Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

What’s the call?<br />

It is relatively hazardous to take a view in this market;<br />

the underlying trend remains negative for the<br />

weakest members of the Eurozone and for the EUR<br />

currency which does not bode well for SOVX and<br />

MAIN as well as for FIN SEN and SUB indices. That<br />

being said, a lot of efforts are made by officials to<br />

stop the bleeding and a momentarily snapback is<br />

very likely to come in the next days.<br />

For us, the index which should continue to<br />

outperform is XO as it should remain relatively more<br />

immune to developments in PIIGS. We nevertheless<br />

note that some High-Yield names like Irish Eircom<br />

and Spanish Codere, ONO and Sol Melia have<br />

recently underperformed the market.<br />

All in all, we continue to expect the XO/MAIN ratio to<br />

decrease and see the risk/reward of the “Long risk<br />

XO / Short risk MAIN x5” trade, which is a disguised<br />

bearish call on MAIN, more attractive than an outright<br />

short on MAIN.<br />

Update on FIN SEN vs. FIN SUB<br />

It is probably the pair trade on which we have the<br />

highest level of conviction given (1) its very attractive<br />

entry level and (2) its relative lack of directionality.<br />

Regarding the entry level, we view a very favourable<br />

risk/reward in the decompression trade at x1.50. The<br />

downside is probably limited to x0.10 while its upside<br />

can be as high as x0.30 if the ratio catches up with<br />

SUB/SEN levels prevailing when the SEN index was<br />

trading in the 130-150 range.<br />

Moreover, the widest member of the basket (BESPL)<br />

is already trading at a SUB/SEN ratio of x1.17, a 2-<br />

year historical low and an already very compressed<br />

level where hedgers could start thinking about buying<br />

SUB protection rather than SEN keeping in mind that<br />

all the debt deliverable into the SEN CDS can also<br />

be delivered into the SUB. That being said, UK<br />

single-names RBS and HBOS, with SUB/SEN ratio<br />

between x1.6 and x1.7 have some room to compress<br />

further.<br />

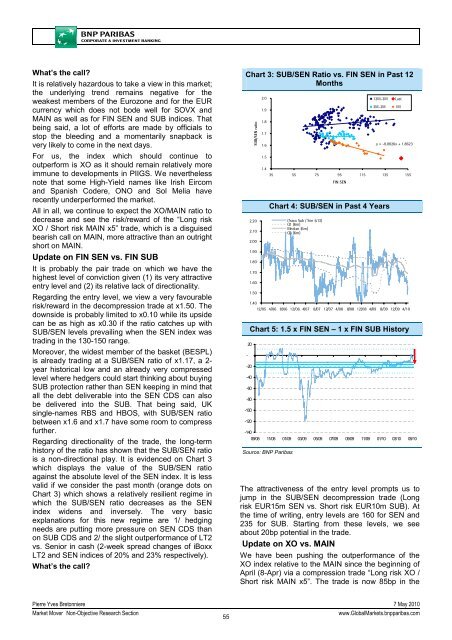

Regarding directionality of the trade, the long-term<br />

history of the ratio has shown that the SUB/SEN ratio<br />

is a non-directional play. It is evidenced on Chart 3<br />

which displays the value of the SUB/SEN ratio<br />

against the absolute level of the SEN index. It is less<br />

valid if we consider the past month (orange dots on<br />

Chart 3) which shows a relatively resilient regime in<br />

which the SUB/SEN ratio decreases as the SEN<br />

index widens and inversely. The very basic<br />

explanations for this new regime are 1/ hedging<br />

needs are putting more pressure on SEN CDS than<br />

on SUB CDS and 2/ the slight outperformance of LT2<br />

vs. Senior in cash (2-week spread changes of iBoxx<br />

LT2 and SEN indices of 20% and 23% respectively).<br />

What’s the call?<br />

Chart 3: SUB/SEN Ratio vs. FIN SEN in Past 12<br />

Months<br />

-<br />

SUB/SEN ratio<br />

2.20<br />

2.10<br />

2.00<br />

1.90<br />

1.80<br />

1.70<br />

1.60<br />

1.50<br />

2.0<br />

1.9<br />

1.8<br />

1.7<br />

1.6<br />

1.5<br />

y = -0.0026x + 1.8623<br />

1.4<br />

35 55 75 95 115 135 155<br />

FIN SEN<br />

12M-3M<br />

3M-2M<br />

Chart 4: SUB/SEN in Past 4 Years<br />

iTraxx Sub / Sen (s13)<br />

Q1 (6m)<br />

Median (6m)<br />

Q3 (6m)<br />

1.40<br />

12/05 4/06 8/06 12/06 4/07 8/07 12/07 4/08 8/08 12/08 4/09 8/09 12/09 4/10<br />

Chart 5: 1.5 x FIN SEN – 1 x FIN SUB History<br />

20<br />

-20<br />

-40<br />

-60<br />

-80<br />

-100<br />

-120<br />

-140<br />

09/08 11/08 01/09 03/09 05/09 07/09 09/09 11/09 01/10 03/10 05/10<br />

Source: <strong>BNP</strong> Paribas<br />

The attractiveness of the entry level prompts us to<br />

jump in the SUB/SEN decompression trade (Long<br />

risk EUR15m SEN vs. Short risk EUR10m SUB). At<br />

the time of writing, entry levels are 160 for SEN and<br />

235 for SUB. Starting from these levels, we see<br />

about 20bp potential in the trade.<br />

Update on XO vs. MAIN<br />

We have been pushing the outperformance of the<br />

XO index relative to the MAIN since the beginning of<br />

April (8-Apr) via a compression trade “Long risk XO /<br />

Short risk MAIN x5”. The trade is now 85bp in the<br />

Last<br />

1M<br />

Pierre Yves Bretonniere 7 May 2010<br />

<strong>Market</strong> Mover Non-Objective Research Section<br />

55<br />

www.Global<strong>Market</strong>s.bnpparibas.com