Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Market</strong> <strong>Economics</strong> | <strong>Interest</strong> <strong>Rate</strong> <strong>Strategy</strong> | Forex <strong>Strategy</strong> 7 May 2010<br />

<strong>Market</strong> Mover<br />

<strong>Market</strong> Outlook 2-3<br />

Fundamentals 4-31<br />

• ECB: All Talk, No Action 4-6<br />

• Eurozone Periphery: Compare and 7-9<br />

Contrast<br />

• Eurozone: External Exposure 10<br />

• <strong>Market</strong> Stress Charts 11-13<br />

• Greece: The Austerity Programme 14-16<br />

• Germany: Downs and Ups 17-19<br />

• Norway: Concern over Europe 20-21<br />

• US: Recovery Turning into Expansion 22-24<br />

• US Credit: Still the Recovery’s Ball and 25-26<br />

Chain<br />

• Japan: Rising Chance of Sales Tax 27-28<br />

Hike?<br />

• <strong>BNP</strong> Paribas Surprise Indicator 29-31<br />

<strong>Interest</strong> <strong>Rate</strong> <strong>Strategy</strong> 32-60<br />

• Global: Liquidity Conditions Update 32<br />

• US: Supply Could Affect Swap Spread 33-35<br />

Curve<br />

• MBS: Sell MBS for Cheap Vol 36-39<br />

• US Gamma: Vol Playing Catch-Up with 40-41<br />

<strong>Market</strong> Turmoil<br />

• EUR: Could The Long End Collapse? 42<br />

• EUR: Limited Nervousness at ECB<br />

43<br />

Tenders<br />

• EGBs: <strong>Market</strong> Update and Top Trade 44-45<br />

Ideas<br />

• UK: Pressures on Gilts Likely? 46-47<br />

• Global Inflation Watch 48-51<br />

• Inflation: FTQ Forces Trounce<br />

52-53<br />

Breakevens<br />

• Europe iTraxx Credit Indices 54-57<br />

• Technical Analysis 58-59<br />

• Trade Reviews 60<br />

FX <strong>Strategy</strong> 61-67<br />

• <strong>Strategy</strong>: Judging Currencies by 61-64<br />

Liquidity<br />

• Technical <strong>Strategy</strong>: EUR dives 65-66<br />

• Trading Positions 67<br />

Forecasts & Calendars 68-83<br />

• 1 Week Economic Calendar 68-70<br />

• Key Data Preview 71-77<br />

• 4 Week Calendar 78<br />

• Treasury & SAS Issuance 79-80<br />

• Central Bank Watch 81<br />

• Economic & <strong>Interest</strong> <strong>Rate</strong> Forecasts 82<br />

• FX Forecasts 83<br />

Contacts 84<br />

www.Global<strong>Market</strong>s.bnpparibas.com<br />

• The EMU crisis continues to set the tone with risk<br />

aversion, asset correlations and liquidity spreads on the<br />

rise.<br />

• There is an urgent need for the authorities to get ahead<br />

of the game but this week’s ECB meeting was a missed<br />

opportunity.<br />

• The key way of bringing support – buying government<br />

bonds – is very controversial but the markets need to know<br />

whether or not the euro area can address the crisis.<br />

• Panic trading and contagion risks continue to support<br />

the core government bond markets, with core EGBs<br />

outperforming in the rally.<br />

• The crisis will reinforce the pressure on governments to<br />

put their public finances in order while compounding<br />

deflationary pressures.<br />

• Hence we maintain our medium-term constructive call<br />

on core government bond markets.<br />

• Economic data are being ignored in this environment.<br />

Only a very large upside surprise in US payrolls would<br />

have a meaningful impact on the direction of the Treasury<br />

market.<br />

• An obvious way to trade the crisis has been to short the<br />

euro. This remains valid whether or not radical action is<br />

taken quickly. We reiterate our bearish call on EUR/USD.<br />

• The outcome of the UK election and the ability of the<br />

new government to tackle the budget deficit decisively will<br />

drive sterling markets over the coming days/weeks.<br />

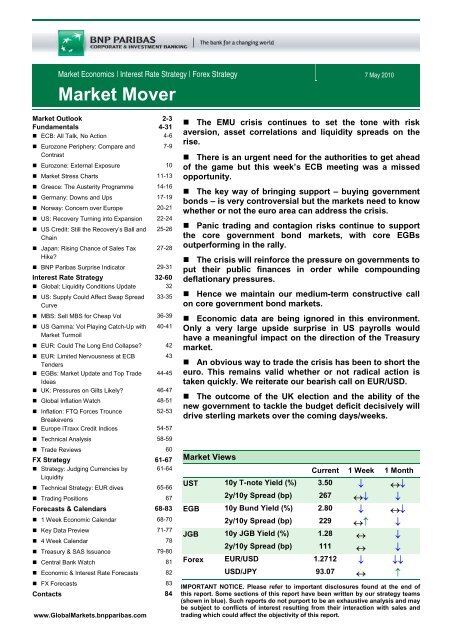

<strong>Market</strong> Views<br />

Current 1 Week 1 Month<br />

UST 10y T-note Yield (%) 3.50 ↓ ↔↓<br />

2y/10y Spread (bp) 267 ↔↓ ↓<br />

EGB 10y Bund Yield (%) 2.80 ↓ ↔↓<br />

2y/10y Spread (bp) 229 ↔↑ ↓<br />

JGB 10y JGB Yield (%) 1.28 ↔ ↓<br />

2y/10y Spread (bp) 111 ↔ ↓<br />

Forex EUR/USD 1.2712 ↓ ↓↓<br />

USD/JPY 93.07 ↔ ↑<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams<br />

(shown in blue). Such reports do not purport to be an exhaustive analysis and may<br />

be subject to conflicts of interest resulting from their interaction with sales and<br />

trading which could affect the objectivity of this report.

<strong>Market</strong> Outlook<br />

EMU crisis: contagion risk<br />

still escalating<br />

Rising risk aversion<br />

supports flight-to-quality<br />

trades<br />

No surprise from the ECB<br />

The nature of the sovereign crisis in Europe has changed dramatically over<br />

the past few weeks, with the contagion effects escalating from EU<br />

peripherals to banks and equity markets. What is now at stake is the future<br />

of the eurozone. There are several reasons why the markets’ reaction to<br />

news of the Greek aid package has been poor and why the financial stress<br />

remains so extreme, including the authorities not appearing to be in control<br />

of the situation and fears that others will be dragged into the maul.<br />

What is needed is first for the cash to be disbursed, second for a favourable<br />

ruling on the package from the German constitutional court and third for the<br />

Greek government to deliver on its promises – which will be monitored over<br />

time. There are significant differences between the Greek situation and that<br />

of other peripherals and it would be simplistic to group them all together.<br />

However, while less acute, there are chronic problems in other economies<br />

such as Portugal and Spain and markets do not appear minded to<br />

discriminate at present. The authorities need to move quickly to get ahead of<br />

the game.<br />

Flight-to-quality trades are dominating with core EGB yields hitting new lows<br />

and Treasuries following the move, ignoring better-than-expected recent<br />

economic data. The latest developments can only reinforce the pressure on<br />

governments to put their public finances in order while also reinforcing<br />

deflationary pressures – one of the key reasons to maintain our mediumterm<br />

constructive call on core government bond markets.<br />

The markets are for the moment in complete disbelief and panic trading and<br />

contagion risks will continue to support core EGBs in the short run.<br />

Treasuries may also benefit from “flight to relative liquidity” trades,<br />

particularly if the safety of Bunds came into question at any stage. Curve<br />

wise, the risk is to see some bull steepening should the setback in equity<br />

markets develop much further. Peripheral ASW curves should disinvert over<br />

the coming weeks if, as expected, the cash is made available to Greece but<br />

other peripheral curves (Portugal, Spain) will likely remain under pressure<br />

until the authorities take new initiatives.<br />

There is overall little flow on peripherals and a tendency to reduce exposure<br />

on any rebound. With no new buyers on the horizon, this explains the latest<br />

widening move on spreads. We also need to keep a close eye on the<br />

widening of the cross-currency basis as it could raise fears of a repeat of the<br />

post-Lehman panic. Generally speaking, the cross-currency basis can be<br />

modelled as a function of global risk (S&P, VIX) and local market liquidity<br />

