Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: Eonias to Push Up Further<br />

• Excess liquidity continues to fall. Along with<br />

less demand at the ECB’s liquidity providing<br />

operations, this is pushing eonias up.<br />

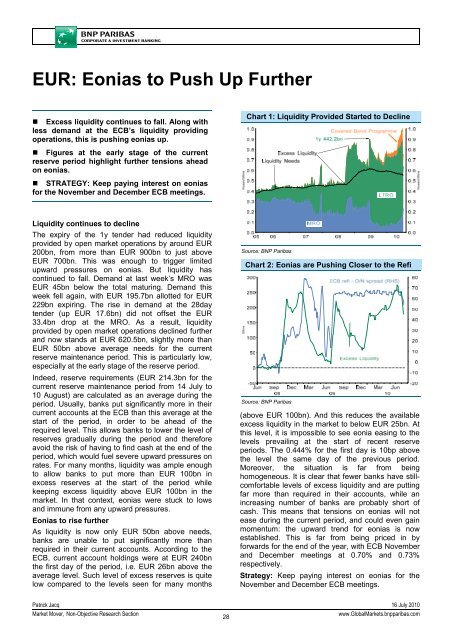

Chart 1: Liquidity Provided Started to Decline<br />

• Figures at the early stage of the current<br />

reserve period highlight further tensions ahead<br />

on eonias.<br />

• STRATEGY: Keep paying interest on eonias<br />

for the November and December ECB meetings.<br />

Liquidity continues to decline<br />

The expiry of the 1y tender had reduced liquidity<br />

provided by open market operations by around EUR<br />

200bn, from more than EUR 900bn to just above<br />

EUR 700bn. This was enough to trigger limited<br />

upward pressures on eonias. But liquidity has<br />

continued to fall. Demand at last week’s MRO was<br />

EUR 45bn below the total maturing. Demand this<br />

week fell again, with EUR 195.7bn allotted for EUR<br />

229bn expiring. The rise in demand at the 28day<br />

tender (up EUR 17.6bn) did not offset the EUR<br />

33.4bn drop at the MRO. As a result, liquidity<br />

provided by open market operations declined further<br />

and now stands at EUR 620.5bn, slightly more than<br />

EUR 50bn above average needs for the current<br />

reserve maintenance period. This is particularly low,<br />

especially at the early stage of the reserve period.<br />

Indeed, reserve requirements (EUR 214.3bn for the<br />

current reserve maintenance period from 14 July to<br />

10 August) are calculated as an average during the<br />

period. Usually, banks put significantly more in their<br />

current accounts at the ECB than this average at the<br />

start of the period, in order to be ahead of the<br />

required level. This allows banks to lower the level of<br />

reserves gradually during the period and therefore<br />

avoid the risk of having to find cash at the end of the<br />

period, which would fuel severe upward pressures on<br />

rates. For many months, liquidity was ample enough<br />

to allow banks to put more than EUR 100bn in<br />

excess reserves at the start of the period while<br />

keeping excess liquidity above EUR 100bn in the<br />

market. In that context, eonias were stuck to lows<br />

and immune from any upward pressures.<br />

Eonias to rise further<br />

As liquidity is now only EUR 50bn above needs,<br />

banks are unable to put significantly more than<br />

required in their current accounts. According to the<br />

ECB, current account holdings were at EUR 240bn<br />

the first day of the period, i.e. EUR 26bn above the<br />

average level. Such level of excess reserves is quite<br />

low compared to the levels seen for many months<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Eonias are Pushing Closer to the Refi<br />

Source: <strong>BNP</strong> Paribas<br />

(above EUR 100bn). And this reduces the available<br />

excess liquidity in the market to below EUR 25bn. At<br />

this level, it is impossible to see eonia easing to the<br />

levels prevailing at the start of recent reserve<br />

periods. The 0.444% for the first day is 10bp above<br />

the level the same day of the previous period.<br />

Moreover, the situation is far from being<br />

homogeneous. It is clear that fewer banks have stillcomfortable<br />

levels of excess liquidity and are putting<br />

far more than required in their accounts, while an<br />

increasing number of banks are probably short of<br />

cash. This means that tensions on eonias will not<br />

ease during the current period, and could even gain<br />

momentum: the upward trend for eonias is now<br />

established. This is far from being priced in by<br />

forwards for the end of the year, with ECB November<br />

and December meetings at 0.70% and 0.73%<br />

respectively.<br />

<strong>Strategy</strong>: Keep paying interest on eonias for the<br />

November and December ECB meetings.<br />

Patrick Jacq 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

28<br />

www.Global<strong>Market</strong>s.bnpparibas.com