MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Market Economics | Interest Rate Strategy | Forex Strategy 4 August 2011<br />

Market Mover<br />

Market Outlook 2-3<br />

Fundamentals 4-30<br />

• US: Forecast Revision & Policy 4-8<br />

Outlook<br />

• US: GDP Revisions Paint Sobering 9-10<br />

Picture<br />

• ECB: Changing Tack 11-13<br />

• ECB: Bond Purchases –<br />

14-16<br />

Acupuncture<br />

• Eurozone: Weaker for Longer 17-19<br />

• Norway: Norges Bank to Wait and 20<br />

See<br />

• Japan: Rebasing to Slash July Core 21-22<br />

CPI<br />

• Japan: IP Recovering But Outlook 23-24<br />

Unclear<br />

• Surprise Indicator 25-27<br />

• FMCI Update 28-30<br />

Interest Rate Strategy 31-56<br />

• US: Taking Stock…Reality Sinks In 31-34<br />

• US: Subtle Changes in the Short 35-36<br />

End<br />

• US: Short-Vol Strategy on 10y10y 37<br />

• EUR: Bullish 5s15s Conditional 38<br />

Steepener<br />

• EMU Debt Monitor: CDS, RV 39-43<br />

Charts, Trade Ideas, Redemptions<br />

• JGBs: 7y/10y Box 44<br />

• Global Inflation Watch 45-48<br />

• Inflation: Beta Hedge the<br />

49-50<br />

Uncertainty Away?<br />

• US TIPS Breakevens Look<br />

51-53<br />

Vulnerable<br />

• Technical Analysis 54-55<br />

• Trade Reviews 56<br />

FX Strategy 57-60<br />

• CHF: Rise to Persist Despite SNB’s 57-58<br />

Actions<br />

• Why EURUSD May Stay in a Range 59-60<br />

Forecasts & Calendars 61-73<br />

• 1 Week Economic Calendar 61-62<br />

• Key Data Preview 63-67<br />

• 4 Week Calendar 68<br />

• Treasury & SAS Issuance 69-70<br />

• Central Bank Watch 71<br />

• FX Forecasts 72<br />

Contacts 73<br />

www.GlobalMarkets.bnpparibas.com<br />

• Risk aversion has been rising sharply on the back of<br />

increased stress in the eurozone combined with weaker<br />

economic data.<br />

• The flight-to-quality move has pushed yields close to<br />

all-time lows.<br />

• All intra-EMU spreads have widened significantly.<br />

Although additional austerity measures are probably<br />

necessary, they won’t be sufficient to restore confidence.<br />

• Such measures could nevertheless be seen as a<br />

precondition for the ECB to start buying more bonds – until<br />

the EFSF is able to do so.<br />

• The reactivation of the ECB purchasing programme<br />

failed to impress the market. Italian and Spanish spreads<br />

hit new highs as only Greece, Portugal and Ireland were<br />

targeted.<br />

• Govvies look solid going into the US employment<br />

report. The data may add to concerns over the economic<br />

outlook.<br />

• The JGB market will continue to move in line with<br />

Treasuries. Though some were expecting harder-hitting<br />

measures from the BoJ, such as a rate cut and extending<br />

the duration of its JGB buying operations, the market will<br />

remain at recent highs.<br />

• In FX, attempts by the Japanese and Swiss authorities<br />

to limit currency strength are unlikely to reverse the recent<br />

appreciation trend while markets are focused on poor US<br />

growth prospects and eurozone bond-market concerns.<br />

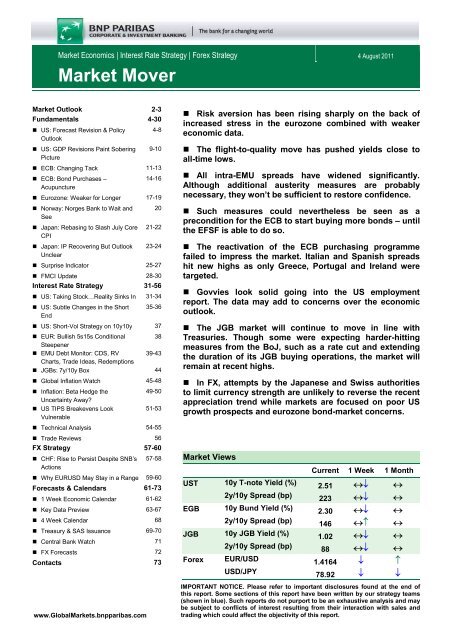

Market Views<br />

UST 10y T-note Yield (%)<br />

2y/10y Spread (bp)<br />

EGB 10y Bund Yield (%)<br />

2y/10y Spread (bp)<br />

JGB 10y JGB Yield (%)<br />

2y/10y Spread (bp)<br />

Forex<br />

EUR/USD<br />

USD/JPY<br />

Current 1 Week 1 Month<br />

2.51 ↔↓ ↔<br />

223 ↔↓ ↔<br />

2.30 ↔↓ ↔<br />

146 ↔↑ ↔<br />

1.02 ↔↓ ↔<br />

88 ↔↓ ↔<br />

1.4164 ↓ ↑<br />

78.92 ↓ ↓<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams<br />

(shown in blue). Such reports do not purport to be an exhaustive analysis and may<br />

be subject to conflicts of interest resulting from their interaction with sales and<br />

trading which could affect the objectivity of this report.

Market Outlook<br />

Risk aversion on the rise<br />

Risk aversion has gained momentum over the past week. Though the US<br />

debt ceiling deadlock has been resolved, we still cannot be sure about rating<br />

implications. Furthermore, the latest disappointing economic data (ISMs,<br />

GDP) have fuelled concern about whether this soft patch is continuing into<br />

the second half of the year. Given increasing stress within the eurozone, the<br />

rally on govvies has accelerated. While the situation now looks<br />

overstretched, it is not easy to see what could change the current mood –<br />

especially if upcoming economic data also surprise on the downside.<br />

Yields back near all-time lows on strong flight-to-quality bid<br />

4.5<br />

4.0<br />

G ilts<br />

3.5<br />

3.0<br />

2.5<br />

T-Note<br />

Bund<br />

2.0<br />

1.5<br />

1.0<br />

JGB<br />

ECB reactivates its buying<br />

programme – with no<br />

impact so far<br />

Govvies look solid going<br />

into the US job report<br />

0.5<br />

Jan<br />

Apr Jul Oct Jan<br />

09<br />

Apr Jul Oct Jan<br />

10<br />

Source: Reuters EcoWin Pro<br />

EU officials are finalising details of the latest measures agreed two weeks<br />

ago that would allow the EFSF to intervene in the bond markets; it is worth<br />

keeping in mind that the plan still needs to be approved by national<br />

parliaments. Any positive news regarding an acceleration of this process<br />

would help turn round the current negative mood. Recent comments<br />

suggesting eurozone governments are also discussing an increase in the<br />

EFSF’s lending capacity also sound supportive.<br />

In the meantime, only the ECB has the ability to intervene via its SMP<br />

programme; this was activated in May 2010 but had not been used for some<br />

time. At today’s press conference, the SMP was reactivated while the ECB<br />

also announced it will conduct a special liquidity operation (6 month LTRO to<br />

be announced on 9 August with allotment the following day) to counter<br />

tensions. The impact on the market has been limited and temporary, with<br />

spreads hitting new highs post ECB. To date, the ECB has only been buying<br />

Greek, Portuguese and Irish bonds.<br />

Reactivating the SMP to buy the same countries is not what is needed. But<br />

the ECB will probably not start buying BTPs unless and until the Italian<br />

government announces greater front-loading of spending cuts and structural<br />

reforms. Taking into account these uncertainties, we maintain a positive bias<br />

on core EGBs with long spread positions at the front end and steepeners (2-<br />

10s). We also recommend buying the Bund July 42 ASW.<br />

In the US, attention will be on the employment report; this is likely to point to<br />

continued weakness. A worse-than-expected report in the wake of recent<br />

disappointing numbers would fuel speculation about the possibility of a third<br />

round of quantitative easing – even if the Fed has so far downplayed the<br />

possibility of this. 5y5y and 10y10y rates have declined sharply in a move<br />

that looks similar to trading last year in the run-up to QE2. Interestingly, the<br />

bullish momentum has moved out from the 5-7y part of the curve, with the<br />

30y now leading the way. In swaps, long dated forwards are breaking<br />

decisively below their recent lows as a result. As for European markets, the<br />