(OIS/BOR). The latest move, also linked to the increase in sovereign risk, is<br />

adding to liquidity pressures.<br />

The ECB meeting and press conference delivered no fireworks. On the<br />

subject of buying government bonds, Mr Trichet reiterated on a number of<br />

occasions in response to questioning that this was not an option discussed<br />

at the Governing Council meeting. It wasn't, however, definitively ruled out.<br />

As pointed out earlier, his comment last weekend that "at this stage, we<br />

have absolutely no decision on the purchase of government bonds" hinted at<br />

a greater degree of flexibility on the issue than before. We know that at least<br />

one Governing Council member is against it.<br />

The same may be true for less radical options such as re-introducing more<br />

longer-term refinancing operations. Differences of opinion were explicitly<br />

recognised on the decision to suspend the minimum credit rating for<br />

collateral relating to Greek government debt. The decision was made by<br />

"overwhelming majority", i.e. it was not unanimous. We suggested<br />

beforehand that the ECB would probably need to see conditions in markets<br />

worsen significantly further before considering radical action.<br />

Cyril Beuzit 7 May 2010<br />

<strong>Market</strong> Mover<br />

2<br />

www.Global<strong>Market</strong>s.bnpparibas.com

UK: all eyes on the election<br />

US: recent economic data<br />

continue to push higher…<br />

…but Treasuries are being<br />

driven by rising risk<br />

aversion<br />

EUR/USD: further decline<br />

ahead<br />

GBP at risk<br />

A new phrase was slipped into the Introductory Statement: "Monetary policy<br />

will do all that is necessary to maintain price stability in the euro area over<br />

the medium term”. This gives the ECB more wriggle room should it need it in<br />

future. One could imagine this phrase being trotted out should the ECB opt<br />

for the 'nuclear option' of buying government bonds – linked explicitly to<br />

downside risks to price stability.<br />

The UK election outcome is not known at the time of writing but markets<br />

seem to have become more optimistic in recent days about a late swing to<br />

the Conservatives. If this does not occur and, above all, if the result and<br />

coalition negotiations look to have fallen short of delivering a government<br />

that will tackle the deficit decisively, we could see sterling and sterling<br />

markets becoming very twitchy. We believe markets have priced in too small<br />

a probability of a UK downgrade.<br />

The US recovery continues to build, with the recent orders component of the<br />

manufacturing ISM, at 65.7, close to its January high. Non-manufacturing<br />

ISM held steady in the mid-50s but this is still five points above the levels at<br />

the turn of the year. Consistent with the picture of a slowly building and<br />

broadening recovery, but with bumps, is a gradual improvement in payrolls.<br />

The ADP data were consistent with private job creation approaching 100k.<br />

With the census hiring, we expect an overall rise of 165k, a bit below the<br />

market consensus.<br />

The unemployment rate should stay at 9.7% and average hourly earnings<br />

should rise only 1%. Weak wage growth and good productivity delivered a<br />

5.9% q/q aar fall in unit labour costs this week, emphasising the subdued<br />

inflation picture. Next week should see the March trade balance widen a bit<br />

while we suspect that retail sales at the end of next week will be softer than<br />

the market expects.<br />

We keep a neutral call on Treasury yields and the curve in the short run. The<br />

reason for our recommendation is that there is no clear catalyst for a move<br />

in either direction in the short term, yet the market could make a substantial<br />

move in either direction on a whim. While there could be some pressure if<br />

there is a positive surprise in economic data, the current rally is fuelled by<br />

external problems (i.e. the eurozone) and financial reform concerns, rather<br />

than the domestic macroeconomic situation. It would therefore probably take<br />

a very large upside surprise in Payrolls on Friday to have a meaningful<br />

impact on market direction. Finally, we also note that the larger-thanexpected<br />

Treasury supply cuts are contributing to the bullish momentum.<br />

We have adjusted our currency projection and now call for EUR/USD to fall<br />

to parity in Q1 2011. Europe has played its option of fiscal transfers but this<br />

policy has so far failed, as illustrated by the widening of bond and OIS<br />

spreads. The ECB must now rescue the EMU project and this will require a<br />

further easing of monetary conditions. Irrespective of how this easing is<br />

conducted, the result will be further EUR weakness.<br />

Since it came into existence, the ECB has been cautious when easing<br />

monetary conditions while often operating ahead of the curve when<br />

conducting tightening moves. This asymmetric policy approach is no longer<br />

feasible without putting the currency project at risk. EMU looks increasingly<br />

like Japan, which is a surplus-generating deflationary economy. In order to<br />

prevent outright European deflation, the ECB will have to pursue unorthodox<br />

monetary policies. EUR weakness will be part of the solution for keeping the<br />

currency union together.<br />

While we see the EUR being the weakest of the major currencies, risk<br />

contagion will keep the USD generally supported. Sterling will be<br />

sandwiched between USD strength and EUR weakness. Indeed, EUR/GBP<br />

is the only currency pair where we call for a change of direction compared to<br />

our previous forecast. EUR/GBP is likely to move lower provided the UK<br />

elects a government able to deal with fiscal and debt issues in a credible<br />

way. Should we be disappointed on this side, we will not hesitate to project<br />

