Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

term structure models mentioned below that 30-year<br />

spread dynamics have been incorporated with some<br />

success into the standard framework.<br />

One of the drawbacks to linear regression models is<br />

that they can’t capture any tendency for the influence<br />

of the factors to vary over time or operate across<br />

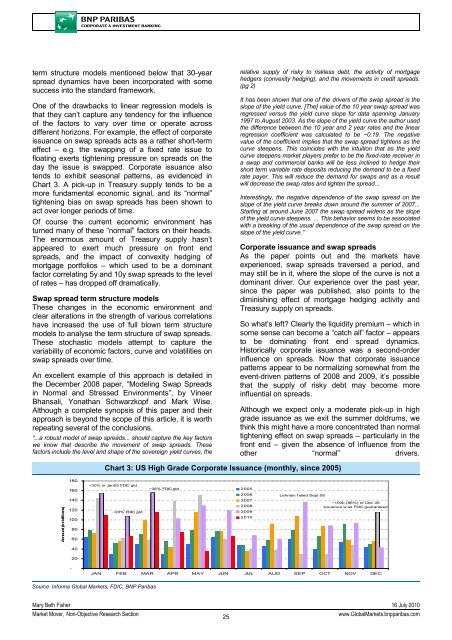

different horizons. For example, the effect of corporate<br />

issuance on swap spreads acts as a rather short-term<br />

effect – e.g. the swapping of a fixed rate issue to<br />

floating exerts tightening pressure on spreads on the<br />

day the issue is swapped. Corporate issuance also<br />

tends to exhibit seasonal patterns, as evidenced in<br />

Chart 3. A pick-up in Treasury supply tends to be a<br />

more fundamental economic signal, and its “normal”<br />

tightening bias on swap spreads has been shown to<br />

act over longer periods of time.<br />

Of course the current economic environment has<br />

turned many of these “normal” factors on their heads.<br />

The enormous amount of Treasury supply hasn’t<br />

appeared to exert much pressure on front end<br />

spreads, and the impact of convexity hedging of<br />

mortgage portfolios – which used to be a dominant<br />

factor correlating 5y and 10y swap spreads to the level<br />

of rates – has dropped off dramatically.<br />

Swap spread term structure models<br />

These changes in the economic environment and<br />

clear alterations in the strength of various correlations<br />

have increased the use of full blown term structure<br />

models to analyse the term structure of swap spreads.<br />

These stochastic models attempt to capture the<br />

variability of economic factors, curve and volatilities on<br />

swap spreads over time.<br />

An excellent example of this approach is detailed in<br />

the December 2008 paper, “Modeling Swap Spreads<br />

in Normal and Stressed Environments”, by Vineer<br />

Bhansali, Yonathan Schwarzkopf and Mark Wise.<br />

Although a complete synopsis of this paper and their<br />

approach is beyond the scope of this article, it is worth<br />

repeating several of the conclusions.<br />

“...a robust model of swap spreads... should capture the key factors<br />

we know that describe the movement of swap spreads. These<br />

factors include the level and shape of the sovereign yield curves, the<br />

relative supply of risky to riskless debt, the activity of mortgage<br />

hedgers (convexity hedging), and the movements in credit spreads.<br />

(pg 2)<br />

It has been shown that one of the drivers of the swap spread is the<br />

slope of the yield curve. [The] value of the 10 year swap spread was<br />

regressed versus the yield curve slope for data spanning January<br />

1997 to August 2003. As the slope of the yield curve the author used<br />

the difference between the 10 year and 2 year rates and the linear<br />

regression coefficient was calculated to be −0.19. The negative<br />

value of the coefficient implies that the swap spread tightens as the<br />

curve steepens. This coincides with the intuition that as the yield<br />

curve steepens market players prefer to be the fixed-rate receiver in<br />

a swap and commercial banks will be less inclined to hedge their<br />

short term variable rate deposits reducing the demand to be a fixed<br />

rate payer. This will reduce the demand for swaps and as a result<br />

will decrease the swap rates and tighten the spread...<br />

<strong>Interest</strong>ingly, the negative dependence of the swap spread on the<br />

slope of the yield curve breaks down around the summer of 2007...<br />

Starting at around June 2007 the swap spread widens as the slope<br />

of the yield curve steepens. ... This behavior seems to be associated<br />

with a breaking of the usual dependence of the swap spread on the<br />

slope of the yield curve.”<br />

Corporate issuance and swap spreads<br />

As the paper points out and the markets have<br />

experienced, swap spreads traversed a period, and<br />

may still be in it, where the slope of the curve is not a<br />

dominant driver. Our experience over the past year,<br />

since the paper was published, also points to the<br />

diminishing effect of mortgage hedging activity and<br />

Treasury supply on spreads.<br />

So what’s left? Clearly the liquidity premium – which in<br />

some sense can become a “catch all” factor – appears<br />

to be dominating front end spread dynamics.<br />

Historically corporate issuance was a second-order<br />

influence on spreads. Now that corporate issuance<br />

patterns appear to be normalizing somewhat from the<br />

event-driven patterns of 2008 and 2009, it’s possible<br />

that the supply of risky debt may become more<br />

influential on spreads.<br />

Although we expect only a moderate pick-up in high<br />

grade issuance as we exit the summer doldrums, we<br />

think this might have a more concentrated than normal<br />

tightening effect on swap spreads – particularly in the<br />

front end – given the absence of influence from the<br />

other “normal” drivers.<br />

Chart 3: US High Grade Corporate Issuance (monthly, since 2005)<br />

Amount (in billions)<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

~30% in Jan09 FDIC gtd<br />

~20% FDIC gtd<br />

~36% FDIC gtd<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

Lehman failed Sept 08<br />

~100b (86%) of Dec 08<br />

issuance w as FDIC guaranteed<br />

40<br />

20<br />

-<br />

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC<br />

Source: Informa Global <strong>Market</strong>s, FDIC, <strong>BNP</strong> Paribas<br />

Mary Beth Fisher 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

25<br />

www.Global<strong>Market</strong>s.bnpparibas.com