Apr<br />

11<br />

Jul<br />

Cyril Beuzit 4 August 2011<br />

Market Mover<br />

2<br />

www.GlobalMarkets.bnpparibas.com

momentum is not something we would expect to fade just yet, considering<br />

the extent to which optimism has waned in the wake of disappointing<br />

numbers. The bull-flattening move has further to go.<br />

US yield path looks similar to the run-up to QE2 in 2010<br />

4.00<br />

Jan<br />

10yr Note Yield<br />

3.75<br />

Dec<br />

3.50<br />

2010<br />

3.25<br />

3.00<br />

2011<br />

2.75<br />

Aug<br />

2.50<br />

Jackson<br />

Hole<br />

2.25<br />

0 20 40 60 80 100 120 140 160 180 200 220 240<br />

BoJ intervention<br />

disappoints<br />

CHF and JPY to remain<br />

strong in the short run<br />

Source: Reuters EcoWin Pro<br />

In Japan, the yen was back near its all-time high versus the US dollar amid<br />

concerns that the US might be downgraded. The Ministry of Finance staged<br />

a yen-selling intervention in the FX market this morning, and the 10y JGB<br />

yield temporarily broke below 1% on expectations of additional easing after<br />

the Bank of Japan said that its next Monetary Policy Meeting – originally<br />

scheduled for 4-5 August – would instead conclude on the afternoon of 4<br />

August.<br />

The BoJ announced after the meeting that it was necessary to further<br />

intensify monetary easing, thereby ensuring a successful transition from the<br />

recovery phase following the earthquake disaster to a sustainable growth<br />

path with price stability. The BoJ increased the total amount of its asset<br />

purchase programme from JPY 40trn to JPY 50trn (an additional JPY 5trn<br />

on the asset purchase fund, an additional JPY 5trn for 6m fixed rate<br />

operations). However, the JGB market was disappointed by the decision as<br />

some participants had expected more hard-hitting measures such as a rate<br />

cut and extension of the duration of the BoJ’s JGB buying operations.<br />

The JGB 10y sector looks a touch cheaper as investors took profit below<br />

1%. However, with many investors somewhat behind in their FY 2011 bondbuying<br />

plans, we expect that JGB yields will continue to test their downside<br />

unless US and European markets rapidly move out of risk-off mode.<br />

On the FX market, both the USD and the EUR remain weak as markets<br />

focus on poor US growth prospects and the ongoing issues with eurozone<br />

bond markets. Furthermore, the general weakness in equity markets and<br />

riskier assets has produced a relatively sharp unwinding of the strength in<br />

the commodity-linked G10 currencies: the AUD, CAD and NZD. In this<br />

environment, demand for the CHF and JPY as safe havens has intensified.<br />

We do not expect this week’s attempts by Swiss and Japanese authorities to<br />

weaken their currencies to reverse trend appreciation.<br />

Until fixed-income markets stabilise in the eurozone and the prospects for<br />

the US economy improve, we expect further declines in both the EUR and<br />

USD. We also look for a re-emergence of the CHF and JPY appreciation<br />

trends. In contrast, a stabilisation in global equity markets would likely<br />

produce a return to the risk-on approach in currency markets, thus lending<br />

support to commodity currencies once again. The ongoing process of<br />

currency reserve diversification among sovereigns favours alternatives to the<br />

USD and EUR. Recent trends suggest ongoing support for currencies apart<br />

from the USD and EUR, especially the AUD, CAD and SEK.<br />

Cyril Beuzit 4 August 2011<br />

Market Mover<br />

3<br />

www.GlobalMarkets.bnpparibas.com

US: Forecast Revision & Policy Outlook<br />

• We have revised our growth forecast lower<br />

in H2 2011 and 2012. We are looking for growth<br />

of 2.25% saar in H2 2011 and 2.1% q4/q4 in 2012.<br />

The unemployment rate is expected to reach<br />

9.4% by year end, and then, fall to 8.5% by the<br />

end of 2012 on falling labor force participation<br />

Chart 1: Not Your Typical Post-War Cycle<br />

• The main drivers of the revision are an<br />

intensifying fiscal tightening, downward<br />

revision to GDP that highlight the structural<br />

headwinds restraining the US economy, and a<br />

deterioration in the US data that point to slower<br />

momentum entering H2 2011.<br />

• We still think the economy avoids recession,<br />

but there is a growing likelihood and argument<br />

that can be made for further monetary easing.<br />

We think the Fed will take a modest step in that<br />

direction at next week’s meeting and see QE3 as<br />

a close call.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Absolutely No Pent Up Demand<br />

10500<br />

Real Consumer Spending (USD bn)<br />

10000<br />

9500<br />

9000<br />

8500<br />

We have revised our forecast for growth lower<br />

through 2012 and pushed back our expectations<br />

for monetary tightening<br />

We have lowered our forecast for GDP growth by<br />

0.75pp saar in both H2 2011 and in 2012. The<br />

forecast and revisions are presented in Table 1.<br />

Growth in business investment, personal<br />

consumption and government spending has been<br />

lowered over the next six quarters. Accordingly, we<br />

anticipate somewhat less hiring and for the<br />

unemployment rate to end 2011 at 9.4%, 0.2pp<br />

higher than the June reading, and then, we expect it<br />

to fall to 8.5% by the end of 2012. We are currently<br />

reviewing our forecast for inflation but anticipate that<br />

we will lower our forecast for both core and headline<br />

inflation to some degree.<br />

We feel more uncertainty about the underlying<br />

potential growth rate than we did before. We had<br />

previously held the view that potential growth has<br />

slowed from 3.5% in recent decades to something<br />

closer to 2.0%. However, it could be even lower.<br />

While growth in 2012 is certainly not expected to<br />

exceed potential growth by much, we think the<br />

unemployment rate will fall on continued declines in<br />

the participation rate. Some of the decline reflects an<br />

aging population, and some reflects the structural<br />

nature of the economic adjustment currently under<br />

way.<br />

8000<br />

7500<br />

7000<br />

6500<br />

6000<br />

95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11<br />

Source: Reuters EcoWin Pro<br />

Our expectation for fiscal policy has also changed.<br />

We have lowered our deficit-to-GDP estimate for<br />

fiscal years 2011 and 2012 as we have seen notably<br />

more fiscal consolidation than expected in H1 2011<br />

and have raised our expectations for the size and<br />

impact over the forecast horizon.<br />

With slower progress on both the Fed’s mandates,<br />

we now do not expect the first increase in the Fed<br />

funds rate until Q4 2013. Previously, we thought the<br />

first increase in the Fed funds rate would come in Q3<br />

2012. Indeed, it seems the chances of a near-term<br />

further easing in monetary tightening are on the rise.<br />

Three recent developments lie behind our<br />

forecast revision<br />

The annual revisions to GDP were a view changer<br />

(see following article on the revisions). Like last year,<br />

they confirmed and deepened the picture of the<br />

current economy as quite distinct from any other<br />

post-war business cycle (see Charts 1 and 2). In<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