the GBP following the EUR lower step by step.<br />

Cyril Beuzit 7 May 2010<br />

<strong>Market</strong> Mover<br />

3<br />

www.Global<strong>Market</strong>s.bnpparibas.com

ECB: All Talk, No Action<br />

• The latest ECB press conference was long<br />

on words, short on action.<br />

• Options were left open for future action but<br />

differences of opinion on the Governing Council<br />

could slow down the response time.<br />

• The case for outright buying of government<br />

debt is short-term stress avoidance.<br />

• But there are longer-term drawbacks.<br />

• The likelihood of the ECB having to make<br />

such purchases is increasing though it may try<br />

to exhaust other routes first.<br />

• The risk, as so often during this crisis, is for<br />

too little, too late.<br />

Nothing doing<br />

Those expecting radical action from the ECB at this<br />

month’s press conference were, rather predictably,<br />

disappointed. As were markets, as speculation prior<br />

to the meeting that the ECB would respond to the<br />

continuing turmoil with a big announcement proved<br />

to be just that, speculation.<br />

There were plenty of challenging questions for Mr<br />

Trichet to answer during the Q & A session. Some of<br />

them he ducked. Specifically, on the subject of<br />

buying government bonds, he reiterated on a number<br />

of occasions in response to questioning that this was<br />

not an option discussed at today's Governing Council<br />

meeting. It was not, however, definitively ruled out.<br />

As we pointed out prior to the meeting, his comment<br />

last weekend that "at this stage, we have absolutely<br />

no decision on the purchase of government bonds"<br />

hinted at a greater degree of flexibility on the issue<br />

than we had heard previously.<br />

A positive to take from the latest meeting was that<br />

while no action was taken this month, Mr Trichet left<br />

options open for future action should the need arise<br />

(as we expect it will).<br />

Less positive are the differences of opinion on the<br />

Governing Council which could slow down the ECB’s<br />

response time. On the basis of what Mr Weber said<br />

on the subject prior to the meeting, we know that at<br />

least one Governing Council member is against the<br />

purchase of government bonds. He is probably not<br />

alone. This is one of the reasons why Mr Trichet was<br />

reluctant to be drawn on the issue.<br />

Box: Extracts from ECB Introductory<br />

Statement, May 2010<br />

Recent economic data – including positive survey indicators –<br />

support the view that the economic recovery in the euro area is<br />

continuing in 2010. While adverse weather conditions, in<br />

particular, dampened growth in the early part of the year, some<br />

strengthening appears to be taking place during the spring.<br />

Looking ahead, the Governing Council expects real GDP to<br />

expand at a moderate pace. The Governing Council continues<br />

to view the risks to this outlook as broadly balanced, in an<br />

environment of high uncertainty.<br />

On the upside, the global economy and foreign trade may<br />

recover more strongly than projected and confidence may<br />

improve more than expected, with the result that the recovery<br />

becomes self-sustained. On the downside, concerns remain<br />

relating to renewed tensions in some financial market<br />

segments. In addition, a stronger or more protracted than<br />

expected negative feedback loop between the real economy<br />

and the financial sector, renewed increases in oil and other<br />

commodity prices, and the intensification of protectionist<br />

pressures, as well as the possibility of a disorderly correction of<br />

global imbalances, may weigh on the downside.<br />

Looking ahead, global inflationary pressures may increase,<br />

driven mainly by price developments in commodity markets and<br />

in fast-growing economic regions of the world, while euro area<br />

domestic price pressures are still expected to remain contained.<br />

In the near term, given the developments in energy prices, risks<br />

to earlier projections for HICP inflation are tilted somewhat<br />

towards the upside, while risks to price stability over the<br />

medium term are viewed as still remaining broadly balanced.<br />

Upside risks over the medium term relate, in particular, to the<br />

evolution of commodity prices. Furthermore, increases in<br />

indirect taxation and administered prices may be greater than<br />

currently expected, owing to the need for fiscal consolidation in<br />

the coming years. At the same time, risks to domestic price and<br />

cost developments are contained. Overall, we need to monitor<br />

closely the future evolution of all available price indicators<br />

Source: Reuters EcoWin Pro<br />

Differences of opinion were signalled by Mr Trichet<br />

on the decision to suspend the minimum credit rating<br />

in the collateral eligibility requirements for debt<br />

issued or guaranteed by the Greek government. The<br />

decision was made by "overwhelming majority": i.e. it<br />

was not unanimous. This goes to show that just<br />

because some members of the Governing Council<br />

are opposed to something it does not mean it cannot<br />

happen. Various Governing Council members also<br />

expressed resistance to the deep cuts in rates in late<br />

2008 and early 2009 but, eventually, they were<br />

delivered. Our concern is the time it takes for the<br />

Governing Council to reach agreement.<br />

Paul Mortimer-Lee/Ken Wattret 7 May 2010<br />

<strong>Market</strong> Mover<br />

4<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Event response<br />

The ECB is being overtaken by events. Mr Trichet<br />

would probably concur having seen that:<br />

• The IMF was welcomed into the Greek<br />

rescue package when he had been reported<br />

as having said, “If the IMF or any other<br />

authority exercises any responsibility instead<br />

of the eurogroup, instead of the<br />

governments, this would clearly be very, very<br />

bad” (Senat television); and<br />

• The ECB decision to suspend the minimum<br />

credit rating threshold for Greek debt came<br />

after Mr Trichet said on 14 January, “We will<br />

not change our collateral framework for the<br />

sake of any particular country. Our collateral<br />

framework applies to all countries concerned.<br />

And that has been said already by the Vice-<br />

President, by me and by colleagues. That is<br />

crystal clear.”<br />

The ECB is reacting to events and it cannot be<br />

blamed for that; it should be praised for helping the<br />

Greek banks, for example. But these episodes show<br />

that its forward vision is restricted and that it is not in<br />

charge of developments. Rather, it is reactive.<br />

Further challenges lie ahead. First is probably the<br />

phasing out of liquidity injections. Basically,<br />

unconventional measures are responses to financial<br />

stress. When OIS/BOR came in, VIX declined and<br />

bank CDS shrank; with financial stress on the wane,<br />

it was sensible to start to withdraw liquidity. Now<br />

stress is back and it is no longer sensible for the ECB<br />

to continue tightening through scaling back liquidity<br />

provision. We would cite in support of this a tendency<br />

for BOR/OIS to widen, the increased participation at<br />

the regular MRO and the marginal rate of 1.5% at the<br />

recent 3-month LTRO despite massive overprovision<br />

possibilities at that repo by the ECB.<br />

The potentially most toxic development is for banking<br />

stress to appear in economies where the sovereign is<br />

under pressure. If a sovereign cannot save itself,<br />

how can it save its banks? Such a situation can only<br />

lead to losses on sovereign debt that hurt the banks,<br />

in turn hurting the sovereign through increased<br />

bailout costs and likely lower future growth.<br />

It is best not to get into such a vicious spiral. The<br />

most effective way to avoid this is through massive<br />

liquidity provision to the banks on cheap terms and<br />

for a long period to remove liquidity worries.<br />

Change of direction<br />

A key event on the horizon is the expiry of last June’s<br />

