MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

stubbornly high as have spreads between retail and<br />

wholesale prices so that the relief is only moderate.<br />

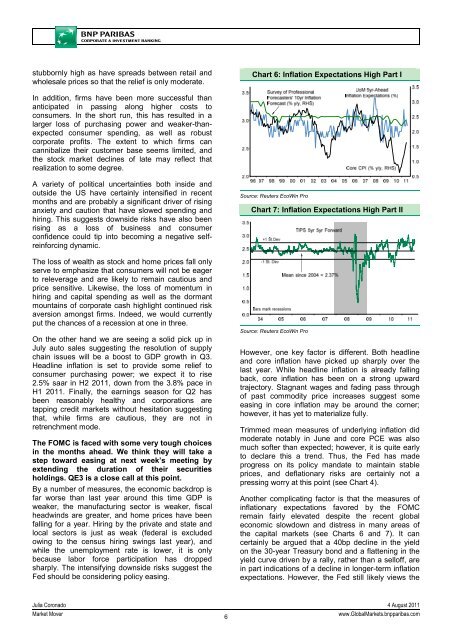

Chart 6: Inflation Expectations High Part I<br />

In addition, firms have been more successful than<br />

anticipated in passing along higher costs to<br />

consumers. In the short run, this has resulted in a<br />

larger loss of purchasing power and weaker-thanexpected<br />

consumer spending, as well as robust<br />

corporate profits. The extent to which firms can<br />

cannibalize their customer base seems limited, and<br />

the stock market declines of late may reflect that<br />

realization to some degree.<br />

A variety of political uncertainties both inside and<br />

outside the US have certainly intensified in recent<br />

months and are probably a significant driver of rising<br />

anxiety and caution that have slowed spending and<br />

hiring. This suggests downside risks have also been<br />

rising as a loss of business and consumer<br />

confidence could tip into becoming a negative selfreinforcing<br />

dynamic.<br />

The loss of wealth as stock and home prices fall only<br />

serve to emphasize that consumers will not be eager<br />

to releverage and are likely to remain cautious and<br />

price sensitive. Likewise, the loss of momentum in<br />

hiring and capital spending as well as the dormant<br />

mountains of corporate cash highlight continued risk<br />

aversion amongst firms. Indeed, we would currently<br />

put the chances of a recession at one in three.<br />

On the other hand we are seeing a solid pick up in<br />

July auto sales suggesting the resolution of supply<br />

chain issues will be a boost to GDP growth in Q3.<br />

Headline inflation is set to provide some relief to<br />

consumer purchasing power; we expect it to rise<br />

2.5% saar in H2 2011, down from the 3.8% pace in<br />

H1 2011. Finally, the earnings season for Q2 has<br />

been reasonably healthy and corporations are<br />

tapping credit markets without hesitation suggesting<br />

that, while firms are cautious, they are not in<br />

retrenchment mode.<br />

The FOMC is faced with some very tough choices<br />

in the months ahead. We think they will take a<br />

step toward easing at next week’s meeting by<br />

extending the duration of their securities<br />

holdings. QE3 is a close call at this point.<br />

By a number of measures, the economic backdrop is<br />

far worse than last year around this time GDP is<br />

weaker, the manufacturing sector is weaker, fiscal<br />

headwinds are greater, and home prices have been<br />

falling for a year. Hiring by the private and state and<br />

local sectors is just as weak (federal is excluded<br />

owing to the census hiring swings last year), and<br />

while the unemployment rate is lower, it is only<br />

because labor force participation has dropped<br />

sharply. The intensifying downside risks suggest the<br />

Fed should be considering policy easing.<br />

Source: Reuters EcoWin Pro<br />

Chart 7: Inflation Expectations High Part II<br />

Source: Reuters EcoWin Pro<br />

However, one key factor is different. Both headline<br />

and core inflation have picked up sharply over the<br />

last year. While headline inflation is already falling<br />

back, core inflation has been on a strong upward<br />

trajectory. Stagnant wages and fading pass through<br />

of past commodity price increases suggest some<br />

easing in core inflation may be around the corner;<br />

however, it has yet to materialize fully.<br />

Trimmed mean measures of underlying inflation did<br />

moderate notably in June and core PCE was also<br />

much softer than expected; however, it is quite early<br />

to declare this a trend. Thus, the Fed has made<br />

progress on its policy mandate to maintain stable<br />

prices, and deflationary risks are certainly not a<br />

pressing worry at this point (see Chart 4).<br />

Another complicating factor is that the measures of<br />

inflationary expectations favored by the FOMC<br />

remain fairly elevated despite the recent global<br />

economic slowdown and distress in many areas of<br />

the capital markets (see Charts 6 and 7). It can<br />

certainly be argued that a 40bp decline in the yield<br />

on the 30-year Treasury bond and a flattening in the<br />

yield curve driven by a rally, rather than a selloff, are<br />

in part indications of a decline in longer-term inflation<br />

expectations. However, the Fed still likely views the<br />

Julia Coronado 4 August 2011<br />

Market Mover<br />

6<br />

www.GlobalMarkets.bnpparibas.com