4<br />

www.GlobalMarkets.bnpparibas.com

particular, estimates of consumer spending were<br />

marked lower and the recession now looks much<br />

deeper, the recovery much flatter, and there has<br />

been a distinct loss of momentum in 2011.<br />

Chart 3: Hiring Losing Momentum Again…<br />

The rule of thumb used to be never bet against the<br />

US consumer. In the brave new world, the caution is<br />

be wary of the fickle American. In an era of<br />

deleveraging in the aftermath of the greatest financial<br />

crisis since the Great Depression, consumers are<br />

quite vulnerable to any changes in their employment<br />

and wealth prospects. It doesn’t take much to knock<br />

them off course.<br />

This year, the combination of higher inflation, falling<br />

home prices, continued uncertain employment<br />

prospects, geopolitical uncertainties (including Middle<br />

Eastern tensions, the ongoing European debt crisis,<br />

and the discord in Washington), and the prospect of<br />

a future with higher tax liabilities and a thinner<br />

retirement safety net, have led real consumer<br />

spending to grind to a halt. The supply chain issues<br />

resulting from events in Japan exacerbated the slow<br />

down by depressing auto sales. Our conviction in the<br />

already held view that consumer behavior has<br />

fundamentally changed has only been deepened.<br />

The second development driving the revision is the<br />

recent fiscal dogfight in Washington. The agreed to<br />

fiscal package suggests a modest fiscal drag in the<br />

coming year in addition to the one we had already<br />

factored in. However, it also raises serious questions<br />

about the fate of a number of stimulus provisions that<br />

are due to expire at the end of this year. The payroll<br />

tax cut, the fix to the Alternative Minimum Tax, the<br />

investment depreciation allowance, and extended<br />

unemployment benefits are all set to end in<br />

December.<br />

We had assumed that, with a weak economy and an<br />

upcoming election, Congress would be inclined to<br />

extend most of these measures into 2012. The<br />

rancour and bent toward near-term fiscal tightening<br />

raise a risk that fewer provisions will be extended<br />

implying a greater fiscal tightening. As shown in<br />

Table 1, we have increased our estimated fiscal<br />

tightening over 2011 and 2012 by nearly 2pp. The<br />

key offsetting force going into 2012 is expected to be<br />

moderating inflation, which will allow consumers to<br />

recoup some lost purchasing power and growth to<br />

pick up a little.<br />

The third factor behind the revision is the continued<br />

deterioration in the data, which appears to reflect<br />

both transitory and more entrenched factors. Supply<br />

chain constraints resulting from events in Japan<br />

appeared to be a material factor behind the very<br />

weak consumer spending growth in Q2, and a<br />

bounce in auto sales in July already suggests some<br />

Source: Reuters EcoWin Pro<br />

Chart 4: …But Inflation Backdrop has Changed<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Global Manufacturing Losing Steam<br />

Source: Reuters EcoWin Pro<br />

reversal of that factor. However, the loss of<br />

momentum clearly is a much broader phenomenon.<br />

The manufacturing sector, a key source of strength<br />

for the US, is experiencing a slowdown globally that<br />

is much more pronounced than what we saw this<br />

time last year (see Chart 5), perhaps because<br />

emerging markets have been tightening policy to<br />

curb rising inflation (e.g. China, Brazil, <strong>India</strong>).<br />

While falling gas prices have provided some relief for<br />

consumers, crude oil prices have remained<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

5<br />

www.GlobalMarkets.bnpparibas.com

stubbornly high as have spreads between retail and<br />

wholesale prices so that the relief is only moderate.<br />

Chart 6: Inflation Expectations High Part I<br />

In addition, firms have been more successful than<br />

anticipated in passing along higher costs to<br />

consumers. In the short run, this has resulted in a<br />

larger loss of purchasing power and weaker-thanexpected<br />

consumer spending, as well as robust<br />

corporate profits. The extent to which firms can<br />

cannibalize their customer base seems limited, and<br />

the stock market declines of late may reflect that<br />

realization to some degree.<br />

A variety of political uncertainties both inside and<br />

outside the US have certainly intensified in recent<br />

months and are probably a significant driver of rising<br />

anxiety and caution that have slowed spending and<br />

hiring. This suggests downside risks have also been<br />

rising as a loss of business and consumer<br />

confidence could tip into becoming a negative selfreinforcing<br />

dynamic.<br />

The loss of wealth as stock and home prices fall only<br />

serve to emphasize that consumers will not be eager<br />

to releverage and are likely to remain cautious and<br />

price sensitive. Likewise, the loss of momentum in<br />

hiring and capital spending as well as the dormant<br />

mountains of corporate cash highlight continued risk<br />

aversion amongst firms. Indeed, we would currently<br />

put the chances of a recession at one in three.<br />

On the other hand we are seeing a solid pick up in<br />

July auto sales suggesting the resolution of supply<br />

chain issues will be a boost to GDP growth in Q3.<br />

Headline inflation is set to provide some relief to<br />

consumer purchasing power; we expect it to rise<br />

2.5% saar in H2 2011, down from the 3.8% pace in<br />

H1 2011. Finally, the earnings season for Q2 has<br />

been reasonably healthy and corporations are<br />

tapping credit markets without hesitation suggesting<br />

that, while firms are cautious, they are not in<br />

retrenchment mode.<br />

The FOMC is faced with some very tough choices<br />

in the months ahead. We think they will take a<br />

step toward easing at next week’s meeting by<br />

extending the duration of their securities<br />

holdings. QE3 is a close call at this point.<br />

By a number of measures, the economic backdrop is<br />

far worse than last year around this time GDP is<br />

weaker, the manufacturing sector is weaker, fiscal<br />

headwinds are greater, and home prices have been<br />

falling for a year. Hiring by the private and state and<br />

local sectors is just as weak (federal is excluded<br />

owing to the census hiring swings last year), and<br />

while the unemployment rate is lower, it is only<br />

because labor force participation has dropped<br />

sharply. The intensifying downside risks suggest the<br />

Fed should be considering policy easing.<br />

Source: Reuters EcoWin Pro<br />

Chart 7: Inflation Expectations High Part II<br />

Source: Reuters EcoWin Pro<br />

However, one key factor is different. Both headline<br />

and core inflation have picked up sharply over the<br />

last year. While headline inflation is already falling<br />

back, core inflation has been on a strong upward<br />

trajectory. Stagnant wages and fading pass through<br />

of past commodity price increases suggest some<br />

easing in core inflation may be around the corner;<br />

however, it has yet to materialize fully.<br />

Trimmed mean measures of underlying inflation did<br />

moderate notably in June and core PCE was also<br />

much softer than expected; however, it is quite early<br />

to declare this a trend. Thus, the Fed has made<br />

progress on its policy mandate to maintain stable<br />

prices, and deflationary risks are certainly not a<br />

pressing worry at this point (see Chart 4).<br />

Another complicating factor is that the measures of<br />

inflationary expectations favored by the FOMC<br />

remain fairly elevated despite the recent global<br />

economic slowdown and distress in many areas of<br />

the capital markets (see Charts 6 and 7). It can<br />

certainly be argued that a 40bp decline in the yield<br />

on the 30-year Treasury bond and a flattening in the<br />

yield curve driven by a rally, rather than a selloff, are<br />

in part indications of a decline in longer-term inflation<br />

expectations. However, the Fed still likely views the<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