12-month fixed term repo. We would advise replacing<br />

this with another fixed term repo of six or preferably<br />

twelve months duration at 1%. Would this be another<br />

ECB climb-down? Yes, but it would be a sensible<br />

one.<br />

Then there is the issue of the ECB buying the<br />

government debt of countries in trouble. Increasingly,<br />

market participants’ view this as very likely. Why?<br />

Because they see the real possibility of funding<br />

stresses and are sceptical of first, the ability of the<br />

Greek programme to run its full course and second,<br />

the willingness of Germany in particular to stump up<br />

for another bailout after Greece.<br />

If these circumstances arise, so the argument runs,<br />

there may be two choices: the ECB buys the afflicted<br />

government’s debt, or there is default. The first looks<br />

the lesser of two evils, as a default would set off a<br />

domino reaction that ultimately could lead to severe<br />

strains on EMU itself and at least could lead to<br />

further defaults and stress in the banking system.<br />

QE problems<br />

There are of course objections to the ECB effectively<br />

providing QE not to help the general economy but to<br />

help regional governments in the euro area:<br />

• ECB monetary policy should be decided on<br />

the basis of the needs of the aggregate area,<br />

not a small proportion of it;<br />

• Monetary policy should be driven by<br />

monetary considerations and should not be<br />

driven by fiscal policy;<br />

• Printing money because governments cannot<br />

finance themselves can be a precursor to<br />

inflation;<br />

• At the least, the ECB’s credibility would be<br />

damaged;<br />

• If there is a solvency problem in a country,<br />

the ECB has not got the balance sheet to fix<br />

that – only other governments can sort it.<br />

Dealing with a liquidity crisis alone is more<br />

defensible, but Greece’s liquidity crisis has<br />

stemmed from solvency worries;<br />

• The step may be one too far for Germany.<br />

Recourse to the constitutional court would be<br />

likely with large-scale monetisation<br />

reminiscent of the Weimar republic. Such a<br />

move could make EMU even more unpopular<br />

within the population, which has already<br />

manifested its opposition to plans to bail out<br />

Greece;<br />

• As the ECB has often pointed out with<br />

reference to US and UK QE, it may be very<br />

difficult to back out of such holdings;<br />

Paul Mortimer-Lee/Ken Wattret 7 May 2010<br />

<strong>Market</strong> Mover<br />

5<br />

www.Global<strong>Market</strong>s.bnpparibas.com

• Large holdings could result in large losses<br />

and recapitalising the ECB could increase<br />

political influence and threaten ECB<br />

independence. In any case, the ECB would<br />

be more politicised by the move; and<br />

• Once you’ve started this, where do you stop?<br />

How to do it<br />

Should the ECB opt to embark on some forms of<br />

quantitative easing, an important issue would be the<br />

purchase allocation in terms of maturity and across<br />

countries.<br />

Should it be short or long-term debt? One constraint<br />

for the ECB would be to minimize possible distortion<br />

which suggests buying across the whole curve. That<br />

said, two considerations suggest short-term debt<br />

might be preferable. First, it would help ease<br />

immediate funding pressures reducing therefore the<br />

liquidity risk for many issuers. Moreover, it would<br />

facilitate the ‘exit strategy’, a consideration that the<br />

ECB gave priority to when designing the liquidity<br />

injections. Short-term debt would not need to be sold<br />

back to the market but it could simply be held until<br />

expiration.<br />

The allocation by country would pose another<br />

significant challenge. A pro-rata allocation (either<br />

linked to GDP or to contributions to ECB capital)<br />

would help communication. It would be easy in this<br />

case to sell the decision as a purely monetary policy<br />

action, motivated for example by increasing risks of<br />

deflation rather than an attempt to bail out this or that<br />

country. On the other hand, it would dramatically<br />

increase the size of total purchases needed in order<br />

to make a material difference for the countries which<br />

are currently under pressure.<br />

The alternative would be to focus on the sovereign<br />

debt of those countries under most stress, justifying<br />

the choice with the ‘cheap’ price they offer under the<br />

assumption that no country within the eurozone will<br />

ever be allowed to default. An obvious drawback<br />

would be the implied ‘moral hazard’ not to mention<br />

the inconsistency with the ‘no-bailout’ clause of the<br />

EU Treaty.<br />

Of course, all these relate to long-term problems that<br />

could result from short-term event-driven actions<br />

intended with the best will in the world to avoid<br />

problems today. We see an increasing risk that the<br />

ECB does end up buying government debt, but we<br />

would expect it to try to enhance liquidity first so that<br />

it is private banks not the ECB that buy government<br />

debt.<br />

The trouble with such an approach is that many<br />

banks already feel themselves to be overexposed to<br />

risky governments. Increasing liquidity might not<br />

work. The chances of outright ECB purchases are<br />

increasing. They would support markets directly, help<br />

to put a floor under bond prices and increase money<br />

market liquidity at the same time. We can envisage<br />

circumstances where they look like the least worst<br />

option. The risk is, as so often in this crisis, too little,<br />

too late.<br />

Macro picture<br />

Macroeconomic developments are obviously playing<br />

second fiddle at present when it comes to listening to<br />

what the ECB has to say. The assessment at this<br />

month’s press conference was broadly similar to its<br />

predecessor which was no surprise. There were a<br />

few changes, however, which merit comment.<br />

One was a reference to near-term risks to inflation<br />

being “somewhat tilted to the upside”. The upside<br />

risks relate specifically to external factors, however,<br />

including higher oil prices and strong growth in other<br />

parts of the world.<br />

The medium-term assessment of inflation was as<br />

before, i.e. pressures are low. The key to this is that<br />

domestic wage and cost pressures remain contained.<br />

The differentiation between the internal and external<br />

influences on inflation we see as significant. It tells us<br />

that the ECB will look through upward pressure on<br />

inflation generated by factors beyond their control<br />

and focus instead on domestic pressures which are<br />

going to remain subdued.<br />

The tone of Mr Trichet’s comments on growth was a<br />

bit more positive than previously. Specifically, there<br />

was a reference to the “strengthening” of the upturn<br />

in activity during the spring. But in bigger picture<br />

terms, the outlook was much as before. Growth rates<br />

will remain moderate and the recovery uneven.<br />

More flexibility<br />

A new phrase was also slipped into the statement:<br />

"Monetary policy will do all that is necessary to<br />

maintain price stability in the euro area over the<br />

medium term." We see this as a way of giving the<br />

ECB more room for manoeuvre should they need it in<br />

future - in both directions.<br />

This is just the kind of phrase which could be used in<br />

future should the ECB opt for the 'nuclear option' of<br />

buying government bonds. Such action would then<br />

be linked explicitly to the downside risks to price<br />

stability. Alternatively it could be deployed should,<br />

perish the thought, a surge in inflation and upward<br />

pressure on inflation expectations necessitate a rate<br />

hike despite economic and financial stress a la<br />

summer 2008. The latter we continue to believe is a<br />

much lower probability than the former.<br />

Paul Mortimer-Lee/Ken Wattret 7 May 2010<br />

<strong>Market</strong> Mover<br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Eurozone Periphery: Compare and Contrast<br />

