Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

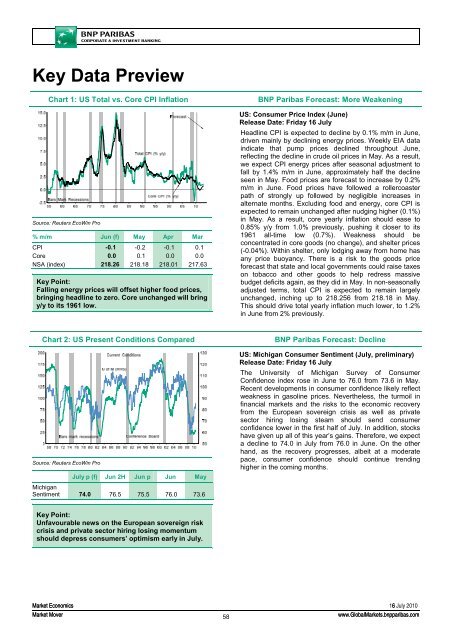

Chart 1: US Total vs. Core CPI Inflation<br />

Source: Reuters EcoWin Pro<br />

% m/m Jun (f) May Apr Mar<br />

CPI -0.1 -0.2 -0.1 0.1<br />

Core 0.0 0.1 0.0 0.0<br />

NSA (index) 218.26 218.18 218.01 217.63<br />

Key Point:<br />

Falling energy prices will offset higher food prices,<br />

bringing headline to zero. Core unchanged will bring<br />

y/y to its 1961 low.<br />

<strong>BNP</strong> Paribas Forecast: More Weakening<br />

US: Consumer Price Index (June)<br />

Release Date: Friday 16 July<br />

Headline CPI is expected to decline by 0.1% m/m in June,<br />

driven mainly by declining energy prices. Weekly EIA data<br />

indicate that pump prices declined throughout June,<br />

reflecting the decline in crude oil prices in May. As a result,<br />

we expect CPI energy prices after seasonal adjustment to<br />

fall by 1.4% m/m in June, approximately half the decline<br />

seen in May. Food prices are forecast to increase by 0.2%<br />

m/m in June. Food prices have followed a rollercoaster<br />

path of strongly up followed by negligible increases in<br />

alternate months. Excluding food and energy, core CPI is<br />

expected to remain unchanged after nudging higher (0.1%)<br />

in May. As a result, core yearly inflation should ease to<br />

0.85% y/y from 1.0% previously, pushing it closer to its<br />

1961 all-time low (0.7%). Weakness should be<br />

concentrated in core goods (no change), and shelter prices<br />

(-0.04%). Within shelter, only lodging away from home has<br />

any price buoyancy. There is a risk to the goods price<br />

forecast that state and local governments could raise taxes<br />

on tobacco and other goods to help redress massive<br />

budget deficits again, as they did in May. In non-seasonally<br />

adjusted terms, total CPI is expected to remain largely<br />

unchanged, inching up to 218.256 from 218.18 in May.<br />

This should drive total yearly inflation much lower, to 1.2%<br />

in June from 2% previously.<br />

Chart 2: US Present Conditions Compared<br />

Source: Reuters EcoWin Pro<br />

July p (f) Jun 2H Jun p Jun May<br />

Michigan<br />

Sentiment 74.0 76.5 75.5 76.0 73.6<br />

<strong>BNP</strong> Paribas Forecast: Decline<br />

US: Michigan Consumer Sentiment (July, preliminary)<br />

Release Date: Friday 16 July<br />

The University of Michigan Survey of Consumer<br />

Confidence index rose in June to 76.0 from 73.6 in May.<br />

Recent developments in consumer confidence likely reflect<br />

weakness in gasoline prices. Nevertheless, the turmoil in<br />

financial markets and the risks to the economic recovery<br />

from the European sovereign crisis as well as private<br />

sector hiring losing steam should send consumer<br />

confidence lower in the first half of July. In addition, stocks<br />

have given up all of this year’s gains. Therefore, we expect<br />

a decline to 74.0 in July from 76.0 in June. On the other<br />

hand, as the recovery progresses, albeit at a moderate<br />

pace, consumer confidence should continue trending<br />

higher in the coming months.<br />

Key Point:<br />

Unfavourable news on the European sovereign risk<br />

crisis and private sector hiring losing momentum<br />

should depress consumers’ optimism early in July.<br />

<strong>Market</strong> <strong>Economics</strong> 166 July 2010<br />

<strong>Market</strong> Mover<br />

58<br />

www.Global<strong>Market</strong>s.bnpparibas.com