Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

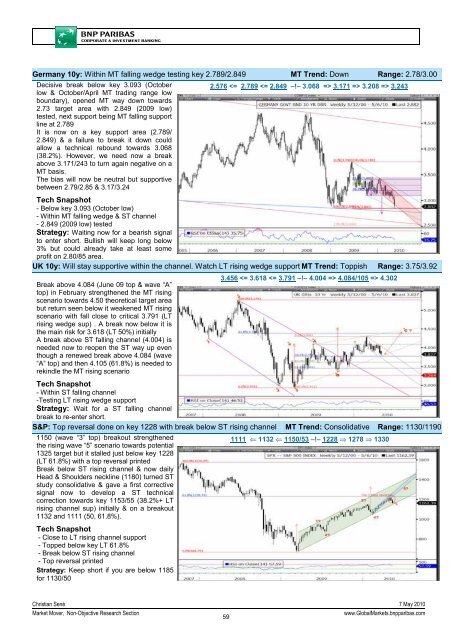

Germany 10y: Within MT falling wedge testing key 2.789/2.849 MT Trend: Down Range: 2.78/3.00<br />

Decisive break below key 3.093 (October<br />

2.576 3.208 => 3.243<br />

low & October/April MT trading range low<br />

boundary), opened MT way down towards<br />

2.73 target area with 2.849 (2009 low)<br />

tested, next support being MT falling support<br />

line at 2.789<br />

It is now on a key support area (2.789/<br />

2.849) & a failure to break it down could<br />

allow a technical rebound towards 3.068<br />

(38.2%). However, we need now a break<br />

above 3.171/243 to turn again negative on a<br />

MT basis.<br />

The bias will now be neutral but supportive<br />

between 2.79/2.85 & 3.17/3.24<br />

Tech Snapshot<br />

- Below key 3.093 (October low)<br />

- Within MT falling wedge & ST channel<br />

- 2.849 (2009 low) tested<br />

<strong>Strategy</strong>: Waiting now for a bearish signal<br />

to enter short. Bullish will keep long below<br />

3% but could already take at least some<br />

profit on 2.80/85 area.<br />

UK 10y: Will stay supportive within the channel. Watch LT rising wedge support MT Trend: Toppish Range: 3.75/3.92<br />

Break above 4.084 (June 09 top & wave “A”<br />

top) in February strengthened the MT rising<br />

scenario towards 4.50 theoretical target area<br />

but return seen below it weakened MT rising<br />

scenario with fall close to critical 3.791 (LT<br />

rising wedge sup) . A break now below it is<br />

the main risk for 3.618 (LT 50%) initially<br />

A break above ST falling channel (4.004) is<br />

needed now to reopen the ST way up even<br />

though a renewed break above 4.084 (wave<br />

“A” top) and then 4.105 (61.8%) is needed to<br />

rekindle the MT rising scenario<br />

3.456 4.302<br />

Tech Snapshot<br />

- Within ST falling channel<br />

-Testing LT rising wedge support<br />

<strong>Strategy</strong>: Wait for a ST falling channel<br />

break to re-enter short.<br />

S&P: Top reversal done on key 1228 with break below ST rising channel MT Trend: Consolidative Range: 1130/1190<br />

1150 (wave “3” top) breakout strengthened<br />

the rising wave “5” scenario towards potential<br />

1111 ⇐ 1132 ⇐ 1150/53 –!– 1228 ⇒ 1278 ⇒ 1330<br />

1325 target but it stalled just below key 1228<br />

(LT 61.8%) with a top reversal printed<br />

Break below ST rising channel & now daily<br />

Head & Shoulders neckline (1180) turned ST<br />

study consolidative & gave a first corrective<br />

signal now to develop a ST technical<br />

correction towards key 1153/55 (38.2%+ LT<br />

rising channel sup) initially & on a breakout<br />

1132 and 1111 (50, 61.8%).<br />

Tech Snapshot<br />

- Close to LT rising channel support<br />

- Topped below key LT 61.8%<br />

- Break below ST rising channel<br />

- Top reversal printed<br />

<strong>Strategy</strong>: Keep short if you are below 1185<br />

for 1130/50<br />

Christian Sené 7 May 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

59<br />

www.Global<strong>Market</strong>s.bnpparibas.com