• The Greek crisis is spreading to other socalled<br />

peripheral countries.<br />

Chart 1: 10yr Spreads to Bund<br />

• It is important to highlight significant<br />

differences between these economies.<br />

• These include differences in the size of<br />

deficits & debts, liquidity risks, contingent<br />

liabilities, fiscal credibility and social tolerance.<br />

• But we should also recognise that there are<br />

similarities which make them vulnerable to<br />

further market tensions.<br />

• Portugal shares Greece’s low saving ratio.<br />

• Spain’s problem is an excess of private debt<br />

with possible fallout on the financial sector.<br />

• Ireland’s fiscal reform to date has been<br />

impressive but sovereign risk is tied up with the<br />

banking system, making the recent widening of<br />

spreads a reason for concern.<br />

• Italy’s imbalances are less worrying than in<br />

other economies, but its high debt-to-GDP ratio<br />

makes it vulnerable to an interest rate shock.<br />

Source: Reuters EcoWin Pro<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

Chart 2: Age-Related Expenditure<br />

(Change 2010-2060, % of GDP)<br />

6<br />

4<br />

The agreement of eurozone finance ministers over<br />

the weekend to provide EUR 110bn worth of financial<br />

support to Greece has failed in its objective of<br />

calming markets and preventing risk aversion from<br />

increasing. The crisis is now spreading to other socalled<br />

peripheral countries. Portugal is leading the<br />

way but sovereign spreads have significantly<br />

widened in Spain, Ireland and Italy, highlighting the<br />

risks of an indiscriminate contagion effect.<br />

From a macro perspective, it is important to highlight<br />

that these economies are heterogeneous and differ<br />

significantly from Greece. At the same time, they<br />

share a number of structural weaknesses and<br />

imbalances which, in the absence of a prompt and<br />

decisive response from the eurozone authorities,<br />

make them vulnerable to further market tensions.<br />

Greece versus other peripherals<br />

Greece’ situation differs significantly from that of<br />

other peripheral countries on a number of counts:<br />

• First, the level of the public deficit and debt. At<br />

13.6% of GDP in 2009, the Greek public deficit<br />

was second only to Ireland’s (14.3% of GDP).<br />

Greek public debt as a share of GDP (115.1%) is<br />

similar to Italy’s (115.8%) but significantly higher<br />

2<br />

0<br />

Belgium<br />

Germany<br />

Ireland<br />

Greece<br />

Spain<br />

France<br />

Source: EU Commission<br />

Italy<br />

Cyprus<br />

Malta<br />

Netherlands<br />

than those of Portugal (76.8%) and Spain<br />

(53.2%). Ireland’s debt-to-GDP ratio can be<br />

relatively low (64%) or high (around 100%)<br />

depending on whether you choose to include all<br />

its interventions in the banking sector;<br />

• Second, liquidity risk. Greek redemptions this<br />

year are relatively high this year, about twice<br />

those of Spain and Portugal in relation to GDP.<br />

Moreover, Greece’s refunding tends to be heavily<br />

concentrated during certain months of the year –<br />

increasing rollover risk;<br />

• Third, contingent liabilities. In the absence of a<br />

reform of the pension system, age-related<br />

spending would increase by a massive 16% of<br />

GDP in Greece between 2010 and 2060<br />

according to EU Commission estimates (Chart<br />

2). This is about double the estimates for Spain<br />

(8.3% of GDP) and much higher than the<br />

anticipated rises in Portugal and Italy, where past<br />

reforms should bear fruit over the following<br />

years;<br />

Austria<br />

Portugal<br />

Slovenia<br />

Slovakia<br />

Finland<br />

UK<br />

Eurozone<br />

Luigi Speranza / Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

7<br />

www.Global<strong>Market</strong>s.bnpparibas.com

• Credibility. Spain’s record in terms of public<br />

finances is one of the strongest within the<br />

eurozone while Portugal has achieved significant<br />

adjustments in the past. Greece, with a record of<br />

having published incorrect figures on more than<br />

one occasion, has much less credibility; and<br />

• Last but not least, social tolerance. Portugal’s<br />

past adjustment has shown a high degree of<br />

social tolerance. The ability of Greek society to<br />

withstand the needed fiscal adjustment is one of<br />

the market’s primary reasons for concern.<br />

Yesterday’s tragic events were a harsh reminder<br />

of the difficulties lying ahead for the Greek<br />

government.<br />

That said, peripheral economies share a number of<br />

weaknesses that, in the absence of a quick and<br />

credible adjustment, make them vulnerable to further<br />

market tensions.<br />

More specifically, Portugal and Greece share a key<br />

feature: a lack of competitiveness associated with a<br />

low rate of national savings. This implies they rely on<br />

inflows of capital to finance consumption.<br />

Conversely, in Spain and Ireland, private debt and<br />

the state of the financial system are the core of the<br />

problem. Both economies are undergoing a<br />

significant adjustment in the housing sector which is<br />

heavily weighing on growth, with negative<br />

implications for the banking sector. Italy is in a group<br />

of its own. Both internal and external imbalances are<br />

less of an issue than for other peripheral economies<br />

but the high level of public debt is a persistent risk<br />

factor.<br />

Portugal<br />

As for Greece, a distinguishing feature of the<br />

Portuguese economy is the extremely low level of the<br />

national saving ratio; this has its roots in the<br />

structural lack of competitiveness of the economy. In<br />

2009, Portugal’s gross national saving amounted to a<br />

modest 8.6% of GDP, versus an average of 18.5%<br />

for the eurozone as a whole. Once adjusted for<br />

capital consumption, Portugal’s national saving rate<br />

was negative at -8.5% of GDP (Chart 3).<br />

Low levels of savings imply that the economy has to<br />

continuously rely on large inflows of capital to finance<br />

consumption, as shown by Portugal’s high current<br />

account deficit (-10.2% of GDP in 2009). Over time,<br />

these imbalances have led to the accumulation of a<br />

sizeable external debt. As of 2008, Portugal’s net<br />

external financial asset position was in deficit to the<br />

extent of 95% of GDP (Chart 4).<br />

Under these circumstances, when the government<br />

tries to achieve a deficit reduction by cutting transfer<br />

spending or increasing taxes, the private sector will<br />

find it difficult to borrow more and will be forced to cut<br />

Chart 3: Net National Savings (% of GDP)<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Total Economy Net Financial Assets<br />

(% of GDP)<br />

Source: Reuters EcoWin Pro<br />

back investment and consumption. This is different<br />

from the ‘standard’ fiscal adjustment, in which the<br />

private sector dis-saves in reaction to fiscal<br />

tightening, thus partially compensating for the<br />

negative impact on growth of the fiscal retrenchment.<br />

In sum, more than a fiscal problem, Portugal has got<br />

a chronic problem of low growth. But persistently low<br />

growth is likely to frustrate any attempt to correct<br />

fiscal imbalances. In the absence of a combination of<br />

fiscal adjustment and supply-side reforms, fiscal<br />

trends could therefore become unsustainable.<br />

Spain<br />

Spain’s problem is an excess of private debt, which<br />

can be traced back to the interest rate shock due to<br />

the EMU accession. Historically loose credit<br />

conditions led to a massive credit expansion and<br />

debt accumulation by both households and<br />

corporations, which was associated with a boom in<br />

the housing market and growing external deficits.<br />

The financial crisis has triggered a sharp adjustment<br />

in most of these imbalances (Chart 5) which has<br />

already taken a significant toll on domestic demand<br />

(-6.5% y/y in 2009), employment (unemployment just<br />

Luigi Speranza / Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

8<br />

www.Global<strong>Market</strong>s.bnpparibas.com

over 20% in Q1) and, last but not least, the public<br />

finances.<br />

This adjustment will continue to imply a protracted<br />

period of subdued growth and low or even negative<br />

inflation. In the absence of a credible adjustment in<br />

fiscal trends possibly associated with structural<br />

reforms, the most urgent being a reform of the labour<br />

market, this is likely to involve persistently high fiscal<br />

deficits and a rising public debt. In the short term, the<br />

biggest risk is represented by the stability of the<br />

banking sector. The banking sector appears to have<br />

withstood the financial crisis remarkably well so far,<br />

but the collapse in the housing market remains a<br />

significant source of uncertainty and a reason for<br />

concern especially with regard to the cajas (savings<br />

banks).<br />

The problem is that Spain’s share of eurozone GDP<br />

is around 12%, almost five times as big as that of<br />

Greece. Providing the same scale of assistance to<br />

Spain as to Greece would thus require a sizeable<br />

contribution that would be more difficult from a<br />

political point of view.<br />

Ireland<br />

Similar to Spain, Ireland’s problems also emanate<br />

from a domestic demand, housing and credit boom,<br />

fuelled in part by the positive interest rate shock the<br />

economy experienced when it joined the euro.<br />

The difference is that Ireland is much further down<br />

the path of adjustment than any of the other<br />

peripheral countries. Measures to reduce the deficit<br />

were announced as early as July 2008. Three<br />

budgets and two expenditure reviews over the past<br />

two years have produced paper savings of around<br />

7% of GDP and the government has made a multiyear<br />

commitment to find additional savings out to<br />

2013. These measures, as well as skilful debt<br />

issuance by the NTMA and the high quality of<br />

announced reform, helped push Irish sovereign debt<br />

spreads down substantially from their 2009 highs.<br />

The government’s impressive commitment to fiscal<br />

reform is, however, only part of the sovereign risk<br />

story in Ireland. A banking crisis at the end of 2008<br />

and start of 2009 prompted the government to step in<br />

and effectively underwrite the banking system. The<br />

state has guaranteed liabilities with a maturity of up<br />

to five years issued before September 2010, injected<br />

capital into some institutions and nationalised others.<br />

More recently, it has begun purchasing assets from<br />

the banks at a deep discount to book value to force<br />

them to crystallise losses on their commercial<br />

property portfolios – a process that is further<br />

increasing the state’s level of ownership of the<br />

domestic banking system.<br />

Chart 3: Spain’s Financial Balances<br />

(% of GDP, 4Q Avg.)<br />

Source: Reuters EcoWin Pro<br />

The aggressiveness of Ireland’s fiscal reforms needs<br />

to be put in this context. With the state underwriting<br />

the banking system, whose liabilities amount to<br />

roughly 300% of GDP, the government had no<br />

choice but to act decisively to regain market<br />

confidence. This is also why the recent sharp<br />

widening of Irish spreads over the past few weeks is<br />

such a worrying development; the viability of the<br />

government back-stop to the banking system is<br />

determined by confidence in the sovereign.<br />

Italy<br />

We have all along been more positive on Italy. Italy’s<br />

public deficit deteriorated less than the eurozone<br />

average in 2009, as discretionary intervention was<br />

limited. Combined with more structural factors such<br />

as the low indebtedness of the private sector and the<br />

banking sector’s higher resilience to the financial<br />

crisis, this should continue to support Italian bonds<br />

compared with those of the eurozone’s peripheral<br />

countries. However, given the high and rising debtto-GDP<br />

ratio and low structural growth, Italian public<br />

finances are of course extremely sensitive to an<br />

interest rate shock. In our central scenario we<br />

assume that interest rates will remain low but the<br />

recent market reaction to the Greek deal highlights<br />

there are risks.<br />

Bottom line<br />

There are significant differences between the Greek<br />

situation and that of other peripherals and it would be<br />

simplistic to group all them together. But while less<br />

acute, there are chronic problems in peripheral<br />

economies. With markets not minded to discriminate<br />

at present, the authorities need to get ahead of the<br />

game. The question is – will they?<br />

Luigi Speranza / Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

9<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Eurozone: External Exposure<br />

• Portugal, like Greece, has a relatively high<br />

share of its public sector debt held abroad.<br />

• In contrast, foreign investors hold a lower<br />

proportion of Spanish and Italian debt.<br />

Chart 1: General Government Debt Held Abroad<br />

(% GDP)<br />

100<br />

90<br />

80<br />

70<br />

60<br />

Contagion not equal<br />

The contagion across sovereign debt markets in the<br />

eurozone has been spreading but yield spreads<br />

between Portuguese and German government bonds<br />

have widened substantially further than their Italian<br />

and Spanish counterparts. The underperformance in<br />

Portugal reflects various factors, some fundamentally<br />

driven, some more market-driven.<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Greece<br />