6<br />

www.GlobalMarkets.bnpparibas.com

much higher inflation and inflation expectations as<br />

barriers to further easing, all else equal.<br />

It is clear we are going to see significant changes to<br />

the FOMC statement. The Committee needs to<br />

acknowledge a steady deterioration in the economy<br />

that reflects more than just temporary factors. In the<br />

policy paragraph, we expect a change that could be<br />

construed as an easing signal but could also be<br />

argued to be a move toward resolving a logical<br />

inconsistency: we think they will apply the extended<br />

period language not just to the stance of the federal<br />

funds rate, but also its expanded holdings of<br />

securities (see annotated statement). Finally, they<br />

will probably take a small step toward actually easing<br />

policy by extending the duration of their securities<br />

holdings. This would be a modest move, but one that<br />

would signal the Fed is willing to do more if economic<br />

momentum fails to pick up in Q3.<br />

There are three key things we think the Fed will be<br />

watching in order to determine if a full-blown QE3 is<br />

necessary. The first is financial conditions. Stock<br />

markets have fallen sharply in recent days on both<br />

political developments and concerns that the global<br />

macro economy is faltering. Should we see another 5<br />

to 10% stock market decline, or should credit market<br />

conditions indicate serious dysfunction, the FOMC<br />

could easily conclude the economy could tip into a<br />

recession as a result.<br />

The second is the labor market. We think the<br />

weakness will continue into Q4 2011 with the<br />

unemployment rate rising to 9.4%. This would<br />

present a serious backtracking in one of the Fed’s<br />

mandates.<br />

Finally, the Fed will be watching a variety of inflation<br />

indicators to see if their outlook for a gradual<br />

stabilization in underlying inflation is tilting toward a<br />

renewed bout of disinflation. These indicators include<br />

commodity prices, inflation expectations, and wages.<br />

A deterioration in any one, or some combination, of<br />

these measures could tip the Fed into more<br />

aggressive action. The unemployment report on<br />

Friday will be important in setting the tone for next<br />

week’s FOMC meeting. And in an uncanny<br />

development, we could be looking to Jackson Hole<br />

yet again for guidance on the future course of Fed<br />

policy.<br />

The Fed is not resetting its quarterly forecasts at the<br />

August meeting, and there will be no press<br />

conference. Nonetheless, we think they will be doing<br />

some soul searching behind closed doors.<br />

At the January meeting this year the central tendency<br />

forecast for GDP growth was 3.4% to 3.9%, and we<br />

are likely to realize less than half of that. Temporary<br />

factors may influence the contour of growth through<br />

the year but can’t explain such an underperformance.<br />

Despite continued evidence to the contrary, the Fed<br />

continues to believe that easy monetary policy can<br />

produce significantly above-trend growth (their own<br />

estimate of potential growth is 2.5% to 2.8%). Has<br />

two years of underperformance convinced them that<br />

a deleveraging cycle is different? If such a conclusion<br />

is reached, then they may conclude that the output<br />

gap is notably smaller than they previous thought,<br />

and the absence of a healthy credit channel means<br />

there is little that can be achieved through monetary<br />

policy. All else equal, this might make the Fed less<br />

inclined to take further action.<br />

Of course, all else isn’t equal, and it is an open<br />

question as to whether the economy can muddle<br />

along or whether there is a stall speed at which we<br />

tip over into recession. In addition to evaluating the<br />

longer-term outlook, the FOMC will have to read the<br />

alarming bouquet of tea leaves over the intermeeting<br />

period and decide whether we are at a<br />

tipping point.<br />

Perhaps, what we are learning is that QE is not for<br />

the faint of heart; incremental gets you less than a<br />

shock and awe approach. One clear lesson is there<br />

is a flow effect to QE; when the Fed steps away from<br />

the market, risk gets priced differently and markets<br />

and the economy become more vulnerable to bad<br />

news. In this sense, more QE makes perfect sense.<br />

It would not an antidote to the structural adjustments<br />

the US is in the midst of, but it would be an insurance<br />

policy against downside risks. We think they are not<br />

yet ready to reach that conclusion, but we will learn<br />

more about their reaction function next week.<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

7<br />

www.GlobalMarkets.bnpparibas.com

Table 1: Economic Forecasts<br />

% saar 2011 2012<br />

Q3 Q4 Q4/Q4 Q4/Q4<br />

GDP 2.0 (2.5) 2.5 (3.5) 1.5 (1.9)** 2.1 (2.8)<br />

Personal Consumer Spending 2.0 (2.0) 3.0 (3.5) 1.8 (1.9) 2.1 (2.6)<br />

Government Spending -2.1(-0.9) -1.6(-1.2) -2.7(-2.3) -1.7 (-0.7)<br />

Unemployment Rate (Q4) 9.4 (9.0) 8.5 (8.3)<br />

Federal Deficit as % of GDP (Annual Avg) -9.0 (-10.4) -8.1 (-8.6)<br />

Source: <strong>BNP</strong> Paribas<br />

* Numbers in parenthesis are the previously published projections ** Number in parenthesis includes GDP revision but prior H2 projection<br />

We expect<br />

significant<br />

changes to the<br />

statement. They<br />

will have to<br />

acknowledge the<br />

significant loss of<br />

economic<br />

momentum and<br />

eliminate the<br />

reference to its<br />

temporary nature.<br />

While the tone will<br />

depend to some<br />

degree on the July<br />

employment<br />

report, we think the<br />

Fed needs to<br />

prepare for<br />

possible easing<br />

should the pace of<br />

growth fail to pick<br />

up in Q3.<br />

We think they<br />

apply the extended<br />

period language to<br />

their expanded<br />

securities<br />

holdings.<br />

Release Date: June 22, 2011<br />

Information received since the Federal Open Market Committee met in April indicates that the<br />

economic recovery is continuing at a moderate pace, though somewhat more slowly than the<br />

Committee had expected. Also, recent labor market indicators have been weaker than<br />

anticipated. The slower pace of the recovery reflects in part factors that are likely to be<br />

temporary, including the damping effect of higher food and energy prices on consumer<br />

purchasing power and spending as well as supply chain disruptions associated with the tragic<br />

events in Japan. Household spending and business investment in equipment and software<br />

continue to expand. However, investment in nonresidential structures is still weak, and the<br />

housing sector continues to be depressed. Inflation has picked up in recent months, mainly<br />

reflecting higher prices for some commodities and imported goods, as well as the recent<br />

supply chain disruptions. However, longer-term inflation expectations have remained stable.<br />

Consistent with its statutory mandate, the Committee seeks to foster maximum employment<br />

and price stability. The unemployment rate remains elevated; however, the Committee<br />

expects the pace of recovery to pick up over coming quarters and the unemployment rate to<br />

resume its gradual decline toward levels that the Committee judges to be consistent with its<br />

dual mandate. Inflation has moved up recently, but the Committee anticipates that inflation<br />

will subside to levels at or below those consistent with the Committee's dual mandate as the<br />

effects of past energy and other commodity price increases dissipate. However, the<br />

Committee will continue to pay close attention to the evolution of inflation and inflation<br />

expectations.<br />

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at<br />

levels consistent with its mandate, the Committee decided today to keep the target range for<br />

the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that<br />

economic conditions--including low rates of resource utilization and a subdued outlook for<br />

inflation over the medium run--are likely to warrant exceptionally low levels for the federal<br />

funds rate for an extended period. The Committee will complete its purchases of $600 billion<br />

of longer-term Treasury securities by the end of this month and will maintain its existing policy<br />

of reinvesting principal payments from its securities holdings. The Committee will regularly<br />

review the size and composition of its securities holdings and is prepared to adjust those<br />

holdings as appropriate.<br />

We think they will<br />

soften the language<br />

around inflation as<br />

commodity prices<br />

have tumbled.<br />

We also think they will<br />

target a somewhat<br />

longer duration for<br />

their portfolio<br />

(currently between 5<br />

and 6 years), thereby<br />

introducing modest<br />

stimulus<br />

The Committee will monitor the economic outlook and financial developments and will act as<br />

needed to best foster maximum employment and price stability.<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

