Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: SAS Diversification to Enhance Yields<br />

• In this analysis, we look at strategies to<br />

enhance yields in a low-rate environment. The<br />

steepness of SAS curves has increased<br />

recently, which is well-suited to our scenario.<br />

• STRATEGY: Sell KFW Apr 15 vs buy CADES<br />

Apr 20; Sell CADES Apr 12 vs buy Apr 15 or 20;<br />

Switch from NETHER Jul 20 to CADES Apr 20.<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

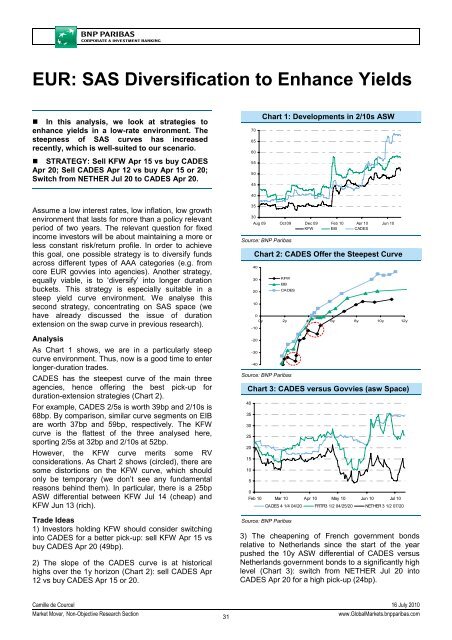

Chart 1: Developments in 2/10s ASW<br />

40<br />

Assume a low interest rates, low inflation, low growth<br />

environment that lasts for more than a policy relevant<br />

period of two years. The relevant question for fixed<br />

income investors will be about maintaining a more or<br />

less constant risk/return profile. In order to achieve<br />

this goal, one possible strategy is to diversify funds<br />

across different types of AAA categories (e.g. from<br />

core EUR govvies into agencies). Another strategy,<br />

equally viable, is to ‘diversify’ into longer duration<br />

buckets. This strategy is especially suitable in a<br />

steep yield curve environment. We analyse this<br />

second strategy, concentrating on SAS space (we<br />

have already discussed the issue of duration<br />

extension on the swap curve in previous research).<br />

Analysis<br />

As Chart 1 shows, we are in a particularly steep<br />

curve environment. Thus, now is a good time to enter<br />

longer-duration trades.<br />

CADES has the steepest curve of the main three<br />

agencies, hence offering the best pick-up for<br />

duration-extension strategies (Chart 2).<br />

For example, CADES 2/5s is worth 39bp and 2/10s is<br />

68bp. By comparison, similar curve segments on EIB<br />

are worth 37bp and 59bp, respectively. The KFW<br />

curve is the flattest of the three analysed here,<br />

sporting 2/5s at 32bp and 2/10s at 52bp.<br />

However, the KFW curve merits some RV<br />

considerations. As Chart 2 shows (circled), there are<br />

some distortions on the KFW curve, which should<br />

only be temporary (we don’t see any fundamental<br />

reasons behind them). In particular, there is a 25bp<br />

ASW differential between KFW Jul 14 (cheap) and<br />

KFW Jun 13 (rich).<br />

Trade Ideas<br />

1) Investors holding KFW should consider switching<br />

into CADES for a better pick-up: sell KFW Apr 15 vs<br />

buy CADES Apr 20 (49bp).<br />

2) The slope of the CADES curve is at historical<br />

highs over the 1y horizon (Chart 2): sell CADES Apr<br />

12 vs buy CADES Apr 15 or 20.<br />

35<br />

30<br />

Aug 09 Oct 09 Dec 09 Feb 10 Apr 10 Jun 10<br />

KFW EIB CADES<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: CADES Offer the Steepest Curve<br />

40<br />

30<br />

20<br />

10<br />

0<br />

0y 2y 4y 6y 8y 10y 12y<br />

-10<br />

-20<br />

-30<br />

-40<br />

KFW<br />

EIB<br />

CADES<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 3: CADES versus Govvies (asw Space)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Feb 10 Mar 10 Apr 10 May 10 Jun 10 Jul 10<br />

CADES 4 1/4 04/20 FRTR3 1/2 04/25/20 NETHER 3 1/2 07/20<br />

Source: <strong>BNP</strong> Paribas<br />

3) The cheapening of French government bonds<br />

relative to Netherlands since the start of the year<br />

pushed the 10y ASW differential of CADES versus<br />

Netherlands government bonds to a significantly high<br />

level (Chart 3): switch from NETHER Jul 20 into<br />

CADES Apr 20 for a high pick-up (24bp).<br />

Camille de Courcel 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

31<br />

www.Global<strong>Market</strong>s.bnpparibas.com