Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Germany: Downs and Ups<br />

• The impact of unusually cold weather on the<br />

construction sector will hit Q1 GDP.<br />

65<br />

Chart 1: GDP and Composite PMI<br />

1.5<br />

• The narrowing trade surplus and weakness<br />

in retail sales also point to a weak outcome.<br />

• We have revised down our forecast: we now<br />

look for GDP to contract on a q/q basis in Q1.<br />

• However, with the improvement in leading<br />

indicators stepping up a gear recently, a strong<br />

rebound in Q2 growth is very likely.<br />

• Germany is set to outperform the eurozone<br />

beyond Q1 despite a lack of consumer demand.<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Composite PMI<br />

German GDP<br />

(% q/q, RHS)<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

-2.5<br />

-3.0<br />

-3.5<br />

Survey strength<br />

Our projection for German GDP in Q1 in the latest<br />

Global Outlook was for a q/q increase of 0.5%. On<br />

the basis of the leading indicators, a growth rate of<br />

this magnitude looks feasible (Chart 1).<br />

25<br />

20<br />

15<br />

10<br />

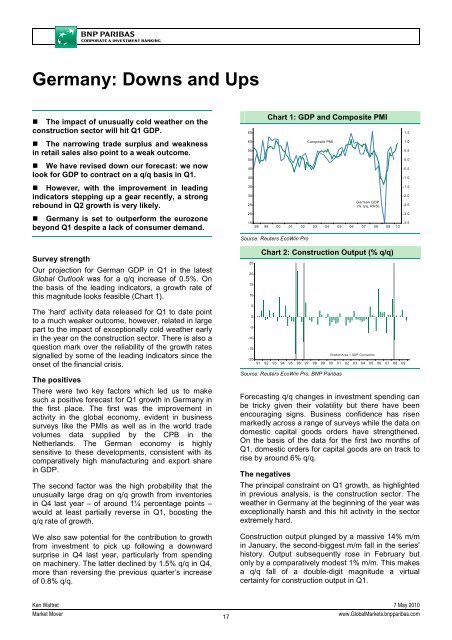

Chart 2: Construction Output (% q/q)<br />

The ‘hard’ activity data released for Q1 to date point<br />

to a much weaker outcome, however, related in large<br />

part to the impact of exceptionally cold weather early<br />

in the year on the construction sector. There is also a<br />

question mark over the reliability of the growth rates<br />

signalled by some of the leading indicators since the<br />

onset of the financial crisis.<br />

The positives<br />

There were two key factors which led us to make<br />

such a positive forecast for Q1 growth in Germany in<br />

the first place. The first was the improvement in<br />

activity in the global economy, evident in business<br />

surveys like the PMIs as well as in the world trade<br />

volumes data supplied by the CPB in the<br />

Netherlands. The German economy is highly<br />

sensitive to these developments, consistent with its<br />

comparatively high manufacturing and export share<br />

in GDP.<br />

The second factor was the high probability that the<br />

unusually large drag on q/q growth from inventories<br />

in Q4 last year – of around 1¼ percentage points –<br />

would at least partially reverse in Q1, boosting the<br />

q/q rate of growth.<br />

We also saw potential for the contribution to growth<br />

from investment to pick up following a downward<br />

surprise in Q4 last year, particularly from spending<br />

on machinery. The latter declined by 1.5% q/q in Q4,<br />

more than reversing the previous quarter’s increase<br />

of 0.8% q/q.<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

Shaded Area = GDP Contraction<br />

-20<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Forecasting q/q changes in investment spending can<br />

be tricky given their volatility but there have been<br />

encouraging signs. Business confidence has risen<br />

markedly across a range of surveys while the data on<br />

domestic capital goods orders have strengthened.<br />

On the basis of the data for the first two months of<br />

Q1, domestic orders for capital goods are on track to<br />

rise by around 6% q/q.<br />

The negatives<br />

The principal constraint on Q1 growth, as highlighted<br />

in previous analysis, is the construction sector. The<br />

weather in Germany at the beginning of the year was<br />

exceptionally harsh and this hit activity in the sector<br />

extremely hard.<br />

Construction output plunged by a massive 14% m/m<br />

in January, the second-biggest m/m fall in the series'<br />

history. Output subsequently rose in February but<br />

only by a comparatively modest 1% m/m. This makes<br />

a q/q fall of a double-digit magnitude a virtual<br />

certainty for construction output in Q1.<br />

Ken Wattret 7 May 2010<br />

<strong>Market</strong> Mover<br />

17<br />

www.Global<strong>Market</strong>s.bnpparibas.com