Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

UK Inflation: Mind the Gap<br />

• Recent changes in the inflation measure<br />

used to index benefits and pensions have<br />

attracted attention to the difference between CPI<br />

and RPI inflation.<br />

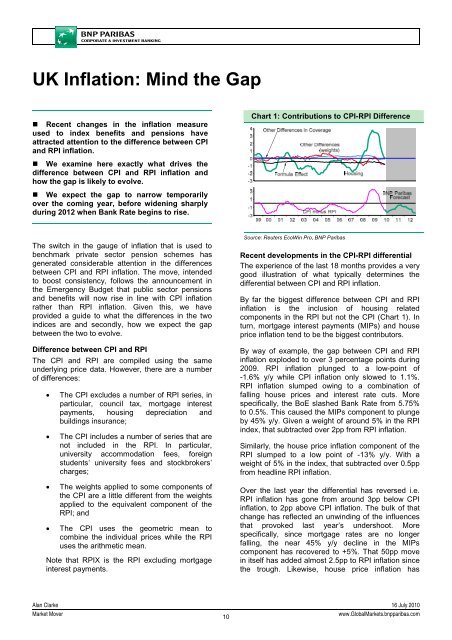

Chart 1: Contributions to CPI-RPI Difference<br />

• We examine here exactly what drives the<br />

difference between CPI and RPI inflation and<br />

how the gap is likely to evolve.<br />

• We expect the gap to narrow temporarily<br />

over the coming year, before widening sharply<br />

during 2012 when Bank <strong>Rate</strong> begins to rise.<br />

The switch in the gauge of inflation that is used to<br />

benchmark private sector pension schemes has<br />

generated considerable attention in the differences<br />

between CPI and RPI inflation. The move, intended<br />

to boost consistency, follows the announcement in<br />

the Emergency Budget that public sector pensions<br />

and benefits will now rise in line with CPI inflation<br />

rather than RPI inflation. Given this, we have<br />

provided a guide to what the differences in the two<br />

indices are and secondly, how we expect the gap<br />

between the two to evolve.<br />

Difference between CPI and RPI<br />

The CPI and RPI are compiled using the same<br />

underlying price data. However, there are a number<br />

of differences:<br />

• The CPI excludes a number of RPI series, in<br />

particular, council tax, mortgage interest<br />

payments, housing depreciation and<br />

buildings insurance;<br />

• The CPI includes a number of series that are<br />

not included in the RPI. In particular,<br />

university accommodation fees, foreign<br />

students’ university fees and stockbrokers’<br />

charges;<br />

• The weights applied to some components of<br />

the CPI are a little different from the weights<br />

applied to the equivalent component of the<br />

RPI; and<br />

• The CPI uses the geometric mean to<br />

combine the individual prices while the RPI<br />

uses the arithmetic mean.<br />

Note that RPIX is the RPI excluding mortgage<br />

interest payments.<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Recent developments in the CPI-RPI differential<br />

The experience of the last 18 months provides a very<br />

good illustration of what typically determines the<br />

differential between CPI and RPI inflation.<br />

By far the biggest difference between CPI and RPI<br />

inflation is the inclusion of housing related<br />

components in the RPI but not the CPI (Chart 1). In<br />

turn, mortgage interest payments (MIPs) and house<br />

price inflation tend to be the biggest contributors.<br />

By way of example, the gap between CPI and RPI<br />

inflation exploded to over 3 percentage points during<br />

2009. RPI inflation plunged to a low-point of<br />

-1.6% y/y while CPI inflation only slowed to 1.1%.<br />

RPI inflation slumped owing to a combination of<br />

falling house prices and interest rate cuts. More<br />

specifically, the BoE slashed Bank <strong>Rate</strong> from 5.75%<br />

to 0.5%. This caused the MIPs component to plunge<br />

by 45% y/y. Given a weight of around 5% in the RPI<br />

index, that subtracted over 2pp from RPI inflation.<br />

Similarly, the house price inflation component of the<br />

RPI slumped to a low point of -13% y/y. With a<br />

weight of 5% in the index, that subtracted over 0.5pp<br />

from headline RPI inflation.<br />

Over the last year the differential has reversed i.e.<br />

RPI inflation has gone from around 3pp below CPI<br />

inflation, to 2pp above CPI inflation. The bulk of that<br />

change has reflected an unwinding of the influences<br />

that provoked last year’s undershoot. More<br />

specifically, since mortgage rates are no longer<br />

falling, the near 45% y/y decline in the MIPs<br />

component has recovered to +5%. That 50pp move<br />

in itself has added almost 2.5pp to RPI inflation since<br />

the trough. Likewise, house price inflation has<br />

Alan Clarke 16 July 2010<br />

<strong>Market</strong> Mover<br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com