />

-120000<br />

-160000<br />

-200000<br />

Aggregate PF Surplus (PPF, 7800)<br />

15y+ Gilt BE<br />

-240000<br />

Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10<br />

Table 2: UK PF ALM Gap vs. Bond <strong>Market</strong><br />

UK Private Pension A/L Structure<br />

Assets (£, bn) Liabilities (£, bn) Surplus / (Deficit) (£, bn)<br />

Duration 5 18<br />

Nominal (bn) 901 923 -21.8<br />

Risk 4507 16619<br />

Duration Gap -12112<br />

Hedge 20y Equivalent 673<br />

Mkt Cap 20y Equiv. (Nominal)<br />

Demand/Supply Ratio<br />

582<br />

(Sov + Corp Nominal Bonds)<br />

116%<br />

Mkt Cap 20y Equiv. (Linkers)<br />

Demand/Supply Ratio<br />

212<br />

(Sov + Corp Index-linked Bonds)<br />

318%<br />

Table 3: PF Asset Allocation & <strong>BNP</strong>P Estimates<br />

Asset Allocation 2007 2008 2009<br />

Equities 59.5% 53.6% 46.4%<br />

Gilts & Fixed <strong>Interest</strong> 29.6% 32.9% 37.1%<br />

Insurance Policies 0.8% 1.1% 1.4%<br />

Cash & Deposits 2.3% 3.0% 3.9%<br />

Property 5.2% 5.6% 5.2%<br />

Other Investments 2.5% 3.8% 4.5%<br />

Detail Equity & Bond Holdings<br />

Weighted Average Share<br />

(2009)<br />

Approximate<br />

Holdings<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

4.0<br />

3.6<br />

3.2<br />

2.8<br />

2.4<br />

2.0<br />

Proportion of<br />

Mkt Cap.<br />

Gilts & Fixed <strong>Interest</strong><br />

UK Gilts 29.0% 98.6 16.8%<br />

Corporate Bonds 38.3% 130.2 28.2%<br />

Index-linked Gilts 32.6% 110.8 57.1%<br />

Equities<br />

UK Equities 44.2%<br />

Overseas Equities 53.8%<br />

Sources: Purple Book 2009, The Pensions Regulator, <strong>BNP</strong> Paribas<br />

Herve Cros/Shahid Ladha 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

41<br />

www.Global<strong>Market</strong>s.bnpparibas.com