Belgium<br />

Source: IMF<br />

Portugal<br />

Austria<br />

Italy<br />

France<br />

Ireland<br />

Netherlands<br />

Germany<br />

Finland<br />

Spain<br />

The fundamental differences between the vulnerable<br />

economies in the eurozone are discussed in detail in<br />

the accompanying article Eurozone Periphery:<br />

Compare and Contrast. In short, the key problems in<br />

Portugal include the following: the low growth rate of<br />

the economy, which makes it difficult to stabilise the<br />

public finances; and the low level of national saving,<br />

linked to the lack of competitiveness of the economy,<br />

which leaves the Portuguese economy heavily reliant<br />

on capital inflows.<br />

While the public sector debt-to-GDP ratio in Portugal<br />

is much lower than in Greece – at around 75% and<br />

115%, respectively, in 2009 – it was the structural<br />

nature of the problems listed above which led us to<br />

conclude earlier in the year that, were problems in<br />

the eurozone bond markets to spread beyond<br />

Greece, then Portugal would be right in the firing line.<br />

Our concerns have been borne out.<br />

Foreign affairs<br />

There are also market-specific factors to consider.<br />

One is less liquidity in the Portuguese bond market<br />

than in other, larger bond markets in the eurozone.<br />

Another significant difference is the high proportion of<br />

public debt in Portugal held by overseas investors.<br />

Chart 1 shows IMF data on general government debt<br />

held by foreign investors as a percentage of GDP for<br />

the largest eleven eurozone member states. Chart 2<br />

then converts this data into the proportion of general<br />

government debt held by foreign investors, using<br />

debt to GDP and nominal GDP data from Eurostat.<br />

Foreign ownership of government debt is much lower<br />

in Spain and Italy than in Portugal which matters in a<br />

period of increasing risk aversion.<br />

Chart 2: General Government Debt Held Abroad<br />

(% Total)<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Austria<br />

Greece<br />

Finland<br />

Portugal<br />

Netherlands<br />

Source: IMF, Eurostat, <strong>BNP</strong> Paribas<br />

Ireland<br />

Belgium<br />

One positive factor for Portugal relative to Greece is<br />

its lower rollover risk, with redemptions in relation to<br />

GDP in 2010 about half those of Greece. The same<br />

is true for Spain.<br />

Spain has other problems, including the after-effects<br />

of the property crash and high levels of private sector<br />

debt. For now, markets have given Spain the benefit<br />

of the doubt, with the 10-year yield spread between<br />

Portugal and Spain rising above 200bp, the highest<br />

since the mid-1990s. This may not continue if stress<br />

in its financial sector increases.<br />

Austria is high in the rankings on debt held abroad<br />

but its fiscal situation is comparatively robust. That<br />

said, Austria has not been immune to market<br />

turbulence of its own, with the 10-year yield spread to<br />

Germany, currently about 40bp, having risen to more<br />

than 125bp in mid-2009 at the height of concern over<br />

its banking sector exposure to the CEE economies.<br />

France<br />

Germany<br />

Spain<br />

Italy<br />

Ken Wattret 7 May 2010<br />

<strong>Market</strong> Mover<br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com

<strong>Market</strong> Stress Charts<br />

• Signs of stress in the euro govvie market<br />

are evident in sovereign debt and CDS spreads.<br />

Chart 1: 10yr Govvie Spread to Bund<br />

• There are also indications of bank funding<br />

tensions in countries such as Greece.<br />

• BOR-OIS spreads have begun to creep<br />

higher…<br />

• …Greek bank debt securities have sold<br />

off…<br />

• …and the market-priced probability of<br />

default for Greek banks has risen.<br />

• There have also been tentative signs of<br />

stress in the most recent ECB auctions.<br />

Source: Reuters EcoWin Pro<br />

Monitoring stress<br />

• Stress in the euro govvie bond markets has been<br />

evident for some time now and is widely gauged<br />

by looking at the spreads of countries’<br />

benchmark bonds versus Bunds (Chart 1).<br />

• The CDS market, which gives us the cost of<br />

insuring against sovereign default, is also widely<br />

watched (Chart 2).<br />

• It is important, however, to also monitor stress<br />

indicators for countries’ banking sectors –<br />

funding problems for the sovereign typically have<br />

implications for banks’ funding ability in the<br />

market.<br />

• The Greek banking system has come under<br />

scrutiny for this reason in recent weeks. Data<br />

released by the Bank of Greece show a 5% fall in<br />

aggregate deposits of the financial sector<br />

(excluding the eurosystem) in the first three<br />

months of the year – some EUR 11bn (Chart 3).<br />

April may have seen this continue or accelerate.<br />

• The data may understate or overstate the deposit<br />

flight faced by Greek domestic banks because<br />

the statistics include the deposits of foreign<br />

banks with subsidiaries or branches in Greece.<br />

• Deposits are just one form of funding for banks.<br />

Money can also be raised from: 1) secured and<br />

unsecured borrowing from the market; 2) the<br />

issuance of debt securities; and 3) liquidity<br />

operations conducted by the European Central<br />

Bank. Equity represents more structural, longterm<br />

liquidity.<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

Chart 2: 5yr Sovereign CDS<br />

Irl<br />

100<br />

It<br />

Sp<br />

0<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

Source: Bloomberg<br />

5yr EUR Sovereign CDS (bp)<br />

Chart 3: MFI (excl. Bank of Greece) Domestic<br />

Deposits (sectors other than central govt)<br />

260<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

Greek Financial Institution Deposits (EURbn)<br />

100<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: Bank of Greece<br />

Gr<br />

Pt<br />

Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

11<br />

www.Global<strong>Market</strong>s.bnpparibas.com

• There is little visibility on the costs Greek banks<br />

face in the secured or unsecured funding<br />

markets. Broader measures of funding stress,<br />

such as BOR-OIS in the eurozone as a whole,<br />

have been inching up in recent weeks (Chart 4).<br />

However, from a long-term perspective, they are<br />

still subdued relative to the levels recorded<br />

during the financial crisis (Chart 5). Note that we<br />

use Euribor future contracts rather than spot<br />

fixings because, as a traded security, they are<br />

more liquid.<br />

• The impact on Greek bank debt securities differs<br />

by instrument, but there is evidence of a parallel<br />

sell-off (Chart 6).<br />

• In part this reflects a rising expectation of default<br />

– evident in rising CDS prices for single name<br />

banks (Chart 7). There has also been a large rise<br />

in CDS for Portuguese banks (Chart 8) with<br />

smaller gains for Irish and Spanish institutions<br />

(Charts 9 and 10).<br />

• Indicators of funding conditions at ECB liquidity<br />

operations are presented at an aggregate level.<br />

As highlighted by our interest rate strategists,<br />

data on the recent ECB auctions have shown<br />

some possible signs of a modest increase in<br />

stress.<br />

• The first variable rate 3m tender since the end of<br />

2008 was conducted at the end of April. Despite<br />

a generous EUR 15bn allotment scheduled, the<br />

average bid rate was dragged up to 1.15% with<br />

at least one bid recorded at 1.5%, 50bp above<br />

the minimum bid rate and just 25bp below the<br />

cost of using the lending facility.<br />

• In addition, at the most recent main refinancing<br />

operation, despite over EUR 200bn of excess<br />

liquidity in the eurosystem, the allocation<br />

increased to EUR 90bn, EUR 15bn up on the<br />

previous week, with 76 bidders –10 higher than<br />

the previous week.<br />

• While this needs to be kept in perspective – the<br />

number of bidders was in the hundreds as<br />

recently as the end of 2009, the results of future<br />

auctions are worth keeping an eye on.<br />

• Some signs of rising tensions are evident in<br />

additional measures such as the volatility implied<br />

in swaption contracts and swap spreads.<br />

In sum, there are increasing signs of tension not just<br />

in the sovereign funding markets, but in the banking<br />

sector too. This is inevitable – the financial crisis<br />

demonstrated that it is the sovereign that ultimately<br />

back-stops the financial system. Sovereign risk is<br />

already wrapped up with banking sector risk in<br />

Ireland, for example. This is why sovereign funding<br />

crises are so dangerous – pressures on liability<br />

refinancing ripple beyond the obligations of the state.<br />

Chart 4: BOR-OIS: Rolling Euribor Contracts I<br />

50<br />

45<br />

1st position<br />

40<br />

35<br />

30<br />

25<br />

3rd<br />

20<br />

2nd<br />

15<br />

BOR (Euribor Futures) - OIS Spread<br />

10<br />

5<br />

0<br />

Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10<br />

Source: Bloomberg<br />

Chart 5: BOR-OIS: Rolling Euribor Contracts II<br />

160 BOR (Euribor Futures) - OIS Spread<br />

140<br />

1st position<br />

120<br />

100<br />

2nd<br />

80<br />

60<br />

40<br />

3rd<br />

20<br />

0<br />

Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 6: Bank Cash Bullet Bonds<br />

