Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

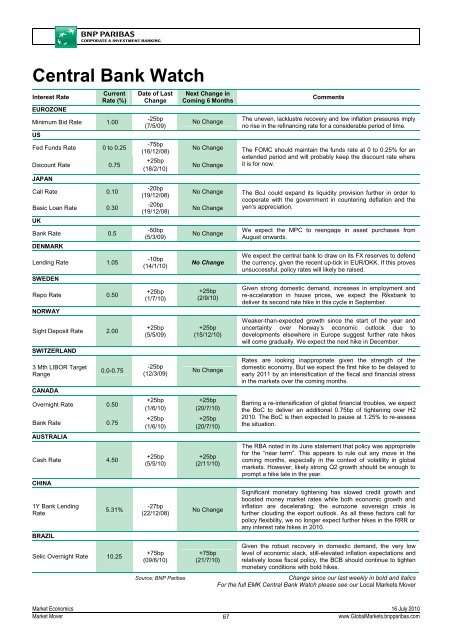

Central Bank Watch<br />

<strong>Interest</strong> <strong>Rate</strong><br />

EUROZONE<br />

Current<br />

<strong>Rate</strong> (%)<br />

Minimum Bid <strong>Rate</strong> 1.00<br />

US<br />

Fed Funds <strong>Rate</strong> 0 to 0.25<br />

Discount <strong>Rate</strong> 0.75<br />

JAPAN<br />

Call <strong>Rate</strong> 0.10<br />

Basic Loan <strong>Rate</strong> 0.30<br />

UK<br />

Bank <strong>Rate</strong> 0.5<br />

DENMARK<br />

Lending <strong>Rate</strong> 1.05<br />

SWEDEN<br />

Repo <strong>Rate</strong> 0.50<br />

NORWAY<br />

Sight Deposit <strong>Rate</strong> 2.00<br />

SWITZERLAND<br />

3 Mth LIBOR Target<br />

Range<br />

CANADA<br />

0.0-0.75<br />

Overnight <strong>Rate</strong> 0.50<br />

Bank <strong>Rate</strong> 0.75<br />

AUSTRALIA<br />

Cash <strong>Rate</strong> 4.50<br />

CHINA<br />

1Y Bank Lending<br />

<strong>Rate</strong><br />

BRAZIL<br />

5.31%<br />

Selic Overnight <strong>Rate</strong> 10.25<br />

Date of Last<br />

Change<br />

-25bp<br />

(7/5/09)<br />

-75bp<br />

(16/12/08)<br />

+25bp<br />

(18/2/10)<br />

-20bp<br />

(19/12/08)<br />

-20bp<br />

(19/12/08)<br />

-50bp<br />

(5/3/09)<br />

-10bp<br />

(14/1/10)<br />

+25bp<br />

(1/7/10)<br />

+25bp<br />

(5/5/09)<br />

-25bp<br />

(12/3/09)<br />

+25bp<br />

(1/6/10)<br />

+25bp<br />

(1/6/10)<br />

+25bp<br />

(5/5/10)<br />

-27bp<br />

(22/12/08)<br />

+75bp<br />

(09/6/10)<br />

Source: <strong>BNP</strong> Paribas<br />

Next Change in<br />

Coming 6 Months<br />

No Change<br />

No Change<br />

No Change<br />

No Change<br />

No Change<br />

No Change<br />

No Change<br />

+25bp<br />

(2/9/10)<br />

+25bp<br />

(15/12/10)<br />

No Change<br />

+25bp<br />

(20/7/10)<br />

+25bp<br />

(20/7/10)<br />

+25bp<br />

(2/11/10)<br />

No Change<br />

+75bp<br />

(21/7/10)<br />

Comments<br />

The uneven, lacklustre recovery and low inflation pressures imply<br />

no rise in the refinancing rate for a considerable period of time.<br />

The FOMC should maintain the funds rate at 0 to 0.25% for an<br />

extended period and will probably keep the discount rate where<br />

it is for now.<br />

The BoJ could expand its liquidity provision further in order to<br />

cooperate with the government in countering deflation and the<br />

yen’s appreciation.<br />

We expect the MPC to reengage in asset purchases from<br />

August onwards.<br />

We expect the central bank to draw on its FX reserves to defend<br />

the currency, given the recent up-tick in EUR/DKK. If this proves<br />

unsuccessful, policy rates will likely be raised.<br />

Given strong domestic demand, increases in employment and<br />

re-accelaration in house prices, we expect the Riksbank to<br />

deliver its second rate hike in this cycle in September.<br />

Weaker-than-expected growth since the start of the year and<br />

uncertainty over Norway’s economic outlook due to<br />

developments elsewhere in Europe suggest further rate hikes<br />

will come gradually. We expect the next hike in December.<br />

<strong>Rate</strong>s are looking inappropriate given the strength of the<br />

domestic economy. But we expect the first hike to be delayed to<br />

early 2011 by an intensification of the fiscal and financial stress<br />

in the markets over the coming months.<br />

Barring a re-intensification of global financial troubles, we expect<br />

the BoC to deliver an additional 0.75bp of tightening over H2<br />

2010. The BoC is then expected to pause at 1.25% to re-assess<br />

the situation.<br />

The RBA noted in its June statement that policy was appropriate<br />

for the “near term”. This appears to rule out any move in the<br />

coming months, especially in the context of volatility in global<br />

markets. However, likely strong Q2 growth should be enough to<br />

prompt a hike late in the year.<br />

Significant monetary tightening has slowed credit growth and<br />

boosted money market rates while both economic growth and<br />

inflation are decelerating; the eurozone sovereign crisis is<br />

further clouding the export outlook. As all these factors call for<br />

policy flexibility, we no longer expect further hikes in the RRR or<br />

any interest rate hikes in 2010.<br />

Given the robust recovery in domestic demand, the very low<br />

level of economic slack, still-elevated inflation expectations and<br />

relatively loose fiscal policy, the BCB should continue to tighten<br />

monetary conditions with bold hikes.<br />

Change since our last weekly in bold and italics<br />

For the full EMK Central Bank Watch please see our Local <strong>Market</strong>s Mover<br />

<strong>Market</strong> <strong>Economics</strong> 16 July 2010<br />

<strong>Market</strong> Mover<br />

67<br />

www.Global<strong>Market</strong>s.bnpparibas.com