8<br />

www.GlobalMarkets.bnpparibas.com

US: GDP Revisions Paint Sobering Picture<br />

• Downward revisions to GDP combined with<br />

weakness in incoming data paint a notably<br />

weaker picture of the economy.<br />

• New source data and methodologies drove<br />

the revisions.<br />

• The lower estimates of GDP don’t do much<br />

to resolve a tension between economic activity<br />

and labor market data.<br />

• This massive reduction in the utilization of<br />

labor was reflected in a productivity boom that<br />

is now in the process of reversing; the new<br />

estimates for H1 2011 suggest productivity<br />

declined more than 1% saar.<br />

• The latest estimates suggest a much softer<br />

trajectory in recent quarters for corporate<br />

profits, both domestic and in the rest of the<br />

world. A healthy increase in corporate profits in<br />

the last couple of years is impressive, but the<br />

more recent data raise concerns of how<br />

sustained corporate profitability will prove to be<br />

in 2011.<br />

Source: Reuters EcoWin Pro<br />

Chart 1: Real GDP Level<br />

Chart 2: Revision to PCE was a Major<br />

Contributor<br />

Annual revisions were mainly driven by revisions<br />

to consumption and investment and don’t<br />

resolve Okun’s law tensions.<br />

The annual revisions to GDP released at the end of<br />

July painted a far worse picture of both the recession<br />

and the recovery. It felt like déjà vu since we were<br />

saying essentially the same thing last August after<br />

the 2010 annual revisions (Chart 1).<br />

The level of real GDP was revised down 0.8% in Q4<br />

2008, 1.6% in Q4 2009, and 1.2% in Q4 2010 as<br />

most categories of final demand were revised lower<br />

in the last three years. The biggest contributor to the<br />

lower estimates of GDP was, yet again, weaker<br />

estimates of consumer spending (Chart 2). In<br />

particular, in Q4 2010 personal spending revisions<br />

contributed 0.7pp to the 1.2pp downward revision to<br />

GDP with the bulk of it coming from services (-<br />

0.5pp). Meanwhile, the rebound in equipment and<br />

software investment has not been as strong as was<br />

previously estimated. The sector contributed 0.3pp to<br />

the GDP downward revision in Q4 2010 (Table 1).<br />

There were also modest downward marks to<br />

government and net trade.<br />

The lower estimates of GDP don’t do much to<br />

resolve a tension between economic activity and<br />

Source: Reuters EcoWin Pro<br />

Source: Reuters EcoWin Pro<br />

Chart 3: Okun’s Law<br />

labor market data. The historical relationship known<br />

as Okun’s law held that for every 2% decline in GDP<br />

relative to potential, the unemployment rate would<br />

rise roughly 1%. Yet even with the lower estimates<br />

from BEA, we saw a peak-to-trough decline of 5.1%<br />

in GDP during the past recession but a rise in the<br />

Yelena Shulyatyeva/Julia Coronado 4 August 2011<br />

Market Mover<br />

9<br />

www.GlobalMarkets.bnpparibas.com

unemployment rate of 5.7% suggesting an Okun’s<br />

law coefficient closer to one (Chart 3). This massive<br />

reduction in the utilization of labor was reflected in a<br />

productivity boom that is now in the process of<br />

reversing; the new estimates for H1 2011 suggest<br />

productivity declined more than 1% saar.<br />

The annual revisions painted a sobering picture as<br />

the revised estimates suggest that both final<br />

domestic demand and GDP are still below the<br />

previous business cycle peak. It was previously<br />

estimated that the economy recovered above that<br />

level (Chart 4).<br />

New source data and methodologies drove the<br />

revisions<br />

This year’s GDP revision includes revised estimates<br />

for most series for 2008 through Q1 2011. In<br />

addition, for selected series—including personal<br />

consumption expenditures, and private fixed<br />

investment—the estimates have been revised for the<br />

most recent 8 years owing to some methodological<br />

changes. The revision incorporates source data that<br />

are more complete and reliable than those previously<br />

available.<br />

Personal consumption spending estimates were<br />

benchmarked to the annual retail trade report (ARTS)<br />

for 2008 and 2009. ARTS is a mandatory census of<br />

retailers. Since 2009 the BEA relies on the Census<br />

Bureau’s monthly retail trade report (MRTS), which is<br />

voluntary survey. Since ARTS is mandatory, it is a<br />

more complete and accurate data source. However,<br />

it is available only with a significant lag, and<br />

therefore, the benchmarking process often leads to<br />

significant revisions in estimates of consumer<br />

spending. Most of the lower estimates of food and<br />

beverage consumption resulted from the<br />

benchmarking to ARTS.<br />

Another mark down was to services spending<br />

reflecting new source data and methodology in<br />

estimating expenditures on financial services and<br />

insurance. The change in methodology included the<br />

use of new price indices. The BEA introduced<br />

improved indices based on the Bureau of Labor<br />

Statistics Producer Price Indices (PPIs) for deflating<br />

expenditures for property and casualty insurance.<br />

Previously, these were based on CPI indices for the<br />

basket of goods or were implicitly derived. Both the<br />

new price index and source data resulted in lower<br />

estimates of consumption of financial services.<br />

Corporate profits are now estimated to have been<br />

stronger earlier in the recovery but have lost<br />

more momentum of late<br />

The recent productivity boom was reflected in the<br />

latest surge in corporate profits. The annual revisions<br />

suggested that the jump in corporate profits in the<br />

Table 1: Real GDP Selected Component Revisions (%<br />

Change from the Previous Estimate)<br />

Q4 2008 Q4 2009 Q4 2010 Q1 2011<br />

GDP -0.8 -1.6 -1.2 -1.6<br />

PCE -0.7 -0.9 -0.7 -0.7<br />

Nondurable<br />

Goods -0.2 -0.3 -0.2 -0.2<br />

<strong>Services</strong> -0.7 -0.7 -0.5 -0.6<br />

Private Fixed<br />

<strong>Investment</strong> -0.2 -0.3 -0.3 -0.3<br />

Equipment &<br />

Software -0.2 -0.2 -0.3 -0.3<br />

Source: BEA, <strong>BNP</strong> Paribas<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Not There Yet<br />

