Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

China: House Price Controls to Continue<br />

• Since April 17, China has tightened policy in<br />

order to control housing prices, focusing on<br />

suppressing investment and speculative<br />

demand.<br />

50<br />

45<br />

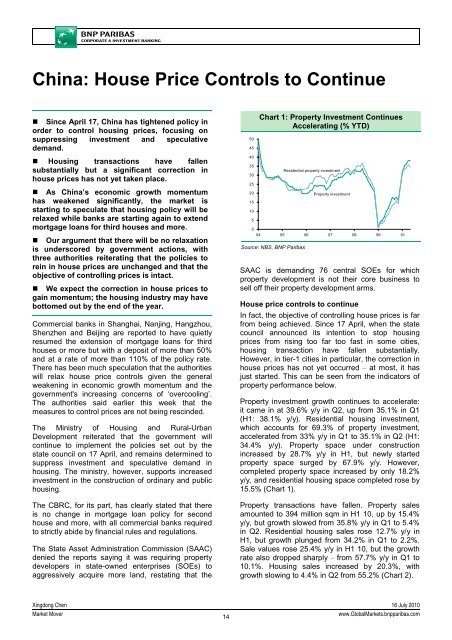

Chart 1: Property Investment Continues<br />

Accelerating (% YTD)<br />

• Housing transactions have fallen<br />

substantially but a significant correction in<br />

house prices has not yet taken place.<br />

• As China’s economic growth momentum<br />

has weakened significantly, the market is<br />

starting to speculate that housing policy will be<br />

relaxed while banks are starting again to extend<br />

mortgage loans for third houses and more.<br />

• Our argument that there will be no relaxation<br />

is underscored by government actions, with<br />

three authorities reiterating that the policies to<br />

rein in house prices are unchanged and that the<br />

objective of controlling prices is intact.<br />

• We expect the correction in house prices to<br />

gain momentum; the housing industry may have<br />

bottomed out by the end of the year.<br />

Commercial banks in Shanghai, Nanjing, Hangzhou,<br />

Shenzhen and Beijing are reported to have quietly<br />

resumed the extension of mortgage loans for third<br />

houses or more but with a deposit of more than 50%<br />

and at a rate of more than 110% of the policy rate.<br />

There has been much speculation that the authorities<br />

will relax house price controls given the general<br />

weakening in economic growth momentum and the<br />

government's increasing concerns of ‘overcooling’.<br />

The authorities said earlier this week that the<br />

measures to control prices are not being rescinded.<br />

The Ministry of Housing and Rural-Urban<br />

Development reiterated that the government will<br />

continue to implement the policies set out by the<br />

state council on 17 April, and remains determined to<br />

suppress investment and speculative demand in<br />

housing. The ministry, however, supports increased<br />

investment in the construction of ordinary and public<br />

housing.<br />

The CBRC, for its part, has clearly stated that there<br />

is no change in mortgage loan policy for second<br />

house and more, with all commercial banks required<br />

to strictly abide by financial rules and regulations.<br />

The State Asset Administration Commission (SAAC)<br />

denied the reports saying it was requiring property<br />

developers in state-owned enterprises (SOEs) to<br />

aggressively acquire more land, restating that the<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

04 05 06 07 08 09 10<br />

Source: NBS, <strong>BNP</strong> Paribas<br />

Residential property investment<br />

Property investment<br />

SAAC is demanding 76 central SOEs for which<br />

property development is not their core business to<br />

sell off their property development arms.<br />

House price controls to continue<br />

In fact, the objective of controlling house prices is far<br />

from being achieved. Since 17 April, when the state<br />

council announced its intention to stop housing<br />

prices from rising too far too fast in some cities,<br />

housing transaction have fallen substantially.<br />

However, in tier-1 cities in particular, the correction in<br />

house prices has not yet occurred – at most, it has<br />

just started. This can be seen from the indicators of<br />

property performance below.<br />

Property investment growth continues to accelerate:<br />

it came in at 39.6% y/y in Q2, up from 35.1% in Q1<br />

(H1: 38.1% y/y). Residential housing investment,<br />

which accounts for 69.3% of property investment,<br />

accelerated from 33% y/y in Q1 to 35.1% in Q2 (H1:<br />

34.4% y/y). Property space under construction<br />

increased by 28.7% y/y in H1, but newly started<br />

property space surged by 67.9% y/y. However,<br />

completed property space increased by only 18.2%<br />

y/y, and residential housing space completed rose by<br />

15.5% (Chart 1).<br />

Property transactions have fallen. Property sales<br />

amounted to 394 million sqm in H1 10, up by 15.4%<br />

y/y, but growth slowed from 35.8% y/y in Q1 to 5.4%<br />

in Q2. Residential housing sales rose 12.7% y/y in<br />

H1, but growth plunged from 34.2% in Q1 to 2.2%.<br />

Sale values rose 25.4% y/y in H1 10, but the growth<br />

rate also dropped sharply – from 57.7% y/y in Q1 to<br />

10.1%. Housing sales increased by 20.3%, with<br />

growth slowing to 4.4% in Q2 from 55.2% (Chart 2).<br />

Xingdong Chen 16 July 2010<br />

<strong>Market</strong> Mover<br />

14<br />

www.Global<strong>Market</strong>s.bnpparibas.com