105 EFG 4 & 3/8% 02/2013 Alpha 3 & 7/8% 09/2012<br />

100<br />

95<br />

90<br />

85<br />

NBG 3 & 7/8% 10/2016<br />

80<br />

75 Bullet Cash Bonds<br />

Piraeus 4% 09/2012<br />

70<br />

Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Chart 7: Greek Bank CDS*<br />

900<br />

Greece Bank CDS 5yr Senior (bp)<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

EFG<br />

NBG<br />

100<br />

0<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

*banks presented had CDS prices available<br />

Chart 8: Portuguese Bank CDS*<br />

500 Portugal Bank CDS 5yr Senior (bp)<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

BCP Espirito Santo<br />

150<br />

100<br />

50<br />

Caixa<br />

Banco BPI<br />

0<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

*banks presented had CDS prices available<br />

Chart 9: Irish Bank CDS*<br />

Chart 10: Spanish Bank CDS*<br />

700<br />

600<br />

600<br />

Ireland Bank CDS 5yr Senior (bp)<br />

500<br />

Spanish Bank CDS 5yr Senior (bp)<br />

500<br />

400<br />

300<br />

Bank of Ireland<br />

Allied Irish<br />

400<br />

300<br />

Sabadell<br />

Pastor<br />

200<br />

200<br />

Popular<br />

100<br />

Irish Life & P<br />

0<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

*banks presented had CDS prices available<br />

100<br />

BBVA<br />

Santander<br />

0<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

*banks presented had CDS prices available<br />

Chart 11: Eurozone Swap Spreads<br />

Chart 12: Eurozone 5y5y ATM Swaption Vol<br />

140<br />

120<br />

Swap Spreads (bp)<br />

2y<br />

91<br />

86<br />

EUR 5y5y ATM Normal Swaption Vol<br />

100<br />

81<br />

80<br />

76<br />

60<br />

5y<br />

71<br />

40<br />

5y<br />

66<br />

20<br />

10y<br />

61<br />

0<br />

May-07 Nov-07 May-08 Nov-08 May-09 Nov-09<br />

Source: <strong>BNP</strong> Paribas<br />

56<br />

Jun-07 Oct-07 Feb-08 Jun-08 Oct-08 Feb-09 Jun-09 Oct-09 Feb-10<br />

Source: <strong>BNP</strong> Paribas<br />

Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Greece: The Austerity Programme<br />