Chart 5: Corporate profits grew faster, growth<br />

has slowed a lot as of late<br />

Source: Reuters EcoWin Pro<br />

beginning of 2009 was even stronger than was<br />

previously calculated (Chart 5). The major contributor<br />

to the upward revision was the domestic financial<br />

sector. However, the latest estimates suggest a<br />

much softer trajectory at the end of last year –<br />

beginning of this year for both domestic and the rest<br />

of the world profits. Therefore despite the recent<br />

earnings readings which have been beating<br />

estimates, we believe growth in corporate profits is<br />

likely to be limited in coming quarters.<br />

Yelena Shulyatyeva/Julia Coronado 4 August 2011<br />

Market Mover<br />

10<br />

www.GlobalMarkets.bnpparibas.com

ECB: Changing Tack<br />

• The use of unconventional policy measures<br />

– including a six-month LTRO and the SMP – in<br />

response to the heightened market tensions is a<br />

very welcome development.<br />

• A shift in the approach to the conventional<br />

policy stance is also probable given increased<br />

uncertainty over the economic outlook.<br />

• We have revised our policy call, taking out<br />

the refi rate hikes we had previously forecast for<br />

October this year and January 2012. However,<br />

we see this as a pause in policy normalisation<br />

rather than an abandonment.<br />

Unconventional tools deployed<br />

The big debate prior to this month’s policy meeting<br />

was whether the ECB would re-start its SMP, given<br />

the delay before the modified EFSF becomes fully<br />

operational. This subject is tackled in more detail in<br />

the accompanying article “ECB: Bond Purchases –<br />

Acupuncture”. Long story short, we welcome the<br />

ECB’s decision to re-engage at an earlier stage than<br />

many in the market had feared. However, spreads<br />

continued to widen because there was not unanimity<br />

on the Governing Council over the SMP purchases<br />

and the strategy seems to be merely to try and ease<br />

the pressure on Italy and Spain by buying in other<br />

markets rather than those two directly.<br />

On the basis of the framework laid out for the use of<br />

the SMP, which is centred on the impairment of the<br />

monetary policy transmission mechanism (Box 1), we<br />

see a compelling case for widening the purchases to<br />

include the Italian and Spanish markets. The ECB<br />

interventions could act as a ‘bridge’ until the EFSF in<br />

its new form is up and running.<br />

One of the reasons why the ECB is perhaps reluctant<br />

to intervene is that it wants to see more action from<br />

governments first. This was hinted at in the fiscal<br />

section of the Introductory Statement. To quote the<br />

key extract: the ECB sees a need for “announcing<br />

and implementing additional and more frontloaded<br />

fiscal adjustment measures.”<br />

In addition to developments on the SMP, the ECB’s<br />

lengthening of its liquidity provision was a very<br />

welcome development, demonstrating an increased<br />

sensitivity to broadening market tensions. This took<br />

the form of a supplementary LTRO with a 6-month<br />

maturity on a full allotment basis, combined with an<br />

Box 1: Extracts from ECB Statement, 10 May 2010<br />

“The Governing Council decided on several measures to address the<br />

severe tensions in certain market segments which are hampering the<br />

monetary policy transmission mechanism. In view of the current<br />

exceptional circumstances prevailing in the market, the Governing<br />

Council decided:<br />

To conduct interventions in the euro area public and private debt<br />

securities markets (Securities Markets Programme) to ensure depth<br />

and liquidity in those market segments which are dysfunctional. The<br />

objective of this programme is to address the malfunctioning of<br />

securities markets and restore an appropriate monetary policy<br />

transmission mechanism. The scope of the interventions will be<br />

determined by the Governing Council. In making this decision we<br />

have taken note of the statement of the euro area governments that<br />

they “will take all measures needed to meet [their] fiscal targets this<br />

year and the years ahead in line with excessive deficit procedures”<br />

and of the precise additional commitments taken by some euro area<br />

governments to accelerate fiscal consolidation and ensure the<br />

sustainability of their public finances.<br />

In order to sterilise the impact of the above interventions, specific<br />

operations will be conducted to re-absorb the liquidity injected<br />

through the Securities Markets Programme. This will ensure that the<br />

monetary policy stance will not be affected.”<br />

Source: ECB<br />

extension of the commitment to full allotment for its<br />

other operations until into next year.<br />

Wait and see<br />

Switching to the ECB’s assessment of the economic<br />

situation and its potential impact on the conventional<br />

policy stance, there were some changes made in the<br />

latest Introductory Statement but, as we expected,<br />

they were comparatively minor – see Box 2. It is only<br />

a month since rates were increased so the ECB was<br />

never going to make radical changes at this point,<br />

giving the impression that the decision to raise rates<br />

was a mistake.<br />

Moreover, as there will be a formal review of the staff<br />

projections between now and September’s policy<br />

meeting, which Mr Trichet made a point of stressing<br />

in the press conference, the latest assessment was a<br />

holding operation.<br />

Most of the changes in the latest statement related to<br />

the growth outlook and particularly high uncertainty.<br />

There was a reference to downside risks to growth<br />

intensifying – again see Box 2 – but the overall view<br />

was that the risks were still broadly balanced. There<br />

must be a good chance that the risk assessment is<br />

tilted to the downside after the September review if<br />

market tensions persist and confidence continues to<br />

slide.<br />

Either way, the hard activity data in the eurozone are<br />

likely to be ‘catching down’ between now and the<br />

Ken Wattret 4 August 2011<br />

Market Mover<br />

11<br />

www.GlobalMarkets.bnpparibas.com

September and October policy meetings following a<br />

run of much weaker sentiment surveys.<br />

Given this, we have taken out the rate hike which we<br />

had factored in for October (as already flagged in our<br />

previous note ”ECB: Game Changer”, 14 July). We<br />

had not changed the forecast prior to the emergency<br />

summit in late July as we saw a possibility that<br />

radical action could lead to a positive reaction in the<br />

markets which, in turn, could boost sentiment. But<br />

even though the summit delivered what we consider<br />

to be a major step forward in dealing with the crisis, it<br />

has not had a lasting effect. This is partly due to the<br />

delay before the broader remit of the EFSF becomes<br />

fully operational.<br />

Inflation risks to the upside<br />

Beyond our forecast change for October, the wider<br />

issue is whether the ECB pause we expect could turn<br />

into a prolonged period of inaction, a scenario which<br />

the market is already discounting, and whether the<br />

bias could ultimately shift towards easing rather than<br />

tightening. Regarding the latter issue, nothing can be<br />

ruled out in this highly uncertain environment but we<br />

doubt that the ECB will give any encouragement to<br />

the prospect of a shift in the bias, as its assessment<br />

of risks to price stability is likely to stay to the upside<br />

for some time to come.<br />

For rate cuts to be contemplated, the risks to price<br />

stability would have to shift to the downside. This is<br />

possible in the event of a major adverse shock, as in<br />

2008. But in the absence of such a shock, this is a<br />

very unlikely scenario with rates so low.<br />

There were only minor changes to the assessment of<br />

the inflation outlook and risks in the latest statement<br />

– see Box 2. The reference to higher capacity use as<br />

an upside risk was removed, relating we presume to<br />

the weaker growth outlook. But, overall, the<br />

emphasis was much as before: i.e. inflation will be<br />

well above 2% for some time to come and the upside<br />

risks will need to be closely monitored. This implies<br />

that, while a pause in the normalisation process is<br />

possible in an environment of high uncertainty, the<br />

underlying bias will still be towards tightening.<br />

Given this assessment, the separation principle will<br />

be prominent in ECB thinking: i.e. conventional policy<br />

will be set on the basis of the assessment of inflation<br />

and its risks, while unconventional policy measures<br />

will deal with tensions in markets.<br />

Lower for longer<br />

The reason for forecasting an interruption to the<br />

ECB’s ‘quarter per quarter’ strategy of normalisation<br />

is clear. Given the exceptionally high uncertainty over<br />

the outlook, the prudent option is for the central bank<br />

to take a wait and see approach. This was hinted at<br />

Box 2: Extracts from ECB Statement, 4 August 2011<br />

On the Policy Stance…<br />

“The information that has become available since then confirms<br />

