Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MBS: Higher Coupons Could Speed Up Later<br />

• Refi risk in current coupon mortgages<br />

could cause them to trade to shorter empirical<br />

durations. Due to this factor, we maintain a<br />

neutral outlook on mortgages.<br />

• Higher coupon prepays could pick up over<br />

coming months as the credit impaired nature<br />

of such borrowers might have delayed<br />

processing.<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

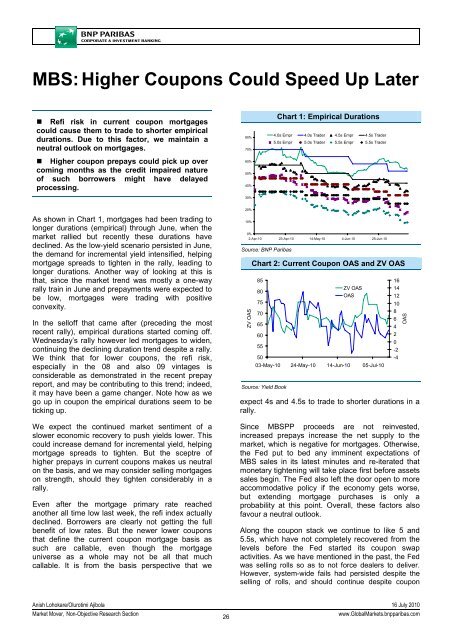

Chart 1: Empirical Durations<br />

4.0s Empr 4.0s Trader 4.5s Empr 4.5s Trader<br />

5.0s Empr 5.0s Trader 5.5s Empr 5.5s Trader<br />

30%<br />

20%<br />

As shown in Chart 1, mortgages had been trading to<br />

longer durations (empirical) through June, when the<br />

market rallied but recently these durations have<br />

declined. As the low-yield scenario persisted in June,<br />

the demand for incremental yield intensified, helping<br />

mortgage spreads to tighten in the rally, leading to<br />

longer durations. Another way of looking at this is<br />

that, since the market trend was mostly a one-way<br />

rally train in June and prepayments were expected to<br />

be low, mortgages were trading with positive<br />

convexity.<br />

In the selloff that came after (preceding the most<br />

recent rally), empirical durations started coming off.<br />

Wednesday’s rally however led mortgages to widen,<br />

continuing the declining duration trend despite a rally.<br />

We think that for lower coupons, the refi risk,<br />

especially in the 08 and also 09 vintages is<br />

considerable as demonstrated in the recent prepay<br />

report, and may be contributing to this trend; indeed,<br />

it may have been a game changer. Note how as we<br />

go up in coupon the empirical durations seem to be<br />

ticking up.<br />

We expect the continued market sentiment of a<br />

slower economic recovery to push yields lower. This<br />

could increase demand for incremental yield, helping<br />

mortgage spreads to tighten. But the sceptre of<br />

higher prepays in current coupons makes us neutral<br />

on the basis, and we may consider selling mortgages<br />

on strength, should they tighten considerably in a<br />

rally.<br />

Even after the mortgage primary rate reached<br />

another all time low last week, the refi index actually<br />

declined. Borrowers are clearly not getting the full<br />

benefit of low rates. But the newer lower coupons<br />

that define the current coupon mortgage basis as<br />

such are callable, even though the mortgage<br />

universe as a whole may not be all that much<br />

callable. It is from the basis perspective that we<br />

10%<br />

0%<br />

2-Apr-10 23-Apr-10 14-May-10 4-Jun-10 25-Jun-10<br />

Source: <strong>BNP</strong> Paribas<br />

ZV OAS<br />

Chart 2: Current Coupon OAS and ZV OAS<br />

85<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

03-May-10 24-May-10 14-Jun-10 05-Jul-10<br />

Source: Yield Book<br />

ZV OAS<br />

OAS<br />

expect 4s and 4.5s to trade to shorter durations in a<br />

rally.<br />

Since MBSPP proceeds are not reinvested,<br />

increased prepays increase the net supply to the<br />

market, which is negative for mortgages. Otherwise,<br />

the Fed put to bed any imminent expectations of<br />

MBS sales in its latest minutes and re-iterated that<br />

monetary tightening will take place first before assets<br />

sales begin. The Fed also left the door open to more<br />

accommodative policy if the economy gets worse,<br />

but extending mortgage purchases is only a<br />

probability at this point. Overall, these factors also<br />

favour a neutral outlook.<br />

Along the coupon stack we continue to like 5 and<br />

5.5s, which have not completely recovered from the<br />

levels before the Fed started its coupon swap<br />

activities. As we have mentioned in the past, the Fed<br />

was selling rolls so as to not force dealers to deliver.<br />

However, system-wide fails had persisted despite the<br />

selling of rolls, and should continue despite coupon<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

OAS<br />

Anish Lohokare/Olurotimi Ajibola 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

26<br />

www.Global<strong>Market</strong>s.bnpparibas.com