Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The sensitivity of the spread curve to 1y OIS/Bor is<br />

once again 40%, which provides some level of<br />

comfort with this hedge ratio.<br />

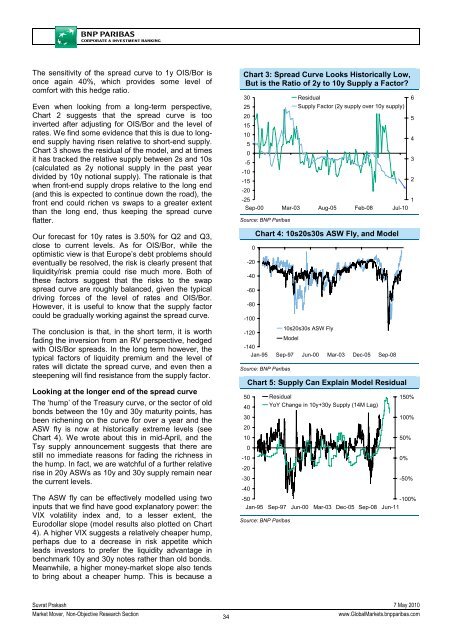

Even when looking from a long-term perspective,<br />

Chart 2 suggests that the spread curve is too<br />

inverted after adjusting for OIS/Bor and the level of<br />

rates. We find some evidence that this is due to longend<br />

supply having risen relative to short-end supply.<br />

Chart 3 shows the residual of the model, and at times<br />

it has tracked the relative supply between 2s and 10s<br />

(calculated as 2y notional supply in the past year<br />

divided by 10y notional supply). The rationale is that<br />

when front-end supply drops relative to the long end<br />

(and this is expected to continue down the road), the<br />

front end could richen vs swaps to a greater extent<br />

than the long end, thus keeping the spread curve<br />

flatter.<br />

Our forecast for 10y rates is 3.50% for Q2 and Q3,<br />

close to current levels. As for OIS/Bor, while the<br />

optimistic view is that Europe’s debt problems should<br />

eventually be resolved, the risk is clearly present that<br />

liquidity/risk premia could rise much more. Both of<br />

these factors suggest that the risks to the swap<br />

spread curve are roughly balanced, given the typical<br />

driving forces of the level of rates and OIS/Bor.<br />

However, it is useful to know that the supply factor<br />

could be gradually working against the spread curve.<br />

The conclusion is that, in the short term, it is worth<br />

fading the inversion from an RV perspective, hedged<br />

with OIS/Bor spreads. In the long term however, the<br />

typical factors of liquidity premium and the level of<br />

rates will dictate the spread curve, and even then a<br />

steepening will find resistance from the supply factor.<br />

Looking at the longer end of the spread curve<br />

The ‘hump’ of the Treasury curve, or the sector of old<br />

bonds between the 10y and 30y maturity points, has<br />

been richening on the curve for over a year and the<br />

ASW fly is now at historically extreme levels (see<br />

Chart 4). We wrote about this in mid-April, and the<br />

Tsy supply announcement suggests that there are<br />

still no immediate reasons for fading the richness in<br />

the hump. In fact, we are watchful of a further relative<br />

rise in 20y ASWs as 10y and 30y supply remain near<br />

the current levels.<br />

The ASW fly can be effectively modelled using two<br />

inputs that we find have good explanatory power: the<br />

VIX volatility index and, to a lesser extent, the<br />

Eurodollar slope (model results also plotted on Chart<br />

4). A higher VIX suggests a relatively cheaper hump,<br />

perhaps due to a decrease in risk appetite which<br />

leads investors to prefer the liquidity advantage in<br />

benchmark 10y and 30y notes rather than old bonds.<br />

Meanwhile, a higher money-market slope also tends<br />

to bring about a cheaper hump. This is because a<br />

Chart 3: Spread Curve Looks Historically Low,<br />

But is the Ratio of 2y to 10y Supply a Factor?<br />

30<br />

25<br />

Residual<br />

Supply Factor (2y supply over 10y supply)<br />

6<br />

20<br />

5<br />

15<br />

10<br />

4<br />

5<br />

0<br />

-5<br />

3<br />

-10<br />

-15<br />

2<br />

-20<br />

-25<br />

1<br />

Sep-00 Mar-03 Aug-05 Feb-08 Jul-10<br />

Source: <strong>BNP</strong> Paribas<br />

0<br />

-20<br />

-40<br />

-60<br />

-80<br />

-100<br />

-120<br />

Chart 4: 10s20s30s ASW Fly, and Model<br />

10s20s30s ASW Fly<br />

Model<br />

-140<br />

Jan-95 Sep-97 Jun-00 Mar-03 Dec-05 Sep-08<br />

Source: <strong>BNP</strong> Paribas<br />

50<br />

40<br />

30<br />

20<br />

10<br />

-10<br />

-20<br />

-30<br />

-40<br />

Chart 5: Supply Can Explain Model Residual<br />

0<br />

-50%<br />

-50<br />

-100%<br />

Jan-95 Sep-97 Jun-00 Mar-03 Dec-05 Sep-08 Jun-11<br />

Source: <strong>BNP</strong> Paribas<br />

Residual<br />

YoY Change in 10y+30y Supply (14M Lag)<br />

150%<br />

100%<br />

50%<br />

0%<br />

Suvrat Prakash 7 May 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

34<br />

www.Global<strong>Market</strong>s.bnpparibas.com