our assessment that an adjustment of the accommodative<br />

monetary policy stance was warranted in the light of upside risks<br />

to price stability. While the monetary analysis indicates that the<br />

underlying pace of monetary expansion is still moderate,<br />

monetary liquidity remains ample and may facilitate the<br />

accommodation of price pressures.”<br />

On Growth…<br />

“Data and survey releases for the second quarter point towards<br />

ongoing real GDP growth, albeit, as expected, at a slower pace.<br />

This moderation also reflects the fact that the strong growth in<br />

the first quarter was in part due to special factors. The underlying<br />

positive momentum of economic growth in the euro area remains<br />

in place and continued moderate expansion is expected in the<br />

period ahead. Growth dynamics are currently weakened by a<br />

number of factors contributing to uncertainty.<br />

“The risks to this economic outlook remain broadly balanced in<br />

an environment of particularly high uncertainty. On the one hand,<br />

consumer and business confidence, together with improvements<br />

in labour market conditions, could continue to provide support to<br />

domestic economic activity. On the other hand, downside risks<br />

may have intensified. They relate to the ongoing tensions in<br />

some segments of the euro area financial markets as well as to<br />

global developments, and the potential for these pressures to<br />

spill over into the euro area real economy. Downside risks also<br />

relate to further increases in energy prices, protectionist<br />

pressures and the possibility of a disorderly correction of global<br />

imbalances.”<br />

On Inflation...<br />

“Upward pressure on inflation, mainly from energy and other<br />

commodity prices, is also still discernible in the earlier stages of<br />

the production process.<br />

Risks to the medium-term outlook for price developments remain<br />

on the upside. They relate, in particular, to higher than assumed<br />

increases in energy prices. Furthermore, there is a risk of<br />

increases in indirect taxes and administered prices that may be<br />

greater than currently assumed, owing to the need for fiscal<br />

consolidation in the coming years. Upside risks may stem from<br />

stronger than expected domestic price pressures.”<br />

Source: ECB<br />

by Mr Trichet in the latest press conference with<br />

regard to the growth outlook.<br />

While eurozone growth is forecast to have slowed in<br />

Q2, as the ECB had already expected and<br />

highlighted, the suggestion was that we would have<br />

to wait and see what Q3 would bring.<br />

On the basis of our expectation of a weaker growth<br />

performance in the eurozone over the second half of<br />

this year than we had previously assumed (see the<br />

accompanying article “Eurozone: Weaker for<br />

Longer”) the pause from the ECB is likely to go<br />

beyond the October meeting.<br />

The shift in growth expectations relates to a range of<br />

factors, including the escalation in financial market<br />

tensions. Looking back at similar periods of high<br />

Ken Wattret 4 August 2011<br />

Market Mover<br />

12<br />

www.GlobalMarkets.bnpparibas.com

uncertainty and market turbulence in the past, they<br />

have usually been characterised by weak business<br />

investment, which typically lasts for two to three<br />

quarters. In the current uncertain circumstances,<br />

businesses are very likely to postpone their<br />

investment. We expect to see this in the composition<br />

of GDP in the second half of the year, along with a<br />

slowdown in exports.<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

Chart 1: Composite PMIs Plunge<br />

France<br />

Germany<br />

Italy<br />

Spain<br />

Some of the eurozone sentiment surveys have been<br />

deteriorating alarmingly quickly recently, including<br />

the PMI figures in particular. They are now signalling<br />

a risk of a contraction in GDP during the second half<br />

of the year if confidence continues to slide. The most<br />

striking features of the recent PMI data have been<br />

the speed and scale of the declines in Germany and<br />

France. Their composite PMIs were above 60 just a<br />

few months ago, indicative of 1%-plus q/q rates of<br />

growth. But they are currently in the low 50s. This will<br />

have come as a major surprise to the ECB as indeed<br />

it did to us. The PMIs for the peripheral countries are<br />

already in recession territory, in line with our longstanding<br />

forecast of double dips.<br />

Significantly, the weakness has become more broad<br />

based across sectors, suggesting that the slowdown<br />

is more than just a temporary disruption caused by<br />

supply chain disruptions due to events in Japan. The<br />

likelihood, therefore, is that Q3 and Q4 data will be<br />

far weaker than we had expected: our assumption is<br />

now for quarter-on-quarter rises in GDP of 0.1%<br />

compared to the prior forecast of 0.3-0.4%. The<br />

consequence is that we have also taken out our<br />

forecast of the next step in the normalisation process<br />

– i.e. a rate hike teed up in December and delivered<br />

in January next year.<br />

Interventions elicit recovery<br />

Whether the pause we forecast turns into an end to<br />

the normalisation process will be heavily dependent<br />

on the prospects for growth and inflation beyond the<br />

weakness we expect in H2.<br />

As tensions in markets usually elicit a response from<br />

policymakers in the eurozone, albeit a tardy one, we<br />

assume that action will ultimately be taken to help<br />

stabilise markets, resulting in positive spillovers on<br />

the real economy.<br />

Consistent with this, our assumption is that growth<br />

prospects will start to improve later this year and into<br />

2012 as the market interventions bear fruit and the<br />

growth environment at the global level also becomes<br />

more supportive. The latter is obviously crucial to the<br />

export-sensitive economies like Germany.<br />

Timing is important. We believe that the underlying<br />

economic fundamentals in the core of the eurozone<br />

are relatively favourable so if credible policy action is<br />

40<br />

35<br />

30<br />

25<br />

98 99 00 01 02 03 04 05 06 07 08 09 10 11 12<br />

Source: Reuters EcoWin Pro<br />

taken soon enough to avert a downward spiral of<br />

confidence, there is potential for the eurozone to<br />

continue to grow at a decent clip beyond the period<br />

immediately ahead.<br />

Unfinished business<br />

On this basis, we forecast a resumption of the policy<br />

normalisation from the ECB, with the meeting in April<br />

next year the most probable timing for the next rate<br />

rise (to be teed up in March in tandem with a new set<br />

of projections, including for 2013). To be clear, we do<br />

not expect a re-engagement because of rampant<br />

growth or because inflation will be shooting upwards.<br />

We expect a gradual recovery in growth rates and<br />

headline inflation should be on a downward path in<br />

2012 given favourable energy base effects.<br />

Rather, the rationale is to reduce the exceptional<br />

level of conventional policy accommodation. This has<br />

been integral to the ECB’s decision to start raising<br />

rates earlier this year and we expect it to remain a<br />

key part of the ECB’s thinking over the longer-term.<br />

We are not forecasting a shift to restrictive policy,<br />

merely a reduction in the degree of accommodation.<br />

Our revised forecast is, therefore, for the refinancing<br />

rate to go up by 25bp each quarter from April 2012<br />

onwards, taking the rate to 2.25% by the end of next<br />

year: i.e. real rates no longer negative.<br />

The risks associated with this forecast are, of course,<br />

extensive, in terms of timing, magnitude and even<br />

direction, given the exceptional uncertainty over the<br />

economic and financial outlook. Moreover, there are<br />

additional complications with regard to the handover<br />

from Mr Trichet to Mr Draghi in November this year.<br />

Still, on the basis of our best judgement of the<br />

economic outlook and the ECB’s reaction function,<br />

we believe a pause until spring 2012 and a gradual<br />

resumption of policy normalisation thereafter is the<br />

most probable course of events.<br />

Ken Wattret 4 August 2011<br />

Market Mover<br />

13<br />

www.GlobalMarkets.bnpparibas.com

ECB: Bond Purchases – Acupuncture<br />

• We believe that the pressures on Italian and<br />

Spanish spreads are interfering with the<br />

monetary transmission mechanism.<br />

Chart 1: Eurozone Monetary Growth (% y/y)<br />

• Demand for broad money has probably risen<br />

while credit supply is probably falling as a result<br />

of the crisis.<br />

• The objective of stabilising markets cannot<br />

wait until parliaments have passed new<br />

legislation on the EFSF.<br />

• We therefore see a respectable and<br />

persuasive case for bond purchases by the<br />

ECB.<br />

• At the moment, we believe that relatively<br />

small-scale purchases could stabilise the<br />

market. The longer the delay, the greater any<br />

subsequent purchases will need to be.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: M3 and Nominal GDP<br />

