Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

C is an active member of a pension scheme. He is<br />

continuing to accrue new rights. If he continues in<br />

pensionable service until he reaches normal pension<br />

age in (for example) 2015, revaluation will not apply.<br />

Once his pension is in payment, he will receive<br />

annual increases calculated in relation to CPI.<br />

D is an active member of a pension scheme. She will<br />

leave pensionable service in 2013, and will reach her<br />

normal pension age in 2020 and begin to receive her<br />

pension at that time. From 2013 to 2020 her rights<br />

will be revalued in relation to CPI. Once her pension<br />

is put into payment, she will receive annual increases<br />

calculated in relation to CPI.”<br />

Limited market impact of public pension<br />

indexation change…<br />

Public pension funds are believed to be in the order<br />

of around GBP 1trn (on a gilt-discounted basis) and,<br />

to the extent they are largely unfunded and<br />

unhedged, have limited impact on the RPI market<br />

with future PF obligations paid from public coffers.<br />

Local authorities, in contrast, do hold assets against<br />

their PF liabilities but are much smaller (20%) whilst<br />

their index-linked holdings are thought to be relatively<br />

small (< GBP 10bn). Future inflation hedging demand<br />

by these entities will most likely manifest itself in CPI<br />

space, not RPI.<br />

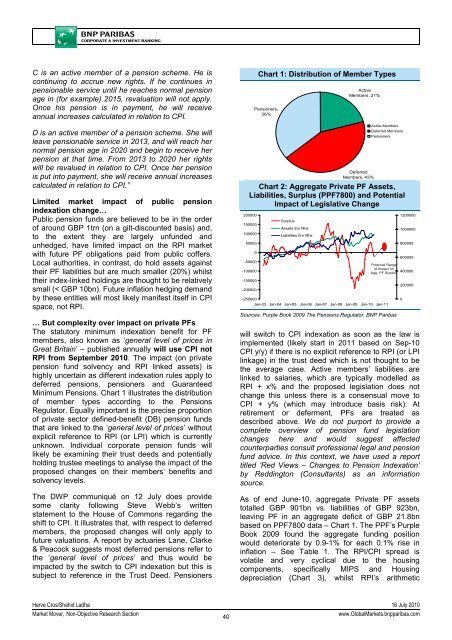

… But complexity over impact on private PFs<br />

The statutory minimum indexation benefit for PF<br />

members, also known as ‘general level of prices in<br />

Great Britain’ – published annually will use CPI not<br />

RPI from September 2010. The impact (on private<br />

pension fund solvency and RPI linked assets) is<br />

highly uncertain as different indexation rules apply to<br />

deferred pensions, pensioners and Guaranteed<br />

Minimum Pensions. Chart 1 illustrates the distribution<br />

of member types according to the Pensions<br />

Regulator. Equally important is the precise proportion<br />

of private sector defined-benefit (DB) pension funds<br />

that are linked to the ‘general level of prices’ without<br />

explicit reference to RPI (or LPI) which is currently<br />

unknown. Individual corporate pension funds will<br />

likely be examining their trust deeds and potentially<br />

holding trustee meetings to analyse the impact of the<br />

proposed changes on their members’ benefits and<br />

solvency levels.<br />

The DWP communiqué on 12 July does provide<br />

some clarity following Steve Webb’s written<br />

statement to the House of Commons regarding the<br />

shift to CPI. It illustrates that, with respect to deferred<br />

members, the proposed changes will only apply to<br />

future valuations. A report by actuaries Lane, Clarke<br />

& Peacock suggests most deferred pensions refer to<br />

the ‘general level of prices’ and thus would be<br />

impacted by the switch to CPI indexation but this is<br />

subject to reference in the Trust Deed. Pensioners<br />

Chart 1: Distribution of Member Types<br />

Pensioners,<br />

36%<br />

Active<br />

Members, 21%<br />

Deferred<br />

Members, 43%<br />

Active Members<br />

Deferred Members<br />

Pensioners<br />

Chart 2: Aggregate Private PF Assets,<br />

Liabilities, Surplus (PPF7800) and Potential<br />

Impact of Legislative Change<br />

200000<br />

150000<br />

100000<br />

50000<br />

0<br />

-50000<br />

-100000<br />

-150000<br />

-200000<br />

Surplus<br />

Assets £m Rhs<br />

Liabilities £m Rhs<br />

Potential Range<br />

of Impact on<br />

Agg. PF Surplus<br />

-250000<br />

Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11<br />

Sources: Purple Book 2009 The Pensions Regulator, <strong>BNP</strong> Paribas<br />

1200000<br />

1000000<br />

800000<br />

600000<br />

400000<br />

200000<br />

will switch to CPI indexation as soon as the law is<br />

implemented (likely start in 2011 based on Sep-10<br />

CPI y/y) if there is no explicit reference to RPI (or LPI<br />

linkage) in the trust deed which is not thought to be<br />

the average case. Active members’ liabilities are<br />

linked to salaries, which are typically modelled as<br />

RPI + x% and the proposed legislation does not<br />

change this unless there is a consensual move to<br />

CPI + y% (which may introduce basis risk). At<br />

retirement or deferment, PFs are treated as<br />

described above. We do not purport to provide a<br />

complete overview of pension fund legislation<br />

changes here and would suggest affected<br />

counterparties consult professional legal and pension<br />

fund advice. In this context, we have used a report<br />

titled ‘Red Views – Changes to Pension Indexation’<br />

by Reddington (Consultants) as an information<br />

source.<br />

As of end June-10, aggregate Private PF assets<br />

totalled GBP 901bn vs. liabilities of GBP 923bn,<br />

leaving PF in an aggregate deficit of GBP 21.8bn<br />

based on PPF7800 data – Chart 1. The PPF’s Purple<br />

Book 2009 found the aggregate funding position<br />

would deteriorate by 0.9-1% for each 0.1% rise in<br />

inflation – See Table 1. The RPI/CPI spread is<br />

volatile and very cyclical due to the housing<br />

components, specifically MIPS and Housing<br />

depreciation (Chart 3), whilst RPI’s arithmetic<br />

0<br />

Herve Cros/Shahid Ladha 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

40<br />

www.Global<strong>Market</strong>s.bnpparibas.com