• The austerity plan jointly agreed with the EU<br />

and the IMF is currently under discussion in the<br />

Greek parliament…<br />

• …and is likely to be approved soon.<br />

• The plan is based on a more realistic set of<br />

forecasts than the SGP.<br />

• Compared to the March auxiliary budget, it<br />

contains additional corrective measures worth<br />

2.5% of GDP in 2010.<br />

• The adjustment is front-loaded in the first<br />

year…<br />

• …while the target of a below-3% deficit is<br />

postponed to 2014 from 2012 previously.<br />

• Measures to boost competitiveness and<br />

growth and an overhaul reform of the pension<br />

system are included.<br />

• Compliance with the set targets would<br />

significantly enhance credibility, probably<br />

allowing Greece to return to the market as early<br />

as next year.<br />

• But the implications for GDP and<br />

employment are likely to be severe, highlighting<br />

the risks that social unrest may weaken or even<br />

halt the consolidation effort.<br />

The main fiscal targets and the detailed corrective<br />

measures of the austerity plan agreed by the Greek<br />

authorities with the EU/IMF last weekend are shown<br />

in Tables 1 and 2. Amongst the main points to note<br />

are:<br />

• The plan is based on a more realistic set of<br />

forecasts than the Stability and Growth Plan<br />

(SGP). The GDP is estimated to contract by 4%<br />

this year and by 2.6% in 2011. Assuming trend<br />

growth of 2%, the cumulative GDP fall from its<br />

trend since 2008 would be around 15%, which is<br />

close to what we had estimated (see: “Eurozone:<br />

The Cost of Fiscal Consolidation” in <strong>Market</strong><br />

Mover, 1 April 2010). This makes the envisaged<br />

plan more credible but at the same time highlights<br />

its implementation risks, as mounting<br />

unemployment and social opposition could<br />

eventually derail the fiscal consolidation effort.<br />

• Inflation was revised lower along the whole<br />

forecast horizon. While we perceive the risks to<br />

the inflation assumptions as still skewed to the<br />

downside, the new projections are certainly more<br />

realistic. One of Greece’s main problems is lack of<br />

price competitiveness. In the absence of flexibility<br />

in the nominal exchange rate, this can be<br />

obtained through relative disinflation compared to<br />

its main trading partners. The risk is in our view<br />

that the HICP will continue to fall beyond 2011;<br />

• As a result of the revisions to growth and inflation,<br />

the projected trajectory for the debt-to-GDP ratio<br />

was revised up significantly. Debt to GDP is now<br />

estimated to peak at 149%, broadly in line with<br />

our own forecasts (see the desknote “Greece:<br />

What’s Next?” published on 29 April 2010).<br />

According to the plan’s assumptions, the debt-to-<br />

GDP ratio would then start descending from 2014.<br />

This is a welcome development. While there is no<br />

magic number or deadline when it comes to longterm<br />

fiscal adjustments, we believe that an<br />

inversion of the upward debt trajectory within a 5-<br />

year horizon is an important requisite for an<br />

adjustment plan;<br />

• The effort is centred on expenditure cuts, which<br />

account for 65% of the total adjustment between<br />

2010 and 2013. Spending cuts are typically more<br />

effective in reducing fiscal imbalances in the long<br />

run. As such, the balance in the adjustment is a<br />

positive factor;<br />

• The adjustment is frontloaded compared to the<br />

SGP. The budget balance is projected to fall by<br />

5.5% of GDP this year, from the improvement of<br />

4% envisaged in the SGP. This would assure that,<br />

even in the case of further upward revisions to the<br />

deficit from Eurostat (which have not been ruled<br />

out), the deficit-to-GDP ratio would still be broadly<br />

in line with the targets previously set in the SGP<br />

(Table 1). This is both a strength and a possible<br />

weakness of the programme. Lack of credibility is<br />

Greece’s main problem at the moment and a<br />

sharp initial adjustment would significantly help to<br />

restore it. On the other hand, as highlighted<br />

above, the drag on growth and employment of the<br />

measures is likely to be massive – potentially<br />

leading to mounting social opposition that wold<br />

put at risk its implementation; and<br />

• The initial bigger effort is offset by a slower<br />

adjustment later on. In the period 2011-2014, the<br />

deficit would fall on average in the amount of<br />

1.4% of GDP per year. This would help Greece<br />

return to growth, while reducing the political cost<br />

of the adjustment over time.<br />

Luigi Speranza/Gizem Kara 7 May 2010<br />

<strong>Market</strong> Mover<br />

14<br />

www.Global<strong>Market</strong>s.bnpparibas.com

• The plan also contains a number of measures to<br />

boost competitiveness, growth and strengthen<br />

capitalisation of domestic banks. These include:<br />

i. Restructuring of the labour legislation<br />

framework;<br />

ii. Reinforcement of flexibility in the labour<br />

market;<br />

iii. Measures to tackle uninsured and illegal<br />

labour;<br />

iv. Restructuring of the social protection<br />

framework;<br />

v. Reforming the regulatory framework for<br />

competition; and<br />

vi. Establishing a new investment framework<br />

through a new development law, to attract<br />

foreign investment.<br />

These measures are an essential part of the<br />

adjustment process. While a sharp rebalancing in<br />

tax revenues and spending is needed in the short<br />

term, fiscal sustainability in the long term requires<br />

a return to more elevated and sustainable growth<br />

rates, which in turn require a significant<br />

improvement in Greece’s external<br />

competitiveness.<br />

• Finally, it contains an overhaul of the pension<br />

system including:<br />

i. Increase of women’s minimum retirement<br />

age to 65 years by the end of 2013, with the<br />

process starting in 2011;<br />

ii. Pensions to be calculated on the basis of<br />

earnings over the whole labour life cycle;<br />

iii. Increase in the minimum early retirement<br />

age to 60 years;<br />

iv. Increase of minimum contribution period<br />

from 37 to 40 years by 2015;<br />

v. Automatic adjustment of pensions to life<br />

expectancy; and<br />

vi. Reduction in the number of social security<br />

organisations (to three);<br />

The proposed pension reforms are a relevant aspect<br />

of the plan with potentially significant implications in<br />

the long term. The EU Commission estimated that,<br />

on unchanged legislation, age-related public<br />

spending would increase by 16% of GDP between<br />

2010 and 2060.<br />

Overall, the plan is certainly coherent, based on a set<br />

of more realistic assumptions than in the past and<br />

potentially able to deliver what Greece needs most at<br />

the moment, which is credibility.<br />

But the implications for growth of the envisaged fiscal<br />

correction, which are more credibly spelled out this<br />

time, would be massive. As we emphasised in<br />

previous research, such an adjustment in such a<br />

short time is unprecedented across advanced<br />

economy and its drag on GDP and employment is<br />

likely to be significant, questioning its social<br />

feasibility. This emphasises there is a persistent<br />

implementation risk which markets will continue to<br />

price in for a while.<br />

Moreover, even if the adjustment is implemented as<br />

planned, Greece would still land up with a debt-to-<br />

GDP ratio of around 145% in 2014. Under the<br />

assumption of nominal growth of 4% and interest<br />

rates of 6%, Greece would need a primary surplus of<br />

2.8% to stabilise the debt-to-GDP ratio at these<br />

levels. But under different assumptions for growth,<br />

the scenario would be less favourable. Persistent low<br />

nominal growth (equal to or less than 2% for<br />

example) is likely to be associated with higher risk<br />

premia (interest rates at or above 6%). In that case,<br />

the primary surplus needed to stabilise the debt-to-<br />

GDP ratio would shoot to 7.1% of GDP. This would<br />

probably be too costly from a social point of view,<br />

opening the door again to alternative options such as<br />

debt restructuring (for more on the possible<br />

scenarios for the Greek outlook see “Greece: What’s<br />

Next?” published on 29 April 2010).<br />

Table 1: Greece Economic Forecasts - Under the New Fiscal Adjustment Programme and the SGP<br />

Forecasts under Greece's New Fiscal Adjustment Programme<br />

2009 2010 2011 2012 2013 2014<br />

Inflation (% y/y) 1.3 1.9 -0.4 1.2 0.7 0.9<br />

GDP (% y/y) -2.0 -4.0 -2.6 1.1 2.1 2.1<br />

Budget Balance (% GDP) -13.6 -8.1 -7.6 -6.5 -4.9 -2.6<br />

Gov Debt (% GDP) 115.1 133.3 145.1 148.6 149.1 144.3<br />

Forecasts under the SGP<br />

2009 2010 2011 2012 2013 2014<br />

HICP (% y/y) 1.2 1.4 1.9 1.8 1.8 -<br />

GDP (% y/y) -1.2 -0.3 1.5 1.9 2.5 -<br />

Budget Balance (% GDP) -12.7 -8.7 -5.6 -2.8 -2.0 -<br />

Gov Debt (% GDP) 113.4 120.4 120.6 117.4 113.2 -<br />

Source: Greece's SGP, Greek Ministry of Finance<br />

Luigi Speranza/Gizem Kara 7 May 2010<br />

<strong>Market</strong> Mover<br />

15<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Table 2: Greece Fiscal Measures (in EURmn)<br />

2010* 2011 2012 2013 Cum % GDP<br />

Revenue Measures<br />

Increase of VAT rates (10% to 11%, 21% to 23%) 800 1000 0 0 1800 0.8<br />

Broadening VAT base 0 1000 500 0 1500 0.7<br />

Excise tax on fuel 200 250 0 0 450 0.2<br />

Excise tax on cigarettes 200 300 0 0 500 0.2<br />

Excise tax on alcoholic beverages 50 50 0 0 100 0.0<br />

Excise goods on non-alcoholic beverages 0 0 300 0 300 0.1<br />

Excise tax on luxury goods 0 100 0 0 100 0.0<br />

Green taxes 0 300 0 0 300 0.1<br />

Gaming royalties 0 200 400 0 600 0.3<br />

Gaming licences 0 500 225 -725 0 0.0<br />

Special levy on highly profitable firms 0 600 0 0 600 0.3<br />

Presumptive taxation of professionals 0 400 100 0 500 0.2<br />

Taxation of wage in kind (cars) 0 150 0 0 150 0.1<br />

Book specification of incomes 0 50 0 0 50 0.0<br />

Increase legal value real estate 0 400 200 100 700 0.3<br />

Amnesty land use violations 0 500 0 0 500 0.2<br />

Taxation of unauthorized establishments 0 800 0 0 800 0.3<br />

Expenditure Measures<br />

Reduce wage bill by cutting bonuses/allowances 1100 400 0 0 1500 0.7<br />

Workforce reduction beyond 5:1 (add. 20,000) 0 0 600 500 1100 0.5<br />

Savings from introduction of unified public sector wages 0 100 0 0 100 0.0<br />

Eliminate pension bonuses (except for min. pensions) 1500 500 0 0 2000 0.9<br />

Additional pension reduction above a certain threshold 350 150 0 0 500 0.2<br />

Nominal pension freeze 0 100 250 200 550 0.2<br />

Means test unemployment benefit 0 0 500 0 500 0.2<br />

Cancel second installment of solidarity allowance 400 0 0 0 400 0.2<br />

Cut intermediate consumption 700 300 0 0 1000 0.4<br />

“Kallikratis” programme for municipalities 0 500 500 500 1500 0.7<br />

Cut in transfers to public enterprises 0 0 1500 0 1500 0.7<br />

Cut domestically funded investment spending 500 500 500 0 1500 0.7<br />

Yet to be quantified yield from structural reform initiatives 0 0 0 4200 4200 1.8<br />

Total Measures 5800 9150 5575 4775 25300 11.0<br />

Revenue Measures 1250 6600 1725 -625 8950 3.9<br />

Expenditure Measures 4550 2550 3850 5400 16350 7.1<br />

Total Measures (% GDP) 2.5 4.1 2.4 2.0 11.0<br />

Revenue Measures 0.5 3.0 0.8 -0.3 3.9<br />

Expenditure Measures 2.0 1.1 1.7 2.3 7.1<br />

Memorandum Item:<br />

Nominal GDP (EURbn) 231 224 228 235<br />

Source: Greek Ministry of Finance, IMF<br />

Note: * measures for 2010 are additional to those already announced in past austerity plans<br />

Luigi Speranza/Gizem Kara 7 May 2010<br />

<strong>Market</strong> Mover<br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Germany: Downs and Ups<br />

• The impact of unusually cold weather on the<br />

construction sector will hit Q1 GDP.<br />

65<br />

Chart 1: GDP and Composite PMI<br />

1.5<br />

• The narrowing trade surplus and weakness<br />

in retail sales also point to a weak outcome.<br />

• We have revised down our forecast: we now<br />

look for GDP to contract on a q/q basis in Q1.<br />

• However, with the improvement in leading<br />

indicators stepping up a gear recently, a strong<br />

rebound in Q2 growth is very likely.<br />

• Germany is set to outperform the eurozone<br />

beyond Q1 despite a lack of consumer demand.<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Composite PMI<br />

German GDP<br />

(% q/q, RHS)<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

-3.0<br />

-3.5<br />

Survey strength<br />

Our projection for German GDP in Q1 in the latest<br />

Global Outlook was for a q/q increase of 0.5%. On<br />

the basis of the leading indicators, a growth rate of<br />

this magnitude looks feasible (Chart 1).<br />

25<br />

20<br />

15<br />

10<br />

Chart 2: Construction Output (% q/q)<br />

The ‘hard’ activity data released for Q1 to date point<br />

to a much weaker outcome, however, related in large<br />

part to the impact of exceptionally cold weather early<br />