• We believe respectable arguments can be<br />

made for EUR 230-400bn of purchases.<br />

• The ECB has also seen the same arguments<br />

and has re-engaged the SMP, though it looks<br />

like so far this is more narrow and limited than<br />

we would like to see.<br />

• JC Trichet was asked at the press<br />

conference why the intervention has been only<br />

in the bond markets of countries already under<br />

the SMP umbrella. We interpret this, in the light<br />

of other Trichet comments, as being because<br />

the ECB first wants to see action from Italy.<br />

• There will be relief in the market that the<br />

ECB has bowed to the inevitable and reengaged<br />

at an earlier stage than many had<br />

feared.<br />

• However, the benefit of the re-engagement<br />

will be tempered if the ECB only follows the<br />

‘acupuncture’ approach to relieving pressure on<br />

Italy and Spain by buying other markets but not<br />

these two.<br />

The 21 July EU Summit took some big steps forward,<br />

including widening the scale of the EFSF to be able<br />

to buy bonds in the secondary market for nonprogramme<br />

countries. However, the EFSF’s mandate<br />

will not be extended until there has been<br />

parliamentary approval in a number of countries; this<br />

could take months. So the eurozone has agreed the<br />

need for such a facility but does not at present have<br />

the means to implement it. The market is therefore<br />

pushing Italian and Spanish spreads wider. Our view<br />

Source: Reuters EcoWin Pro<br />

is that this is exactly the circumstance where the<br />

flexibility of a central bank should be used to bridge<br />

the gap. We have seen a strong case for the ECB to<br />

re-instate its SMP.<br />

Since last year, there have been two distinct sets of<br />

bond-buying operations by central banks.<br />

The Fed and the Bank of England both engaged in<br />

large-scale asset purchases (LSAPs) for quite clear<br />

monetary policy reasons – to lower yields on<br />

government bonds, thereby stimulating the economy<br />

and reducing the risk of deflation.<br />

The ECB bought far fewer bonds. Its motivation was<br />

“to address the severe tensions in certain market<br />

segments which are hampering the monetary policy<br />

transmission mechanism”.<br />

We would argue that the monetary policy mechanism<br />

is being impeded today by the pressures in the Italian<br />

and Spanish government bond markets. Bond<br />

spreads over Germany have widened considerably<br />

over the last month – by over 180bp for Italy at the<br />

Paul Mortimer-Lee 4 August 2011<br />

Market Mover<br />

14<br />

www.GlobalMarkets.bnpparibas.com

10-year maturity and by about 150bp for Spain. CDS<br />

on Italian and Spanish banks have widened also,<br />

increasing the cost of funds to the banks and<br />

therefore the costs to private-sector borrowers. In<br />

other words, there has been an unintended monetary<br />

tightening in Spain and Italy. Term rates will have<br />

risen for a huge variety of actors.<br />

In both countries it is likely that, against the<br />

background of a deepening financial crisis,<br />

precautionary behaviour will have increased in the<br />

banking sector and the corporate and household<br />

sectors. It is likely therefore that credit availability will<br />

have decreased at the same time as the<br />

precautionary demand for money has increased.<br />

Hence there is a need to increase broad liquidity<br />

(M3) and to reduce term rates.<br />

We would argue that this points to a strong case for<br />

monetary stimulus to offset the unplanned monetary<br />

tightening. Cutting rates is not appropriate since<br />

there is a blockage in the transmission mechanism<br />

(and in any case would be difficult for the ECB to<br />

swallow since it would suggest the two hikes so far<br />

were a mistake). Direct intervention in the bond<br />

market is the alternative. Buying bonds in those<br />

segments that are most distressed is the appropriate<br />

policy since it in is those countries that the liquidity<br />

effects of the crisis are most acute.<br />

At this stage, neither Italy nor Spain has a debt<br />

sustainability problem. Spain’s debt/GDP level is<br />

lower than the eurozone average. Italy has a high<br />

debt/GDP ratio but it also has a small primary surplus<br />

that we believe will increase in coming years.<br />

Because there is such a high debt/GDP ratio in Italy,<br />

there are multiple equilibria for the economy. We<br />

could have a high bond yield/high required primary<br />

surplus equilibrium or a low bond yield/low primary<br />

surplus equilibrium.<br />

Which equilibrium we end up with is path-dependent.<br />

The longer Italian yields are at high levels, the<br />

greater the probability that they will remain there.<br />

There is a strong case for early intervention to bring<br />

a better balance to the market, to give a better<br />

perception of two-way risk and to avoid the high<br />

yield/high primary surplus equilibrium. Given the lack<br />

of liquidity in the market, relatively small-scale<br />

purchases – especially if there were the threat of<br />

more to come – could have big effects.<br />

If the ECB were to purchase bonds, what should be<br />

the scale? Under the SMP, the ECB bought EUR<br />

75bn of bonds from Greece, Italy and Ireland. These<br />

countries together comprise about 6% of eurozone<br />

GDP. Spain and Italy comprise 32%. Scaling up the<br />

previous purchases gives EUR 400bn. Given that the<br />

fundamental positions of Italy and Spain are much<br />

better than the three small peripherals, this would<br />

very much be an upper limit, we would argue. The<br />

amounts that might need to be bought should be<br />

much lower – provided action were taken relatively<br />

quickly. The longer the ECB waits, the more damage<br />

will have been done to the countries’ funding base<br />

and the more the ECB would ultimately have to buy<br />

to achieve the same effect.<br />

Chart 1 shows monetary growth in the eurozone and<br />

the rate of growth of credit to the private sector.<br />

Monetary growth in June was 2.1% y/y. This is 2.4pp<br />

below the reference value of 4.5% for M3 growth. M3<br />

is EUR 9652bn. As a first stab, to get M3 to its<br />

reference value would require bond purchases by the<br />

ECB totalling about EUR230bn (=.024*9652). If these<br />

bonds were bought from banks, the M3 effect would<br />

be zero, so a larger quantity of purchases would<br />

likely be required (purchases from non-banks raise<br />

M3, purchases from banks leave M3 unchanged). In<br />

the past, the ECB sterilised the effect of SMP<br />

purchases on bank liquidity. It could do so again.<br />

What matters from our perspective and for the<br />

economy is that it acts to boost M3 (which is why the<br />

ECB has an M3 reference value and not one for<br />

narrow money).<br />

One objection to this M3 approach is that, while<br />

monetary growth has been slow since the crisis, in<br />

2007-2008 a substantial overhang of excess liquidity<br />

built up. Chart 2 shows the ratio of M3 to nominal<br />

GDP is still above its trend level. There is a case for<br />

allowing the M3/GDP ratio to return to its trend level,<br />

the question is the optimum speed for this. We would<br />

argue that, since the ratio has already reduced<br />

substantially, the risks of a liquidity overhang (on<br />

inflation, asset prices) have substantially reduced.<br />

From here on, the adjustment should therefore be<br />

rather gentle.<br />

Overall, we see a persuasive monetary case for the<br />

ECB buying bonds in the secondary market, of Italy<br />

and Spain. Trichet opened the door to this to a<br />

greater degree than expected at the press<br />

conference, with action almost immediately; we<br />

applaud this. Whether buying will extend to BTPs<br />

and bonos at some stage is unclear but we hope so.<br />

It may be tempting for the ECB to go for smaller<br />

markets where intervention has already been made,<br />

so as to get more bang for its buck. Also, Trichet’s<br />

comments that he would like to see more action and<br />

greater front loading seem to be aimed at Italy,<br />

where Prime Minister Berlusconi yesterday showed<br />

no sign of reacting to recent tensions.<br />

Any action by the ECB is welcome, and clearly after<br />

a long hiatus, engaging the SMP again carries the<br />

threat of broader action (countries and size) if<br />

markets do not respond. We would argue that since<br />

Paul Mortimer-Lee 4 August 2011<br />

Market Mover 15<br />

www.GlobalMarkets.bnpparibas.com

the strains currently are in Spain and Italy, direct<br />

action in those markets is required rather than the<br />

‘acupuncture’ approach of buying only in smaller<br />

markets.<br />

The ECB sees fiscal woes as something that should<br />

be addressed by governments, not the central bank.<br />

If Italy is unwilling to implement credibility-enhancing<br />

measures to save itself, then the ECB will be<br />

reluctant to buy BTPs, since that would let the Italian<br />

government off the hook. The ECB will likely only<br />

give something directly to Italy when it gets<br />

something in return.<br />

What is needed now to bring in BTP spreads more<br />

decisively is additional action from Italy, followed by<br />

SMP buying of BTPs and an increase in the size of<br />

the EFSF. Mr Trichet has showed he is willing to play<br />

and has put the ball firmly in the court of Mr<br />

Berlusconi.<br />

Paul Mortimer-Lee 4 August 2011<br />

Market Mover 16<br />

www.GlobalMarkets.bnpparibas.com

Eurozone: Weaker for Longer<br />

• The second half of 2011 is shaping up to be<br />

much weaker than we had initially forecast.<br />

• The deterioration in leading indicators has<br />

become more broadly based across sectors and<br />

national economies.<br />

• Increased tensions in the financial markets<br />

and high uncertainty have been key factors.<br />

• We have revised down our growth forecasts<br />

accordingly – to 1.8% from 2.0% in 2011 and to<br />

1.0% from 1.5% in 2012.<br />

Table 1: GDP Growth Forecasts<br />

(%)<br />

2011 2012<br />

2011 2012 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

Revised<br />

GDP (% q/q) - - - 0.8 0.4 0.1 0.1 0.2 0.3 0.4 0.4<br />

GDP (% y/y) 1.8 1.0 1.5 2.5 1.9 1.6 1.4 0.8 0.7 1.0 1.3<br />

Previous<br />

GDP (% q/q) - - - 0.8 0.4 0.3 0.4 0.3 0.4 0.4 0.4<br />

GDP (% y/y) 2.0 1.5 1.5 2.5 1.9 1.7 1.9 1.4 1.4 1.6 1.5<br />

Source: <strong>BNP</strong> Paribas<br />

65<br />

60<br />

55<br />

Chart 1: Composite PMI & Growth<br />

1.5<br />

1.0<br />

0.5<br />

50<br />

0.0<br />

Weakness spreading…<br />

In the article “Eurozone: Broader Weakness”,<br />

published in the Market Mover on 21 July, we<br />

stressed that the deterioration in economic conditions<br />

in the eurozone was becoming more broadly based<br />

across both sectors and countries.<br />

The latter issue, with the core countries joining the<br />

periphery in experiencing a marked deterioration in<br />

the economic climate, is a key issue for our growth<br />

forecast, as Germany and France account for a<br />

much higher proportion of eurozone output than the<br />

most distressed peripheral countries.<br />

The deterioration reflects various factors, including<br />

weaker global growth, high uncertainty and broader<br />

tensions in the financial markets. The latter looks like<br />

the main reason for the acceleration of the slide in<br />

business sentiment in recent months.<br />

We suggested in the article which is cited above that<br />

a sustained positive market reaction to the summit<br />

agreement on 21 July could see sentiment rebound.<br />

Despite the summit delivering what we consider to be<br />

a major step forward in dealing with the crisis, it has<br />

not had a lasting effect on Italian and Spanish<br />

spreads (though the impact on Greece, Portugal and<br />

Ireland has been more positive). This is partly due to<br />

the delay before the broader remit of the EFSF<br />

becomes fully operational.<br />

The adverse impact of events inside the eurozone<br />

has been compounded by developments outside. In<br />

the US, the fiscal difficulties have not been good for<br />

confidence, while the economy has also been losing<br />

traction. At the same time, economic conditions at<br />

the global level have become less favourable, with<br />

the continued weakness of the manufacturing PMI in<br />

China a key example.<br />

45<br />

40<br />

35<br />

30<br />

25<br />

Composite PMI:<br />

Output<br />

20<br />

98 99 00 01 02 03 04 05 06 07 08 09 10 11<br />

Source: Reuters EcoWin Pro<br />

GDP (% q/q, RHS)<br />